🚨 Quantum vs. Crypto: The Life-and-Death Race

Vitalik just issued a chilling warning:

There is a 20% chance that quantum computers will break all modern encryption before 2030.

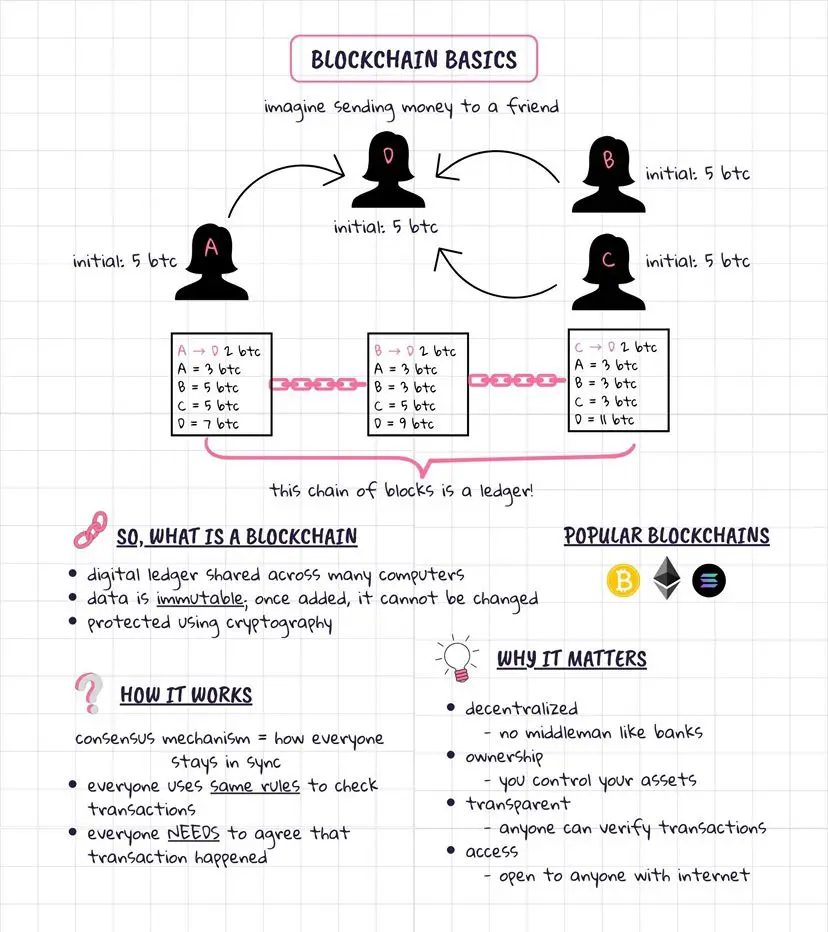

This means that:

➠ The entire blockchain, banking systems, emails, personal data… are all at risk of being exposed.

➠ All "keys" to security today can become useless overnight.

➠ A new era of "post-quantum cryptography" must begin right now.

Vitalik is not saying this to scare. He is reminding that crypto – Ethereum, Bitcoin, and the entire Web3 – will have to evolve if it wants to survive.

⏳ The clock is counting down

Vitalik just issued a chilling warning:

There is a 20% chance that quantum computers will break all modern encryption before 2030.

This means that:

➠ The entire blockchain, banking systems, emails, personal data… are all at risk of being exposed.

➠ All "keys" to security today can become useless overnight.

➠ A new era of "post-quantum cryptography" must begin right now.

Vitalik is not saying this to scare. He is reminding that crypto – Ethereum, Bitcoin, and the entire Web3 – will have to evolve if it wants to survive.

⏳ The clock is counting down

ETH-1.67%