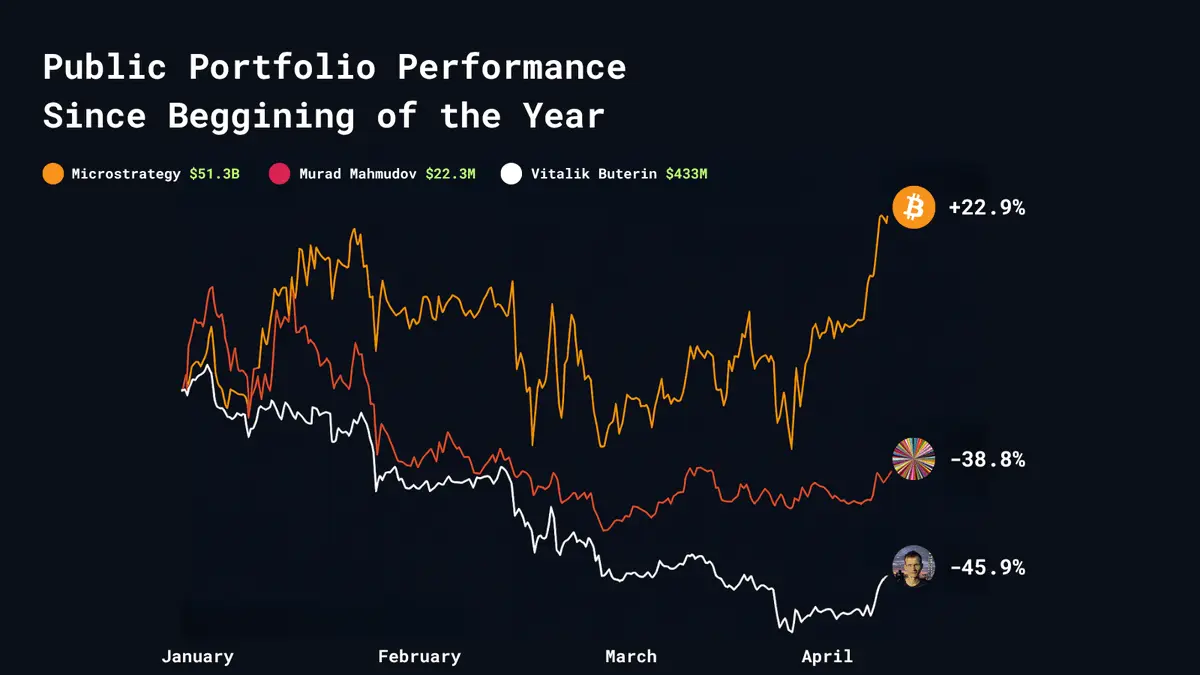

This cycle is pure speculation dressed in shiny UX.

Even the most advanced projects are no match for the degen allure.

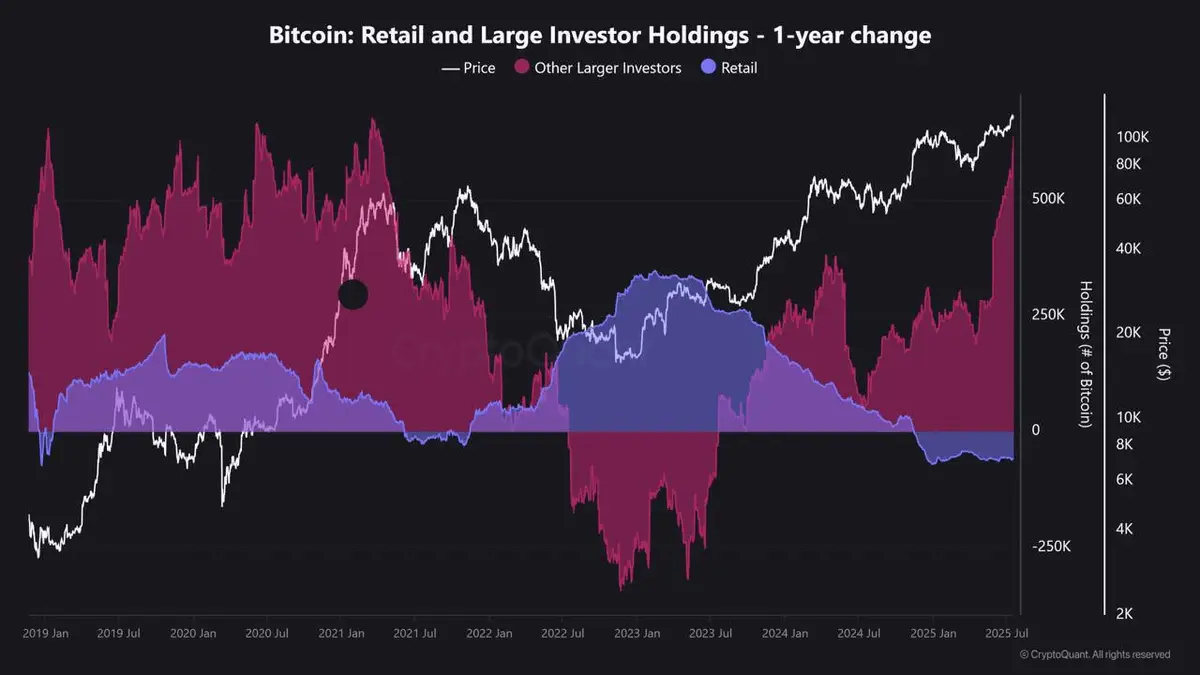

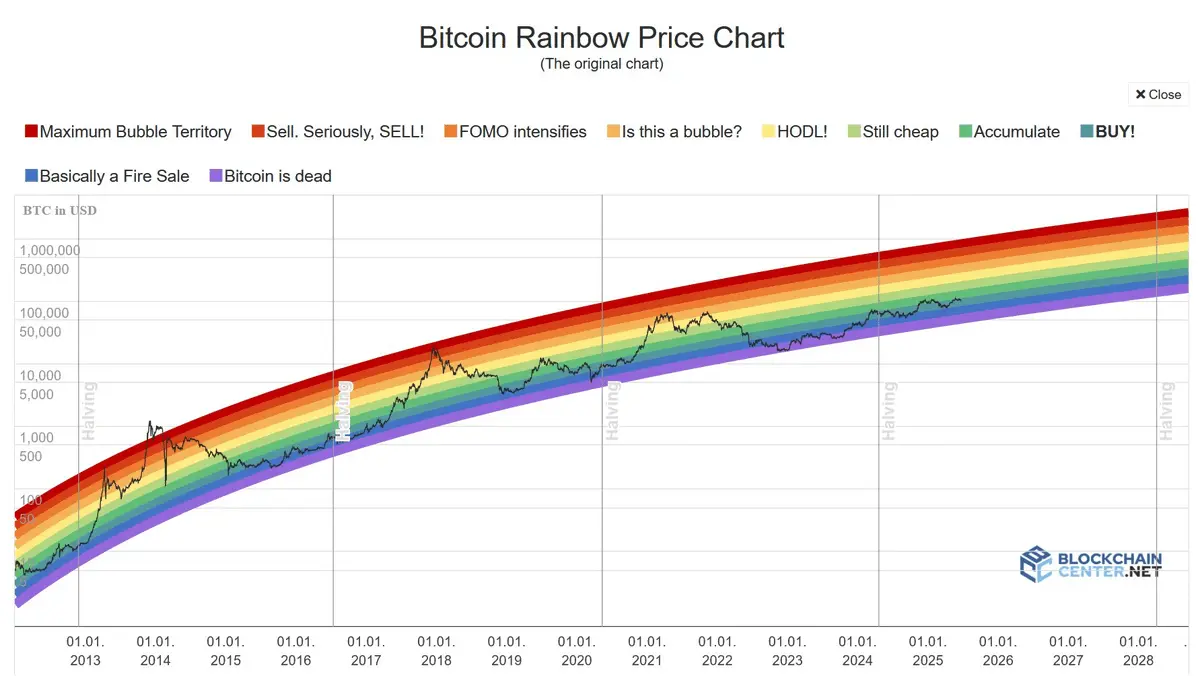

2013 — Bitcoin’s first wave

2017 — Altcoins & ICO mania

2021 — Low caps & launchpads

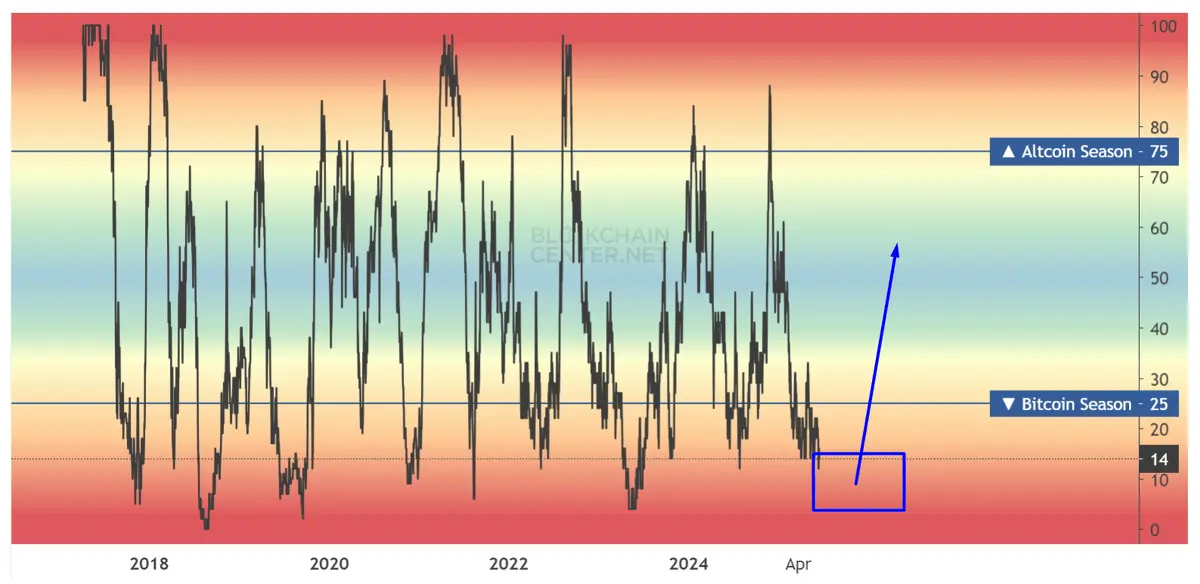

2024/2025 — Instant dopamine, zero utility

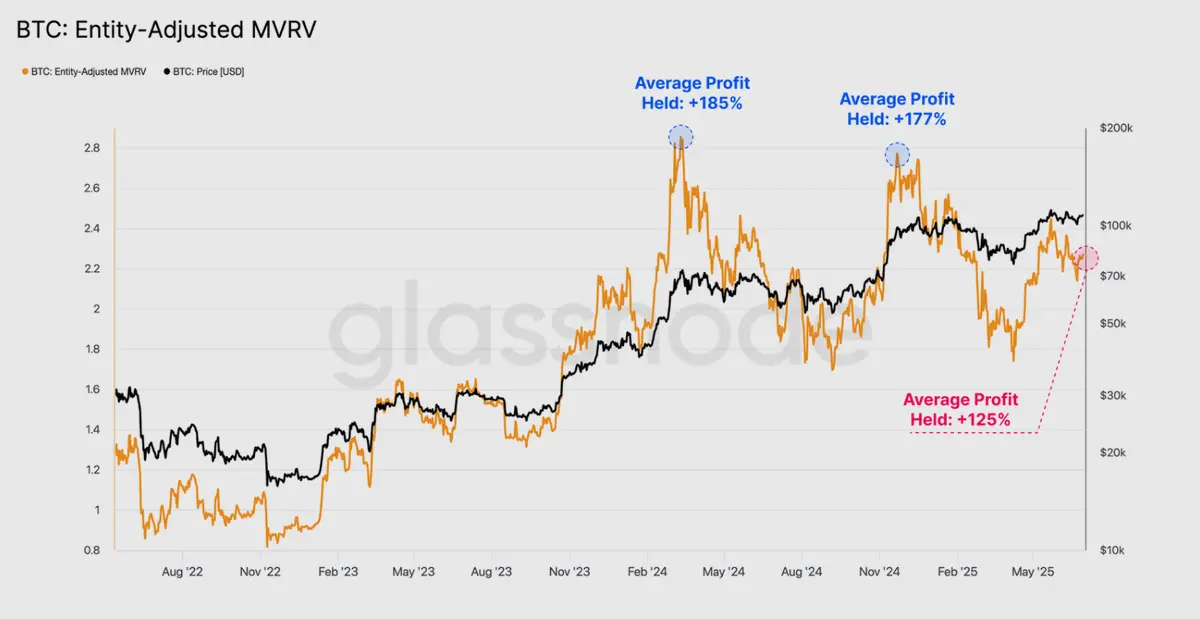

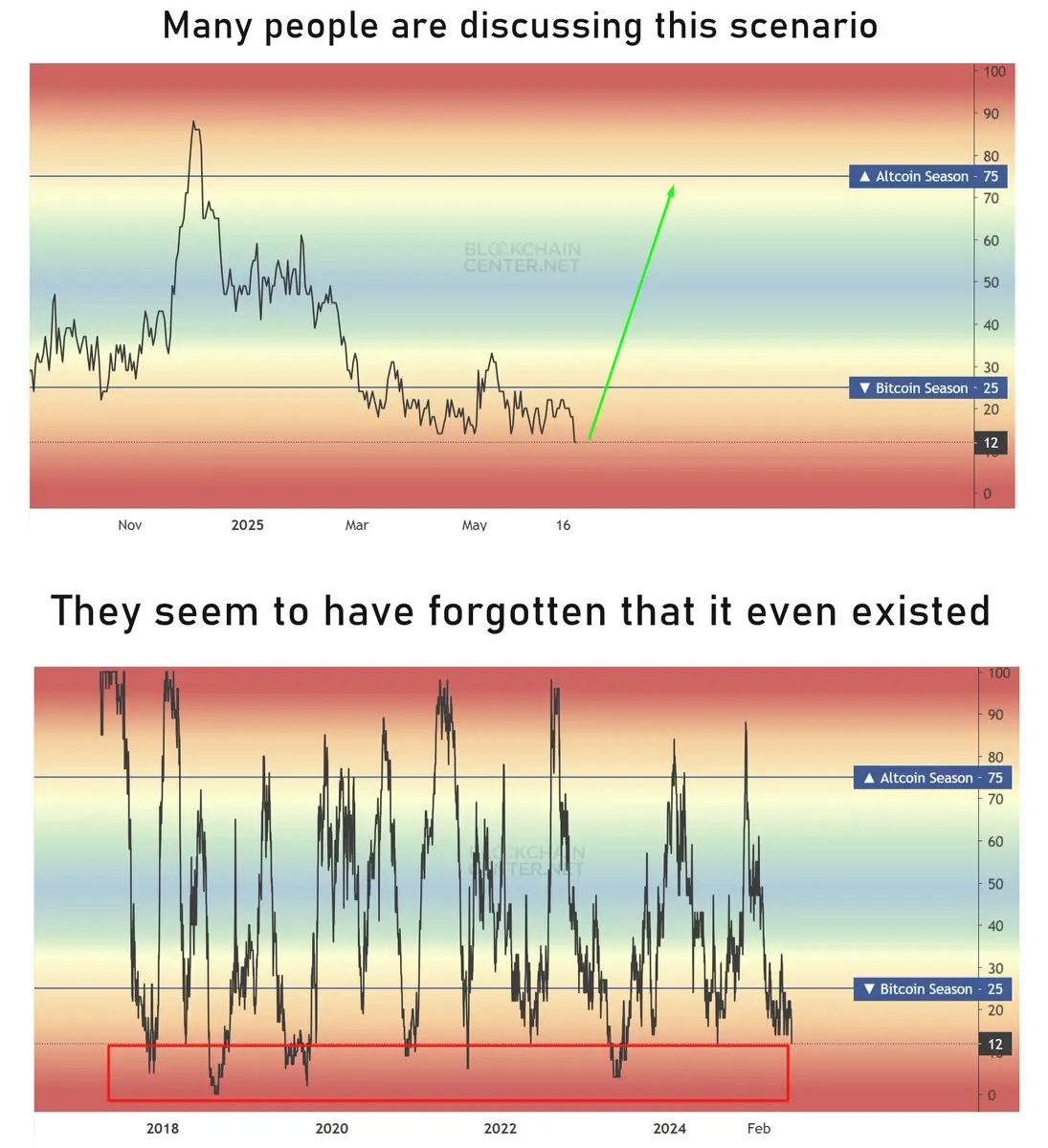

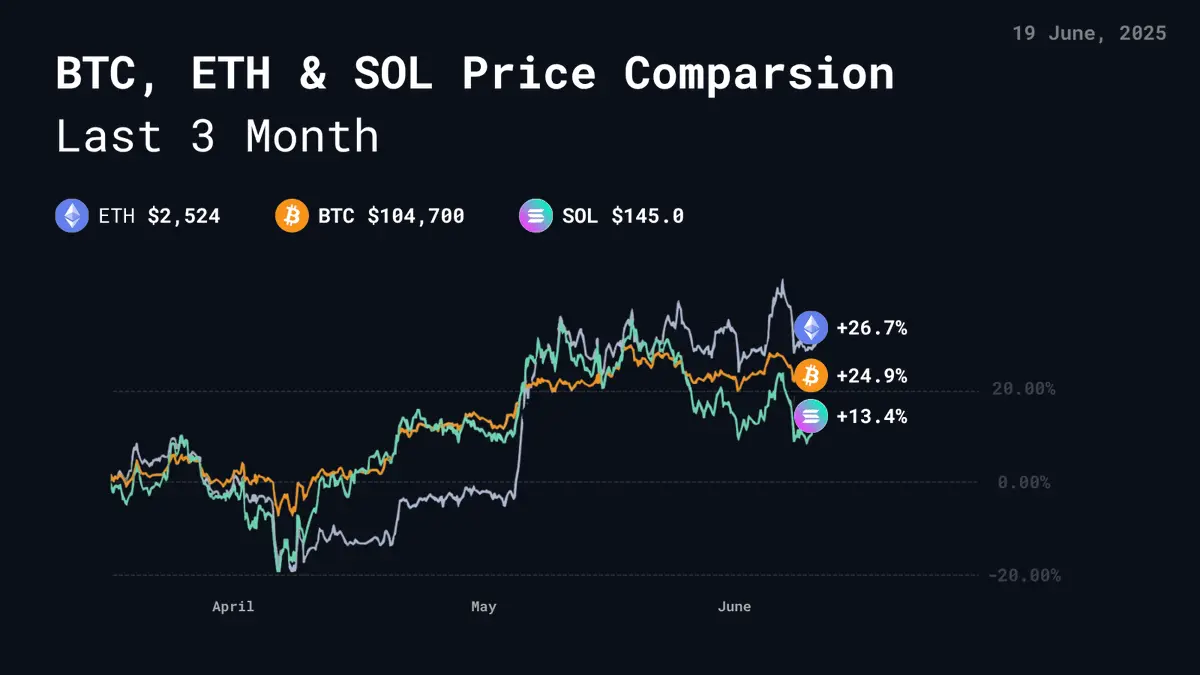

$BTC is just the ignition now — its pump fuels the next wave of meme plays and high-risk punts.

Speculate first, ask questions later — that’s the 2025 meta.

Even the most advanced projects are no match for the degen allure.

2013 — Bitcoin’s first wave

2017 — Altcoins & ICO mania

2021 — Low caps & launchpads

2024/2025 — Instant dopamine, zero utility

$BTC is just the ignition now — its pump fuels the next wave of meme plays and high-risk punts.

Speculate first, ask questions later — that’s the 2025 meta.