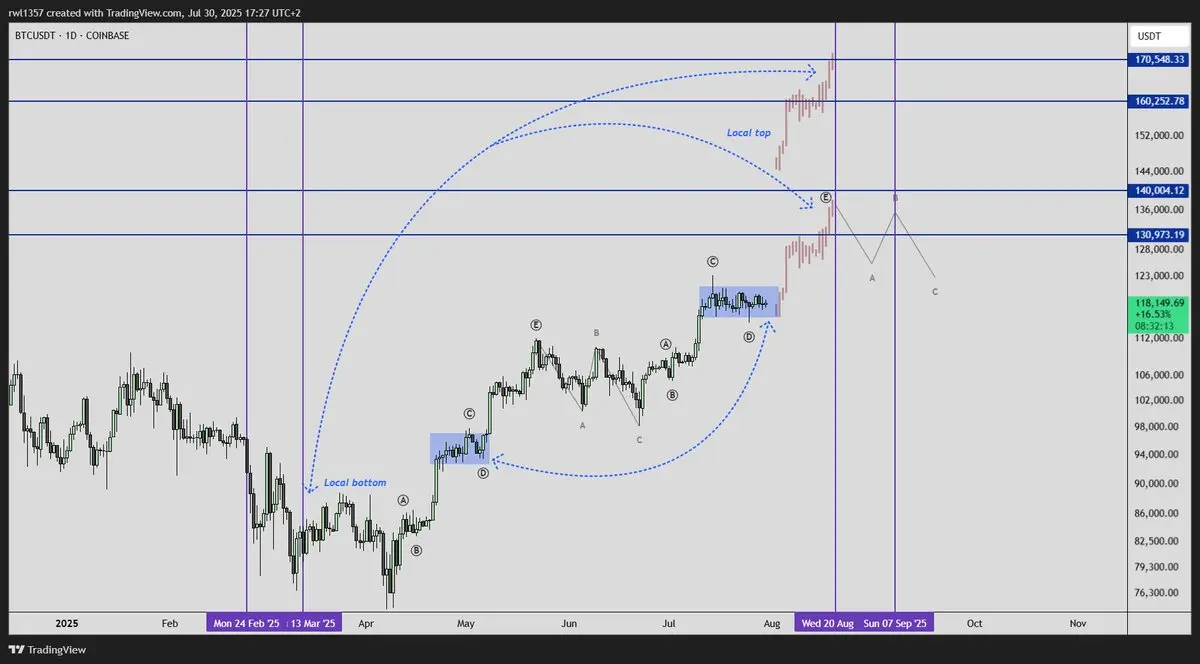

Here are two scenarios I see for how the market might play out, explained simply so everyone can follow:

1. We bounce from current levels early this month and rally into early September.

2. We move sideways until mid-August (around the 15th–20th), then bounce into the September 17th FOMC meeting.

Why do I see it this way?

It all comes down to how the market "prices in" the upcoming FOMC meeting. If we peak by early September, it likely means the market is pricing in the FOMC decision in advance typically a bullish signal followed by a correction or bottom shortly after.

On the other hand, if w

1. We bounce from current levels early this month and rally into early September.

2. We move sideways until mid-August (around the 15th–20th), then bounce into the September 17th FOMC meeting.

Why do I see it this way?

It all comes down to how the market "prices in" the upcoming FOMC meeting. If we peak by early September, it likely means the market is pricing in the FOMC decision in advance typically a bullish signal followed by a correction or bottom shortly after.

On the other hand, if w