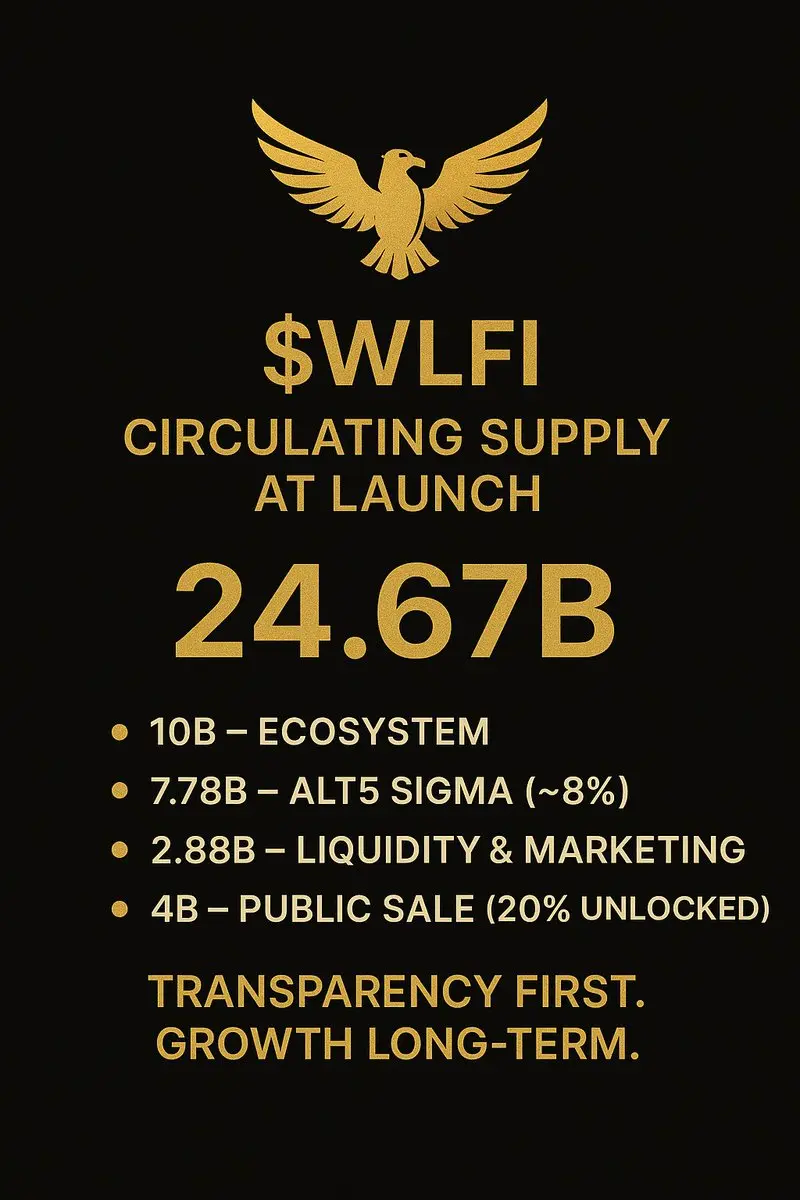

WLFI/USD1: Decentralizing Value Capture

Circle (USDC) Model 🇺🇸🇺🇸♥️

Circle issues USDC, backed by massive USD reserves. These reserves are invested in assets such as U.S. Treasuries, generating substantial interest income. This income becomes Circle’s core profit and ultimately benefits its private shareholders through stock appreciation.

🆑Value Flow: Reserves Interest → Company Profit → Shareholder Returns

$WLFI (USD1) Model

The WLFI ecosystem also issues a stablecoin, #USD1, backed by reserves. These reserves generate interest income. However, unlike Circle, this income is not privatized

Circle (USDC) Model 🇺🇸🇺🇸♥️

Circle issues USDC, backed by massive USD reserves. These reserves are invested in assets such as U.S. Treasuries, generating substantial interest income. This income becomes Circle’s core profit and ultimately benefits its private shareholders through stock appreciation.

🆑Value Flow: Reserves Interest → Company Profit → Shareholder Returns

$WLFI (USD1) Model

The WLFI ecosystem also issues a stablecoin, #USD1, backed by reserves. These reserves generate interest income. However, unlike Circle, this income is not privatized