Satoshitalks

Belum ada konten

Saya diberitahu bahwa tidak ada lagi Jane Street 😭

Lihat Asli

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

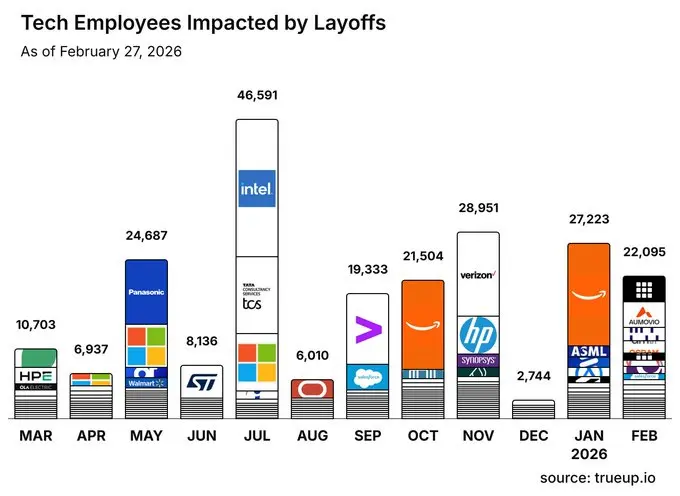

PHK 2026:

Amazon - 16.000

Aumovio - 4.000

Block - 4.000

WiseTech Global - 2.000

ams OSRAM - 2.000

ASML - 1.700

Ericsson - 1.600

Meta - 1.500

Salesforce - 1.000

Livspace - 1.000

Ocado - 1.000

Autodesk - 1.000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

Lihat AsliAmazon - 16.000

Aumovio - 4.000

Block - 4.000

WiseTech Global - 2.000

ams OSRAM - 2.000

ASML - 1.700

Ericsson - 1.600

Meta - 1.500

Salesforce - 1.000

Livspace - 1.000

Ocado - 1.000

Autodesk - 1.000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Selamat pagi! Semua orang

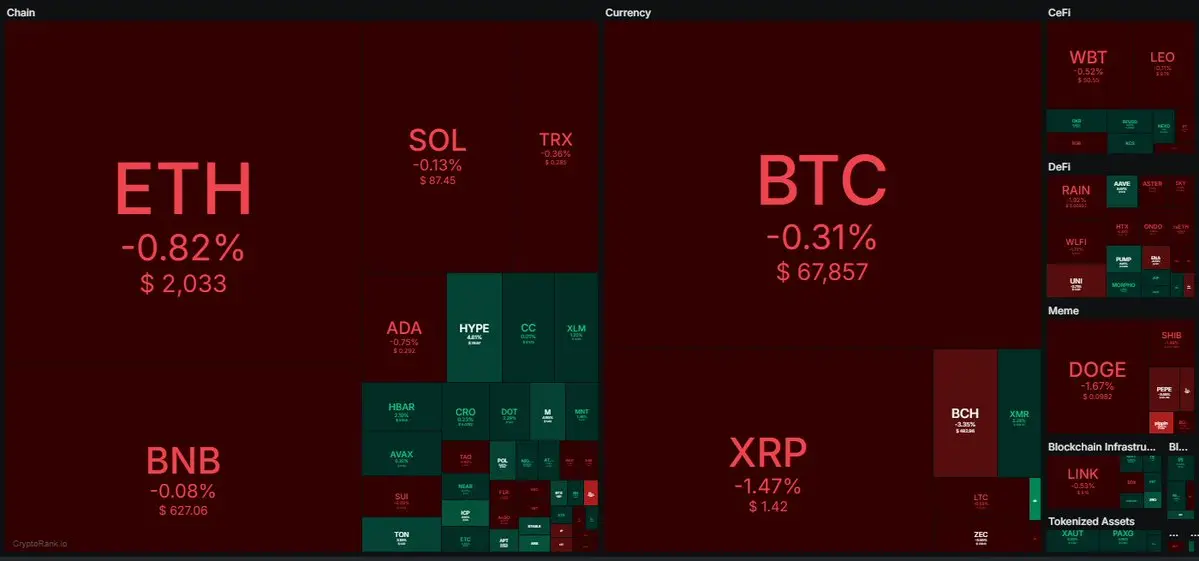

Selamat hari Jumat, Crypto

Lihat AsliSelamat hari Jumat, Crypto

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

BERITA TERKINI: Blok ( $XYZ ) melonjak lebih dari +20% setelah mengumumkan rencana untuk memotong lebih dari 40% dari tenaga kerjanya.

Pasar jelas menyukai pengurangan biaya.

Sekarang pertanyaannya adalah berapa banyak perusahaan lain yang akan mengikuti langkah yang sama.

Lihat AsliPasar jelas menyukai pengurangan biaya.

Sekarang pertanyaannya adalah berapa banyak perusahaan lain yang akan mengikuti langkah yang sama.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

ImprovedTweet

Be Nvidia:

Pendapatan $68.1B (mengalahkan $66.2B)

EPS $1.62 (mengalahkan $1.53)

Panduan kuartal berikutnya $78B mengalahkan $72B(

Saham: -5% )masih turun 5%

Selamat datang di ekspektasi yang sudah dihargai.

Lihat AsliBe Nvidia:

Pendapatan $68.1B (mengalahkan $66.2B)

EPS $1.62 (mengalahkan $1.53)

Panduan kuartal berikutnya $78B mengalahkan $72B(

Saham: -5% )masih turun 5%

Selamat datang di ekspektasi yang sudah dihargai.

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

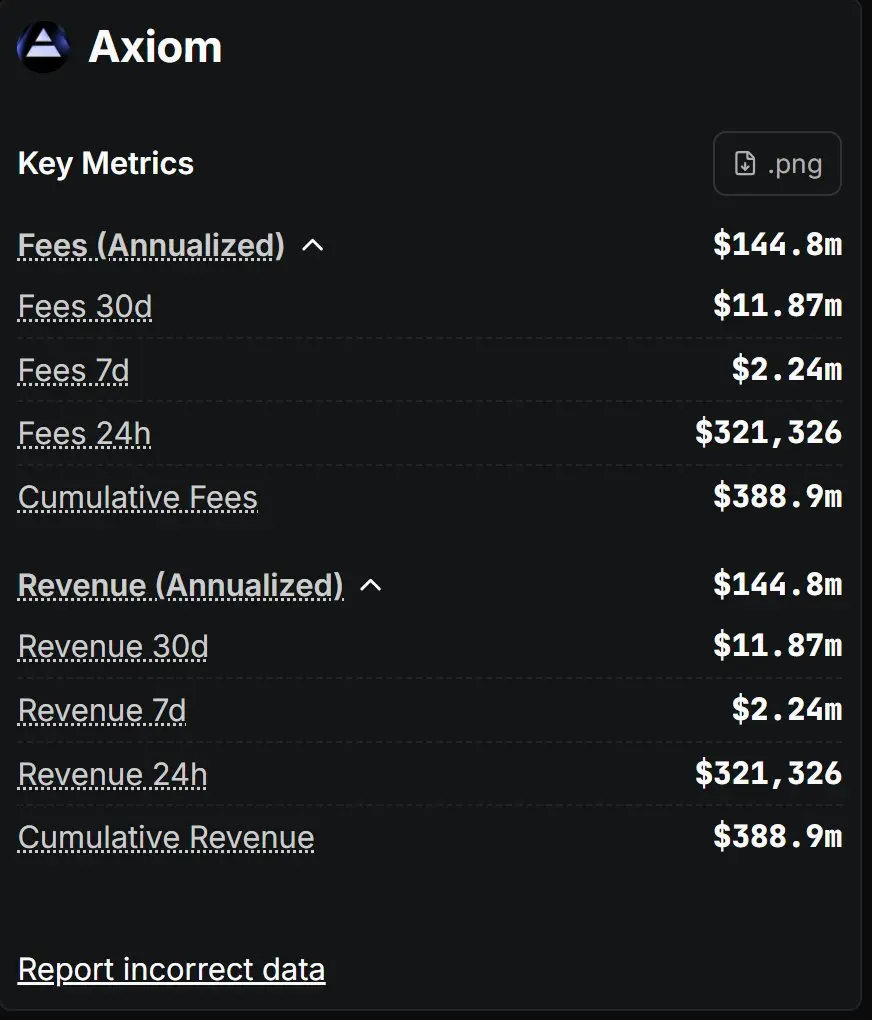

Apakah kita benar-benar terkejut bahwa orang dalam crypto terus terungkap?

Tuduhan perdagangan orang dalam bukanlah hal baru

ZachXBT mengatakan dia dibayar untuk mengulas Axiom

Axiom dilaporkan menghasilkan lebih dari $388M dalam biaya

Transparansi dalam crypto masih memiliki jalan panjang.

Lihat AsliTuduhan perdagangan orang dalam bukanlah hal baru

ZachXBT mengatakan dia dibayar untuk mengulas Axiom

Axiom dilaporkan menghasilkan lebih dari $388M dalam biaya

Transparansi dalam crypto masih memiliki jalan panjang.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

Mengapa #Bitcoin mungkin sedang mencapai titik terendah:

Paling oversold sejak FTX

Dana menjual saham dengan kecepatan rekor

Dimon melihat tekanan gaya 2008

Premium BTC berbalik hijau setelah 40 hari merah

Tekanan perumahan meningkat

$40K–$50K? Itu adalah zona akumulasi.

#BTC

Paling oversold sejak FTX

Dana menjual saham dengan kecepatan rekor

Dimon melihat tekanan gaya 2008

Premium BTC berbalik hijau setelah 40 hari merah

Tekanan perumahan meningkat

$40K–$50K? Itu adalah zona akumulasi.

#BTC

BTC2,71%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

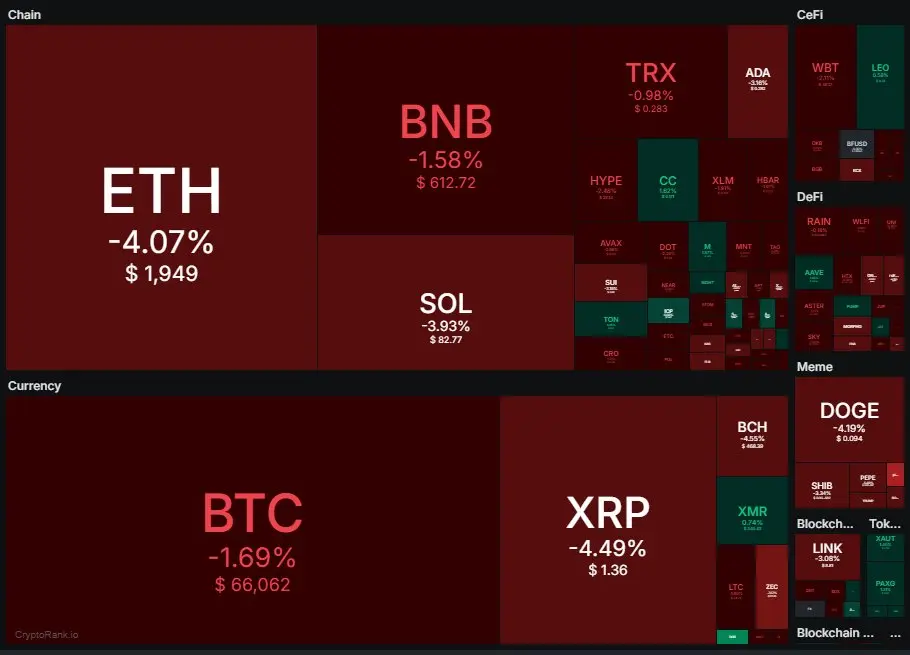

Seekor paus 1.000 BTC baru saja memicu crash kilat.

Apa yang terjadi:

Penjualan besar-besaran di pasar

Harga dihancurkan ke $47K

Rebound instan setelah penyapuan likuiditas

Volatilitas kembali.

Apa yang terjadi:

Penjualan besar-besaran di pasar

Harga dihancurkan ke $47K

Rebound instan setelah penyapuan likuiditas

Volatilitas kembali.

BTC2,71%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

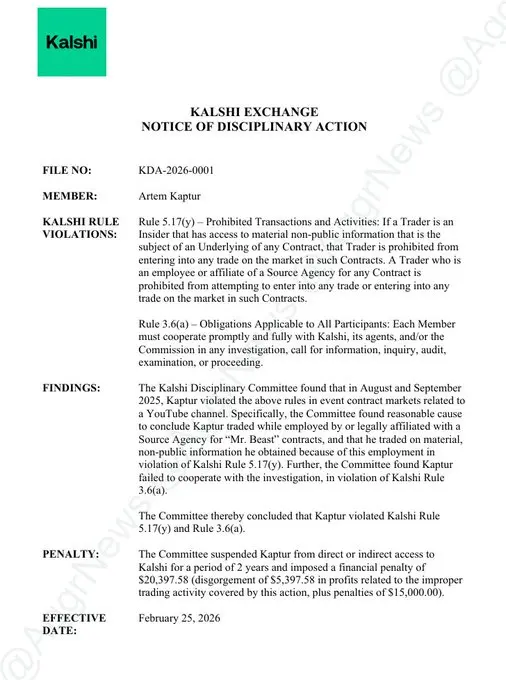

🚨 BERITA TERKINI: Kalshi melarang seorang editor video MrBeast selama 2 tahun karena insider betting.

Artem Kaptur diduga menggunakan informasi rahasia tentang video YouTube yang akan datang untuk melakukan perdagangan sebelum detailnya dipublikasikan.

Dia juga harus membayar denda lebih dari $20.000.

Pasar prediksi sedang mempelajari pelajaran yang sama seperti Wall Street:

Jika Anda berdagang berdasarkan informasi non-publik, ada konsekuensinya.

Lihat AsliArtem Kaptur diduga menggunakan informasi rahasia tentang video YouTube yang akan datang untuk melakukan perdagangan sebelum detailnya dipublikasikan.

Dia juga harus membayar denda lebih dari $20.000.

Pasar prediksi sedang mempelajari pelajaran yang sama seperti Wall Street:

Jika Anda berdagang berdasarkan informasi non-publik, ada konsekuensinya.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

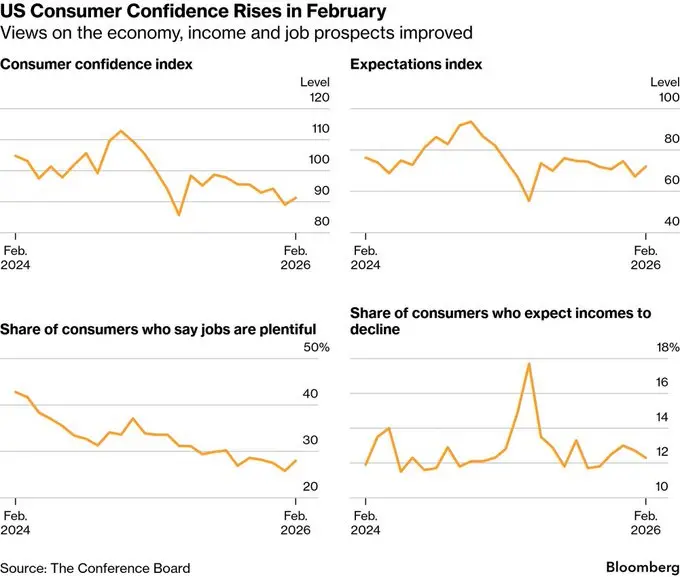

📊 Kepercayaan konsumen AS naik menjadi 91.2 ( dari 89).

Mengapa ini penting untuk pasar:

Sentimen pekerjaan yang lebih kuat

Prospek pengeluaran yang lebih tinggi

Aset berisiko cenderung mendapatkan manfaat

Apakah angin sakal makro sedang terbentuk?

Lihat AsliMengapa ini penting untuk pasar:

Sentimen pekerjaan yang lebih kuat

Prospek pengeluaran yang lebih tinggi

Aset berisiko cenderung mendapatkan manfaat

Apakah angin sakal makro sedang terbentuk?

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

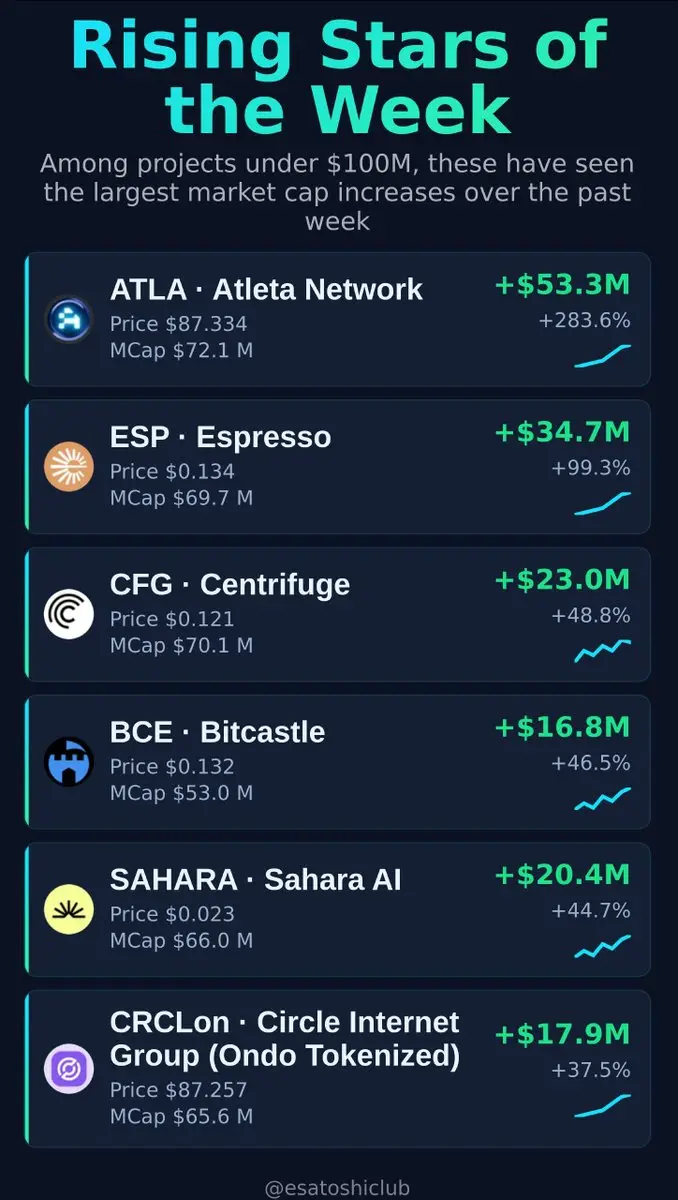

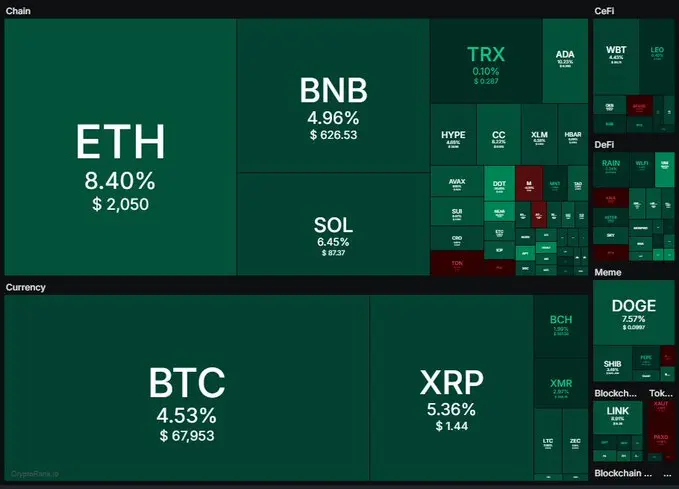

📊 Pasar kripto berbalik hijau:

Mengapa rebound?

• Pantulan oversold

• Optimisme makro

• $32B arus masuk kapital pasar

Lihat AsliMengapa rebound?

• Pantulan oversold

• Optimisme makro

• $32B arus masuk kapital pasar

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

142 hari hanya menurun.

Begitulah cara terbentuknya titik terendah Bitcoin:

Lambat

Menyakitkan

Membebani

Lebih banyak merah bisa datang — tetapi dasar kemungkinan sedang terbentuk di sini.

Bagian tersulit mungkin sudah kita lalui.

Begitulah cara terbentuknya titik terendah Bitcoin:

Lambat

Menyakitkan

Membebani

Lebih banyak merah bisa datang — tetapi dasar kemungkinan sedang terbentuk di sini.

Bagian tersulit mungkin sudah kita lalui.

BTC2,71%

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

🚨 Jaksa penuntut Korea Selatan menuduh seorang pria berusia 39 tahun berusaha membunuh mitra bisnisnya dengan meracuni kopinya menggunakan pestisida setelah kesepakatan investasi kripto enam digit gagal.

Korban jatuh pingsan di sebuah kafe di Seoul dan ditempatkan dalam keadaan koma yang diinduksi secara medis selama tiga hari — tetapi selamat.

Tersangka kini didakwa dengan:

• Percobaan pembunuhan

• Pelanggaran Undang-Undang Pengendalian Pestisida Korea Selatan

Pengingat yang keras: uang berisiko tinggi + kepercayaan yang rusak bisa menjadi sangat berbahaya dengan cepat.

Lihat AsliKorban jatuh pingsan di sebuah kafe di Seoul dan ditempatkan dalam keadaan koma yang diinduksi secara medis selama tiga hari — tetapi selamat.

Tersangka kini didakwa dengan:

• Percobaan pembunuhan

• Pelanggaran Undang-Undang Pengendalian Pestisida Korea Selatan

Pengingat yang keras: uang berisiko tinggi + kepercayaan yang rusak bisa menjadi sangat berbahaya dengan cepat.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

🚨 BERITA TERKINI: Meta dilaporkan berencana untuk kembali meluncurkan stablecoin pada akhir 2026 — bertahun-tahun setelah proyek Diem runtuh.

Setelah penolakan regulasi yang menghentikan upaya pertamanya, raksasa teknologi ini mungkin siap untuk kembali ke pembayaran digital.

Percobaan kedua. Strategi baru. Ambisi yang sama?

Jika ini berjalan, stablecoin baru saja menjadi medan perang Big Tech lagi.

Lihat AsliSetelah penolakan regulasi yang menghentikan upaya pertamanya, raksasa teknologi ini mungkin siap untuk kembali ke pembayaran digital.

Percobaan kedua. Strategi baru. Ambisi yang sama?

Jika ini berjalan, stablecoin baru saja menjadi medan perang Big Tech lagi.

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak42.47M Popularitas

156.97K Popularitas

115.98K Popularitas

1.67M Popularitas

517.4K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$2.47KHolder:10.00%

- MC:$2.56KHolder:20.53%

- MC:$0.1Holder:10.00%

- MC:$0.1Holder:10.00%

- 5

伊朗

伊朗

MC:$0.1Holder:10.00%

Sematkan