What is Coral Finance (CORL)?

What Is Coral Finance?

(Source: Coral_Finance)

Coral Finance integrates DeFi and AI to provide a pre-market trading and discovery platform. Users can identify promising projects, participate in liquidity formation, and access earning opportunities before tokens are officially launched.

Coral Finance is a comprehensive Expectation Market. Investors can trade based on market sentiment and project potential, using intelligent mechanisms to reduce risk and improve transparency, which adds value to the Web3 ecosystem.

Coral’s Vision and Core Principles

Coral Finance’s vision is to become the central hub for liquidity and expectations across all early-stage Web3 projects. The goal is to build an open, aggregated marketplace where everyone can discover opportunities, participate in rewards, and generate liquidity. In Coral’s architecture, Expectation includes:

- Forecasts of specific asset prices in the future.

- Performance projections for projects before and after TGE.

- Potential rewards from participating in activities such as staking or airdrop events.

This expectation-driven framework enables Coral to simulate authentic market dynamics and build a decentralized pre-market ecosystem.

Core Features and Products

1. Point Hub — Coral’s Flagship Product

Point Hub is Coral Finance’s cornerstone feature, designed as a points conversion and trading platform tailored for pre-market activities. Users accumulate points by participating in protocols, liquidity mining, or staking, and can convert points into tradable corTokens on Coral.

This process, called CorTokenization, not only delivers immediate liquidity for points but also allows users to lock in potential returns ahead of time.

2. corSwap — Coral’s Built-In Decentralized Exchange

CorSwap, built on the Uniswap V2 architecture, is the exclusive DEX within the Coral ecosystem. Users can freely exchange corTokens and other paired tokens.

- Low fees: 0.25% transaction fee.

- High reliability: Liquidity provided by liquidity providers (LPs), ensuring robust market depth.

- Cross-platform aggregation: Integrates Coral’s own DEX and aggregates liquidity from leading DEXs to enhance trading efficiency.

3. CorToken Mint & Claim

Coral Finance enables users to convert points earned from different protocols into corTokens (at a 1:1 ratio).

- Minting: Convert points into corTokens and lock them pending unlock.

- Claiming: Gradually unlock corTokens according to release speed and user engagement. These tokens can be traded, staked, or used as entitlements for potential airdrops within the Coral ecosystem.

corSwap and Liquidity Mechanisms

CorSwap anchors Coral’s liquidity infrastructure. Anyone can become a liquidity provider (LP) by depositing equal-value corTokens and paired tokens, receiving LP Tokens as proof of liquidity. LP token holders earn:

- Trading fee revenue (0.25% of transaction fees).

- Additional $CORL rewards, allocated based on pool weight.

CorSwap also utilizes an open aggregation model and will support additional DEX liquidity sources to deepen corToken trading and expand utility.

CORL Tokenomics

As the backbone of the Coral ecosystem, the CORL token serves platform governance, incentives, and long-term value capture. Total supply is capped at 1,000,000,000 tokens, allocated as follows:

- 56.4% for Ecosystem & Community Growth

This largest share is used for Coral’s liquidity incentives, user rewards, and community initiatives. It supports sustained ecosystem growth.

- 14% for Core Contributors

This is allocated to the Coral development team, advisors, and early advocates in recognition of ongoing technical contributions and protocol advancement.

- 12.6% for the Foundation

This supports Coral Foundation’s operations, compliance, and global expansion, maintaining strategic and regulatory stability.

- 10% for Backers & Investors

This provides essential resources for Coral’s launch and early development.

- 7% as Liquidity Reserve

This funds exchange listings, liquidity pools, and market-making, ensuring stable trading conditions for the token.

(Source: Coral_Finance)

This token structure balances development funding, community incentives, and long-term sustainability, establishing a robust foundation for Coral’s continued growth.

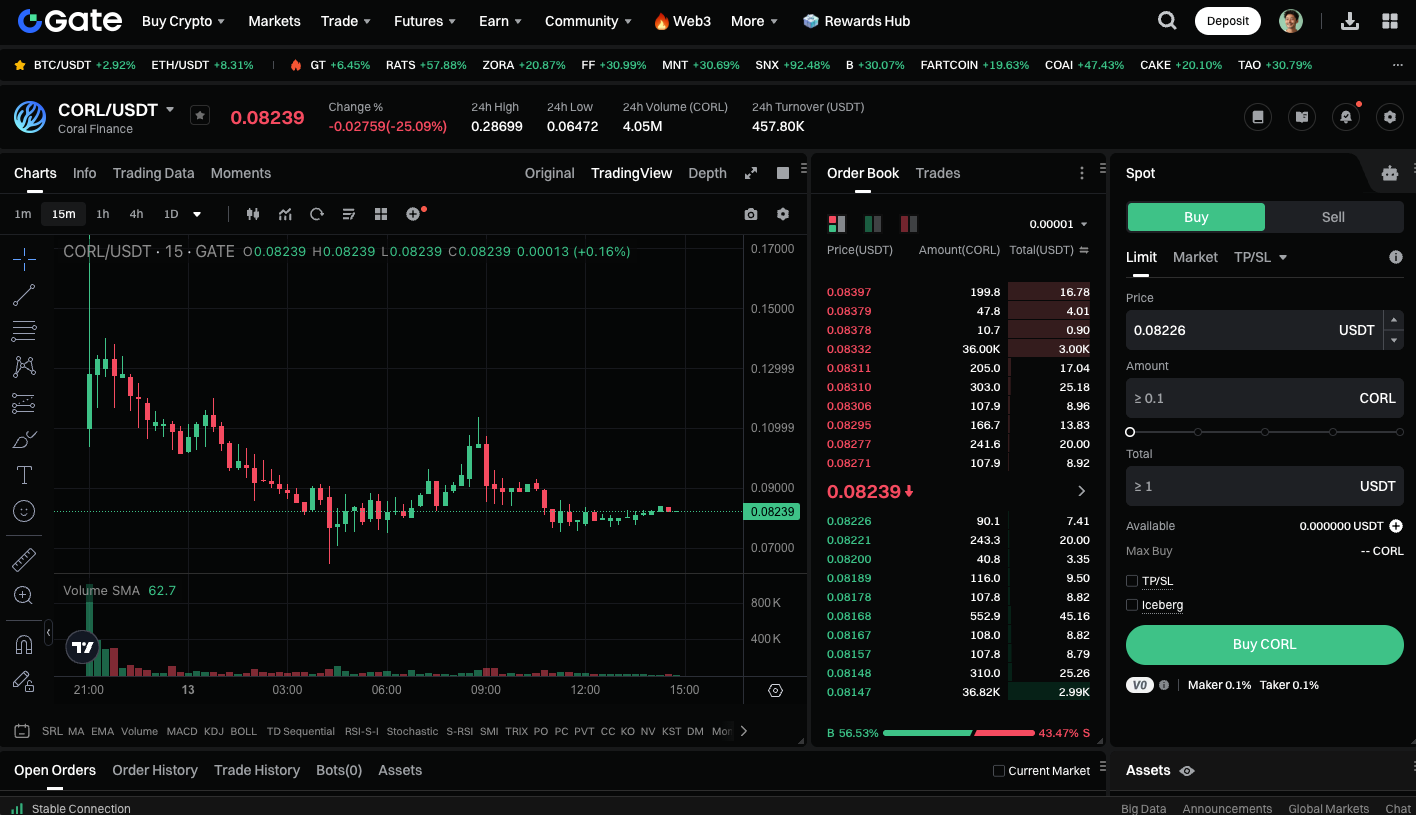

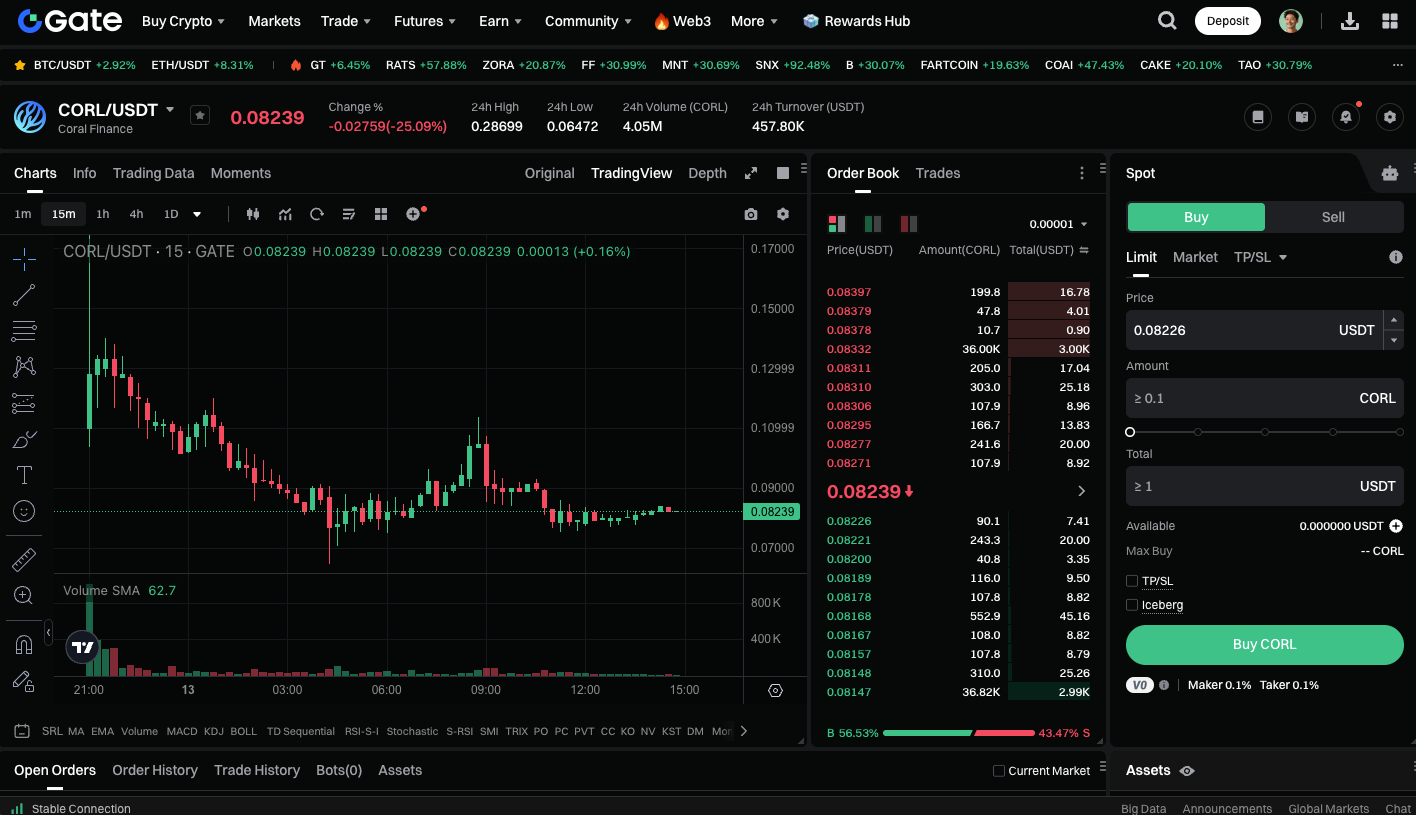

CORL spot trading is available at: https://www.gate.com/trade/CORL_USDT

Conclusion

Coral Finance addresses persistent pre-market liquidity gaps through its corToken mechanism, CorSwap liquidity engine, and CORL tokenomics. Coral Finance brings greater transparency and efficiency to early-stage markets, empowering users to participate in the next wave of DeFi value creation.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article