User_any

สวัสดีทุกคน,

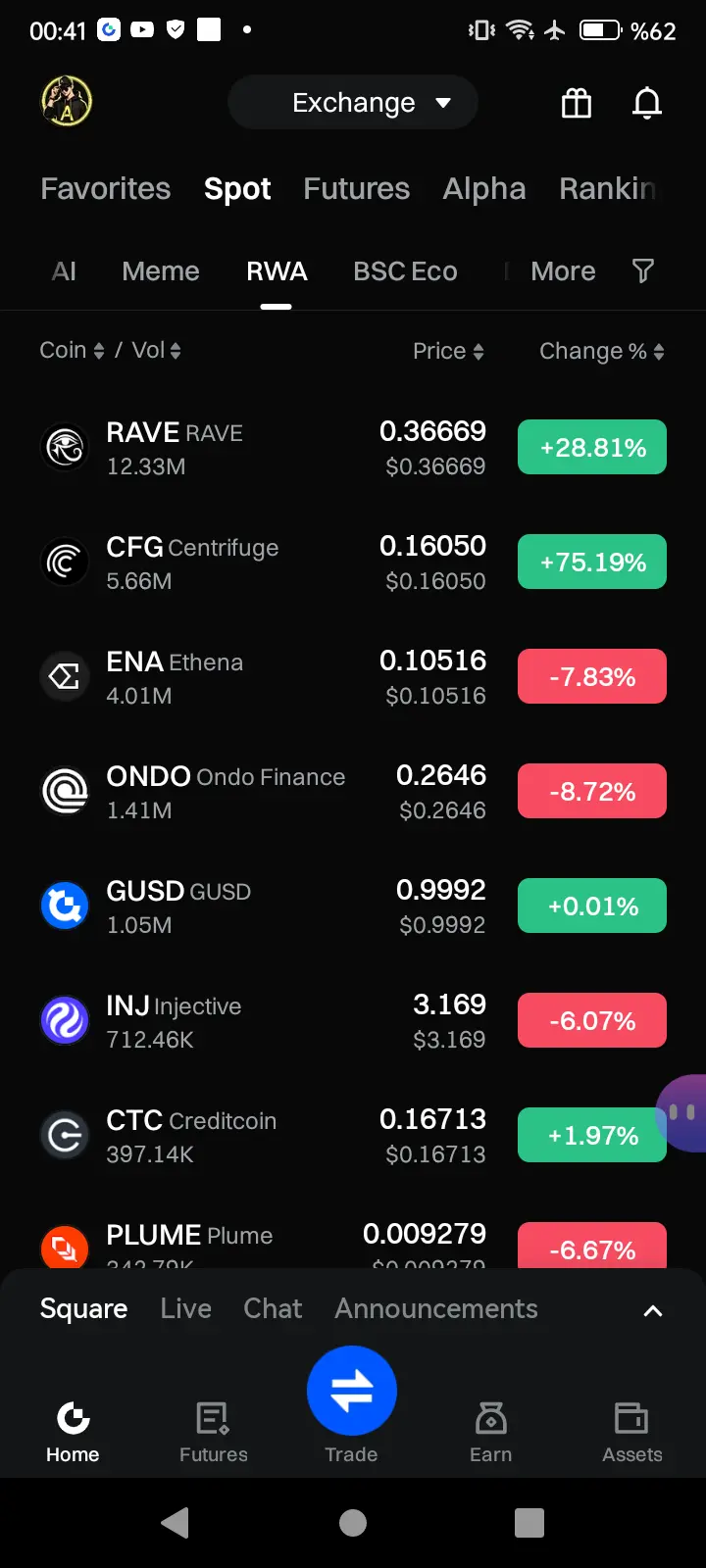

เรากำลังอยู่ในช่วงเปลี่ยนผ่านอย่างรวดเร็วจากความเข้าใจดั้งเดิมเกี่ยวกับคริปโตเคอร์เรนซี ไปสู่การบูรณาการเข้าสู่ระบบใหม่ ในฐานะผู้ใช้ GATE เราเป็นส่วนหนึ่งของการเปลี่ยนแปลงครั้งยิ่งใหญ่นี้ พร้อมกับ ETF, RWAs ได้กลายเป็นที่นิยมของนักลงทุนและพอร์ตโฟลิโอ มูลค่ากว่า 1,000 ล้านดอลลาร์ของกองทุนกำลังเคลื่อนย้ายออกจากตรรกะการลงทุนแบบดั้งเดิม และด้วยความเร่งของการทำโทเคนไนซ์ ความสนใจใน RWAs ก็เพิ่มขึ้นทุกวัน

ภายในปี 2025 ทุกอย่างจะเปลี่ยนไป เรากำลังเห็นการเปลี่ยนผ่านอย่างรวดเร็วจากเครื่องมือและความเข้าใจการลงทุนแบบดั้งเดิม ไปสู่แนวทางการลงทุนใหม่อย่างสมบูรณ์ ด้วย ETF และการทำโทเคนไนซ์ สินทร

ดูต้นฉบับเรากำลังอยู่ในช่วงเปลี่ยนผ่านอย่างรวดเร็วจากความเข้าใจดั้งเดิมเกี่ยวกับคริปโตเคอร์เรนซี ไปสู่การบูรณาการเข้าสู่ระบบใหม่ ในฐานะผู้ใช้ GATE เราเป็นส่วนหนึ่งของการเปลี่ยนแปลงครั้งยิ่งใหญ่นี้ พร้อมกับ ETF, RWAs ได้กลายเป็นที่นิยมของนักลงทุนและพอร์ตโฟลิโอ มูลค่ากว่า 1,000 ล้านดอลลาร์ของกองทุนกำลังเคลื่อนย้ายออกจากตรรกะการลงทุนแบบดั้งเดิม และด้วยความเร่งของการทำโทเคนไนซ์ ความสนใจใน RWAs ก็เพิ่มขึ้นทุกวัน

ภายในปี 2025 ทุกอย่างจะเปลี่ยนไป เรากำลังเห็นการเปลี่ยนผ่านอย่างรวดเร็วจากเครื่องมือและความเข้าใจการลงทุนแบบดั้งเดิม ไปสู่แนวทางการลงทุนใหม่อย่างสมบูรณ์ ด้วย ETF และการทำโทเคนไนซ์ สินทร

- รางวัล

- 32

- 29

- 6

- แชร์

CryptoAlice :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

การเติบโตของ AI ในคริปโต #DeepDiveCreatorCamp

วิธีที่ตัวแทนฉลาดกำลังเปลี่ยนเกม

เฮ้ โลกคริปโตไม่เคยหยุดนิ่งใช่ไหม? เมื่อไม่นานมานี้ ทุกคนกำลังพูดถึงว่า AI กำลังแทรกซึมเข้าไปในทุกอย่าง ตั้งแต่การชำระเงินไปจนถึงการเทรด และฉันคิดว่าจะมาแบ่งปันมุมมองของฉันเกี่ยวกับเรื่องนี้ มันคือกุมภาพันธ์ 2026 และด้วยไฟเขียวด้านกฎระเบียบที่ปรากฏขึ้นอย่างต่อเนื่อง การผสมผสาน AI-คริปโตนี้รู้สึกว่าจะระเบิดออกมาเร็ว ๆ นี้ ฉันได้ติดตามเรื่องนี้มาสักพักแล้ว และบอกตามตรง มันทำให้ฉันต้องคิดใหม่เกี่ยวกับกลยุทธ์ทั้งหมดของฉัน – ไม่ใช่แค่ hype แต่เป็นสิ่งจริงที่ทำให้คริปโตง่ายและฉลาดขึ้น

เริ่มกันที่พื้นฐาน: ตัวแทน AI ตัวแทนเ

ดูต้นฉบับวิธีที่ตัวแทนฉลาดกำลังเปลี่ยนเกม

เฮ้ โลกคริปโตไม่เคยหยุดนิ่งใช่ไหม? เมื่อไม่นานมานี้ ทุกคนกำลังพูดถึงว่า AI กำลังแทรกซึมเข้าไปในทุกอย่าง ตั้งแต่การชำระเงินไปจนถึงการเทรด และฉันคิดว่าจะมาแบ่งปันมุมมองของฉันเกี่ยวกับเรื่องนี้ มันคือกุมภาพันธ์ 2026 และด้วยไฟเขียวด้านกฎระเบียบที่ปรากฏขึ้นอย่างต่อเนื่อง การผสมผสาน AI-คริปโตนี้รู้สึกว่าจะระเบิดออกมาเร็ว ๆ นี้ ฉันได้ติดตามเรื่องนี้มาสักพักแล้ว และบอกตามตรง มันทำให้ฉันต้องคิดใหม่เกี่ยวกับกลยุทธ์ทั้งหมดของฉัน – ไม่ใช่แค่ hype แต่เป็นสิ่งจริงที่ทำให้คริปโตง่ายและฉลาดขึ้น

เริ่มกันที่พื้นฐาน: ตัวแทน AI ตัวแทนเ

- รางวัล

- 13

- 12

- repost

- แชร์

cryptoLog :

:

สู่ดวงจันทร์ 🌕ดูเพิ่มเติม

- รางวัล

- 3

- 5

- repost

- แชร์

ThePriceWillIncreaseTo314 :

:

บริษัทในอเมริกาที่เป็นเงือกทะเลอันดับสาม เมื่อครึ่งเดือนก่อนก็มีคู่เทรด pi/usdt แล้วดูเพิ่มเติม

- รางวัล

- 9

- 5

- repost

- แชร์

WallStreetTrendResearch :

:

การเทรดเป็นเรื่องของความน่าจะเป็น ยิ่งน้อยการดำเนินการก็ยิ่งมีโอกาสชนะมากขึ้น เมื่อเห็นจุดที่เหมาะสมก็เพิ่มตำแหน่ง การซื้อเพิ่มเมื่อราคาต่ำและขายลดเมื่อราคาสูง อย่าทำการเทรดผิดทาง ไม่เช่นนั้นต้นทุนการถือครองจะเพิ่มขึ้นเรื่อย ๆดูเพิ่มเติม

เช็คอินเข้าสตรีม, สปรินท์สำหรับ VIP+1 และโบนัสรายเดือน https://www.gate.com/campaigns/4098?ref=VQBFUFLCBA&ref_type=132

ดูต้นฉบับ

- รางวัล

- 2

- 2

- repost

- แชร์

GateUser-4492b407 :

:

2026 โกโกโก้ 👊ดูเพิ่มเติม

掘金老猫 · เช้าการวิเคราะห์ทองคำย้อนหลัง

ทองคำแท่ง(XAUUSD)

เมื่อคืนนี้ทองคำถูกกดดันในช่วง 5205~5215 ที่เรากำหนดไว้อย่างแม่นยำ ตลาดในเช้าวันนี้แตะสูงสุดใกล้ 5205 แล้วก็ย้อนกลับตามคาดการณ์ ซึ่งเป็นการยืนยันการคาดการณ์การขายทำกำไรในระดับสูง ความกดดันในช่วงนี้ของตลาดแข็งแกร่ง การปรับตัวลงในภายหลังเป็นไปตามแนวโน้มขาลงที่เราคาดไว้

ด้านข่าวสาร ตัวเลขการจ้างงานนอกภาคเกษตรของสหรัฐฯ ออกมาดีกว่าคาด ส่งเสริมความคาดหวังว่าธนาคารกลางสหรัฐฯ จะยังคงอัตราดอกเบี้ยสูงต่อไป ดอลลาร์และผลตอบแทนพันธบัตรสหรัฐฯ ฟื้นตัว ทำให้ราคาทองคำถูกกดดัน ขณะเดียวกัน ความเสี่ยงด้านภูมิรัฐศาสตร์ลดลง ความต้องการหลบภัยลดลง ก็เป็นแรงหนุนให

ดูต้นฉบับทองคำแท่ง(XAUUSD)

เมื่อคืนนี้ทองคำถูกกดดันในช่วง 5205~5215 ที่เรากำหนดไว้อย่างแม่นยำ ตลาดในเช้าวันนี้แตะสูงสุดใกล้ 5205 แล้วก็ย้อนกลับตามคาดการณ์ ซึ่งเป็นการยืนยันการคาดการณ์การขายทำกำไรในระดับสูง ความกดดันในช่วงนี้ของตลาดแข็งแกร่ง การปรับตัวลงในภายหลังเป็นไปตามแนวโน้มขาลงที่เราคาดไว้

ด้านข่าวสาร ตัวเลขการจ้างงานนอกภาคเกษตรของสหรัฐฯ ออกมาดีกว่าคาด ส่งเสริมความคาดหวังว่าธนาคารกลางสหรัฐฯ จะยังคงอัตราดอกเบี้ยสูงต่อไป ดอลลาร์และผลตอบแทนพันธบัตรสหรัฐฯ ฟื้นตัว ทำให้ราคาทองคำถูกกดดัน ขณะเดียวกัน ความเสี่ยงด้านภูมิรัฐศาสตร์ลดลง ความต้องการหลบภัยลดลง ก็เป็นแรงหนุนให

- รางวัล

- 1

- 2

- repost

- แชร์

huangjinshizi :

:

แมวเก๋า, ทำกำไร 500 เท่าของ Tafi ควรตั้งจุดตัดขาดทุนโดยทั่วไปเท่าไหร่?ดูเพิ่มเติม

- รางวัล

- 1

- 2

- repost

- แชร์

LirivasiIsATraditionalDance :

:

1000x Vibes 🤑ดูเพิ่มเติม

🎉 #GateSquare $50K แจกซองแดง! 🎉

เตรียมตัวให้พร้อมสำหรับการแจกของรางวัลครั้งใหญ่ที่สุดของฤดูกาล! เรากำลังแจกซองแดงมูลค่า 50,000 ดอลลาร์ให้กับชุมชนของเรา อย่าพลาดโอกาสที่จะได้รับส่วนแบ่ง!

วิธีเข้าร่วม:

1️⃣ ติดตาม GateSquare บนช่องทางทางการของเรา

2️⃣ ทำภารกิจง่ายๆ ในกิจกรรมแจกของรางวัล

3️⃣ ชวนเพื่อนของคุณและเพิ่มรางวัลของคุณ!

💰 รางวัล: 50,000 ดอลลาร์ที่แจกในซองแดง — ยิ่งคุณมีส่วนร่วมมากเท่าไหร่ โอกาสของคุณก็ยิ่งสูงขึ้นเท่านั้น!

⏰ รีบเลย! เวลาจำกัดเท่านั้น เข้าร่วมตอนนี้และเป็นส่วนหนึ่งของความตื่นเต้น!

🔗 เข้าร่วมการแจกของรางวัลตอนนี้

ให้เราทำให้การเฉลิมฉลองนี้เป็นที่จดจำ! 🚀

ดูต้นฉบับเตรียมตัวให้พร้อมสำหรับการแจกของรางวัลครั้งใหญ่ที่สุดของฤดูกาล! เรากำลังแจกซองแดงมูลค่า 50,000 ดอลลาร์ให้กับชุมชนของเรา อย่าพลาดโอกาสที่จะได้รับส่วนแบ่ง!

วิธีเข้าร่วม:

1️⃣ ติดตาม GateSquare บนช่องทางทางการของเรา

2️⃣ ทำภารกิจง่ายๆ ในกิจกรรมแจกของรางวัล

3️⃣ ชวนเพื่อนของคุณและเพิ่มรางวัลของคุณ!

💰 รางวัล: 50,000 ดอลลาร์ที่แจกในซองแดง — ยิ่งคุณมีส่วนร่วมมากเท่าไหร่ โอกาสของคุณก็ยิ่งสูงขึ้นเท่านั้น!

⏰ รีบเลย! เวลาจำกัดเท่านั้น เข้าร่วมตอนนี้และเป็นส่วนหนึ่งของความตื่นเต้น!

🔗 เข้าร่วมการแจกของรางวัลตอนนี้

ให้เราทำให้การเฉลิมฉลองนี้เป็นที่จดจำ! 🚀

- รางวัล

- 3

- 1

- repost

- แชร์

MrFlower_XingChen :

:

ชอบความคิดเห็นในโพสต์ของฉัน- รางวัล

- 4

- 1

- repost

- แชร์

GateUser-e8f0c5cc :

:

และยังแก้ไขข้อมูลโดยไม่ได้รับอนุญาตการเทรด การถือครอง และ การ staking: อย่าสับสนอีกต่อไป

ในคริปโตเคอร์เรนซี ไม่มีวิธีเดียวที่จะสร้างกำไรได้ แต่มีสามแนวทางหลัก

การเทรด

ซื้อและขายบ่อยครั้งเพื่อใช้ประโยชน์จากความผันผวนของราคา

ศักยภาพในการทำกำไรอย่างรวดเร็ว แต่มีความเสี่ยงสูงหากไม่มีกลยุทธ์ วินัย และการจัดการความเสี่ยง

เป็นวิธีที่ต้องใช้ความพยายาม แนะนำให้เรียนรู้ก่อนลงมือจริง

การถือครอง

ซื้อคริปโตเคอร์เรนซีและเก็บไว้ในระยะยาว

แนวทางที่เสถียรและน้อยความเครียดกว่า

เหมาะสำหรับผู้เริ่มต้นและนักลงทุนที่มีความอดทน

การ staking

ล็อคคริปโตของตนเพื่อมีส่วนร่วมในเครือข่ายและรับรางวัล

แนวทางที่เน้นรายได้แบบค่อยเป็นค่อยไปและแบบ passive

กำไรโดย

ดูต้นฉบับในคริปโตเคอร์เรนซี ไม่มีวิธีเดียวที่จะสร้างกำไรได้ แต่มีสามแนวทางหลัก

การเทรด

ซื้อและขายบ่อยครั้งเพื่อใช้ประโยชน์จากความผันผวนของราคา

ศักยภาพในการทำกำไรอย่างรวดเร็ว แต่มีความเสี่ยงสูงหากไม่มีกลยุทธ์ วินัย และการจัดการความเสี่ยง

เป็นวิธีที่ต้องใช้ความพยายาม แนะนำให้เรียนรู้ก่อนลงมือจริง

การถือครอง

ซื้อคริปโตเคอร์เรนซีและเก็บไว้ในระยะยาว

แนวทางที่เสถียรและน้อยความเครียดกว่า

เหมาะสำหรับผู้เริ่มต้นและนักลงทุนที่มีความอดทน

การ staking

ล็อคคริปโตของตนเพื่อมีส่วนร่วมในเครือข่ายและรับรางวัล

แนวทางที่เน้นรายได้แบบค่อยเป็นค่อยไปและแบบ passive

กำไรโดย

- รางวัล

- 1

- 1

- repost

- แชร์

Mr.Phil :

:

แล้วคุณบอกฉันว่าคุณรู้แล้วใช่ไหม?? แสดงความคิดเห็นของคุณที่นี่และกดติดตามCircle ทำรายได้ $770M ขึ้น ขณะที่ USDC ท้าทายฤดูหนาวของคริปโต - - #sec #sepa #usdc

USDC-0.01%

- รางวัล

- 4

- 1

- repost

- แชร์

Sekayla28 :

:

แม้ในช่วงเวลานี้ ก็ยังมีคนสามารถทำเงินจากคริปโตได้แม้ว่าการปรับตัวลงอย่างรวดเร็วในช่วงเช้าจะทำให้ราคาลดลงแตะใกล้ #加密市场反弹 66600$BTC แต่จากมุมมองทางเทคนิค นี่กลับเป็นการทดสอบแนวรับสำคัญอย่างมีประสิทธิภาพ ตำแหน่งนี้ไม่เพียงแต่เป็นพื้นที่การซื้อขายที่หนาแน่นในช่วงก่อนหน้านี้ แต่ยังซ้อนทับกับเส้นค่าเฉลี่ยเคลื่อนที่ MA60 รายวัน ราคาที่แตะแล้วดีดตัวขึ้นอย่างรวดเร็วและสร้างแท่งเทียนหางยาวด้านล่าง แสดงให้เห็นว่ามีกำลังรับซื้อด้านล่างค่อนข้างแข็งแกร่ง เป็นสัญญาณว่าพลังของการปรับตัวลงกำลังหมดแรง และเป็นสัญญาณหยุดการปรับตัวลง นอกจากนี้ การลงลึกในรอบนี้ยังช่วยเคลียร์อัตราค่าธรรมเนียมของเงินกู้ที่สูงเกินไป ซึ่งช่วยลดแรงขายในช่วงต่อไป

เมื่อราคากลับขึ้นมาที

เมื่อราคากลับขึ้นมาที

BTC-0.69%

- รางวัล

- 2

- 4

- repost

- แชร์

WhenTheMountainDoesn'tMove,The :

:

2026 เร่งด่วน 👊ดูเพิ่มเติม

- รางวัล

- 4

- 1

- repost

- แชร์

mkmknjbhvgcf :

:

81 ก็ยังไปไม่ถึง ยังเหลือ 18- รางวัล

- 2

- 1

- repost

- แชร์

CryptoNomad :

:

อย่ากลัว อย่ารู้สึกเสียใจ อย่าบ่น พรุ่งนี้จะเข้าจดทะเบียน ซื้อในช่วงราคาต่ำ#深度创作营

#加密市场反弹

วันที่วุ่นวายอย่างบ้าคลั่งในตลาด! จังหวะของการฟื้นตัวนี้เกือบจะเหมือนในภาพยนตร์—เมื่อแรงกดดันทางกฎหมายเพิ่มขึ้น “มือที่มองไม่เห็น” ที่ตบตลาดทุกเช้าดูเหมือนจะได้ถอยหลัง

นี่คือสรุปความวุ่นวายปัจจุบันและความหมายต่อพอร์ตโฟลิโอของคุณ:

1. “ปริศนาสองทุ่ม”: บังเอิญหรือระวังตัวทางศาล?

การหายไปของการขายในเวลา 10 โมงเช้ากลายเป็นเรื่องพูดถึงกันทั่วเมือง เป็นเวลาหลายเดือนที่นักลงทุนล้อเลียน (และร้องไห้) เกี่ยวกับการขายออกอย่างเป็นระบบที่เกิดขึ้นเมื่อตลาดสหรัฐฯ เริ่มมีแรงผลักดัน

ตัวกระตุ้น: คดีความฟ้องร้อง Jane Street ซึ่งกล่าวหาการซื้อขายภายในในช่วงวิกฤต Terra ปี 2022 ได้ทำให้บริษัทนี้อ

ดูต้นฉบับ#加密市场反弹

วันที่วุ่นวายอย่างบ้าคลั่งในตลาด! จังหวะของการฟื้นตัวนี้เกือบจะเหมือนในภาพยนตร์—เมื่อแรงกดดันทางกฎหมายเพิ่มขึ้น “มือที่มองไม่เห็น” ที่ตบตลาดทุกเช้าดูเหมือนจะได้ถอยหลัง

นี่คือสรุปความวุ่นวายปัจจุบันและความหมายต่อพอร์ตโฟลิโอของคุณ:

1. “ปริศนาสองทุ่ม”: บังเอิญหรือระวังตัวทางศาล?

การหายไปของการขายในเวลา 10 โมงเช้ากลายเป็นเรื่องพูดถึงกันทั่วเมือง เป็นเวลาหลายเดือนที่นักลงทุนล้อเลียน (และร้องไห้) เกี่ยวกับการขายออกอย่างเป็นระบบที่เกิดขึ้นเมื่อตลาดสหรัฐฯ เริ่มมีแรงผลักดัน

ตัวกระตุ้น: คดีความฟ้องร้อง Jane Street ซึ่งกล่าวหาการซื้อขายภายในในช่วงวิกฤต Terra ปี 2022 ได้ทำให้บริษัทนี้อ

- รางวัล

- 5

- 1

- repost

- แชร์

CryptoChampion :

:

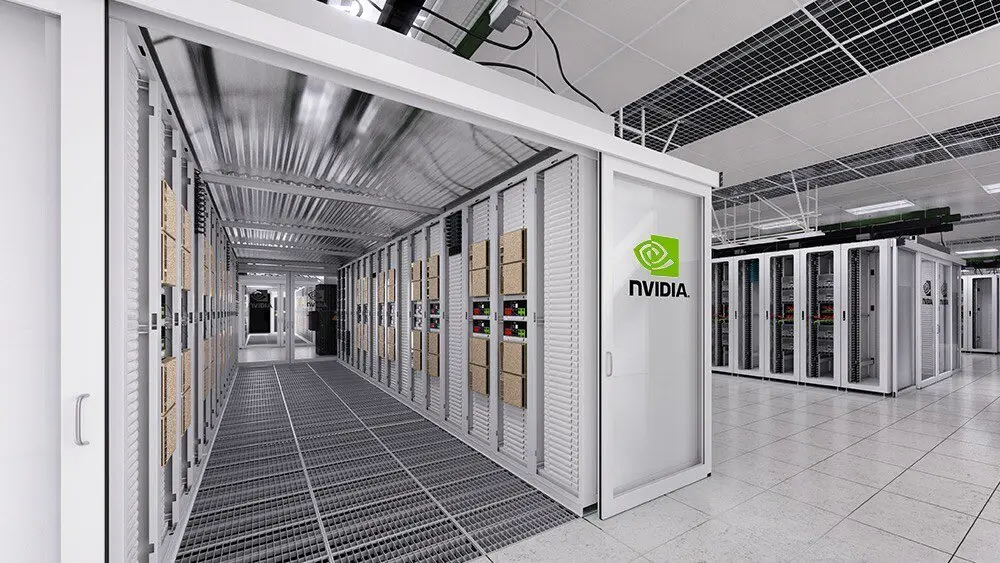

สู่ดวงจันทร์ 🌕$NVDA อยู่ที่มูลค่าตลาด 4.7T

ตลาดน่าจะรู้สึกกังวลว่ามูลค่าประมาณนี้สามารถรักษาไว้ได้เพียงด้วยการใช้จ่ายด้าน AI CAPEX หลายร้อยพันล้านดอลลาร์

มีโอกาสสูงที่กรอบความคิด Overton จะเปลี่ยนแปลงอย่างมากเมื่อพูดถึงมูลค่าหลักทรัพย์

บางทีการใช้จ่าย CAPEX หลายร้อยพันล้านดอลลาร์อาจไม่ใช่จุดสูงสุดที่ตลาดคิดไว้

บางทีมันอาจเป็นจำนวนเล็กน้อยเมื่อเทียบกับสิ่งที่จะเกิดขึ้นในทศวรรษหน้าเมื่อ AI พัฒนาขึ้น

ถ้าเป็นเช่นนั้น $NVDA ที่ 20x EPS ในปี 2026 จะดูชัดเจนมากในภายหลัง

ดูต้นฉบับตลาดน่าจะรู้สึกกังวลว่ามูลค่าประมาณนี้สามารถรักษาไว้ได้เพียงด้วยการใช้จ่ายด้าน AI CAPEX หลายร้อยพันล้านดอลลาร์

มีโอกาสสูงที่กรอบความคิด Overton จะเปลี่ยนแปลงอย่างมากเมื่อพูดถึงมูลค่าหลักทรัพย์

บางทีการใช้จ่าย CAPEX หลายร้อยพันล้านดอลลาร์อาจไม่ใช่จุดสูงสุดที่ตลาดคิดไว้

บางทีมันอาจเป็นจำนวนเล็กน้อยเมื่อเทียบกับสิ่งที่จะเกิดขึ้นในทศวรรษหน้าเมื่อ AI พัฒนาขึ้น

ถ้าเป็นเช่นนั้น $NVDA ที่ 20x EPS ในปี 2026 จะดูชัดเจนมากในภายหลัง

- รางวัล

- 3

- 1

- repost

- แชร์

GateUser-06070724 :

:

มีเพียงสิ่งเดียวที่ต้องพูด: มันคือยักษ์ใหญ่โหลดเพิ่ม

post.trendingtopics

ดูเพิ่มเติม6.8K Popularity

345.34K Popularity

post.hot.gate.fun

ดูเพิ่มเติม- post.mc:$2.46Kpost.holder.count:10.00%

- post.mc:$2.49Kpost.holder.count:20.27%

- 3

1

hc

post.mc:$2.44Kpost.holder.count:10.00% - post.mc:$2.46Kpost.holder.count:10.00%

- post.mc:$2.44Kpost.holder.count:20.00%

ปักหมุด