Investment Portfolio and Risk Management

This course will introduce the basic concepts of investment portfolio and risk management, helping you to understand how to balance returns and risks in the crypto market. By learning about asset allocation, position management, and stop-loss strategies, you will master the key methods for building a robust investment system.

Introduction: Why You Shouldn’t “Bet It All” in Investing

Have you ever heard the saying, “Don’t put all your eggs in one basket”?

This is the very essence of Portfolio Management. In both crypto and traditional finance, investing is never a game of luck but a game of probability and risk. Whether you are buying BTC, ETH, U.S. stock ETFs, gold, or bonds. Every asset carries its own volatility and uncertainty. If you put all your funds into a single asset, a market downturn could cause your portfolio to shrink dramatically overnight.

Portfolio management is all about diversification, optimal allocation, and risk control, enabling you to earn steady returns over time instead of getting wiped out by one sharp market swing. And risk management is the key to surviving market turbulence.

What Is a Portfolio?

Simply put, a portfolio is a “basket” made up of multiple assets. The core idea is that different assets don’t always move in the same direction. Through proper diversification and allocation, you can pursue more stable returns while keeping risks under control.

Example:

- Investor A: Allocated all funds to BTC. This portfolio carries high risk and high volatility as a single market crash could slash the portfolio’s value in half.

- Investor B: Allocated 50% to BTC, 30% to ETH, and 20% to stablecoins. The portfolio is more diversified, and when BTC falls, ETH or stablecoins can help hedge part of the loss.

- Investor C: Allocated 40% to crypto assets, 40% to U.S. stock indexes, and 20% to gold. Since these assets come from markets with low correlation, the portfolio’s overall volatility is significantly reduced.

The key difference among these three approaches lies in the degree of diversification. The more diversified a portfolio is, the less it’s affected by risks in any single market.

Balancing Risk and Return

Every investment involves a trade-off between risk and return. In general, the higher the risk, the greater the potential return; and vice versa.

Think of investing as taking a flight:

- Buying government bonds or staking stablecoins is like taking a commercial flight; it’s safe, but not particularly fast.

- Investing in altcoins or using leveraged futures is like flying a fighter jet; it’s fast and thrilling, but one wrong move can send you crashing.

Successful investors don’t aim to go “the fastest”; they aim to go the most steadily. They know how to control risk and keep their portfolios sailing smoothly through the storms of the market.

How to Build Your Portfolio

For beginners, you can gradually build your own investment portfolio in the following five steps:

Step 1: Define Your Goals and Risk Tolerance

Before you start investing, ask yourself three key questions:

- What is my investment goal? (e.g., wealth accumulation, passive income, long-term capital preservation)

- How much volatility can I tolerate?

- What is my investment horizon? (short-term / medium-term / long-term)

Investors with higher risk tolerance can allocate more to high-volatility assets, while those with lower tolerance should focus on conservative options such as stablecoins or bond-type assets.

Step 2: Choose the Right Asset Classes

Common asset categories include:

- Cryptocurrencies (high risk, high return): BTC, ETH, major public-chain tokens

- Stablecoins (low risk): USDT, USDC, etc.

- Stocks or ETFs (medium risk): S&P 500 index funds, etc.

- Gold / Precious Metals (hedging assets)

- Cash/Savings (risk-free but no growth)

In the crypto market, your portfolio can include both on-chain assets and traditional financial instruments.

Step 3: Manage Asset Allocation

A common beginner’s mistake is thinking: “I’m bullish on BTC, so I’ll put 100% of my funds into it.” That’s actually very risky.

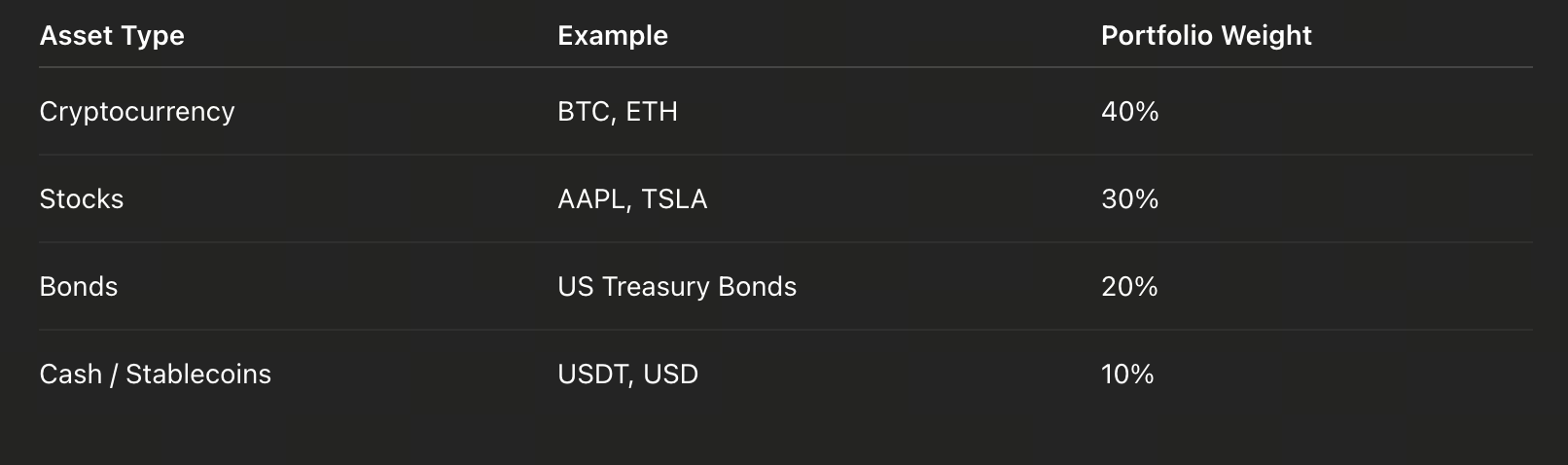

The correct approach is to assign weights to different assets, for example:

At the end of each quarter, review your portfolio:

- If BTC has risen too much and its proportion increases, consider selling part of it to restore the original weight.

- If ETH underperforms, you may rebalance by adding from your stablecoin portion.

- Adjust allocations dynamically according to overall market trends.

This way, your portfolio won’t become unbalanced due to the surge or plunge of a single asset.

Common Mistakes and How to Avoid Them

- Going all-in: Not keeping cash reserves and getting stuck when the market falls.

- Overtrading: Frequent buying and selling in a short period, causing unnecessary fees and slippage.

- No tracking: Failing to record trades, leading to repeated mistakes.

- Ignoring risk metrics: Focusing only on returns while overlooking volatility and drawdown.

- Following the crowd: FOMO buying during rallies and panic selling during downturns.

Remember: Successful investing doesn’t come from luck—it comes from system and discipline.

Build Your Own Investment System

An investment system is not a complex mathematical model. It’s a set of rules and habits you can stick to long-term.

You can refer to this simple framework:

- Investment Goals: Define your target returns and time horizon (e.g., 10% annualized return over 3 years).

- Asset Allocation: Set your allocation ratios and record them on a table.

- Risk Control Rules: Establish stop-loss, take-profit, and position size limits.

- Review Frequency: Review performance and rebalance weekly or monthly.

- Trading Journal: Record every buy and sell, including your reasoning and emotional state.