Post content & earn content mining yield

placeholder

MarketMaestro

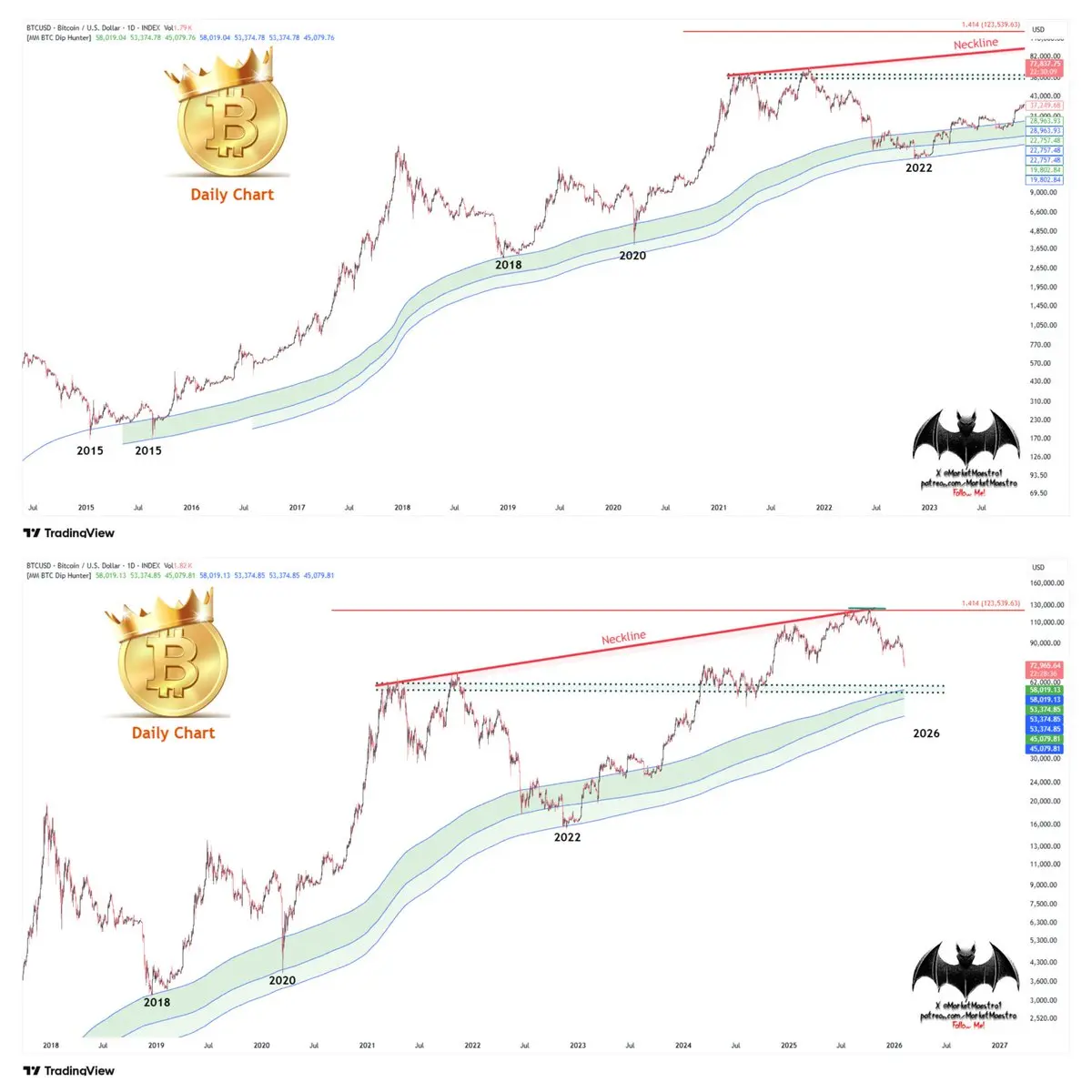

$BTCAs you can see, "MM BTC Dip Hunter" hasn’t missed a single BTC bottom. I think the bottom could end at $58K, but the location of the averages will change depending on time and price. When the time comes, I hope I’ll share the bottomStay tuned 💯 so you don’t miss the updates. And don’t forget, I warned you in time about the BTC topI wrote the averages on the chart myself

BTC-4,16%

- Reward

- like

- Comment

- Repost

- Share

If this bitcoin cycle exactly repeats, bitcoin will hit $250,000 in 2029.Do you understand?

BTC-4,16%

- Reward

- like

- 1

- Repost

- Share

GateUser-38e516db :

:

Understood, but the problem is that the principal is almost gone. At 3 a.m. today, two coins with the same name—explain, for your reputation.Another beautiful day, are you all ready to take profits?

View Original

- Reward

- like

- Comment

- Repost

- Share

CPC

CPCion

Created By@PakistaniLionThePakistaniLion,

Listing Progress

0.00%

MC:

$0.1

Create My Token

Already took profit near 2170 this morning. After a pullback to around 2140, opened a starter position. Currently waiting for the hourly chart to pull back. The first target remains at 2170. The second target is around 2200.

Friendly reminder: Never over-allocate your position. To prevent a reversal and a drop below 2000. $ETH

Friendly reminder: Never over-allocate your position. To prevent a reversal and a drop below 2000. $ETH

ETH-4,12%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

$H /USDT update ⚡🔥

Price: 0.11749 USDT

24h Change: +6.77%

24h High / Low: 0.13416 / 0.10804

24h Volume: 57.79M H

Turnover: 6.88M USDT

On the 15-min chart, H exploded from 0.1093, topped at 0.1341, and is now cooling into a tight consolidation near 0.1175.

Key MAs:

MA(5): 0.11816

MA(10): 0.11837

MA(30): 0.12148

Price is holding above local support while moving averages compress — a classic reset before the next move.

Break 0.121–0.123 and momentum could reignite fast. Lose 0.114, and deeper pullback comes into play.

Volatility is primed. H is not done yet. 🚀

#AIExclusiveSocialNetworkMoltbook

Price: 0.11749 USDT

24h Change: +6.77%

24h High / Low: 0.13416 / 0.10804

24h Volume: 57.79M H

Turnover: 6.88M USDT

On the 15-min chart, H exploded from 0.1093, topped at 0.1341, and is now cooling into a tight consolidation near 0.1175.

Key MAs:

MA(5): 0.11816

MA(10): 0.11837

MA(30): 0.12148

Price is holding above local support while moving averages compress — a classic reset before the next move.

Break 0.121–0.123 and momentum could reignite fast. Lose 0.114, and deeper pullback comes into play.

Volatility is primed. H is not done yet. 🚀

#AIExclusiveSocialNetworkMoltbook

H7,85%

- Reward

- like

- Comment

- Repost

- Share

#WhiteHouseCryptoSummit Crypto at the Center of Policy and Market Strategy

The White House Crypto Summit has once again placed digital assets at the forefront of policy discussions, marking a pivotal moment for the crypto ecosystem. By bringing together regulators, industry leaders, and institutional participants, the summit emphasizes the growing importance of collaboration between government frameworks and decentralized innovation. The outcomes could shape regulatory clarity, market adoption, and institutional confidence—impacting both short-term price action and long-term strategic position

The White House Crypto Summit has once again placed digital assets at the forefront of policy discussions, marking a pivotal moment for the crypto ecosystem. By bringing together regulators, industry leaders, and institutional participants, the summit emphasizes the growing importance of collaboration between government frameworks and decentralized innovation. The outcomes could shape regulatory clarity, market adoption, and institutional confidence—impacting both short-term price action and long-term strategic position

- Reward

- 5

- 6

- Repost

- Share

YingYue :

:

Happy New Year! 🤑View More

Guess what I bought while everyones crying about the market. Trenches are still good with nice volume + this has a very solid narrative, once I\'m sized in properly I\'ll talk more details. Few good wallets and that in too. 5-10m+ targets here.$accelerando

- Reward

- like

- Comment

- Repost

- Share

#FedLeadershipImpact

Federal Reserve leadership is not just about who speaks—it’s about how credibility, reaction functions, and market expectations are shaped. Changes in tone, voting balance, or leadership direction can quietly redefine the entire risk landscape.

1) Fed Leadership = Market Psychology Anchor

Markets don’t trade policy alone—they trade confidence in policy execution.

Strong, consistent Fed leadership:

Anchors inflation expectations

Reduces volatility premiums

Keeps financial conditions predictable

Unclear or divided leadership:

Increases risk premia

Amplifies market overreact

Federal Reserve leadership is not just about who speaks—it’s about how credibility, reaction functions, and market expectations are shaped. Changes in tone, voting balance, or leadership direction can quietly redefine the entire risk landscape.

1) Fed Leadership = Market Psychology Anchor

Markets don’t trade policy alone—they trade confidence in policy execution.

Strong, consistent Fed leadership:

Anchors inflation expectations

Reduces volatility premiums

Keeps financial conditions predictable

Unclear or divided leadership:

Increases risk premia

Amplifies market overreact

- Reward

- 3

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

Notification: The Bitcoin long orders placed yesterday have been filled. Can I still make it to the other side? Yesterday's analysis mentioned that Bitcoin needs to be observed because the 4-hour and daily timeframes show conflicting bullish and bearish signals. After the daily close today, Bitcoin's 4-hour and 6-hour divergences have become even more severe. The resistance at the 5-day moving average on the daily chart is around 75,000, which is still several thousand points away. So today, it's possible to participate in a rebound. The US stock market dropped quite sharply yesterday. To be h

View Original

- Reward

- like

- Comment

- Repost

- Share

🌈 Gate Live Streaming Inspiration - February 5

Trending Topics Recommendations:

🔹 On-chain indicators converge, the selling wave loses momentum, has Bitcoin reached its cycle bottom?

🔹 Vitalik questions L2 homogeneity, Arbitrum, Optimism, and Base collectively shift towards differentiation, is the scaling competition direction changing?

🔹 Gold becomes the ultimate hedge tool in the global capital war, safe-haven assets continue to strengthen!

🔹 Bloomberg: Bitcoin ETF holdings cost approximately $84,100, with an unrealized loss of nearly 9%. Will falling below the cost line trigger selling

View OriginalTrending Topics Recommendations:

🔹 On-chain indicators converge, the selling wave loses momentum, has Bitcoin reached its cycle bottom?

🔹 Vitalik questions L2 homogeneity, Arbitrum, Optimism, and Base collectively shift towards differentiation, is the scaling competition direction changing?

🔹 Gold becomes the ultimate hedge tool in the global capital war, safe-haven assets continue to strengthen!

🔹 Bloomberg: Bitcoin ETF holdings cost approximately $84,100, with an unrealized loss of nearly 9%. Will falling below the cost line trigger selling

- Reward

- 1

- Comment

- Repost

- Share

🗣 Elon Musk says money cannot buy happiness. #crypto

- Reward

- 2

- 1

- Repost

- Share

CAMPEAO :

:

This year of growth is going to be incredible.DeepSeek

DeepSeek

Created By@KKYE

Listing Progress

0.00%

MC:

$0.1

Create My Token

Today marks the 596th day I have been posting updates without a break. Each post is not just a routine but carefully prepared. [微笑] If you think I am a serious person, you can follow me, and I hope the daily content can help you. The world is vast, and I am small. Follow me to make it easier to find. [微笑][微笑]

The real game-changing positive news! There has been new progress on the Bitcoin reserve bill that I’ve been discussing for over a year. This time, it clearly specifies the amount of Bitcoin to be purchased and the source of funds. If the bill passes, the U.S. will buy 1 million Bitcoins

The real game-changing positive news! There has been new progress on the Bitcoin reserve bill that I’ve been discussing for over a year. This time, it clearly specifies the amount of Bitcoin to be purchased and the source of funds. If the bill passes, the U.S. will buy 1 million Bitcoins

BTC-4,16%

- Reward

- 2

- 1

- Repost

- Share

ThisNameIsn_tBad. :

:

🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹🌹【$COLLECT Signal】Long | Volume and Price Rise Together Breakout

$COLLECT Price accompanied by a 10% increase and $40 million in volume strongly pushed higher, with open interest (OI) increasing by over 114 million, indicating a typical main force entry signal rather than a bearish trap.

🎯 Direction: Long

🎯 Entry: 0.0358 - 0.0362

🛑 Stop Loss: 0.0345 ( Rigid Stop Loss )

🚀 Target 1: 0.0395

🚀 Target 2: 0.0420

The market shows sustained absorption of buy orders at key levels, with healthy volume and price structure. The brief cooldown after the push is a healthy reset, with no top distributi

View Original$COLLECT Price accompanied by a 10% increase and $40 million in volume strongly pushed higher, with open interest (OI) increasing by over 114 million, indicating a typical main force entry signal rather than a bearish trap.

🎯 Direction: Long

🎯 Entry: 0.0358 - 0.0362

🛑 Stop Loss: 0.0345 ( Rigid Stop Loss )

🚀 Target 1: 0.0395

🚀 Target 2: 0.0420

The market shows sustained absorption of buy orders at key levels, with healthy volume and price structure. The brief cooldown after the push is a healthy reset, with no top distributi

- Reward

- 1

- Comment

- Repost

- Share

【$SOL Signal】Empty position + Observe for increased volume on decline

$SOL enters a cooling observation period after a volume surge on decline. Price action shows significant selling pressure, combined with high open interest, alerting to the risk of further downside caused by long liquidation. The current market logic favors a bearish dominance, with no clear signs of buying absorption or structural support.

🎯 Direction: Empty position

Be patient and wait for the price structure to reshape. If the price can form a clear reversal pattern (such as a pin bar or demand zone absorption) at key

View Original$SOL enters a cooling observation period after a volume surge on decline. Price action shows significant selling pressure, combined with high open interest, alerting to the risk of further downside caused by long liquidation. The current market logic favors a bearish dominance, with no clear signs of buying absorption or structural support.

🎯 Direction: Empty position

Be patient and wait for the price structure to reshape. If the price can form a clear reversal pattern (such as a pin bar or demand zone absorption) at key

- Reward

- like

- Comment

- Repost

- Share

is there an exchange quietly offloading ???????????

- Reward

- like

- Comment

- Repost

- Share

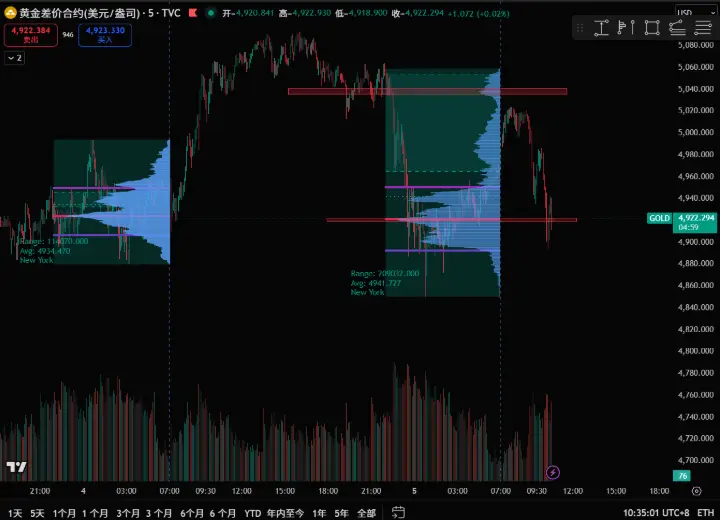

Today is February 5th, 2026. Gold was around 4851 last night. Currently, the same view remains: as long as it does not break below the range I mentioned yesterday, gold is likely to fluctuate widely, building a bottom for the bulls. The overall bullish factors in the market are the global central banks' gold-buying frenzy and the current war risks. The bearish factors are that tonight's European and American central banks may signal a hawkish stance to strengthen the dollar, which could impact gold prices. Lastly, I want to remind everyone to pay close attention to tonight's European and Ameri

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More17.53K Popularity

13.58K Popularity

13.06K Popularity

4.2K Popularity

8.17K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.64KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreAptos and BCG jointly release Hong Kong tokenized fund white paper, focusing on institutional-scale implementation pathways

1 m

The Ethereum Foundation launches a research grant program to support Ethereum academic research led by PhD students.

2 m

OpenAI Expands Advisory Team Significantly, Accelerating Enterprise AI Automation Deployment

2 m

A major whale transferred 2,676 ETH to FalconX, with total losses exceeding $20 million

6 m

Guotou Silver LOF on the exchange hits the limit-down for four consecutive days, with the premium rate falling back to 37.13%

11 m

Pin