MarketMaestro

No content yet

MarketMaestro

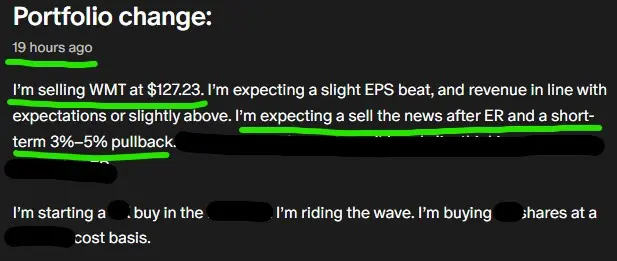

$LMND was flying in the pre market then what happened?

Strong operational growth and upside guidance triggered short term excitement, but the stock was already priced for perfection. A short lived squeeze driven by short interest (around 21%) inflated the pre market, and then selling hit after the open

After profit taking

Strong operational growth and upside guidance triggered short term excitement, but the stock was already priced for perfection. A short lived squeeze driven by short interest (around 21%) inflated the pre market, and then selling hit after the open

After profit taking

- Reward

- 2

- Comment

- Repost

- Share

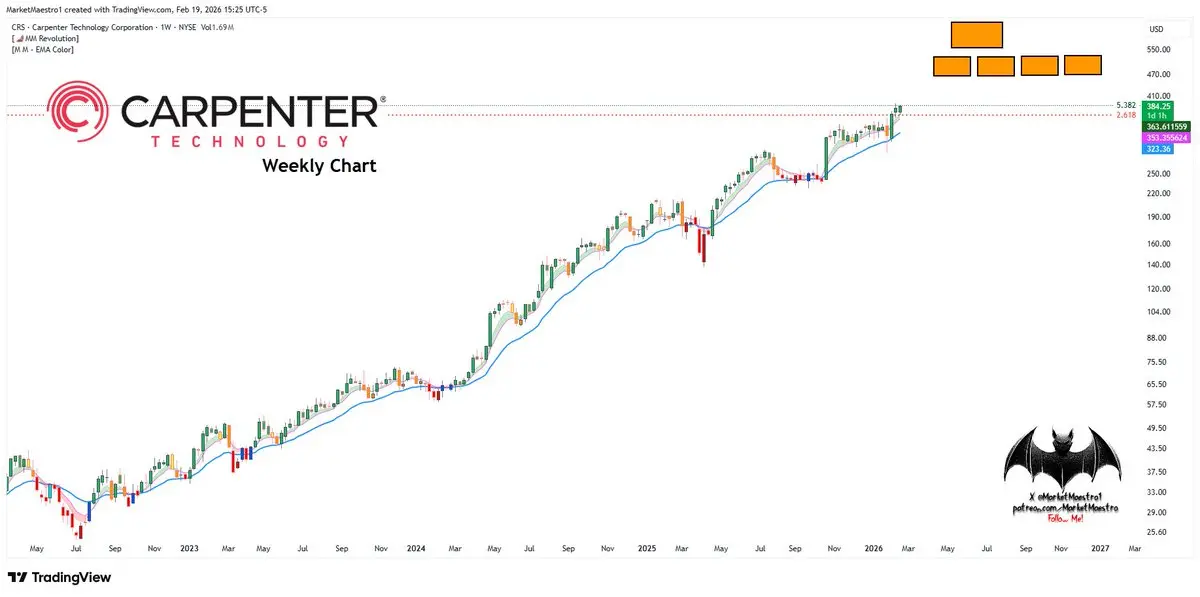

$CRS

It broke the main fibo and got stuck at the intermediate fibo. Yes, it’s rallying very steeply, but it broke the 2007–2023 base, so this rally is natural. The mid to long term picture is still very strong

It broke the main fibo and got stuck at the intermediate fibo. Yes, it’s rallying very steeply, but it broke the 2007–2023 base, so this rally is natural. The mid to long term picture is still very strong

- Reward

- 2

- Comment

- Repost

- Share

$WULF

It got rejected at $16.73 (fibo78). It quickly filled the gap at $14.47. ..

It retested the small red diagonal resistance it had previously broken. .. For now, there’s no problem

It got rejected at $16.73 (fibo78). It quickly filled the gap at $14.47. ..

It retested the small red diagonal resistance it had previously broken. .. For now, there’s no problem

- Reward

- 2

- Comment

- Repost

- Share

$CIFR

It’s holding tight. It’s squeezed between the averages and the range has narrowed a lot. It’ll probably decide direction very soon. ER could be the catalyst that forces that decision

It’s holding tight. It’s squeezed between the averages and the range has narrowed a lot. It’ll probably decide direction very soon. ER could be the catalyst that forces that decision

- Reward

- 2

- Comment

- Repost

- Share

$URG

A similar setup we see in many REE stocks is present here as well. The area I boxed in green whether it turns into a double top or evolves into a cup+handle isn’t clear yet...

A similar setup we see in many REE stocks is present here as well. The area I boxed in green whether it turns into a double top or evolves into a cup+handle isn’t clear yet...

- Reward

- 2

- Comment

- Repost

- Share

$EU

It got rejected from the fibo78 zone for the second time. At the same time, there are institutional bearish order block orders there and they’ve built a wall. ..

It looks like it’s holding in this area, but it’s not certain. yet

It got rejected from the fibo78 zone for the second time. At the same time, there are institutional bearish order block orders there and they’ve built a wall. ..

It looks like it’s holding in this area, but it’s not certain. yet

- Reward

- 2

- Comment

- Repost

- Share

$ONDS

If it can hold above the green line, it will be out of the risky zone. For momentum to strengthen, it needs to break the red resistance band. There are two FVG zones below

If it can hold above the green line, it will be out of the risky zone. For momentum to strengthen, it needs to break the red resistance band. There are two FVG zones below

- Reward

- 2

- Comment

- Repost

- Share

$SERV

Institutions didn’t allow a pass through the red zone. It dropped into an area with very strong supports. If it can ride out the storm in this zone without breaking those supports, that would be very good. For that, it needs to put in upside reactions from time to time

Institutions didn’t allow a pass through the red zone. It dropped into an area with very strong supports. If it can ride out the storm in this zone without breaking those supports, that would be very good. For that, it needs to put in upside reactions from time to time

- Reward

- like

- Comment

- Repost

- Share

$TMDX

... It’s in a choppy market and a negative gamma regime trying to stay strong, basically spending time getting tossed around in the wind.

The good thing is it can use the FVG zones (blue areas) as a base and lift from there. It’s back at the FVG retest area again and ..

Institutions have been capping upside with bearish block orders in the red OBZ area. ..

The outlook isn’t bad, but it isn’t great either. ..

... It’s in a choppy market and a negative gamma regime trying to stay strong, basically spending time getting tossed around in the wind.

The good thing is it can use the FVG zones (blue areas) as a base and lift from there. It’s back at the FVG retest area again and ..

Institutions have been capping upside with bearish block orders in the red OBZ area. ..

The outlook isn’t bad, but it isn’t great either. ..

- Reward

- 1

- Comment

- Repost

- Share

$SMCI

It held the $29 support. That was important. On the weekly chart, it held the green zone, and the minority says there’s a positive divergence possibility

It held the $29 support. That was important. On the weekly chart, it held the green zone, and the minority says there’s a positive divergence possibility

- Reward

- 2

- Comment

- Repost

- Share

$ATRO

breaking out! 💥

breaking out! 💥

- Reward

- like

- Comment

- Repost

- Share

$XOP $BNO

The U.S. military buildup is at war scale...oil ETFs ..

The U.S. military buildup is at war scale...oil ETFs ..

- Reward

- like

- Comment

- Repost

- Share

$PWR

Quanta Services Non-GAAP EPS of $3.16 beats by $0.14, revenue of $7.84B beats by $470M

Feb. 19, 2026

Q4 Non-GAAP EPS of $3.16 beats by $0.14.

Revenue of $7.84B (+19.7% Y/Y) beats by $470M.

Year-End Remaining Performance Obligations (RPO) of $23.76 Billion* and Total Backlog of $43.98 Billion

For the full year ending December 31, 2026, Quanta expects revenues to range between $33.25 billion and $33.75 billion vs $31.49B consensus and net income attributable to common stock to range between $1.27 billion and $1.38 billion. Quanta also expects diluted earnings per share attributable to commo

Quanta Services Non-GAAP EPS of $3.16 beats by $0.14, revenue of $7.84B beats by $470M

Feb. 19, 2026

Q4 Non-GAAP EPS of $3.16 beats by $0.14.

Revenue of $7.84B (+19.7% Y/Y) beats by $470M.

Year-End Remaining Performance Obligations (RPO) of $23.76 Billion* and Total Backlog of $43.98 Billion

For the full year ending December 31, 2026, Quanta expects revenues to range between $33.25 billion and $33.75 billion vs $31.49B consensus and net income attributable to common stock to range between $1.27 billion and $1.38 billion. Quanta also expects diluted earnings per share attributable to commo

- Reward

- like

- Comment

- Repost

- Share

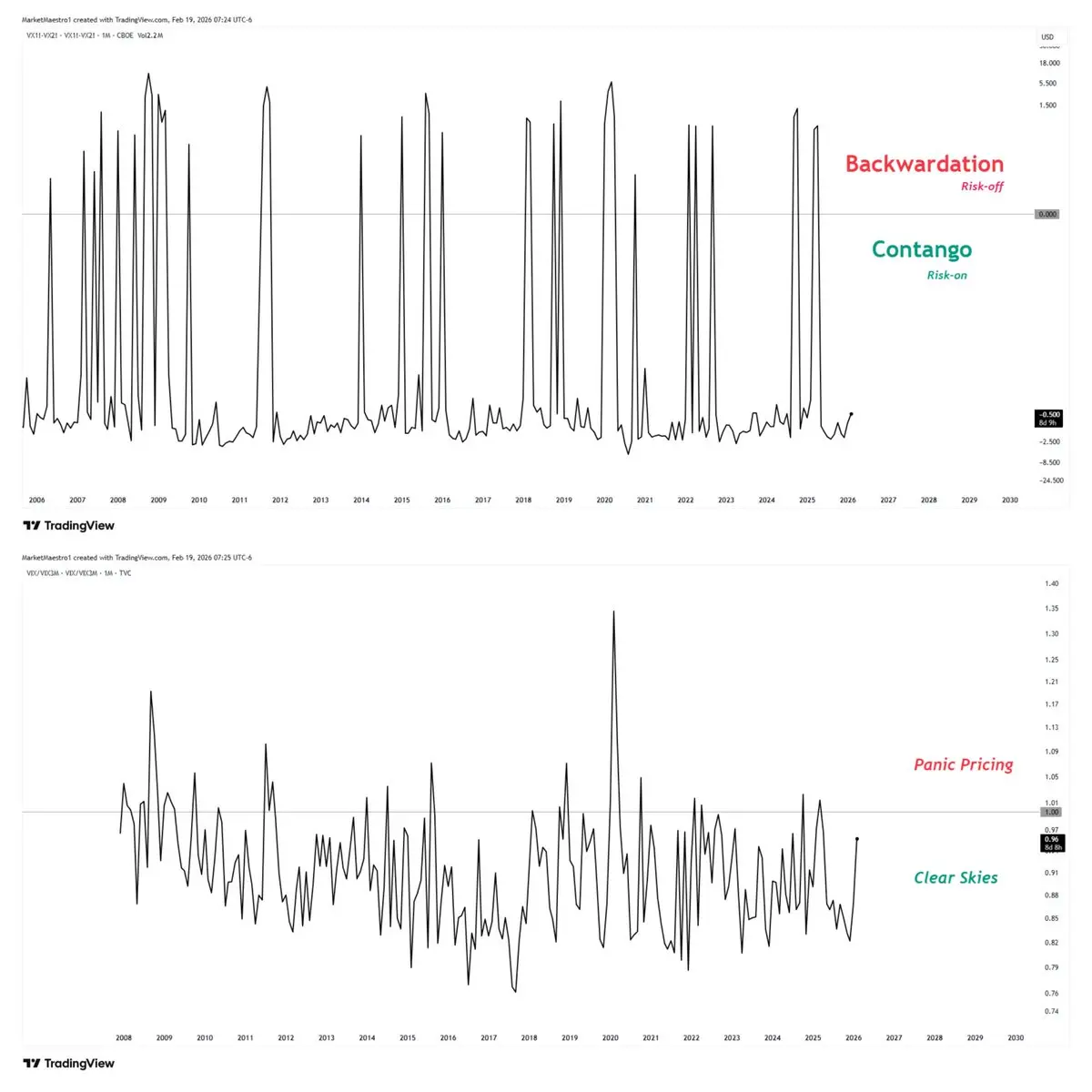

$VIX

They’ve started pumping fear again on X just for engagement. Based on this read, there’s no problem right now!

They’ve started pumping fear again on X just for engagement. Based on this read, there’s no problem right now!

- Reward

- 2

- Comment

- Repost

- Share

$FOUR

On the daily chart, there’s a double bottom and a positive divergence, but since it’s oversold on the monthly chart, it could also react to the selloff. At this stage, the move is a reaction move

On the daily chart, there’s a double bottom and a positive divergence, but since it’s oversold on the monthly chart, it could also react to the selloff. At this stage, the move is a reaction move

- Reward

- 2

- Comment

- Repost

- Share

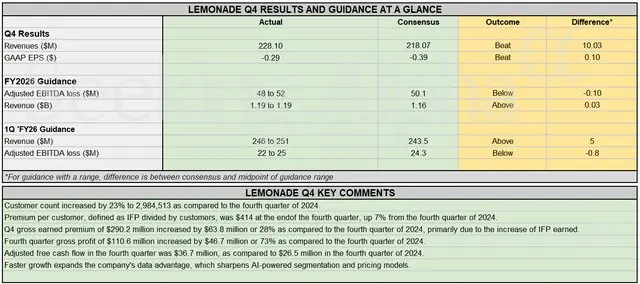

$LMND 🚀

Lemonade GAAP EPS of -$0.29 beats by $0.10, revenue of $228.1M beats by $10.03M

Feb. 19, 2026

Q4 GAAP EPS of -$0.29 beats by $0.10.

Revenue of $228.1M (+53.3% Y/Y) beats by $10.03M.

Fourth quarter revenue of $228.1 million increased by $79.3 million or 53% ascompared to the fourth quarter of 2024, primarily due to the increase of grossearned premium, ceding commission income, and a reduced premium cession raterelated to quota share reinsurance following our recent renewal, as covered indetail in the second quarter's letter to shareholders.

IFP, defined as the aggregate annualized prem

Lemonade GAAP EPS of -$0.29 beats by $0.10, revenue of $228.1M beats by $10.03M

Feb. 19, 2026

Q4 GAAP EPS of -$0.29 beats by $0.10.

Revenue of $228.1M (+53.3% Y/Y) beats by $10.03M.

Fourth quarter revenue of $228.1 million increased by $79.3 million or 53% ascompared to the fourth quarter of 2024, primarily due to the increase of grossearned premium, ceding commission income, and a reduced premium cession raterelated to quota share reinsurance following our recent renewal, as covered indetail in the second quarter's letter to shareholders.

IFP, defined as the aggregate annualized prem

- Reward

- 2

- Comment

- Repost

- Share