A #CryptoMarketPullback often begins quietly, almost unnoticed, before it evolves into a phase that captures the full attention of traders, investors, and analysts across the digital asset space. Prices that once climbed with confidence start to slow, momentum weakens, and suddenly the market atmosphere shifts from celebration to caution. Yet a pullback is not merely a downward move on the charts; it is a reflection of collective psychology where profit-taking, uncertainty, macroeconomic signals, and shifting sentiment converge to create a natural pause in the market cycle. While many newcomers interpret these moments as signs of failure or collapse, experienced participants understand that pullbacks are not only normal but necessary for long-term sustainability.

During a pullback, emotions become the most influential market driver. Fear spreads faster than logic, social media becomes saturated with mixed opinions, and traders find themselves questioning decisions they once felt confident about. Some rush to exit positions in order to protect capital, while others view the correction as an opportunity to enter the market at more favorable levels. This contrast in behavior highlights one of the most fascinating aspects of the crypto ecosystem: the same price movement can inspire panic in one investor and strategic optimism in another. The difference lies in experience, planning, and the ability to manage emotional responses during uncertainty.

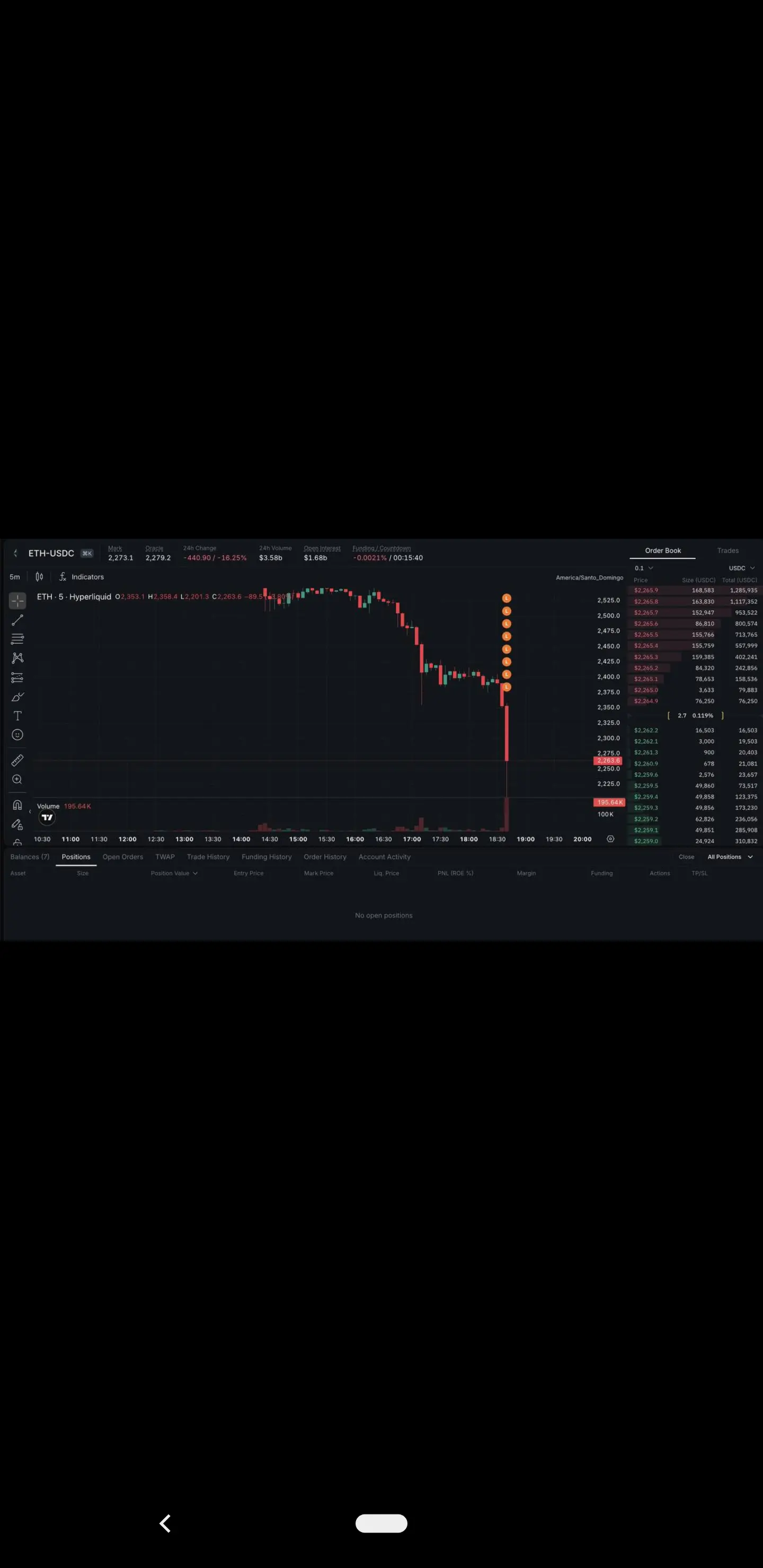

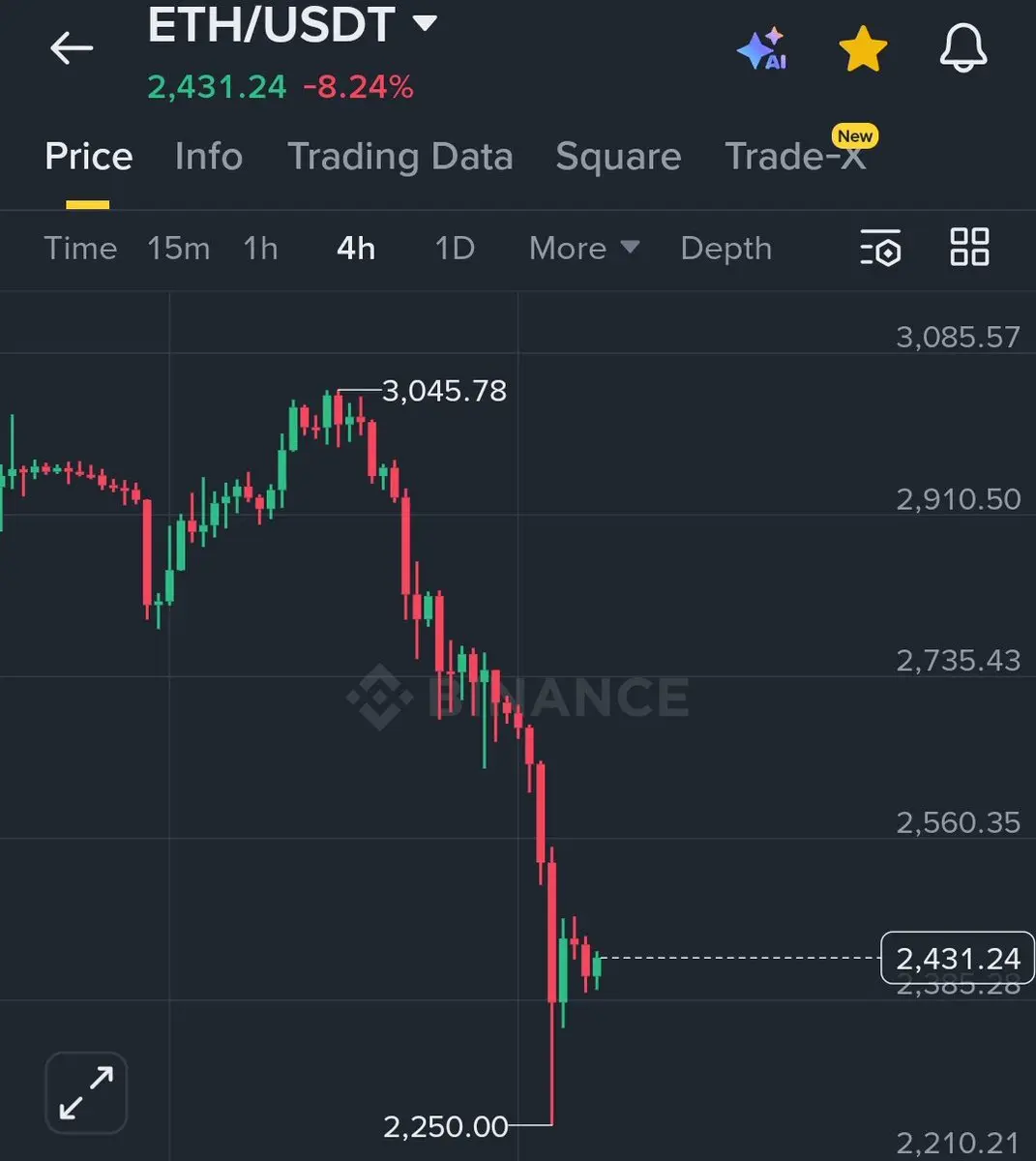

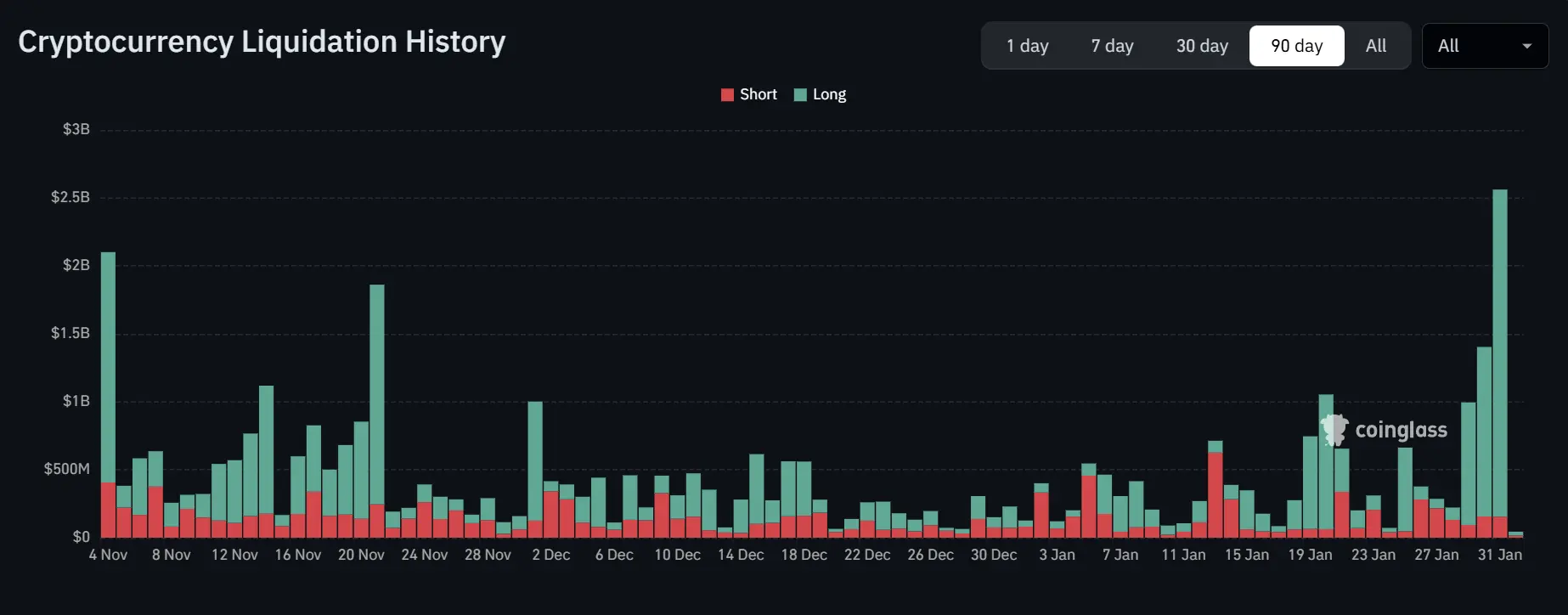

Another critical dimension of a crypto market pullback is its role in resetting market structure. Rapid rallies often lead to overleveraged positions, inflated expectations, and unsustainable hype. A correction helps stabilize these imbalances by cooling speculation and allowing the market to establish stronger support zones. This process is essential because it builds a healthier foundation for future growth. Without periodic pullbacks, markets risk becoming overly fragile, where even minor disruptions could trigger larger collapses. In this sense, a pullback is less of a setback and more of a recalibration that prepares the ecosystem for more stable progress.

From a broader perspective, crypto pullbacks rarely occur in isolation. Global economic conditions, interest rate policies, inflation data, and geopolitical developments often influence investor behavior across all financial markets, including digital assets. As cryptocurrency becomes increasingly integrated into the global financial system, its reactions to macroeconomic events grow more pronounced. This connection reinforces the idea that crypto is no longer a separate experimental industry but a significant component of modern finance, influenced by the same external pressures that shape traditional markets.

For long-term investors, pullbacks serve as moments of reflection rather than panic. They provide an opportunity to reassess portfolio strategies, review project fundamentals, and identify assets that demonstrate resilience despite broader market weakness. Historically, many successful investors have emphasized that wealth is often built during market corrections, not during euphoric rallies. When prices decline, the focus naturally shifts from hype-driven speculation to real value, encouraging participants to study technology, adoption rates, and long-term viability instead of short-term price movements.

At the community level, these phases often foster deeper conversations and knowledge sharing. Experienced traders step forward to guide newcomers, analysts publish insights that bring clarity to uncertainty, and educators emphasize the importance of patience, risk management, and emotional discipline. This collective learning process strengthens the ecosystem because it transforms moments of doubt into opportunities for growth. The crypto space has repeatedly demonstrated resilience, with each correction contributing to greater maturity and awareness among participants.

Volatility, although intimidating, is also the force that creates opportunity. Markets that move only in one direction eventually lose momentum, but those that experience healthy corrections develop stronger foundations for the future. Developers continue building regardless of price fluctuations, innovation progresses behind the scenes, and communities remain engaged, proving that the true strength of the crypto industry extends beyond temporary market trends. Pullbacks remind participants that progress is rarely linear and that resilience often emerges from periods of challenge.

Ultimately, a #CryptoMarketPullback should not be viewed as an interruption of growth but as an essential phase within a larger cycle of expansion and consolidation. Those who approach these periods with research, patience, and strategic thinking often emerge stronger and more informed. Every correction leaves the market more refined, more stable, and better prepared for the next phase of development. In the ever-evolving world of cryptocurrency, pullbacks are not signs of weakness but evidence of a living, adapting ecosystem that continues to mature with each cycle, shaping a future where informed participation and long-term vision remain the keys to success.

During a pullback, emotions become the most influential market driver. Fear spreads faster than logic, social media becomes saturated with mixed opinions, and traders find themselves questioning decisions they once felt confident about. Some rush to exit positions in order to protect capital, while others view the correction as an opportunity to enter the market at more favorable levels. This contrast in behavior highlights one of the most fascinating aspects of the crypto ecosystem: the same price movement can inspire panic in one investor and strategic optimism in another. The difference lies in experience, planning, and the ability to manage emotional responses during uncertainty.

Another critical dimension of a crypto market pullback is its role in resetting market structure. Rapid rallies often lead to overleveraged positions, inflated expectations, and unsustainable hype. A correction helps stabilize these imbalances by cooling speculation and allowing the market to establish stronger support zones. This process is essential because it builds a healthier foundation for future growth. Without periodic pullbacks, markets risk becoming overly fragile, where even minor disruptions could trigger larger collapses. In this sense, a pullback is less of a setback and more of a recalibration that prepares the ecosystem for more stable progress.

From a broader perspective, crypto pullbacks rarely occur in isolation. Global economic conditions, interest rate policies, inflation data, and geopolitical developments often influence investor behavior across all financial markets, including digital assets. As cryptocurrency becomes increasingly integrated into the global financial system, its reactions to macroeconomic events grow more pronounced. This connection reinforces the idea that crypto is no longer a separate experimental industry but a significant component of modern finance, influenced by the same external pressures that shape traditional markets.

For long-term investors, pullbacks serve as moments of reflection rather than panic. They provide an opportunity to reassess portfolio strategies, review project fundamentals, and identify assets that demonstrate resilience despite broader market weakness. Historically, many successful investors have emphasized that wealth is often built during market corrections, not during euphoric rallies. When prices decline, the focus naturally shifts from hype-driven speculation to real value, encouraging participants to study technology, adoption rates, and long-term viability instead of short-term price movements.

At the community level, these phases often foster deeper conversations and knowledge sharing. Experienced traders step forward to guide newcomers, analysts publish insights that bring clarity to uncertainty, and educators emphasize the importance of patience, risk management, and emotional discipline. This collective learning process strengthens the ecosystem because it transforms moments of doubt into opportunities for growth. The crypto space has repeatedly demonstrated resilience, with each correction contributing to greater maturity and awareness among participants.

Volatility, although intimidating, is also the force that creates opportunity. Markets that move only in one direction eventually lose momentum, but those that experience healthy corrections develop stronger foundations for the future. Developers continue building regardless of price fluctuations, innovation progresses behind the scenes, and communities remain engaged, proving that the true strength of the crypto industry extends beyond temporary market trends. Pullbacks remind participants that progress is rarely linear and that resilience often emerges from periods of challenge.

Ultimately, a #CryptoMarketPullback should not be viewed as an interruption of growth but as an essential phase within a larger cycle of expansion and consolidation. Those who approach these periods with research, patience, and strategic thinking often emerge stronger and more informed. Every correction leaves the market more refined, more stable, and better prepared for the next phase of development. In the ever-evolving world of cryptocurrency, pullbacks are not signs of weakness but evidence of a living, adapting ecosystem that continues to mature with each cycle, shaping a future where informed participation and long-term vision remain the keys to success.