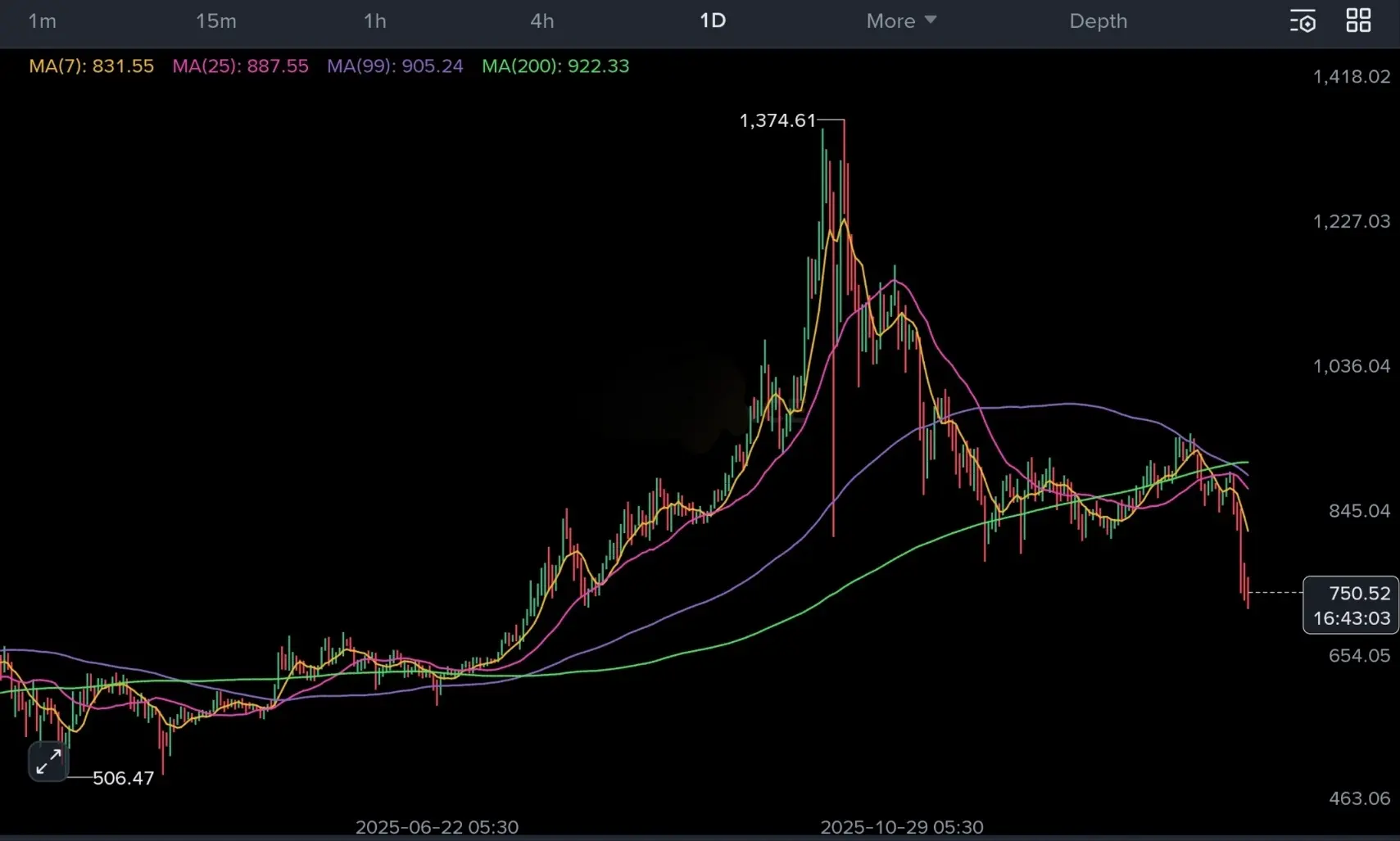

$BNB has officially retraced approximately 47% from its all-time high (ATH) of 1374 on October 13, 2025, and has just touched the 728 zone, which now represents the lowest point of this entire correction.

This level is not arbitrary; it is where long-term structure intersects with fear.

Currently, the price is at a significant decision area—this is where smart money either defends or steps aside.

Strong rejection from ATH → clear distribution phase

Price now below key moving averages → momentum remains weak

728 = last major demand before a deeper correction

🔽 Bearish continuation