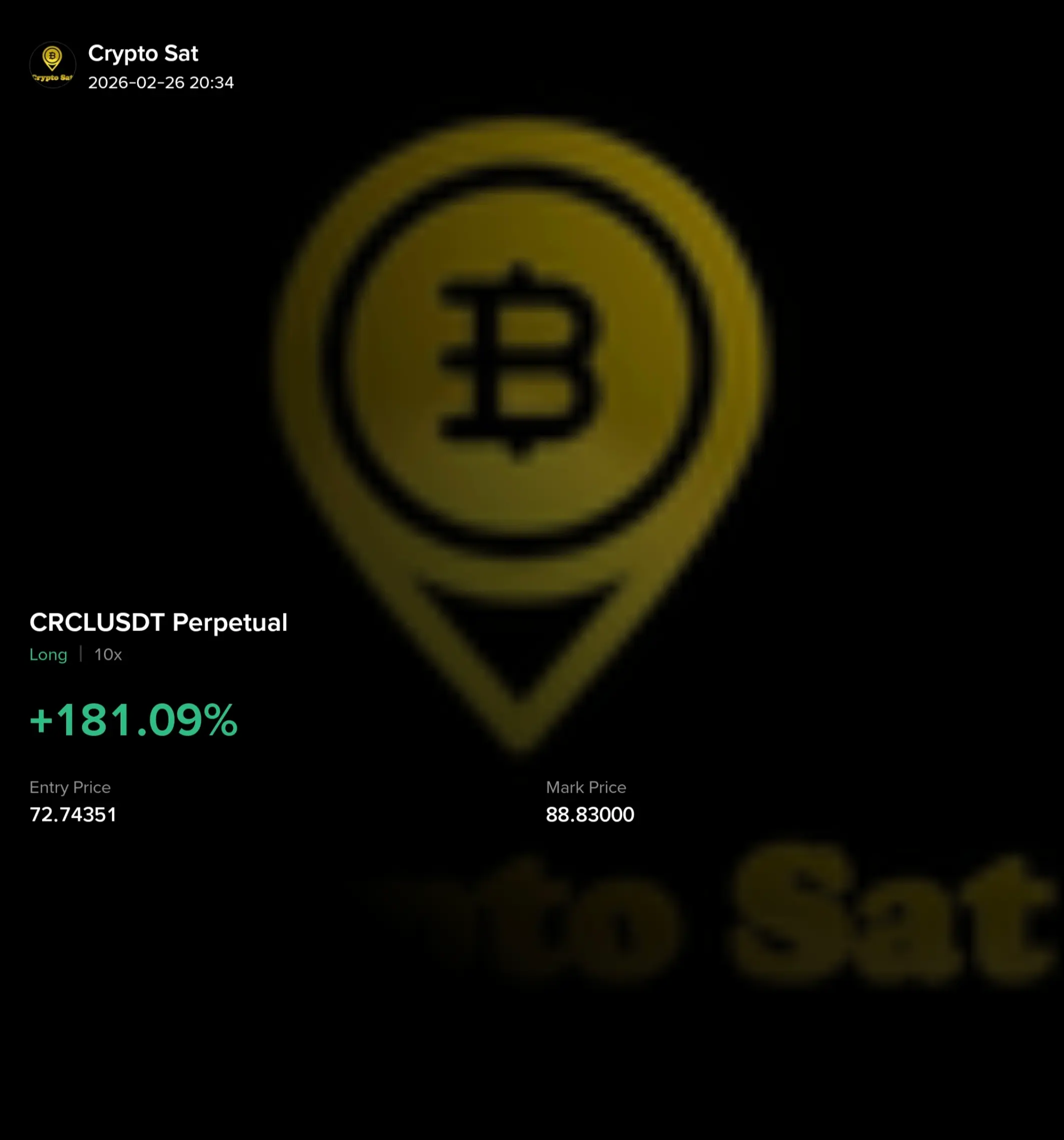

💰 $CRCL /USDT

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 73 - 72

🎯 TARGETS - 75.30, 76, 77, 78.20, 80, 85, 90

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 70.50

#GateTradFiExperience

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 73 - 72

🎯 TARGETS - 75.30, 76, 77, 78.20, 80, 85, 90

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 70.50

#GateTradFiExperience