Post content & earn content mining yield

placeholder

OldCatInTheCryptoCi

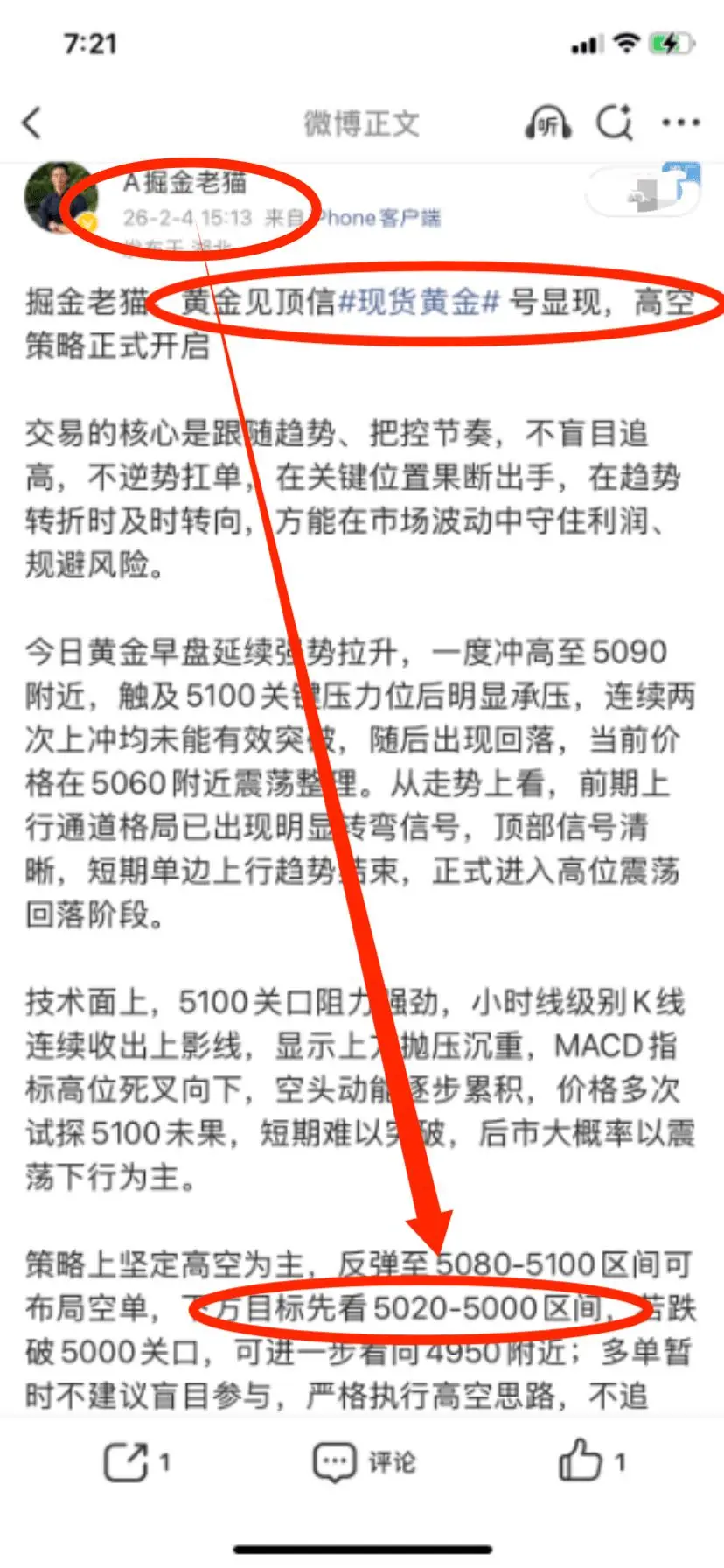

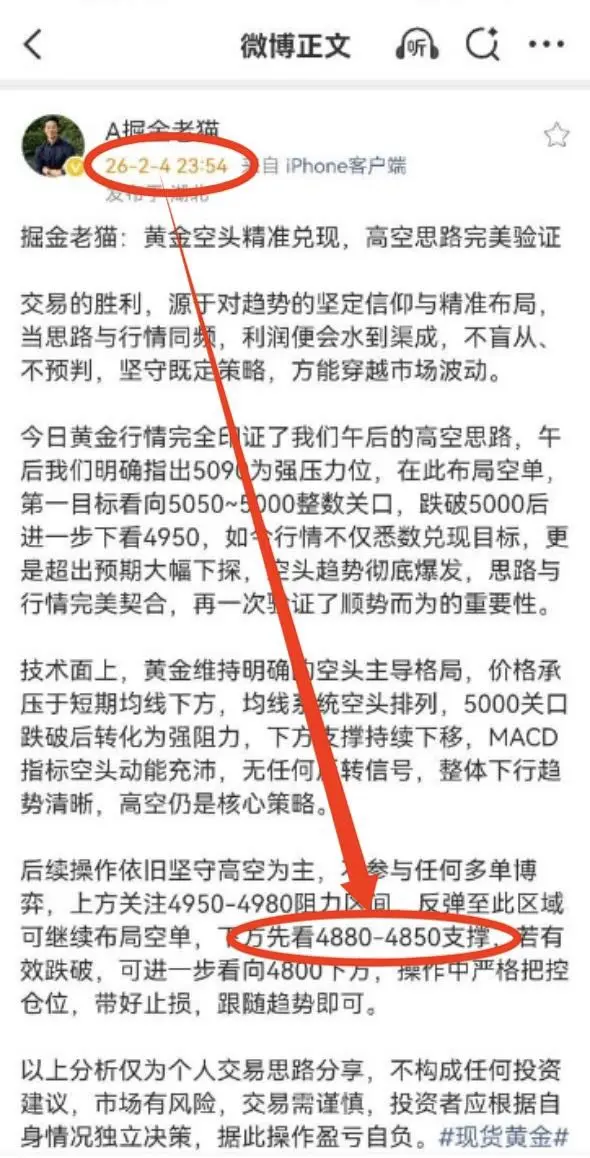

Yesterday afternoon, we identified a top signal for gold, turning bearish from 5090. We initially targeted 5050 in stages, then 5000 and 4900. Later in the evening, we even looked below 4850~4800. The market ultimately fell from 5090 to 4850, with a huge gap in between. Following this strategy, even capturing just a small segment could yield significant gains.

View Original

- Reward

- like

- Comment

- Repost

- Share

#加密市场隔夜V型震荡 $ETH A crash in broad daylight will cause panic selling and stampedes.

ETH-5,98%

- Reward

- 2

- 14

- Repost

- Share

GateUser-cd13cdf0 :

:

反弹了View More

February 5, 2026 Spot Gold Morning Analysis

The market has always been about finding direction amid volatility. After the spot gold stabilized at a high level, it entered a consolidation phase. The correction after a sharp rise is normal, and as long as key ranges are maintained, there are opportunities for swing trading.

From a news perspective, geopolitical tensions between the US and Iran support safe-haven buying of gold. The Federal Reserve's personnel changes reinforce hawkish policy expectations. The bullish and bearish factors are mutually restrained, and the market currently lacks cle

The market has always been about finding direction amid volatility. After the spot gold stabilized at a high level, it entered a consolidation phase. The correction after a sharp rise is normal, and as long as key ranges are maintained, there are opportunities for swing trading.

From a news perspective, geopolitical tensions between the US and Iran support safe-haven buying of gold. The Federal Reserve's personnel changes reinforce hawkish policy expectations. The bullish and bearish factors are mutually restrained, and the market currently lacks cle

XAUT-2,8%

- Reward

- 1

- Comment

- Repost

- Share

STABLE

稳住,我们能赢

Created By@LianceStudySociety-BrotherJing

Listing Progress

0.00%

MC:

$0.1

Create My Token

GM #bitcoin Smart money slowly accumulating behind the scenes While dumb money is selling Not saying it\'s the bottom because my levels below are there but Being bearish from 125k We are approaching the institutional Weekly order block Accumulate if you have conviction #bitcoin

BTC-5,45%

- Reward

- like

- Comment

- Repost

- Share

February 5, 2026 Spot Silver Midday Analysis

The market has always been about finding direction amid fluctuations. Spot silver continues to oscillate at high levels. While there is a short-term upward basis, the risk of a pullback is gradually becoming apparent. Do not chase the highs; mastering the oscillation rhythm is key.

From a news perspective, industrial demand for silver remains supportive, but risk aversion sentiment is cooling marginally. Coupled with profit-taking after the previous sharp rise, market buying momentum has weakened, becoming the main factor putting short-term pressure

The market has always been about finding direction amid fluctuations. Spot silver continues to oscillate at high levels. While there is a short-term upward basis, the risk of a pullback is gradually becoming apparent. Do not chase the highs; mastering the oscillation rhythm is key.

From a news perspective, industrial demand for silver remains supportive, but risk aversion sentiment is cooling marginally. Coupled with profit-taking after the previous sharp rise, market buying momentum has weakened, becoming the main factor putting short-term pressure

XAG3L-15,98%

- Reward

- like

- Comment

- Repost

- Share

$H /USDT update ⚡🔥

Price: 0.11749 USDT

24h Change: +6.77%

24h High / Low: 0.13416 / 0.10804

24h Volume: 57.79M H

Turnover: 6.88M USDT

On the 15-min chart, H exploded from 0.1093, topped at 0.1341, and is now cooling into a tight consolidation near 0.1175.

Key MAs:

MA(5): 0.11816

MA(10): 0.11837

MA(30): 0.12148

Price is holding above local support while moving averages compress — a classic reset before the next move.

Break 0.121–0.123 and momentum could reignite fast. Lose 0.114, and deeper pullback comes into play.

Volatility is primed. H is not done yet. 🚀

#AIExclusiveSocialNetworkMoltbook

Price: 0.11749 USDT

24h Change: +6.77%

24h High / Low: 0.13416 / 0.10804

24h Volume: 57.79M H

Turnover: 6.88M USDT

On the 15-min chart, H exploded from 0.1093, topped at 0.1341, and is now cooling into a tight consolidation near 0.1175.

Key MAs:

MA(5): 0.11816

MA(10): 0.11837

MA(30): 0.12148

Price is holding above local support while moving averages compress — a classic reset before the next move.

Break 0.121–0.123 and momentum could reignite fast. Lose 0.114, and deeper pullback comes into play.

Volatility is primed. H is not done yet. 🚀

#AIExclusiveSocialNetworkMoltbook

H7,61%

- Reward

- like

- Comment

- Repost

- Share

🇪🇺 LATEST: Spanish bank BBVA joins consortium of 11 #major European financial institutions to #launch euro-pegged stablecoin in H2 2026. #crypto

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊$CRY went 15X last night from the callNot sure who’s behind it would always take profits, 15X is solid regardless40K to 600K🍿

- Reward

- like

- Comment

- Repost

- Share

"I’m not saying I’m a genius, but Red Bull Racing is on the graphic, so clearly I’m moving at the speed of financial ruin."

- Reward

- 1

- Comment

- Repost

- Share

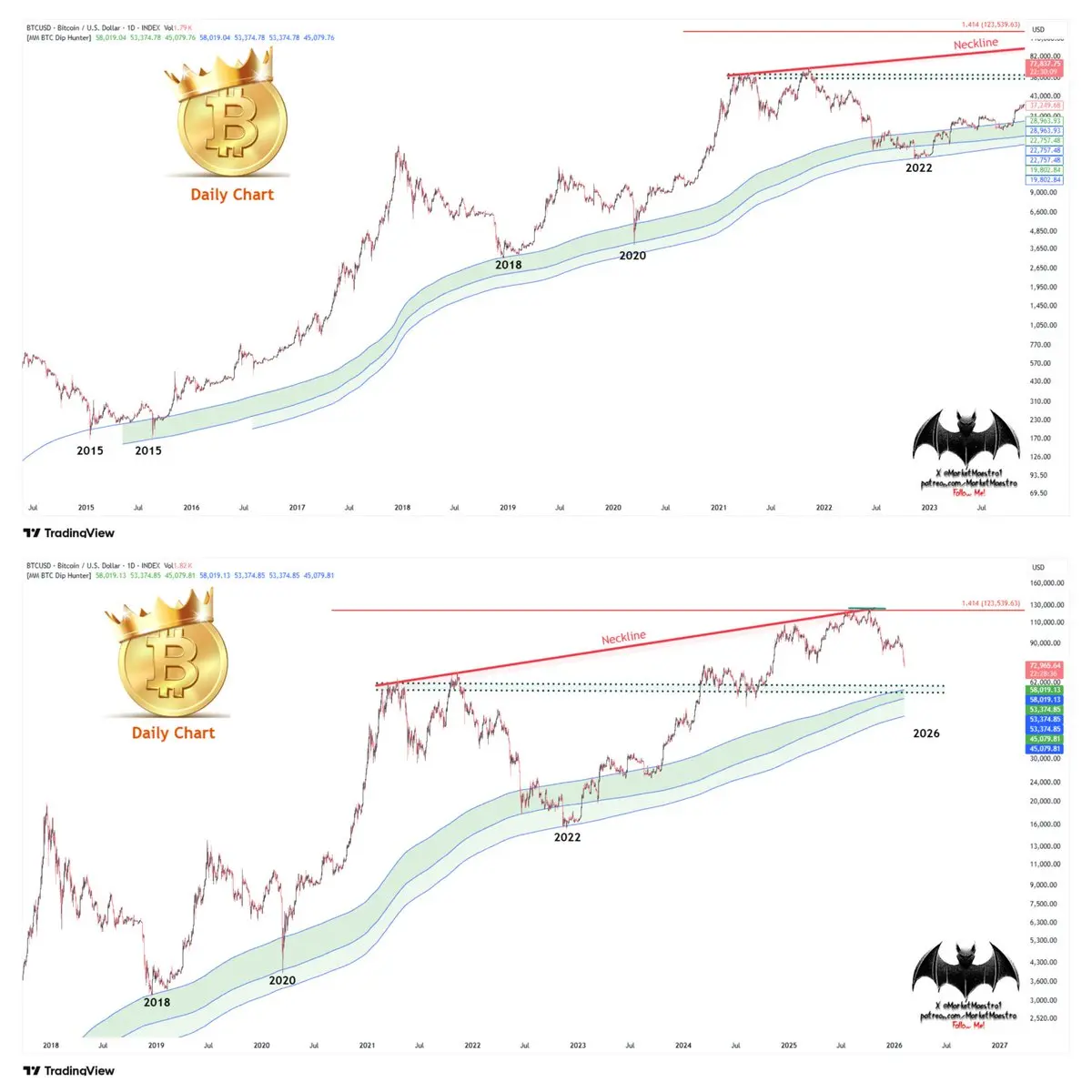

$BTCAs you can see, "MM BTC Dip Hunter" hasn’t missed a single BTC bottom. I think the bottom could end at $58K, but the location of the averages will change depending on time and price. When the time comes, I hope I’ll share the bottomStay tuned 💯 so you don’t miss the updates. And don’t forget, I warned you in time about the BTC topI wrote the averages on the chart myself

BTC-5,45%

- Reward

- like

- Comment

- Repost

- Share

芝麻传奇

芝麻传奇之路

Created By@gatefunuser_e111

Listing Progress

100.00%

MC:

$2.44K

Create My Token

are we going to get a historical crypto nuke here soon?

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilverRebound GoldAndSilverRebound Gold and silver aren’t just metals — they’re macro hedges and long-term safe havens.

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

After recent pullbacks:

🔹 Gold: Holding key support, positioning for renewed institutional inflows

🔹 Silver: Highly sensitive to industrial demand and global liquidity cycles

Why This Rebound Matters

1️⃣ Macro Context

• Geopolitical tensions and inflation uncertainty continue to support demand

• Central bank policy shifts are creating windows for strategic accumulation

2️⃣ Market Implications

• Investors rotate from high-risk assets into defensive hedges

• ETFs and

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#GoldAndSilver | Why Precious Metals Are Back on the Radar

After weeks of controlled pullback, gold and silver are showing early signs of strength, hinting at a shift in how markets are pricing risk. This move isn’t just a bounce — it reflects deeper changes in macro expectations.

🌍 Macro Backdrop — Confidence Is Being Rebalanced

Investors are quietly reassessing exposure as growth optimism cools and uncertainty rises. In this environment, capital often rotates toward assets with long-standing defensive credibility. Gold and silver are responding as strategic stores of value, not speculative

After weeks of controlled pullback, gold and silver are showing early signs of strength, hinting at a shift in how markets are pricing risk. This move isn’t just a bounce — it reflects deeper changes in macro expectations.

🌍 Macro Backdrop — Confidence Is Being Rebalanced

Investors are quietly reassessing exposure as growth optimism cools and uncertainty rises. In this environment, capital often rotates toward assets with long-standing defensive credibility. Gold and silver are responding as strategic stores of value, not speculative

- Reward

- 2

- 1

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎#StrategyBitcoinPositionTurnsRed Managing Red Positions in BTC

Bitcoin Market Alert — What Red Positions Really Mean

Positions turning red is a natural part of market cycles, but it also signals an important moment for strategic decision-making. Traders and investors must differentiate between temporary pullbacks and signs of sustained weakness.

🔍 Understanding Red Positions

Short-term Losses: Negative returns indicate BTC has retraced from recent highs.

Market Sentiment: Widespread red can trigger fear—but it also creates accumulation opportunities for disciplined participants.

Risk Managem

Bitcoin Market Alert — What Red Positions Really Mean

Positions turning red is a natural part of market cycles, but it also signals an important moment for strategic decision-making. Traders and investors must differentiate between temporary pullbacks and signs of sustained weakness.

🔍 Understanding Red Positions

Short-term Losses: Negative returns indicate BTC has retraced from recent highs.

Market Sentiment: Widespread red can trigger fear—but it also creates accumulation opportunities for disciplined participants.

Risk Managem

BTC-5,45%

- Reward

- 5

- 6

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎View More

🗣 Elon Musk says money cannot buy happiness. #crypto

- Reward

- 2

- 1

- Repost

- Share

CAMPEAO :

:

This year of growth is going to be incredible.#WhenWillBTCRebound? Why Most Traders Ask the Wrong Question

If you’re still asking, “When will Bitcoin rebound?” without defining conditions, you’re not analyzing the market—you’re gambling emotionally.

Bitcoin doesn’t rebound on hope.

It rebounds when pressure exhausts and incentives flip.

Right now, BTC is not struggling because of retail fear. It’s under pressure because liquidity is selective and smart money is patient. Institutions are not chasing green candles. They wait for imbalance, forced selling, and narrative resets before committing capital.

Here’s the uncomfortable truth most wo

If you’re still asking, “When will Bitcoin rebound?” without defining conditions, you’re not analyzing the market—you’re gambling emotionally.

Bitcoin doesn’t rebound on hope.

It rebounds when pressure exhausts and incentives flip.

Right now, BTC is not struggling because of retail fear. It’s under pressure because liquidity is selective and smart money is patient. Institutions are not chasing green candles. They wait for imbalance, forced selling, and narrative resets before committing capital.

Here’s the uncomfortable truth most wo

BTC-5,45%

- Reward

- 1

- 2

- Repost

- Share

HeavenSlayerSupporter :

:

Experienced driver, guide me 📈View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More23.74K Popularity

13.58K Popularity

13.02K Popularity

4.15K Popularity

8.16K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.64KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreA major whale transferred 2,676 ETH to FalconX, with total losses exceeding $20 million

1 m

Guotou Silver LOF on the exchange hits the limit-down for four consecutive days, with the premium rate falling back to 37.13%

6 m

Data: 199.99 BTC transferred out from Cumberland DRW, then relayed to another anonymous address after intermediary processing.

7 m

COLLECT (Collect on Fanable) up 14.68% in the last 24 hours

11 m

Market Report: Top 5 cryptocurrencies by decline on February 5, 2026, with Zcash experiencing the largest drop

13 m

Pin