#GrayscaleEyesAVESpotETFConversion

Grayscale’s AVAX Spot ETF: A Major Milestone in Crypto’s Institutional Evolution (2026 Deep Dive)

The crypto market in 2026 continues its transformation from retail speculation to regulated, institutional-grade finance. Grayscale’s push to convert its Avalanche Trust into a spot AVAX ETF exemplifies this shift — bridging traditional investors with high-performance Layer-1 networks like Avalanche.

1️⃣ What’s Happening Right Now? (Latest Updates as of February 2026)

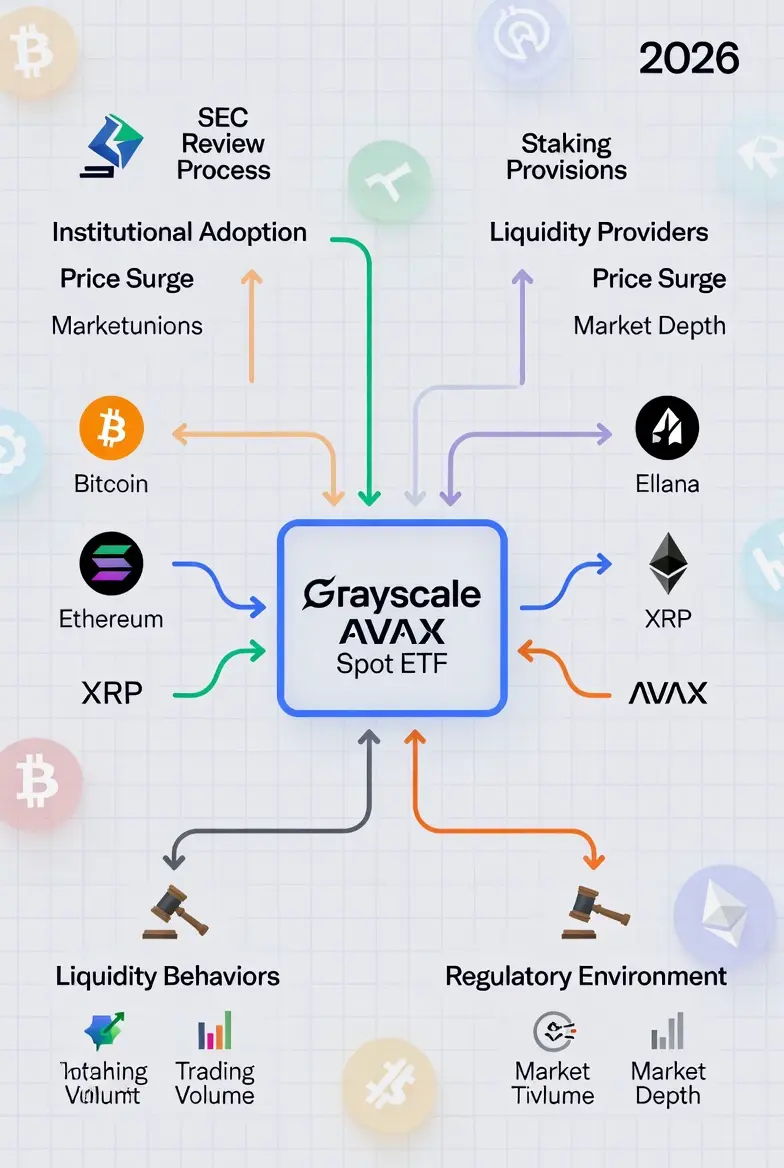

Grayscale Investments has filed (and amended multiple times) an S-1 registration statement with the U.S. SEC to convert its existing Avalanche Trust into a spot AVAX ETF. The proposed product would:

Hold actual AVAX tokens directly (spot exposure).

Trade on Nasdaq under a ticker like GAVX (previously discussed as AVAX or similar).

Allow cash-based creations/redemptions for easier institutional access.

Custody via trusted partners like Coinbase Custody.

Recent amendments (late 2025/early 2026) include explicit staking provisions — up to 70-85% of holdings could be staked on the Avalanche network, with rewards potentially passed to ETF holders (after fees to custodian/staking providers, typically 5-10% of rewards). This makes the ETF not just a price tracker but a yield-generating vehicle — a game-changer for passive investors seeking both appreciation and staking income without managing nodes or wallets.

Other players like VanEck and Bitwise have similar filings, signaling a race for the first spot AVAX ETF. Approval isn’t guaranteed (SEC review ongoing), but momentum is building post-Bitcoin/Ethereum/Solana/XRP ETF successes.

2️⃣ What Is a Spot ETF — and Why Does It Matter for AVAX?

Unlike futures-based products, a spot ETF directly holds the underlying asset (AVAX), tracking its real-time price closely. Investors gain exposure via regular brokerage accounts — no crypto wallets, exchanges, or key management required.

For AVAX specifically:

It democratizes access to a fast, scalable Layer-1 blockchain known for sub-second finality, low fees, and strong DeFi/gaming ecosystems.

Staking integration could deliver ~7-10%+ annual yields (depending on network conditions), offsetting management fees (~2.5% expense ratio historically for Grayscale trusts) and adding real utility beyond pure speculation.

3️⃣ Immediate Market Reaction & Price Action

ETF filing news (and amendments) triggered positive momentum:

AVAX surged ~11% on initial announcements, with follow-on spikes.

As of mid-February 2026: AVAX trades around ~$9.10–$9.20 (up from recent lows near $7.50–$8.00).

24h trading volume: ~$200–$230 million (spikes toward $500M+ during hype).

Market cap: ~$3.9–$4 billion.

Higher volume enhances liquidity, tightens spreads, and reduces slippage — making AVAX more attractive for large trades. However, broader market corrections (e.g., post-rally pullbacks) have capped gains, showing crypto’s macro sensitivity remains.

4️⃣ Liquidity & Trading Dynamics Boost

ETFs act as liquidity magnets:

Institutional inflows create steady buy pressure.

Authorized participants (big banks/market makers) handle creations/redemptions efficiently.

Altcoins like AVAX (historically lower depth than BTC/ETH) benefit disproportionately — smoother price discovery, reduced volatility from whale moves, and better order books.

In 2026, spot ETFs for altcoins are accelerating this: Solana, XRP, and others have seen deeper markets post-approval. AVAX could follow suit if launched.

5️⃣ The Institutional Adoption Mega-Trend

2025–2026 marks the pivot: Crypto shifts from retail-driven hype to institutional allocation.

Spot Bitcoin ETFs: Projected $180B+ AUM (and growing).

Ethereum, Solana, XRP ETFs: Already live or scaling, drawing pension funds, hedge funds, and wealth managers.

Altcoin ETFs (AVAX, Cardano, Polkadot): Next wave, focusing on utility tokens with staking, DeFi, and real-world use cases.

Institutions treat these as portfolio diversifiers — uncorrelated to stocks/bonds, with yield potential. Grayscale’s AVAX move aligns with this: AVAX powers subnets, enterprise blockchains, and tokenization — fitting 2026’s RWA (real-world asset) and stablecoin/tokenization boom.

6️⃣ Broader Crypto Market Impact & Spillover Effects

Positive sentiment ripple: AVAX gains lift Layer-1 peers (SOL, ADA, ETH) via “altcoin season” rotation.

Ecosystem maturity: Regulated products attract mainstream capital, improving overall liquidity and reducing manipulation risks.

Staking innovation: If AVAX ETF staking passes, it could set precedents for other PoS assets — blending price exposure with passive income.

Market evolution: From speculative cycles to infrastructure-driven growth, with regulatory clarity (post-2025 advancements) enabling scale.

7️⃣ Risks & Considerations to Watch

Regulatory hurdles: SEC could delay or reject (concerns over staking, custody, market manipulation).

Volatility persists: Macro factors (Fed rates, equities) still dominate; AVAX dipped in broader corrections.

Token unlocks: Upcoming AVAX unlocks (e.g., ~1.67M in early 2026) could add supply pressure short-term.

Staking risks: Lock-up periods, slashing potential, or reward variability introduce new dynamics.

Competition: Multiple issuers (VanEck, Bitwise) mean fragmented liquidity if multiple AVAX ETFs launch.

Quick Summary & Bottom Line

Grayscale’s AVAX spot ETF push is a pivotal step in crypto’s mainstream integration:

✔ Direct spot exposure + potential staking yields (~70-85% staked).

✔ Boosted liquidity, volume (~$200M+ daily), and price stability.

✔ Signals institutional confidence in utility-focused altcoins like AVAX.

✔ Part of a larger 2026 trend: More altcoin ETFs, deeper markets, and regulated yield products.

Crypto is maturing into a structured asset class — ETFs are the bridge. AVAX, with its speed, scalability, and staking, stands to benefit massively if approved.

Watch SEC updates, ETF inflows, and AVAX on-chain metrics closely — this could spark the next altcoin wave.

Grayscale’s AVAX Spot ETF: A Major Milestone in Crypto’s Institutional Evolution (2026 Deep Dive)

The crypto market in 2026 continues its transformation from retail speculation to regulated, institutional-grade finance. Grayscale’s push to convert its Avalanche Trust into a spot AVAX ETF exemplifies this shift — bridging traditional investors with high-performance Layer-1 networks like Avalanche.

1️⃣ What’s Happening Right Now? (Latest Updates as of February 2026)

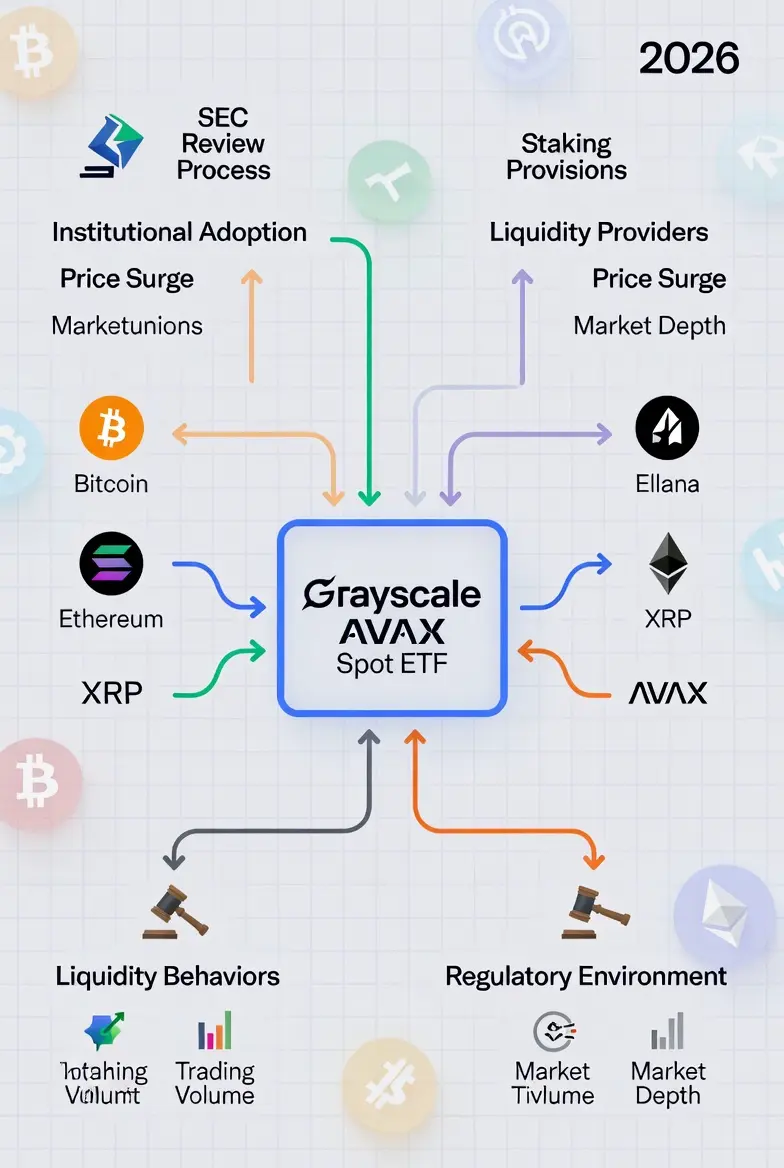

Grayscale Investments has filed (and amended multiple times) an S-1 registration statement with the U.S. SEC to convert its existing Avalanche Trust into a spot AVAX ETF. The proposed product would:

Hold actual AVAX tokens directly (spot exposure).

Trade on Nasdaq under a ticker like GAVX (previously discussed as AVAX or similar).

Allow cash-based creations/redemptions for easier institutional access.

Custody via trusted partners like Coinbase Custody.

Recent amendments (late 2025/early 2026) include explicit staking provisions — up to 70-85% of holdings could be staked on the Avalanche network, with rewards potentially passed to ETF holders (after fees to custodian/staking providers, typically 5-10% of rewards). This makes the ETF not just a price tracker but a yield-generating vehicle — a game-changer for passive investors seeking both appreciation and staking income without managing nodes or wallets.

Other players like VanEck and Bitwise have similar filings, signaling a race for the first spot AVAX ETF. Approval isn’t guaranteed (SEC review ongoing), but momentum is building post-Bitcoin/Ethereum/Solana/XRP ETF successes.

2️⃣ What Is a Spot ETF — and Why Does It Matter for AVAX?

Unlike futures-based products, a spot ETF directly holds the underlying asset (AVAX), tracking its real-time price closely. Investors gain exposure via regular brokerage accounts — no crypto wallets, exchanges, or key management required.

For AVAX specifically:

It democratizes access to a fast, scalable Layer-1 blockchain known for sub-second finality, low fees, and strong DeFi/gaming ecosystems.

Staking integration could deliver ~7-10%+ annual yields (depending on network conditions), offsetting management fees (~2.5% expense ratio historically for Grayscale trusts) and adding real utility beyond pure speculation.

3️⃣ Immediate Market Reaction & Price Action

ETF filing news (and amendments) triggered positive momentum:

AVAX surged ~11% on initial announcements, with follow-on spikes.

As of mid-February 2026: AVAX trades around ~$9.10–$9.20 (up from recent lows near $7.50–$8.00).

24h trading volume: ~$200–$230 million (spikes toward $500M+ during hype).

Market cap: ~$3.9–$4 billion.

Higher volume enhances liquidity, tightens spreads, and reduces slippage — making AVAX more attractive for large trades. However, broader market corrections (e.g., post-rally pullbacks) have capped gains, showing crypto’s macro sensitivity remains.

4️⃣ Liquidity & Trading Dynamics Boost

ETFs act as liquidity magnets:

Institutional inflows create steady buy pressure.

Authorized participants (big banks/market makers) handle creations/redemptions efficiently.

Altcoins like AVAX (historically lower depth than BTC/ETH) benefit disproportionately — smoother price discovery, reduced volatility from whale moves, and better order books.

In 2026, spot ETFs for altcoins are accelerating this: Solana, XRP, and others have seen deeper markets post-approval. AVAX could follow suit if launched.

5️⃣ The Institutional Adoption Mega-Trend

2025–2026 marks the pivot: Crypto shifts from retail-driven hype to institutional allocation.

Spot Bitcoin ETFs: Projected $180B+ AUM (and growing).

Ethereum, Solana, XRP ETFs: Already live or scaling, drawing pension funds, hedge funds, and wealth managers.

Altcoin ETFs (AVAX, Cardano, Polkadot): Next wave, focusing on utility tokens with staking, DeFi, and real-world use cases.

Institutions treat these as portfolio diversifiers — uncorrelated to stocks/bonds, with yield potential. Grayscale’s AVAX move aligns with this: AVAX powers subnets, enterprise blockchains, and tokenization — fitting 2026’s RWA (real-world asset) and stablecoin/tokenization boom.

6️⃣ Broader Crypto Market Impact & Spillover Effects

Positive sentiment ripple: AVAX gains lift Layer-1 peers (SOL, ADA, ETH) via “altcoin season” rotation.

Ecosystem maturity: Regulated products attract mainstream capital, improving overall liquidity and reducing manipulation risks.

Staking innovation: If AVAX ETF staking passes, it could set precedents for other PoS assets — blending price exposure with passive income.

Market evolution: From speculative cycles to infrastructure-driven growth, with regulatory clarity (post-2025 advancements) enabling scale.

7️⃣ Risks & Considerations to Watch

Regulatory hurdles: SEC could delay or reject (concerns over staking, custody, market manipulation).

Volatility persists: Macro factors (Fed rates, equities) still dominate; AVAX dipped in broader corrections.

Token unlocks: Upcoming AVAX unlocks (e.g., ~1.67M in early 2026) could add supply pressure short-term.

Staking risks: Lock-up periods, slashing potential, or reward variability introduce new dynamics.

Competition: Multiple issuers (VanEck, Bitwise) mean fragmented liquidity if multiple AVAX ETFs launch.

Quick Summary & Bottom Line

Grayscale’s AVAX spot ETF push is a pivotal step in crypto’s mainstream integration:

✔ Direct spot exposure + potential staking yields (~70-85% staked).

✔ Boosted liquidity, volume (~$200M+ daily), and price stability.

✔ Signals institutional confidence in utility-focused altcoins like AVAX.

✔ Part of a larger 2026 trend: More altcoin ETFs, deeper markets, and regulated yield products.

Crypto is maturing into a structured asset class — ETFs are the bridge. AVAX, with its speed, scalability, and staking, stands to benefit massively if approved.

Watch SEC updates, ETF inflows, and AVAX on-chain metrics closely — this could spark the next altcoin wave.