交易员汤龙

No content yet

交易员汤龙

December is coming to an end, and the year is approaching. The market rhythm is accelerating, and opportunities are entering the countdown stage.

If you have been waiting and watching before, now is the critical window to follow the trend and seize the structural opportunities.

We adhere to not holding against the trend, not going against the market, and maintaining full transparency in strategy execution.

Each round of positioning is based on market logic and risk control systems, serving only traders who truly respect professionalism.

In the current oscillating and structurally biased market

If you have been waiting and watching before, now is the critical window to follow the trend and seize the structural opportunities.

We adhere to not holding against the trend, not going against the market, and maintaining full transparency in strategy execution.

Each round of positioning is based on market logic and risk control systems, serving only traders who truly respect professionalism.

In the current oscillating and structurally biased market

BTC1,18%

- Reward

- 1

- 1

- Repost

- Share

Ironed :

:

Jump in 🚀The Iron Law of Survival in the Crypto World: Your True Opponent Has Never Been Market Fluctuations

In this gladiatorial arena of the crypto world, what knocks traders down is never the rise or fall itself,

but that uncontrollable hand that always wants to jump ahead.

How many people have fallen to the floor cutting losses, or chased highs at the peak?

The root cause is only one—emotional out of control.

Fearing zero after a decline, fearing missing out after a rise, once driven by emotion, operations begin to distort,

shifting from riding the trend to sending money against the trend.

The mark

In this gladiatorial arena of the crypto world, what knocks traders down is never the rise or fall itself,

but that uncontrollable hand that always wants to jump ahead.

How many people have fallen to the floor cutting losses, or chased highs at the peak?

The root cause is only one—emotional out of control.

Fearing zero after a decline, fearing missing out after a rise, once driven by emotion, operations begin to distort,

shifting from riding the trend to sending money against the trend.

The mark

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

BNB Strategy Update:

From the 4-hour timeframe, the price has already experienced a slight pullback and is currently trading below the upper Bollinger Band. The highest touch was at the 916 level, but no sustained momentum was formed, with clear resistance above.

Combined with the 1-hour timeframe, both KDJ and MACD are turning downward simultaneously, indicating weakening short-term momentum. There is still some room for a correction downward.

The overall approach is to focus on shorting rebounds.

Trading suggestion:

Short in the 910–915 range, with a target around 870,

Set stop-loss flexibly

From the 4-hour timeframe, the price has already experienced a slight pullback and is currently trading below the upper Bollinger Band. The highest touch was at the 916 level, but no sustained momentum was formed, with clear resistance above.

Combined with the 1-hour timeframe, both KDJ and MACD are turning downward simultaneously, indicating weakening short-term momentum. There is still some room for a correction downward.

The overall approach is to focus on shorting rebounds.

Trading suggestion:

Short in the 910–915 range, with a target around 870,

Set stop-loss flexibly

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

LTC Thinking Update:

The overall trend is relatively mild, and since yesterday, it has been oscillating within a range. The short position above 85 given yesterday has already moved out a certain space during the session.

Currently, the price is above 84, but there are no signs of sustained upward attack, and the momentum is clearly insufficient. The overall trend still leans towards high-level resistance. The strategy remains mainly to short on rebounds.

Operational reference:

Short near 84–85, target the 75–73 zone.

One sentence summary:

No continuation of the rebound, do not chase longs at

The overall trend is relatively mild, and since yesterday, it has been oscillating within a range. The short position above 85 given yesterday has already moved out a certain space during the session.

Currently, the price is above 84, but there are no signs of sustained upward attack, and the momentum is clearly insufficient. The overall trend still leans towards high-level resistance. The strategy remains mainly to short on rebounds.

Operational reference:

Short near 84–85, target the 75–73 zone.

One sentence summary:

No continuation of the rebound, do not chase longs at

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

SOL Strategy Update:

Overnight, the price briefly reached the 139 level. The short position at 139 given yesterday is still being held.

From a short-term structure perspective, the bulls have a slight advantage, but the upward momentum has yet to form an effective breakout. The price is clearly under pressure at higher levels, and the overall trend remains more inclined towards oscillation and pullback.

The strategy remains unchanged: continue to focus on shorting from high levels, with key attention on short opportunities in the 139–140 zone.

Initial target below is 130, with further focus on

Overnight, the price briefly reached the 139 level. The short position at 139 given yesterday is still being held.

From a short-term structure perspective, the bulls have a slight advantage, but the upward momentum has yet to form an effective breakout. The price is clearly under pressure at higher levels, and the overall trend remains more inclined towards oscillation and pullback.

The strategy remains unchanged: continue to focus on shorting from high levels, with key attention on short opportunities in the 139–140 zone.

Initial target below is 130, with further focus on

ETH2,72%

- Reward

- like

- Comment

- Repost

- Share

1.6 Morning Bitcoin Strategy | Bullish Momentum Fading, Patience for Pullback

Overnight Bitcoin surged again, reaching a high of around 94,700. The slow upward trend has indeed put some pressure on the bears. However, it’s important to note that this rally is not a one-sided explosion but a typical gradual rise from high levels. Currently, the upward momentum has clearly slowed, and chasing longs at these levels is not advisable.

From a technical perspective, although the bulls are strong, they have not effectively opened up more space above. The 4-hour price is oscillating along the upper Bol

Overnight Bitcoin surged again, reaching a high of around 94,700. The slow upward trend has indeed put some pressure on the bears. However, it’s important to note that this rally is not a one-sided explosion but a typical gradual rise from high levels. Currently, the upward momentum has clearly slowed, and chasing longs at these levels is not advisable.

From a technical perspective, although the bulls are strong, they have not effectively opened up more space above. The 4-hour price is oscillating along the upper Bol

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

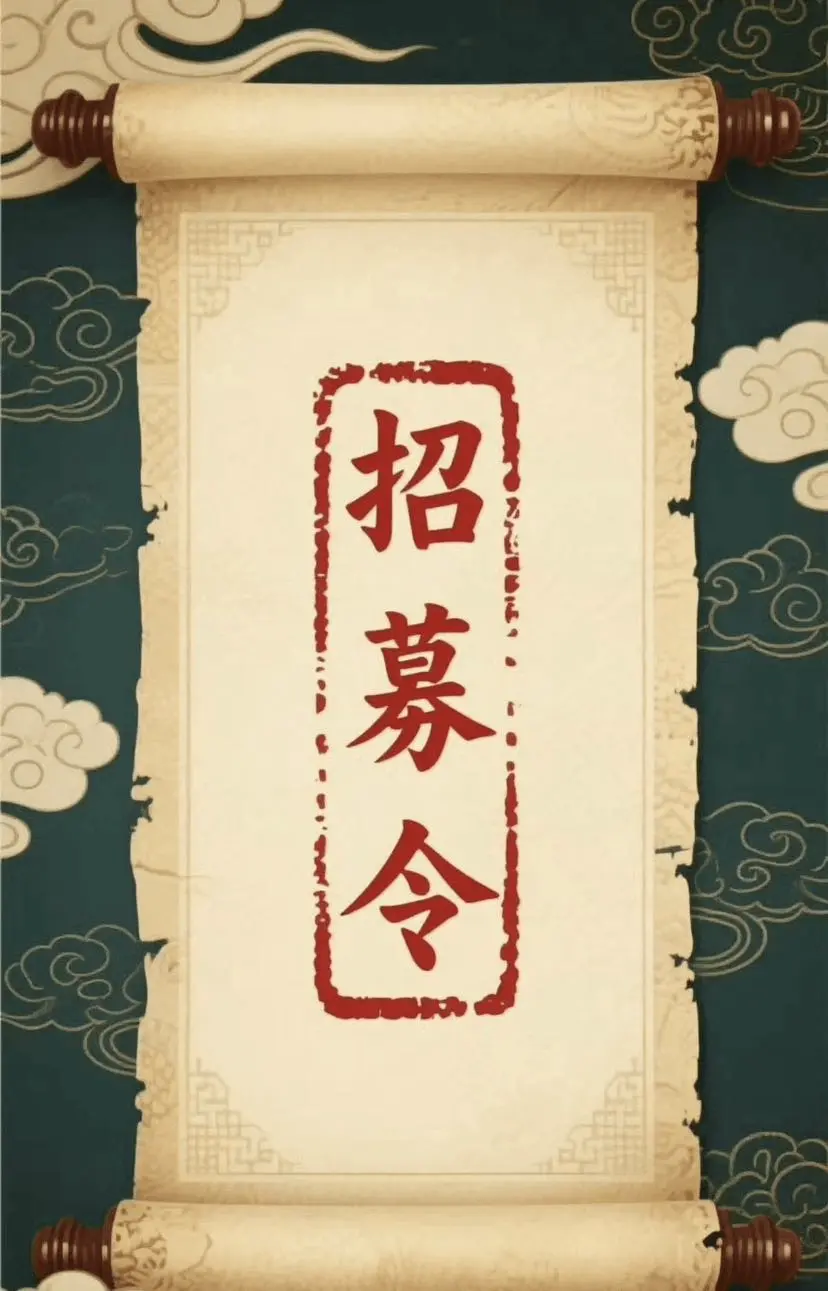

U.S. stocks open higher, with short-term sentiment leaning strong.

Friends without positions, don't rush; wait for a rebound before considering short positions.

Bitcoin around 93,300 can be entered lightly,

Tonight's overall rhythm is expected to be calm; be sure to set proper defenses when trading,

Target first around 91,800.

The mistress's strategy can be synchronized; follow Bitcoin's rhythm. $BTC #加密市场开年反弹

Friends without positions, don't rush; wait for a rebound before considering short positions.

Bitcoin around 93,300 can be entered lightly,

Tonight's overall rhythm is expected to be calm; be sure to set proper defenses when trading,

Target first around 91,800.

The mistress's strategy can be synchronized; follow Bitcoin's rhythm. $BTC #加密市场开年反弹

BTC1,18%

- Reward

- 1

- Comment

- Repost

- Share

Unplanned trading is like stepping on the gas with your eyes closed in a thunderstorm— the faster you go, the quicker you crash.

The market is never soft-hearted, regardless of how much capital you have; every fluctuation is eliminating those who are unprepared.

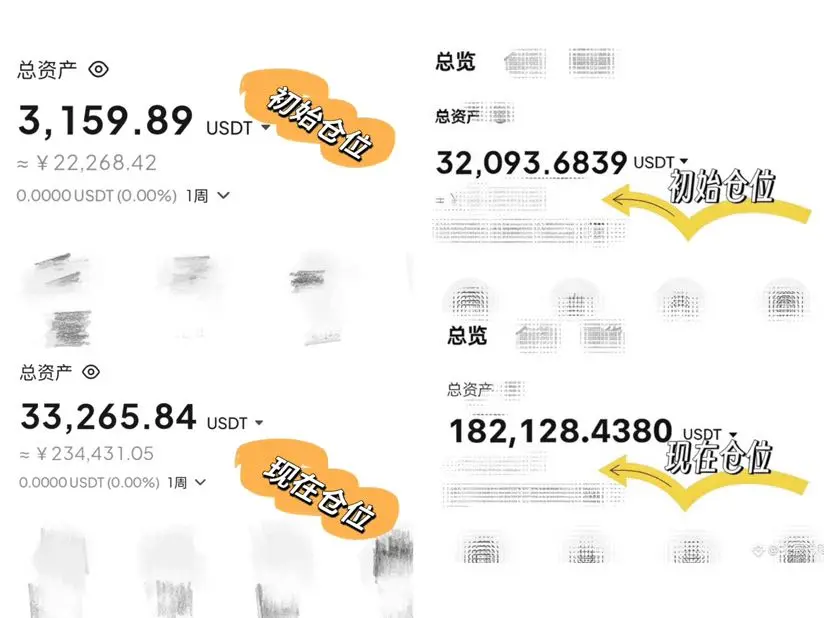

Doubling your investment is never luck, nor mysticism, but a set of trading systems that can be repeatedly validated and executed over the long term.

If you're willing to hand over the steering wheel to me, I will provide you with a clear route, real-time alerts, and accompany you through turbulence and fog, step by step reaching the d

The market is never soft-hearted, regardless of how much capital you have; every fluctuation is eliminating those who are unprepared.

Doubling your investment is never luck, nor mysticism, but a set of trading systems that can be repeatedly validated and executed over the long term.

If you're willing to hand over the steering wheel to me, I will provide you with a clear route, real-time alerts, and accompany you through turbulence and fog, step by step reaching the d

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

Pullbacks are just a dip. The Silk Road's thousand-point rally in the early morning has been taken, and there is still plenty of room for growth.

Once the trend is confirmed, we will always be on the front line!

Maximize efficiency, professionalism without boasting, follow through with execution, and flipping accounts is just routine operation.

As for the other two more cautious strategies,

the pace will naturally be slower,

and the market will move more steadily and with greater restraint. $BTC #加密市场开年反弹 #ETH走势分析

Once the trend is confirmed, we will always be on the front line!

Maximize efficiency, professionalism without boasting, follow through with execution, and flipping accounts is just routine operation.

As for the other two more cautious strategies,

the pace will naturally be slower,

and the market will move more steadily and with greater restraint. $BTC #加密市场开年反弹 #ETH走势分析

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

Evening Market Analysis | Cryptocurrency Market Observation

Prices showed a clear slowdown after a rally, with bullish momentum beginning to weaken. On the technical side, both KDJ and RSI are operating in overbought zones, indicating a gradual need for a correction; meanwhile, the MACD red momentum bars are shortening, and trading volume is insufficient, signaling potential divergence in the short term.

Although the overall trend remains bullish, the short-term overheating is evident, increasing the likelihood of a technical pullback. It is not recommended to chase highs blindly; instead, pat

Prices showed a clear slowdown after a rally, with bullish momentum beginning to weaken. On the technical side, both KDJ and RSI are operating in overbought zones, indicating a gradual need for a correction; meanwhile, the MACD red momentum bars are shortening, and trading volume is insufficient, signaling potential divergence in the short term.

Although the overall trend remains bullish, the short-term overheating is evident, increasing the likelihood of a technical pullback. It is not recommended to chase highs blindly; instead, pat

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

Weekly Economic Calendar Preview | Key Data Releases Intensify, Market Volatility May Increase

In the upcoming week, major economic data from multiple countries will be released in succession, accompanied by central bank officials' speeches and important international exhibitions, leading to heightened market attention.

Monday

US December ISM Manufacturing PMI release;

South Korean President Lee Jae-myung begins official visit to China;

Minneapolis Fed President Kashkari delivers a speech.

Tuesday

France, Germany, and Eurozone December Services PMI final figures released;

Domestic refined oil

In the upcoming week, major economic data from multiple countries will be released in succession, accompanied by central bank officials' speeches and important international exhibitions, leading to heightened market attention.

Monday

US December ISM Manufacturing PMI release;

South Korean President Lee Jae-myung begins official visit to China;

Minneapolis Fed President Kashkari delivers a speech.

Tuesday

France, Germany, and Eurozone December Services PMI final figures released;

Domestic refined oil

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

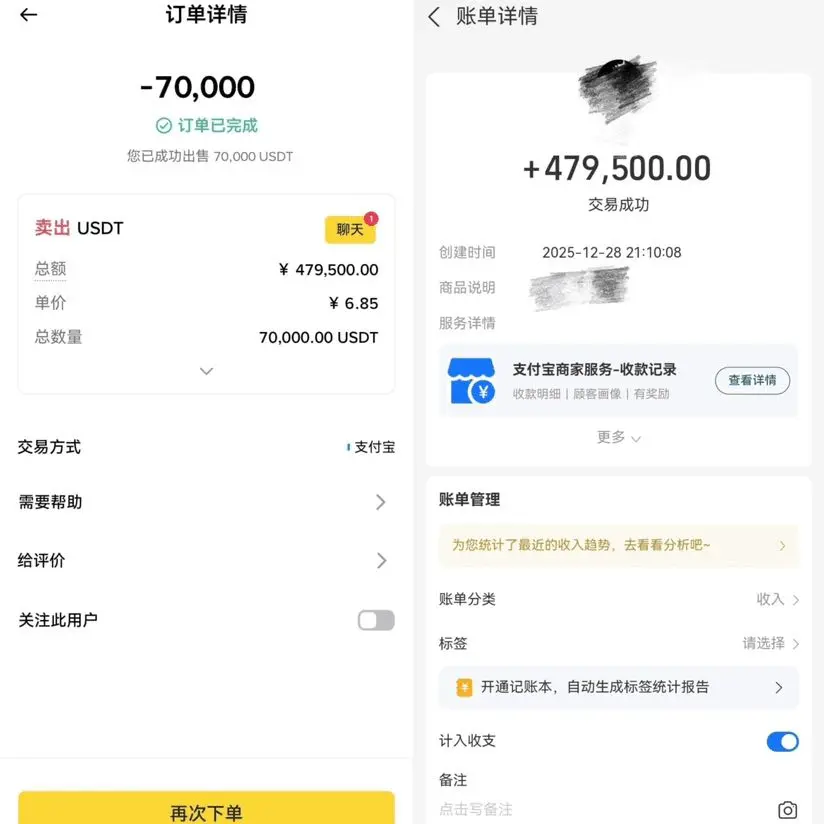

No fancy tricks, only customized practical strategies. With clear ideas and precise entry points, the opportunity to recover costs and turn the tide is right in front of you.

Brothers who entered in November can already relax and go home for the New Year,

If you're still hesitating, you'll just keep missing out.

It's not hard to replicate this kind of profit,

Whether you can get the meat depends mainly on who you follow.#加密市场开年反弹 #ETH走势分析 $BTC

Brothers who entered in November can already relax and go home for the New Year,

If you're still hesitating, you'll just keep missing out.

It's not hard to replicate this kind of profit,

Whether you can get the meat depends mainly on who you follow.#加密市场开年反弹 #ETH走势分析 $BTC

BTC1,18%

- Reward

- like

- 1

- Repost

- Share

公子赢浪 :

:

New Year Wealth Explosion 🤑💥**Don't panic when you're caught in a position, here's the right way to handle it!**💥

1️⃣ Stay calm first, don't cut randomly

Markets go up and down, many losses come from panic selling. As long as your position isn't heavy and your funds can handle it, wait and see. Unrealized losses don't equal real losses. The worst thing is to panic and sell at the bottom.

2️⃣ Stick to your stop-loss level

When it’s time to stop loss, be decisive and exit. Don’t be soft-hearted. First, control the risk, and once the market stabilizes, look for new opportunities to recover your money.

3️⃣ Be quick in sho

1️⃣ Stay calm first, don't cut randomly

Markets go up and down, many losses come from panic selling. As long as your position isn't heavy and your funds can handle it, wait and see. Unrealized losses don't equal real losses. The worst thing is to panic and sell at the bottom.

2️⃣ Stick to your stop-loss level

When it’s time to stop loss, be decisive and exit. Don’t be soft-hearted. First, control the risk, and once the market stabilizes, look for new opportunities to recover your money.

3️⃣ Be quick in sho

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin breaks through the 93,000 level strongly. This wave has been quite aggressive. I've been busy with real trading operations these past two days. The specific profits will be summarized and announced later.

From the market perspective, Ethereum's KDJ has been in a dead cross at high levels in the past two days, showing signs of overbought correction, but the daily sentiment has not fully cooled down yet. Overall, it remains a volatile and slightly bullish structure.

The current strategy mainly focuses on tentative short positions:

Start with a small position, reserving room for additiona

From the market perspective, Ethereum's KDJ has been in a dead cross at high levels in the past two days, showing signs of overbought correction, but the daily sentiment has not fully cooled down yet. Overall, it remains a volatile and slightly bullish structure.

The current strategy mainly focuses on tentative short positions:

Start with a small position, reserving room for additiona

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

LTC Strategy

Yesterday, there was a rally, reaching a high of around 82, but the upward pressure was clearly too strong, and it couldn't stabilize and was pushed down.

From the 4-hour chart, the current price has been oscillating below the upper band of the Bollinger Bands, unable to break higher or fall faster, overall still in a state of resistance.

The next approach is simple: rebounds are opportunities, continue to focus on shorting.

Trading suggestions:

Look for short opportunities around 83–85,

Target first around 78,

Defensive positions can be flexibly controlled based on individual hol

Yesterday, there was a rally, reaching a high of around 82, but the upward pressure was clearly too strong, and it couldn't stabilize and was pushed down.

From the 4-hour chart, the current price has been oscillating below the upper band of the Bollinger Bands, unable to break higher or fall faster, overall still in a state of resistance.

The next approach is simple: rebounds are opportunities, continue to focus on shorting.

Trading suggestions:

Look for short opportunities around 83–85,

Target first around 78,

Defensive positions can be flexibly controlled based on individual hol

LTC2,51%

- Reward

- like

- Comment

- Repost

- Share

Wave goodbye to 2025!

Although the year-end market has been fluctuating widely with gradually narrowing volatility, many brothers engaged in swing trading have been tortured into a dilemma of whether to buy or sell, but I have repeatedly emphasized one point—the sideways market is actually the fastest and best time to recover and make profits.

Throughout December, I have consistently adhered to the "less but refined" trading approach, with the core high-altitude logic never changing. Every key position is planned in advance and publicly verified, avoiding chasing the market or making reckless

Although the year-end market has been fluctuating widely with gradually narrowing volatility, many brothers engaged in swing trading have been tortured into a dilemma of whether to buy or sell, but I have repeatedly emphasized one point—the sideways market is actually the fastest and best time to recover and make profits.

Throughout December, I have consistently adhered to the "less but refined" trading approach, with the core high-altitude logic never changing. Every key position is planned in advance and publicly verified, avoiding chasing the market or making reckless

BTC1,18%

- Reward

- like

- Comment

- Repost

- Share

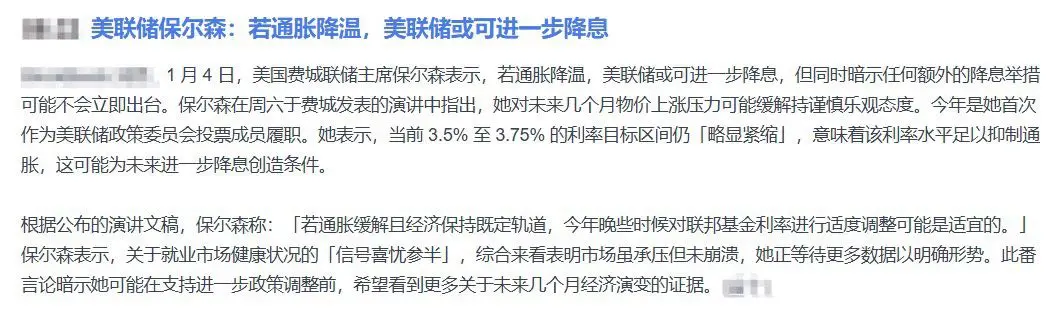

Do you hear the sound of the wind?

Over at the Federal Reserve, some people are already starting to crack and hold back their dovishness.

Poulson straightforwardly said: If inflation continues to decline, there’s a possibility of rate cuts later on.

Currently, the interest rate is stuck at 3.5%–3.75%. To be honest, even they feel it’s tightening too much.

The crypto world has been under pressure from high interest rates for too long.

Money is fully locked in banks and US bonds; where’s the liquidity to pour into crypto?

So there’s only one question — is a turning point coming soon?

Brother Lon

Over at the Federal Reserve, some people are already starting to crack and hold back their dovishness.

Poulson straightforwardly said: If inflation continues to decline, there’s a possibility of rate cuts later on.

Currently, the interest rate is stuck at 3.5%–3.75%. To be honest, even they feel it’s tightening too much.

The crypto world has been under pressure from high interest rates for too long.

Money is fully locked in banks and US bonds; where’s the liquidity to pour into crypto?

So there’s only one question — is a turning point coming soon?

Brother Lon

BTC1,18%

- Reward

- 9

- 6

- Repost

- Share

GFat :

:

New Year Wealth Explosion 🤑View More

Trending Topics

View More16.21K Popularity

1.82K Popularity

1.33K Popularity

1.4K Popularity

85.93K Popularity

Pin