GregMiller

No content yet

GregMiller

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin is holding firm while equities bleed.

On a day when the Nasdaq is down, $BTC is showing relative strength

This is something we haven’t seen consistently in months

That kind of divergence doesn’t happen by accident.

It suggests real spot demand stepping in rather than passive correlation with tech

With the noise around Jane Street fading, price action feels less distorted and more natural

If this decoupling continues, the narrative shifts from “BTC follows stocks” to “BTC leads.”

On a day when the Nasdaq is down, $BTC is showing relative strength

This is something we haven’t seen consistently in months

That kind of divergence doesn’t happen by accident.

It suggests real spot demand stepping in rather than passive correlation with tech

With the noise around Jane Street fading, price action feels less distorted and more natural

If this decoupling continues, the narrative shifts from “BTC follows stocks” to “BTC leads.”

BTC-2,96%

- Reward

- 2

- 1

- Repost

- Share

ParnoRuslan :

:

Bitcoin remains strong while stocks fall. On the day Nasdaq declines,

$HOT

Parabolic Breakout

Major trend shift from the 0.000347 floor → explosive 32.65% vertical rally clearing multiple resistance zones. Price is currently hovering near 0.000520 after testing a daily high of 0.000541, backed by a massive surge in trading volume.

Long Setup

0.000450 – 0.000485

Targets:

0.000541

0.000620

0.000700

Stop loss:

0.000410

Strong impulsive structure → looking for a brief consolidation or retest of the 0.000465 breakout level to flip it into support before the next leg up.

#HOT #Crypto

Parabolic Breakout

Major trend shift from the 0.000347 floor → explosive 32.65% vertical rally clearing multiple resistance zones. Price is currently hovering near 0.000520 after testing a daily high of 0.000541, backed by a massive surge in trading volume.

Long Setup

0.000450 – 0.000485

Targets:

0.000541

0.000620

0.000700

Stop loss:

0.000410

Strong impulsive structure → looking for a brief consolidation or retest of the 0.000465 breakout level to flip it into support before the next leg up.

#HOT #Crypto

HOT-6,92%

- Reward

- 3

- Comment

- Repost

- Share

$MIRA

Explosive Outflow

Violent breakout from the 0.0766 base → massive 25% intraday candle peaking at 0.1500 → currently cooling off as traders take profit near 0.1090.

Momentum is vertical with a huge volume spike confirming strong institutional interest.

Long Setup

0.095 – 0.102

Targets:

0.125

0.150

0.175

Stop loss:

0.088

Impulsive trend shift → looking for a local higher low to form above the previous resistance before targeting a retest of the psychological 0.1500 peak.

#Mira #MiraProtocol #Crypto

Explosive Outflow

Violent breakout from the 0.0766 base → massive 25% intraday candle peaking at 0.1500 → currently cooling off as traders take profit near 0.1090.

Momentum is vertical with a huge volume spike confirming strong institutional interest.

Long Setup

0.095 – 0.102

Targets:

0.125

0.150

0.175

Stop loss:

0.088

Impulsive trend shift → looking for a local higher low to form above the previous resistance before targeting a retest of the psychological 0.1500 peak.

#Mira #MiraProtocol #Crypto

MIRA-12,11%

- Reward

- 3

- 1

- Repost

- Share

Muazzzzz :

:

2026 GOGOGO 👊$BNB

Recovery Attempt

Strong bounce from the 577 local bottom → impulsive rally to 640 → price currently cooling off near 622 after a minor 1.36% intraday dip.

Structure remains bullish on the 4H timeframe as buyers defend the newly formed higher low.

Long Setup

605 – 618

Targets:

640

675

710

Stop loss:

585

Healthy consolidation after expansion → looking for a volume-backed continuation to clear the 640 resistance for a move toward the 700 psychological zone.

#BNB #BNBChain #Crypto

Recovery Attempt

Strong bounce from the 577 local bottom → impulsive rally to 640 → price currently cooling off near 622 after a minor 1.36% intraday dip.

Structure remains bullish on the 4H timeframe as buyers defend the newly formed higher low.

Long Setup

605 – 618

Targets:

640

675

710

Stop loss:

585

Healthy consolidation after expansion → looking for a volume-backed continuation to clear the 640 resistance for a move toward the 700 psychological zone.

#BNB #BNBChain #Crypto

BNB-2,76%

- Reward

- like

- Comment

- Repost

- Share

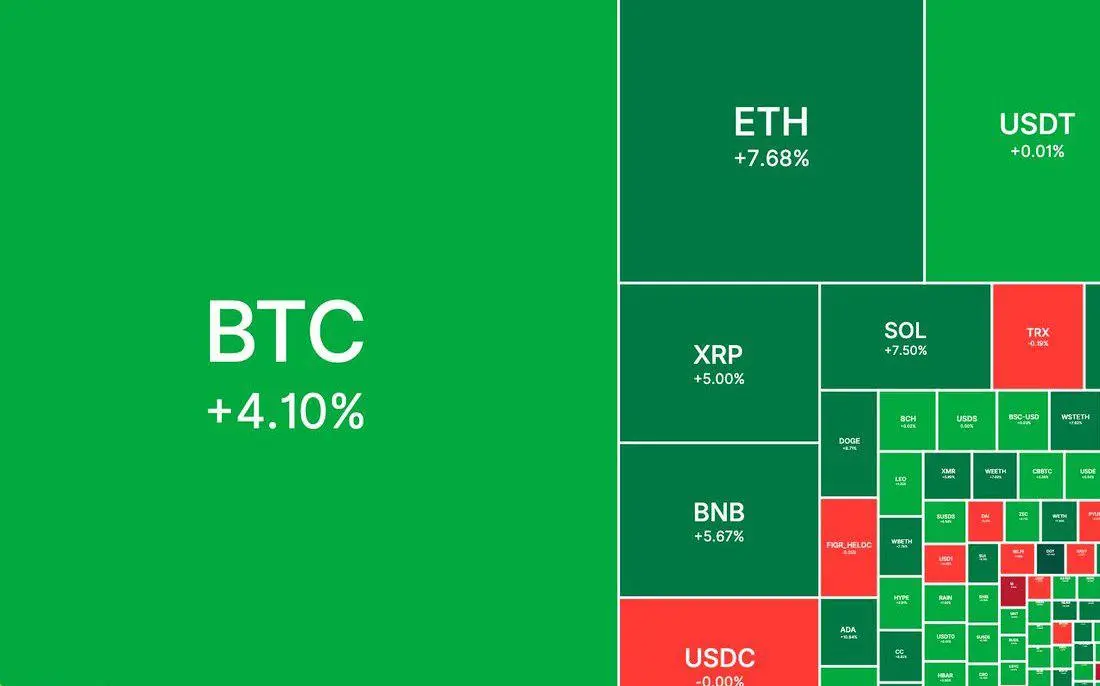

Zoom out and look at the sequence

Two days after the lawsuit headlines, crypto adds $240B in market cap

$500M in shorts get liquidated

$BTC jumps 10%

$ETH 15%

Alts 25%+

At the same time that familiar intraday sell pressure just fades

Maybe it’s coincidence.

Maybe it’s positioning.

But when aggressive supply disappears and price expands this violently it usually means the market was leaning the wrong way

That kind of unwind isn’t noise

It’s a structural shift.

And structurally, that’s bullish.

Two days after the lawsuit headlines, crypto adds $240B in market cap

$500M in shorts get liquidated

$BTC jumps 10%

$ETH 15%

Alts 25%+

At the same time that familiar intraday sell pressure just fades

Maybe it’s coincidence.

Maybe it’s positioning.

But when aggressive supply disappears and price expands this violently it usually means the market was leaning the wrong way

That kind of unwind isn’t noise

It’s a structural shift.

And structurally, that’s bullish.

- Reward

- 1

- Comment

- Repost

- Share

$ZAMA

Corrective Phase

Sharp rejection at 0.02619 → lower high formed → price currently in a mid-range corrective slide with a 6.27% intraday dip. Momentum is leaning bearish as it approaches the critical support zone established earlier this month.

Short Setup

0.0232 – 0.0240

Targets:

0.0213

0.0198

0.0182

Stop loss:

0.0252

Weakening structure → looking for a test of the 0.0213 floor; a breakdown there confirms a deeper move toward the primary demand zone.

#Zama #Crypto

Corrective Phase

Sharp rejection at 0.02619 → lower high formed → price currently in a mid-range corrective slide with a 6.27% intraday dip. Momentum is leaning bearish as it approaches the critical support zone established earlier this month.

Short Setup

0.0232 – 0.0240

Targets:

0.0213

0.0198

0.0182

Stop loss:

0.0252

Weakening structure → looking for a test of the 0.0213 floor; a breakdown there confirms a deeper move toward the primary demand zone.

#Zama #Crypto

ZAMA-4,5%

- Reward

- 1

- Comment

- Repost

- Share

$DOT

Bullish Expansion

Strong reversal from the 1.225 local floor → explosive 35.54% vertical rally → price now testing high-level liquidity after clearing major resistance zones. Momentum is firmly bullish with significant volume supporting the current leg up.

Long Setup

1.52 – 1.60

Targets:

1.696

1.850

2.000

Stop loss:

1.420

Impulsive breakout structure → looking for a shallow pullback to the previous breakout zone for a continuation toward the next major psychological level.

#dot #Polkadot #Crypto

Bullish Expansion

Strong reversal from the 1.225 local floor → explosive 35.54% vertical rally → price now testing high-level liquidity after clearing major resistance zones. Momentum is firmly bullish with significant volume supporting the current leg up.

Long Setup

1.52 – 1.60

Targets:

1.696

1.850

2.000

Stop loss:

1.420

Impulsive breakout structure → looking for a shallow pullback to the previous breakout zone for a continuation toward the next major psychological level.

#dot #Polkadot #Crypto

DOT-7,38%

- Reward

- 4

- Comment

- Repost

- Share

$ETH

Bullish Reversal

Strong recovery from the 1,800 local bottom → impulsive 11.98% surge reclaiming major resistance → price currently consolidating near 2,068 after testing a daily high of 2,086.

Momentum has flipped bullish on the 4H timeframe with significant volume expansion.

Long Setup

2,020 – 2,045

Targets:

2,125

2,240

2,350

Stop loss:

1,940

Healthy breakout structure → looking for a successful retest of the psychological 2,000 zone before targeting higher liquidity levels.

#ETH #Ethereum #Crypto

Bullish Reversal

Strong recovery from the 1,800 local bottom → impulsive 11.98% surge reclaiming major resistance → price currently consolidating near 2,068 after testing a daily high of 2,086.

Momentum has flipped bullish on the 4H timeframe with significant volume expansion.

Long Setup

2,020 – 2,045

Targets:

2,125

2,240

2,350

Stop loss:

1,940

Healthy breakout structure → looking for a successful retest of the psychological 2,000 zone before targeting higher liquidity levels.

#ETH #Ethereum #Crypto

ETH-4,45%

- Reward

- 2

- Comment

- Repost

- Share

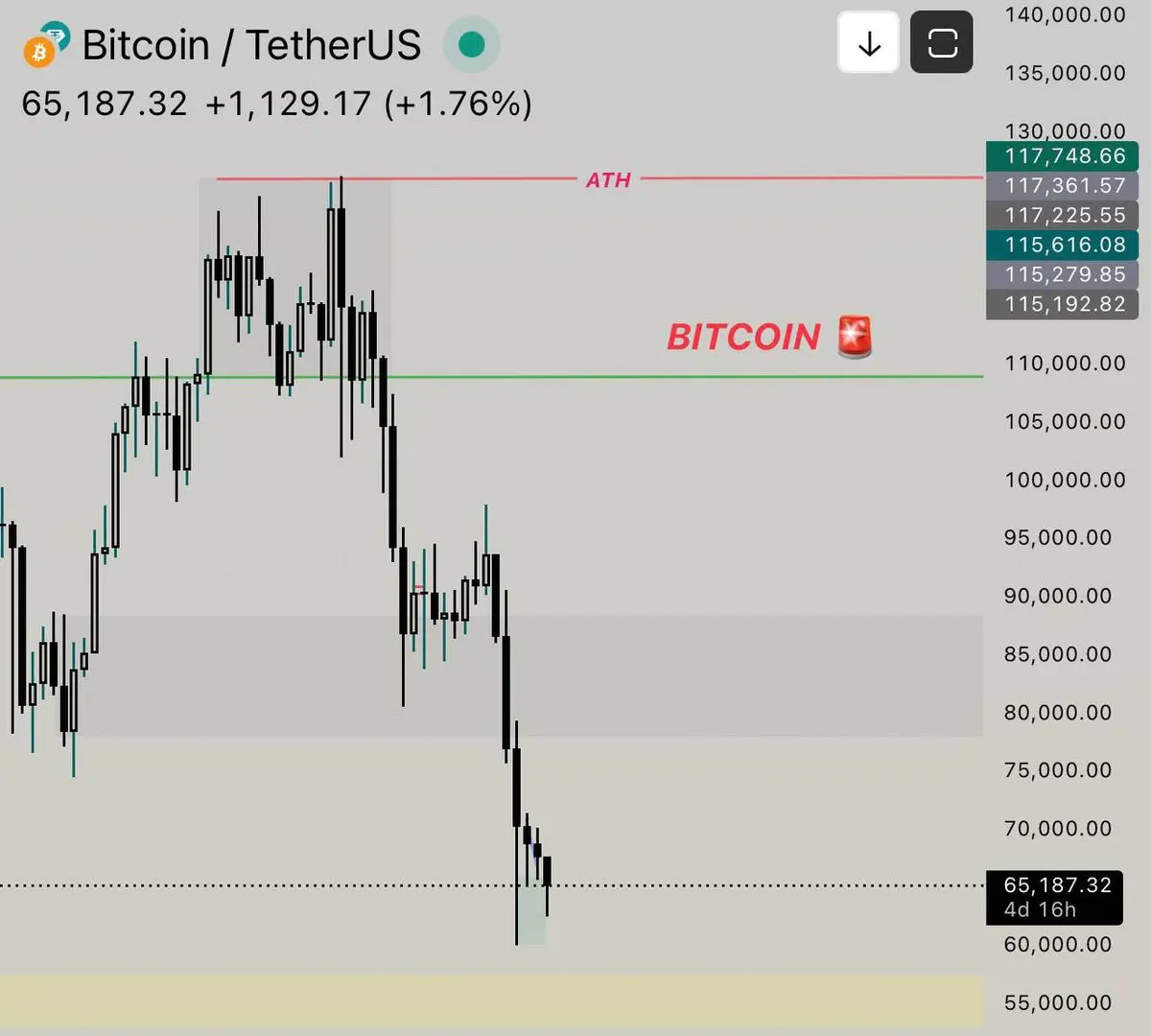

$BTC went from $126,000 to $65,000 in just 140 days

That’s nearly a 50% drawdown in less than five months

From euphoria at all-time highs to fear under $70K.

▸ Same asset.

▸ Different emotions.

The chart shows a clean rejection from ATH, loss of the $110K region, then a cascade through mid-range support around $85–90K

Now price is sitting near $65K after a vertical sell-off

This is what real volatility looks like

If $60K–$62K holds, we could see a relief bounce toward $75K–$80K.

That’s nearly a 50% drawdown in less than five months

From euphoria at all-time highs to fear under $70K.

▸ Same asset.

▸ Different emotions.

The chart shows a clean rejection from ATH, loss of the $110K region, then a cascade through mid-range support around $85–90K

Now price is sitting near $65K after a vertical sell-off

This is what real volatility looks like

If $60K–$62K holds, we could see a relief bounce toward $75K–$80K.

BTC-2,96%

- Reward

- 3

- Comment

- Repost

- Share

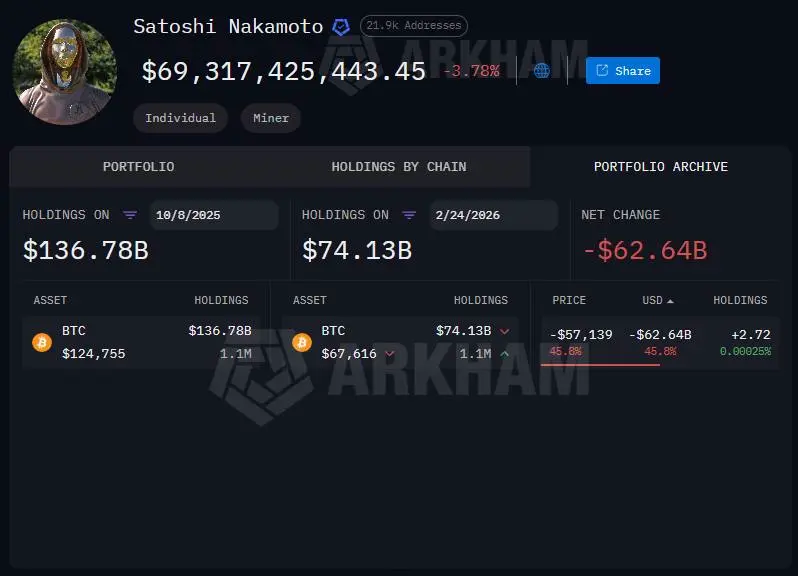

$62.6B wiped from Satoshi’s peak valuation

The largest $BTC wallet on the planet just saw $62.64 billion in unrealized value disappear since Bitcoin topped

The creator of Bitcoin is riding the same volatility as everyone else

No hedge.

No special protection.

No immunity

This market doesn’t care who you are it tests conviction equally.

The largest $BTC wallet on the planet just saw $62.64 billion in unrealized value disappear since Bitcoin topped

The creator of Bitcoin is riding the same volatility as everyone else

No hedge.

No special protection.

No immunity

This market doesn’t care who you are it tests conviction equally.

BTC-2,96%

- Reward

- like

- Comment

- Repost

- Share

$LA is showing bullish strength, surging 11.61% intraday to trade near $0.2326.

This relief bounce follows a reclaim of the $0.1936 local support, although the price has retreated from a daily high of $0.2971.

Bulls need to decisively hold above $0.211 to maintain momentum for a potential retest of the recent peak and clear immediate overhead resistance.

#LA #Lagrange #Crypto

This relief bounce follows a reclaim of the $0.1936 local support, although the price has retreated from a daily high of $0.2971.

Bulls need to decisively hold above $0.211 to maintain momentum for a potential retest of the recent peak and clear immediate overhead resistance.

#LA #Lagrange #Crypto

LA-6,77%

- Reward

- 3

- 6

- Repost

- Share

SatoshiNakamotoReturn :

:

Bull run 🐂View More

$ZAMA is showing signs of a recovery, trading at $0.02145 after a modest 1.90% intraday gain.

Following a significant rejection at the $0.026 local peak, the price has successfully established a higher floor above the $0.020 level.

Bulls must now decisively reclaim the $0.023 resistance zone to shift short-term momentum and target a retest of previous monthly highs.

#Zama #Crypto

Following a significant rejection at the $0.026 local peak, the price has successfully established a higher floor above the $0.020 level.

Bulls must now decisively reclaim the $0.023 resistance zone to shift short-term momentum and target a retest of previous monthly highs.

#Zama #Crypto

ZAMA-4,5%

- Reward

- 1

- Comment

- Repost

- Share

$ETH is currently facing downward pressure, trading near $1,861 following a 4.13% intraday decline.

After failing to hold the $2,000 psychological level, the price tested a local support floor at $1,837.

Bulls must now defend this zone to prevent a deeper slide, while a reclaim of the $1,960 resistance is necessary to shift the immediate short-term momentum back toward a bullish outlook.

#ETH #Ethereum #Crypto

After failing to hold the $2,000 psychological level, the price tested a local support floor at $1,837.

Bulls must now defend this zone to prevent a deeper slide, while a reclaim of the $1,960 resistance is necessary to shift the immediate short-term momentum back toward a bullish outlook.

#ETH #Ethereum #Crypto

ETH-4,45%

- Reward

- like

- Comment

- Repost

- Share

Breakdown confirmed.

$BTC just lost the $66K range support and flushed straight into the demand zone around $64K–$65K

Right now price is reacting inside the green demand area

If $64K fails cleanly next downside liquidity likely sits near $62K

If buyers defend this zone, we could see a relief bounce back toward $67K–$68K

For now, momentum favors sellers.

$BTC just lost the $66K range support and flushed straight into the demand zone around $64K–$65K

Right now price is reacting inside the green demand area

If $64K fails cleanly next downside liquidity likely sits near $62K

If buyers defend this zone, we could see a relief bounce back toward $67K–$68K

For now, momentum favors sellers.

BTC-2,96%

- Reward

- like

- Comment

- Repost

- Share

US Relocating Troops From Qatar Amid Iran Tensions 🚨👇

US officials are reportedly moving hundreds of military personnel from a base in Qatar as tensions with Iran escalate

This isn’t routine.

When non-essential staff are relocated, it usually signals

• Rising threat levels

• Preparation for retaliation scenarios

• Expectation of possible direct strikes

Military posture changes always come before headlines.

Markets will read this as escalation risk:

• Oil volatility likely increases

• Risk assets may face pressure

• Safe havens could catch bids

Stay Safe.

US officials are reportedly moving hundreds of military personnel from a base in Qatar as tensions with Iran escalate

This isn’t routine.

When non-essential staff are relocated, it usually signals

• Rising threat levels

• Preparation for retaliation scenarios

• Expectation of possible direct strikes

Military posture changes always come before headlines.

Markets will read this as escalation risk:

• Oil volatility likely increases

• Risk assets may face pressure

• Safe havens could catch bids

Stay Safe.

- Reward

- like

- Comment

- Repost

- Share

Gold & Silver Just Added Over $1 TRILLION in 24 Hours 👇

Gold and Silver have seen massive capital inflows in a single day as safe-haven demand accelerates

▸ Geopolitical tension is rising

▸ Risk assets are unstable

▸ Capital is moving into protection

With the U.S. potentially striking Iran within the next 48 hours, markets could open with heightened volatility

If escalation headlines hit over the weekend, gold could gap higher at Monday’s open

Safe-haven rotation is active.

Gold and Silver have seen massive capital inflows in a single day as safe-haven demand accelerates

▸ Geopolitical tension is rising

▸ Risk assets are unstable

▸ Capital is moving into protection

With the U.S. potentially striking Iran within the next 48 hours, markets could open with heightened volatility

If escalation headlines hit over the weekend, gold could gap higher at Monday’s open

Safe-haven rotation is active.

- Reward

- like

- Comment

- Repost

- Share

Market Impact if the US Attacks Iran 🚨👇

▸ Oil spikes

Iran sits near the Strait of Hormuz ~20% of global oil flow

Any disruption → crude surges → inflation fears return.

▸ Gold & Silver rally

War uncertainty = capital moves to safety.

Precious metals typically catch immediate bids.

▸ Equities sell off

Risk assets get hit

Tech and EM stocks likely down, while defense names could outperform

▸ Crypto drops first

In shock events, $BTC and alts trade like high-beta tech

Liquidity tightens → initial sell-off

Only after panic fades does the hedge narrative return.

Stay Safe.

▸ Oil spikes

Iran sits near the Strait of Hormuz ~20% of global oil flow

Any disruption → crude surges → inflation fears return.

▸ Gold & Silver rally

War uncertainty = capital moves to safety.

Precious metals typically catch immediate bids.

▸ Equities sell off

Risk assets get hit

Tech and EM stocks likely down, while defense names could outperform

▸ Crypto drops first

In shock events, $BTC and alts trade like high-beta tech

Liquidity tightens → initial sell-off

Only after panic fades does the hedge narrative return.

Stay Safe.

BTC-2,96%

- Reward

- like

- Comment

- Repost

- Share

This is a decision point for the broader alt market 👇

Alt coin market is compressing at major support

Rn price is sitting inside a key demand zone around 0.10–0.13.

Structure right now:

~ Downtrend still intact

~ Horizontal resistance overhead

~ Multiple rejections near 0.15

~ Tight consolidation forming

If this range breaks upward and flips 0.15 into support, it opens room toward 0.18–0.20

But if 0.10 loses cleanly, that likely triggers another leg down and altcoins continue underperforming BTC and large caps.

Alt coin market is compressing at major support

Rn price is sitting inside a key demand zone around 0.10–0.13.

Structure right now:

~ Downtrend still intact

~ Horizontal resistance overhead

~ Multiple rejections near 0.15

~ Tight consolidation forming

If this range breaks upward and flips 0.15 into support, it opens room toward 0.18–0.20

But if 0.10 loses cleanly, that likely triggers another leg down and altcoins continue underperforming BTC and large caps.

BTC-2,96%

- Reward

- 2

- Comment

- Repost

- Share