MrFlower_XingChen

No content yet

MrFlower_XingChen

#CryptoSurvivalGuide The Crypto Survival Guide is becoming increasingly important as global participation in the cryptocurrency market continues to grow, driven by assets such as Bitcoin and Ethereum. While digital currencies offer significant financial opportunities, the market is also characterized by high volatility, regulatory uncertainty, and rapid technological change. Understanding risk management principles has become essential for anyone participating in modern crypto trading.

One of the most important survival strategies in cryptocurrency investment is portfolio diversification. Rely

One of the most important survival strategies in cryptocurrency investment is portfolio diversification. Rely

- Reward

- 1

- 3

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

Volatility is an opportunity 📊View More

#ZachXBTExposesTheAxiomIncident The blockchain investigation community has been closely watching revelations released by ZachXBT, who recently exposed details surrounding what is being referred to as “The Axiom Incident.” The disclosure has generated significant discussion across cryptocurrency social media circles and raised new questions about security, transparency, and risk management inside the digital asset ecosystem.

ZachXBT is widely known for conducting independent on-chain investigations related to fraud detection, rug pulls, and suspicious blockchain activity. In this case, the inve

ZachXBT is widely known for conducting independent on-chain investigations related to fraud detection, rug pulls, and suspicious blockchain activity. In this case, the inve

BTC-0,36%

- Reward

- 3

- 3

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

Volatility is an opportunity 📊View More

#GateSquare$50KRedPacketGiveaway Gate.io has announced an exciting community reward campaign, the $50,000 Red Packet Giveaway, designed to celebrate user engagement and trading participation across its global platform. The event reflects the exchange’s ongoing strategy to strengthen community interaction while providing promotional incentives for active users in the cryptocurrency ecosystem.

The Red Packet campaign is inspired by traditional reward distribution concepts, symbolizing luck, prosperity, and community sharing within the digital trading environment. Participants are encouraged to j

The Red Packet campaign is inspired by traditional reward distribution concepts, symbolizing luck, prosperity, and community sharing within the digital trading environment. Participants are encouraged to j

BTC-0,36%

- Reward

- like

- Comment

- Repost

- Share

#TrumpordersfederalbanonAnthropicAI The U.S. government has taken a major step in artificial intelligence policy after Donald Trump ordered federal agencies to stop using technology developed by Anthropic. The directive marks one of the most controversial government actions in recent years regarding AI governance, national security control, and the relationship between public institutions and private technology developers.

The core issue behind the decision centers on disagreement over the military and surveillance applications of advanced AI systems. Anthropic, known for its AI model Claude,

The core issue behind the decision centers on disagreement over the military and surveillance applications of advanced AI systems. Anthropic, known for its AI model Claude,

- Reward

- 2

- Comment

- Repost

- Share

#VitalikOutlinesEthereumScalingPlan Vitalik Buterin, the visionary behind Ethereum, has unveiled a comprehensive roadmap for the next generation of Ethereum scaling — pushing the network closer to achieving mass adoption, higher transaction throughput, and significantly reduced fees. This new plan reflects years of research, development, and community feedback aimed at maintaining Ethereum’s position as a leading decentralized computing platform.

At the core of Vitalik’s scaling strategy is a continued emphasis on Layer-2 solutions, which process transactions off the main blockchain (Layer-1)

At the core of Vitalik’s scaling strategy is a continued emphasis on Layer-2 solutions, which process transactions off the main blockchain (Layer-1)

- Reward

- 1

- Comment

- Repost

- Share

#GateSurpasses50MGlobalRegisteredUsers Gate.io has officially crossed the extraordinary milestone of 50 million registered users worldwide, marking one of the most significant growth achievements in the global digital asset trading industry. This landmark reflects the platform’s continuous expansion, increasing market trust, and its ability to attract both retail and professional traders across multiple regions. The development demonstrates how cryptocurrency trading ecosystems are transitioning from early adoption stages into large-scale financial infrastructure.

Since its establishment in 20

Since its establishment in 20

BTC-0,36%

- Reward

- like

- Comment

- Repost

- Share

#Bitcoin’sSafeHavenAppeal The global financial landscape is undergoing a rapid transformation as Bitcoin continues to attract attention as a potential digital safe-haven asset. In an era marked by geopolitical uncertainty, inflationary pressure, and shifting monetary policies, investors are increasingly exploring decentralized financial storage options beyond traditional banking systems. The growing discussion about Bitcoin’s protective role in investment portfolios reflects a broader evolution in how wealth may be preserved in the future digital economy.

The safe-haven narrative of Bitcoin ha

The safe-haven narrative of Bitcoin ha

BTC-0,36%

- Reward

- 1

- Comment

- Repost

- Share

#IranTensionsEscalate The escalating confrontation involving Iran and Western-aligned regional powers has pushed the Middle East into one of the most fragile security situations in modern history. What began as a series of political and military disagreements has now evolved into a high-risk strategic conflict involving missile strikes, counterattacks, and intense diplomatic pressure from global institutions. Intelligence analysts warn that the current cycle of retaliation could reshape security arrangements across the entire region if immediate de-escalation does not occur.

Recent military op

Recent military op

- Reward

- 2

- Comment

- Repost

- Share

#PreciousMetalsAndOilPricesSurge Markets are reacting strongly to the escalating Middle East tensions. The United States and Israel launched airstrikes, followed by Iran’s retaliation and pressure around the Strait of Hormuz, triggering sharp moves in commodities and risk assets.

Shipping disruption concerns have pushed energy prices higher, while safe-haven demand has driven strong buying in precious metals.

📊 Live Market Snapshot (March 2, 2026)

🛢 Brent Crude Oil: approximately $79–$82 per barrel

🥇 Gold (Spot): approximately $5,400 per ounce

Volatility remains elevated as traders react to

Shipping disruption concerns have pushed energy prices higher, while safe-haven demand has driven strong buying in precious metals.

📊 Live Market Snapshot (March 2, 2026)

🛢 Brent Crude Oil: approximately $79–$82 per barrel

🥇 Gold (Spot): approximately $5,400 per ounce

Volatility remains elevated as traders react to

- Reward

- 4

- 3

- Repost

- Share

Yusfirah :

:

To The Moon 🌕View More

Join my live

- Reward

- 4

- 3

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

2026 Go Go Go 👊View More

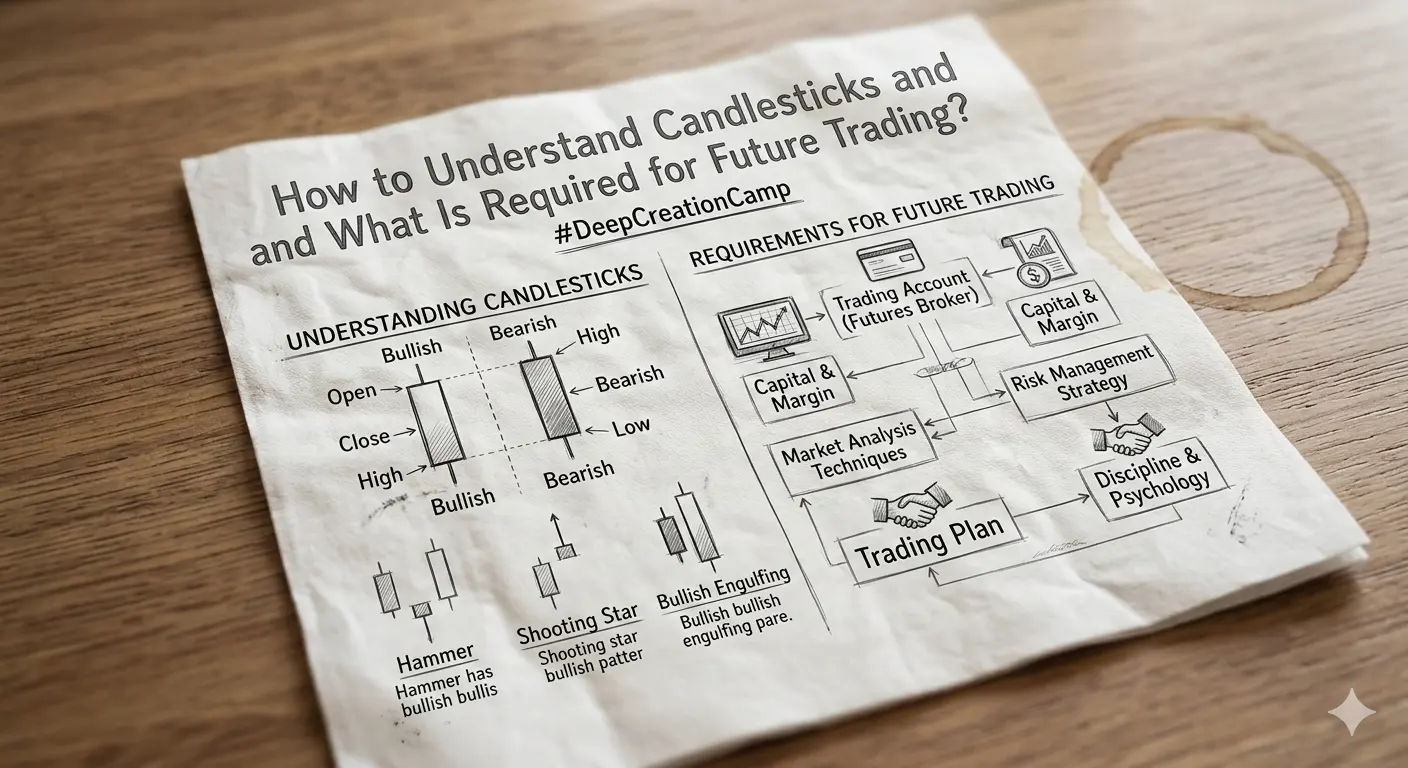

#DeepCreationCamp How to Understand Candlesticks and What Is Required for Future Trading?

Introduction

Technical analysis plays a vital role in achieving success in financial markets. In particular, understanding candlestick charts is considered a fundamental skill for traders. The global popularity of Japanese candlestick techniques was largely introduced by Steve Nison, who helped spread this method worldwide.

Whether you are doing future trading or spot trading, entering the market without proper knowledge can be risky. Therefore, learning the basics first and then practicing real trading i

Introduction

Technical analysis plays a vital role in achieving success in financial markets. In particular, understanding candlestick charts is considered a fundamental skill for traders. The global popularity of Japanese candlestick techniques was largely introduced by Steve Nison, who helped spread this method worldwide.

Whether you are doing future trading or spot trading, entering the market without proper knowledge can be risky. Therefore, learning the basics first and then practicing real trading i

- Reward

- 7

- 10

- Repost

- Share

CryptoSocietyOfRhinoBrotherIn :

:

2026 Go Go Go 👊View More

#BitcoinBouncesBack The move from the $63K region toward the $68K zone reflects a technical rebound after the recent macro-driven volatility shock. However, this price action should currently be interpreted as a structural test of demand strength rather than a confirmed trend reversal.

The bounce itself was driven by classic market mechanics. The sell-side pressure near the $63K demand zone exhausted short-term leverage positions, forcing liquidation cascades that temporarily pushed price downward. Once leverage was cleared, buyers stepped in, producing a recovery of roughly 7–8%. Importantly

The bounce itself was driven by classic market mechanics. The sell-side pressure near the $63K demand zone exhausted short-term leverage positions, forcing liquidation cascades that temporarily pushed price downward. Once leverage was cleared, buyers stepped in, producing a recovery of roughly 7–8%. Importantly

BTC-0,36%

- Reward

- 4

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#NvidiaQ4RevenueSurges73% The latest earnings release from NVIDIA revealed an impressive 73% year-over-year revenue increase in Q4, far exceeding market expectations and signaling robust demand across AI, data center, and cloud infrastructure segments.

Here’s a fresh, up-to-date strategic breakdown of what this surge means for tech markets, AI adoption, and broader risk assets like crypto:

🔹 1. What Drove the Revenue Explosion

NVIDIA’s growth wasn’t isolated — it reflects structural demand for AI compute:

🚀 AI & Data Centers

The largest contributor to revenue gains.

Enterprises and cloud pr

Here’s a fresh, up-to-date strategic breakdown of what this surge means for tech markets, AI adoption, and broader risk assets like crypto:

🔹 1. What Drove the Revenue Explosion

NVIDIA’s growth wasn’t isolated — it reflects structural demand for AI compute:

🚀 AI & Data Centers

The largest contributor to revenue gains.

Enterprises and cloud pr

- Reward

- 5

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TrumpAnnouncesNewTariffs The announcement of a global 15% tariff policy by Donald Trump has triggered a classic macro-driven risk-off shock across financial markets, with crypto assets reacting immediately to the policy uncertainty.

The tariff expansion is part of a broader trade strategy that aims to increase leverage in international negotiations, but markets interpreted the move as a potential inflationary and growth-slowdown signal. Higher import taxes tend to raise production costs, tighten global liquidity cycles, and push investors toward defensive assets such as gold and cash-equival

The tariff expansion is part of a broader trade strategy that aims to increase leverage in international negotiations, but markets interpreted the move as a potential inflationary and growth-slowdown signal. Higher import taxes tend to raise production costs, tighten global liquidity cycles, and push investors toward defensive assets such as gold and cash-equival

BTC-0,36%

- Reward

- 6

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CLARITYActAdvances signals a major legislative momentum shift surrounding the Digital Asset Market Clarity Act (H.R. 3633), commonly known as the CLARITY Act. The proposal reflects the United States’ effort to establish a unified regulatory architecture for digital assets, reducing jurisdictional conflict between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). For years, regulatory ambiguity has shaped crypto market behavior, influencing innovation migration, compliance costs, and institutional participation. The advancement of this bill sugge

- Reward

- 7

- 7

- Repost

- Share

AYATTAC :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow? March 2, 2026 — Bitcoin’s quiet power phase is unfolding after the violent geopolitical volatility that shocked markets earlier.

The flash crash driven by regional conflict news pushed price rapidly toward the $63,000 zone, triggering panic selling and forced liquidation events. Emotional traders exited positions during the chaos, while disciplined participants focused on structure rather than headlines. This is a classic market behavior pattern — volatility creates opportunity for prepared capital.

Currently, Bitcoin is trading around the mid-$66K region, sitting above a

The flash crash driven by regional conflict news pushed price rapidly toward the $63,000 zone, triggering panic selling and forced liquidation events. Emotional traders exited positions during the chaos, while disciplined participants focused on structure rather than headlines. This is a classic market behavior pattern — volatility creates opportunity for prepared capital.

Currently, Bitcoin is trading around the mid-$66K region, sitting above a

BTC-0,36%

- Reward

- 5

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#USOCCIssuesNewStablecoinRules — The Office of the Comptroller of the Currency (OCC) has released a comprehensive set of updated regulatory guidelines aimed at stablecoin issuers, marking one of the most significant U.S. policy moves affecting digital assets in 2026. These new rules are designed to establish clearer federal standards for reserve requirements, auditing transparency, custodial practices, and systemic risk mitigation across the stablecoin sector.

What the New Rules Entail

Under the updated framework, stablecoin issuers will be required to adhere to:

🔹 Stronger Reserve Transparen

What the New Rules Entail

Under the updated framework, stablecoin issuers will be required to adhere to:

🔹 Stronger Reserve Transparen

DEFI-8,11%

- Reward

- 7

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#JaneStreet10AMSellOff is trending after market participants observed an unusually large block sale executed around 10:00 AM (UTC) by trading desk firms linked to Jane Street. The transaction, executed across multiple exchanges and asset pairs, triggered a sharp repricing in both spot and derivatives markets — particularly in major cryptocurrencies like Bitcoin and Ethereum.

What Happened

At approximately 10:00 AM, a series of coordinated sell orders hit major order books, absorbing significant bid liquidity and causing rapid price declines. Traders later identified that the selling cadence, s

What Happened

At approximately 10:00 AM, a series of coordinated sell orders hit major order books, absorbing significant bid liquidity and causing rapid price declines. Traders later identified that the selling cadence, s

- Reward

- 7

- 9

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#EthereumFoundationUnveilsItsStrawmap The Ethereum Foundation has officially released its long-anticipated Strawmap initiative, marking a strategic blueprint for the next phase of the Ethereum ecosystem’s evolution. Unlike traditional roadmaps, the Strawmap is designed to be dynamic, modular, and community-driven — reflecting Ethereum’s ethos of decentralized governance, iterative progress, and adaptable innovation.

What Is the Strawmap?

The Strawmap isn’t a fixed timeline; it’s a living framework outlining priority vectors in protocol advancement, ecosystem tooling, and cross-chain interoper

What Is the Strawmap?

The Strawmap isn’t a fixed timeline; it’s a living framework outlining priority vectors in protocol advancement, ecosystem tooling, and cross-chain interoper

ETH-2,1%

- Reward

- 7

- 7

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#ZachXBTExposesTheAxiomIncident is gaining major traction across Crypto X after blockchain investigator ZachXBT published a detailed thread outlining alleged irregularities connected to a project known as Axiom.

According to the on-chain breakdown, wallet clustering analysis revealed suspicious fund movements between early investor allocations, internal team-linked addresses, and liquidity pools. The investigation highlighted patterns such as rapid token distribution shifts prior to major announcements, strategic liquidity withdrawals, and transfers routed through intermediary wallets — all of

According to the on-chain breakdown, wallet clustering analysis revealed suspicious fund movements between early investor allocations, internal team-linked addresses, and liquidity pools. The investigation highlighted patterns such as rapid token distribution shifts prior to major announcements, strategic liquidity withdrawals, and transfers routed through intermediary wallets — all of

TOKEN-2,87%

- Reward

- 7

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More