#CryptoSurvivalGuide Crypto Survival Guide — How to Trade Ethereum (ETH) Effectively

Ethereum (ETH) is one of the most traded, liquid, and versatile assets in crypto. Whether you’re a short-term trader, swing trader, or long-term investor, understanding ETH’s behavior, market structure, and risk factors is crucial for survival and profitability in 2026’s volatile environment.

1️⃣ ETH Market Overview

Current Market Context (Mid-Feb 2026)

Price: ~$2,400–$2,500 (example range; adjust to real-time)

Market Cap: ~$300B

Dominance: ~17–18% of total crypto market

Volume: Daily on-chain + exchange volume combined ~$20–25B

Market Structure:

ETH remains highly correlated with BTC, but also responds to DeFi, NFT, and Layer-2 adoption trends.

Short-term: Consolidation between key support and resistance levels.

Medium-term: Uptrend potential from post-merge network improvements and scaling solutions.

2️⃣ Technical Analysis Essentials

Key Tools for ETH Trading:

✅ Support & Resistance

Identify major support zones (previous swing lows) and resistance (recent highs).

Example: $2,200–$2,300 as support, $2,600–$2,700 as near-term resistance.

✅ Moving Averages

50-day MA: Tracks short-term trend

200-day MA: Tracks long-term trend

Golden cross/death cross signals are important for swing trades.

✅ RSI & MACD

RSI (14-day) oversold <30 → potential buying opportunity

RSI >70 → overbought, possible short-term correction

MACD crossovers → trend confirmation

✅ Volume Analysis

Confirm breakouts with high volume to avoid false moves

Divergence between price and volume may indicate weakening momentum

✅ Candlestick Patterns

Long tails/wicks → absorption of buying/selling

Doji, hammer, shooting star → indicate reversals or indecision

3️⃣ Fundamental Analysis

ETH’s price is heavily influenced by network adoption and utility:

DeFi & Layer-2 Usage: Higher transaction volume → positive sentiment

ETH Staking: Locked ETH reduces circulating supply → bullish pressure

Smart Contract Activity: Growth in NFT, gaming, and enterprise adoption drives demand

Macro Correlation: ETH reacts to BTC moves, Fed liquidity, and risk-on/risk-off sentiment

Recent Example (2026):

Surge in Layer-2 usage + institutional ETH staking → supported price near $2,500

Market pullbacks often coincide with BTC corrections, not ETH-specific issues

4️⃣ Trading Strategies

🔹 A. Short-Term / Day Trading

Focus on 15m–1H charts

Trade around volatility ranges, using support/resistance

Tight stops (1–2% of position) to survive high volatility

Use limit orders to capture entries; avoid chasing moves

🔹 B. Swing Trading

Hold positions 3–10 days based on technical patterns

Combine MA crossovers, RSI, and volume spikes for confirmation

Average into positions on pullbacks near support

🔹 C. Long-Term Investing

DCA into ETH during dips (<30–50% off recent highs)

Focus on network fundamentals, staking yields, and adoption metrics

Ignore short-term noise; patience pays for long-term investors

5️⃣ Risk Management

Crypto survival is impossible without strong risk discipline:

Risk 1–2% of capital per trade

Always set stop-loss orders

Avoid over-leveraging — ETH is highly volatile

Diversify across other cryptos or stablecoins

Don’t let emotion dictate trading; stick to a plan

6️⃣ Psychological Edge

Fear and Greed: Recognize that dips trigger emotional panic, and rallies trigger FOMO

Patience: Wait for confirmations rather than entering impulsively

Record Keeping: Track trades, entry/exit rationale, and emotions

Adaptability: ETH’s behavior evolves with network updates, regulation, and macro conditions

7️⃣ Macro Considerations

Fed Policy: Rate cuts → risk-on → ETH gains; hawkish → downside risk

Crypto Regulation: Impact on exchanges, staking, and DeFi platforms

Market Liquidity: Stablecoin yields and inflows/outflows affect ETH’s buying power

BTC Correlation: ETH generally follows BTC for direction, but decoupling occurs during ETH-specific events

8️⃣ Advanced Tips

Use layered entries: Split capital into multiple positions at different support zones

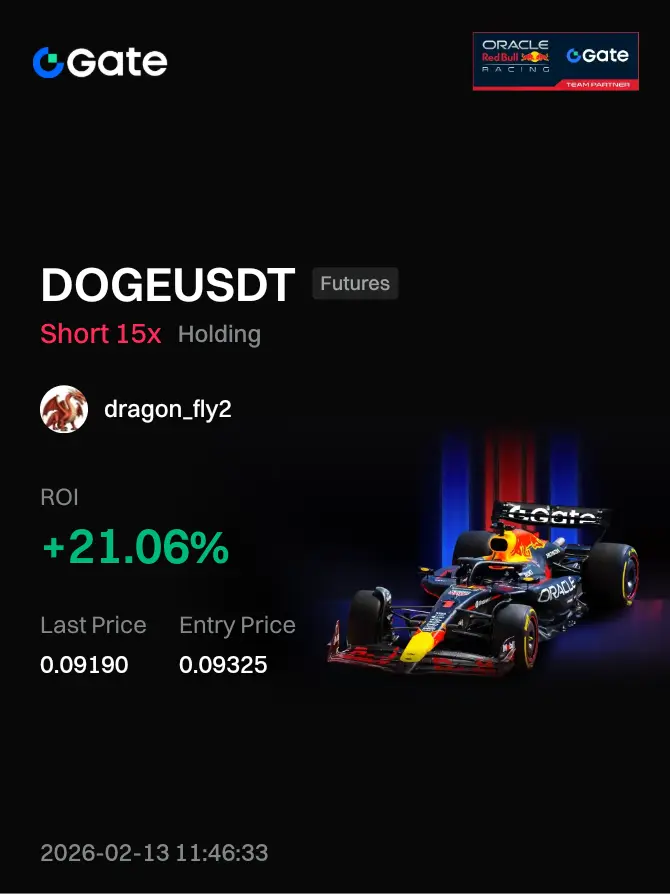

Monitor ETH derivatives: Futures OI and funding rates provide insights into market sentiment

Stay aware of network events: ETH upgrades, Layer-2 launches, staking rewards, and protocol changes can move price rapidly

Track whale movements: Large on-chain ETH transfers often precede volatility

9️⃣ Survival Rules

Plan every trade — entry, exit, stop-loss

Always account for leverage risk

Protect capital over chasing profit

Follow the trend, don’t fight it

Observe macro + network fundamentals for context

Embrace volatility — it’s ETH’s natural state

🔟 Bottom Line

Trading ETH successfully in 2026 requires a blend of technical mastery, fundamental understanding, macro awareness, and disciplined psychology.

Short-term traders profit from volatility and pattern recognition

Swing traders balance trend and momentum

Long-term holders focus on adoption, staking, and network growth

Crypto survival isn’t luck — it’s strategy, patience, and execution. ETH rewards those who prepare, adapt, and stay disciplined.