2025 VFYPrice Prediction: Analyzing Market Trends and Future Value Potential of VFY in a Shifting Crypto Landscape

Introduction: VFY's Market Position and Investment Value

zkVerify (VFY) has emerged as a universal proof verification layer for real-world applications across the Internet since its inception. As of 2025, zkVerify's market capitalization has reached $30,358,260, with a circulating supply of approximately 306,000,000 tokens, and a price hovering around $0.09921. This asset, dubbed the "ZK proof verification layer," is playing an increasingly crucial role in enabling high-speed and low-cost verification for both Web2 and Web3 applications.

This article will comprehensively analyze zkVerify's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. VFY Price History Review and Current Market Status

VFY Historical Price Evolution

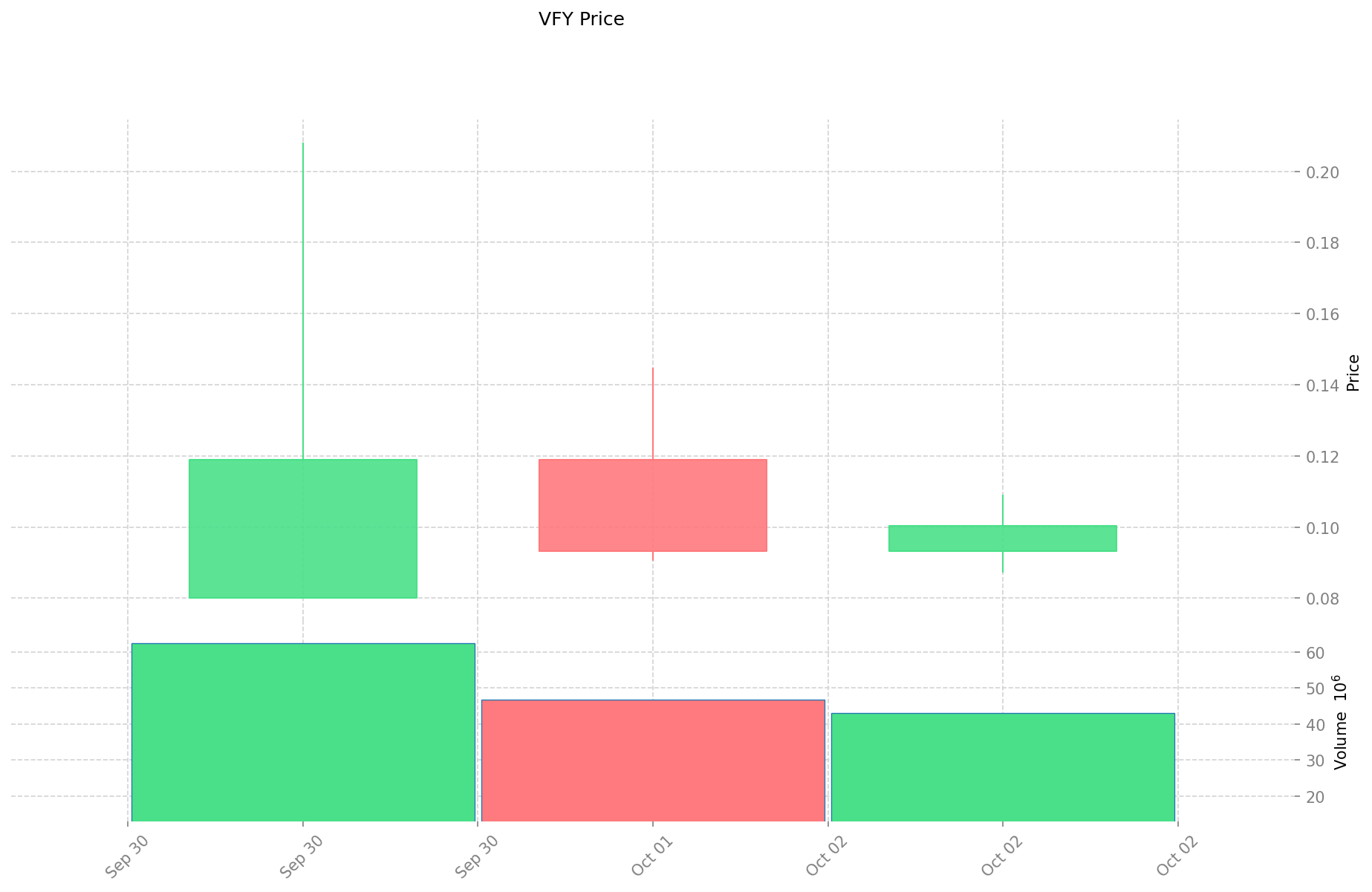

- 2025: VFY launched, price fluctuated between $0.08 and $0.20814

VFY Current Market Situation

As of October 3, 2025, VFY is trading at $0.09921. The token has experienced a 1.51% increase in the last 24 hours, with a trading volume of $4,237,490.77501. VFY's market capitalization currently stands at $30,358,260, ranking it 911th in the overall cryptocurrency market.

The token's all-time high of $0.20814 was recorded on September 30, 2025, while its all-time low of $0.08 was also observed on the same date. This indicates a volatile start for the newly launched token.

VFY has shown positive short-term momentum with a 1.70% increase in the past hour. However, it has experienced a significant decline of 46.53% over the past week and month, suggesting a downward trend in the medium term.

The current circulating supply of VFY is 306,000,000 tokens, which represents 30.6% of its total supply of 1,000,000,000 tokens. The fully diluted market cap is $99,210,000.

Click to view the current VFY market price

VFY Market Sentiment Indicator

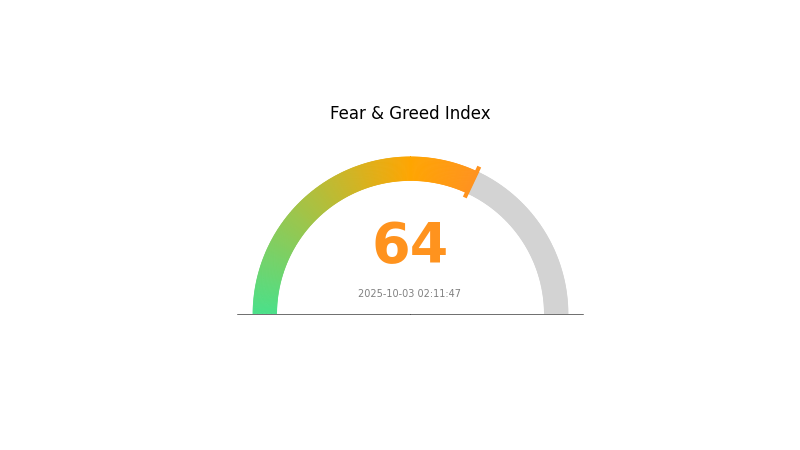

2025-10-03 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently showing signs of greed, with the Fear and Greed Index at 64. This suggests investors are becoming increasingly optimistic, possibly driven by recent price rallies or positive news in the sector. However, it's important to remember that extreme greed can lead to overbought conditions and potential market corrections. Traders should exercise caution and consider diversifying their portfolios. As always, conducting thorough research and using risk management strategies is crucial in this volatile market.

VFY Holdings Distribution

The address holdings distribution data for VFY reveals an interesting picture of token concentration. This metric is crucial for understanding the decentralization and potential market dynamics of a cryptocurrency.

Upon analysis, it appears that the VFY token distribution is currently showing a relatively balanced structure. The absence of addresses holding extremely large percentages of the total supply suggests a lack of overwhelming concentration among a few major holders. This distribution pattern is generally favorable for market stability and reduces the risk of price manipulation by individual large holders.

However, the exact level of decentralization is difficult to determine without more granular data. The current distribution may indicate a healthy ecosystem with a diverse range of stakeholders, which could contribute to more organic price discovery and reduced volatility. Overall, the VFY token's holdings distribution appears to reflect a market structure that leans towards decentralization, potentially fostering a more resilient and equitable ecosystem for participants.

Click to view the current VFY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing VFY's Future Price

Supply Mechanism

- Bitcoin Halving: The upcoming Bitcoin halving in April 2024 will reduce mining rewards from 6.25 BTC to 3.125 BTC, potentially impacting the entire cryptocurrency market, including VFY.

Institutional and Whale Dynamics

- Enterprise Adoption: The adoption of VFY in the decentralized verification ecosystem could play a crucial role in its price movement.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, including interest rate decisions, may influence VFY's price as part of the broader cryptocurrency market.

- Inflation Hedging Properties: VFY's performance in inflationary environments could affect its attractiveness as an investment.

- Geopolitical Factors: International tensions and political developments may impact the overall cryptocurrency market, including VFY.

Technical Development and Ecosystem Building

- Ecosystem Applications: VFY's utility in DeFi, NFTs, gaming, and payment scenarios could significantly influence its value proposition and price.

III. VFY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.06599 - $0.09849

- Neutral prediction: $0.09849 - $0.12000

- Optimistic prediction: $0.12000 - $0.14281 (requires strong market recovery and increased VFY adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range forecast:

- 2027: $0.09764 - $0.16673

- 2028: $0.10142 - $0.16798

- Key catalysts: Technological advancements in VFY ecosystem, broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.13711 - $0.17057 (assuming steady market growth)

- Optimistic scenario: $0.17057 - $0.19445 (with favorable market conditions and increased VFY utility)

- Transformative scenario: Above $0.19445 (with major breakthroughs in VFY technology and mass adoption)

- 2030-12-31: VFY $0.17057 (potential stabilization point after long-term growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14281 | 0.09849 | 0.06599 | 0 |

| 2026 | 0.17977 | 0.12065 | 0.07239 | 21 |

| 2027 | 0.16673 | 0.15021 | 0.09764 | 51 |

| 2028 | 0.16798 | 0.15847 | 0.10142 | 59 |

| 2029 | 0.17792 | 0.16323 | 0.13711 | 64 |

| 2030 | 0.19445 | 0.17057 | 0.10234 | 71 |

IV. VFY Professional Investment Strategies and Risk Management

VFY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate VFY tokens during market dips

- Set price alerts for significant market movements

- Store tokens in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor zkVerify project developments and partnerships

- Keep an eye on overall market sentiment in the zero-knowledge proof sector

VFY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk assessment

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for VFY

VFY Market Risks

- High volatility: Cryptocurrency markets are known for extreme price fluctuations

- Competition: Other zero-knowledge proof projects may gain market share

- Adoption challenges: Slow integration of zkVerify technology in real-world applications

VFY Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on cryptocurrencies

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax laws related to cryptocurrency transactions

VFY Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the zkVerify protocol

- Scalability challenges: Possible limitations in handling increased network load

- Interoperability issues: Compatibility concerns with other blockchain networks

VI. Conclusion and Action Recommendations

VFY Investment Value Assessment

zkVerify (VFY) presents a promising long-term value proposition in the zero-knowledge proof sector, with potential for significant growth. However, short-term risks include high volatility and regulatory uncertainties.

VFY Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider VFY as part of a diversified crypto portfolio

VFY Trading Participation Methods

- Spot trading: Buy and sell VFY tokens on Gate.com

- Staking: Participate in Staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities involving VFY tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

U vs DOT: Understanding the Different Safety Standards for Motorcycle Helmets

2025 MINA Price Prediction: Analyzing Growth Potential and Market Trends for the Lightweight Blockchain

2025 VFY Price Prediction: Analyzing Market Trends and Future Growth Potential for Virtual Finance Yield Token

How Has ZEC's Recent Price Surge Affected Its On-Chain Metrics and Exchange Flows?

How to Analyze a Cryptocurrency Project's Fundamentals: 5 Key Factors to Consider

What Is the Future of Zcash (ZEC) Based on Its Fundamentals?

Exploring the Ownership Structure of a Major Cryptocurrency Platform

2025 CRWN Price Prediction: Expert Analysis and Market Forecast for Crown Token Investment

2025 CEEK Price Prediction: Expert Analysis and Market Outlook for Virtual Reality Token

2025 BOX Price Prediction: Expert Analysis and Market Outlook for the Next Bull Run

2025 TET Price Prediction: Expert Analysis and Market Forecast for the Coming Year