2025 VFY Price Prediction: Analyzing Market Trends and Future Growth Potential for Virtual Finance Yield Token

Introduction: VFY's Market Position and Investment Value

zkVerify (VFY), as a universal proof verification layer for real-world applications across the Internet, has made significant strides since its inception. As of 2025, zkVerify's market capitalization has reached $40,529,700, with a circulating supply of approximately 306,000,000 tokens, and a price hovering around $0.13245. This asset, often referred to as the "ZK proof verification enabler," is playing an increasingly crucial role in both Web2 and Web3 applications.

This article will provide a comprehensive analysis of zkVerify's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. VFY Price History Review and Current Market Status

VFY Historical Price Evolution

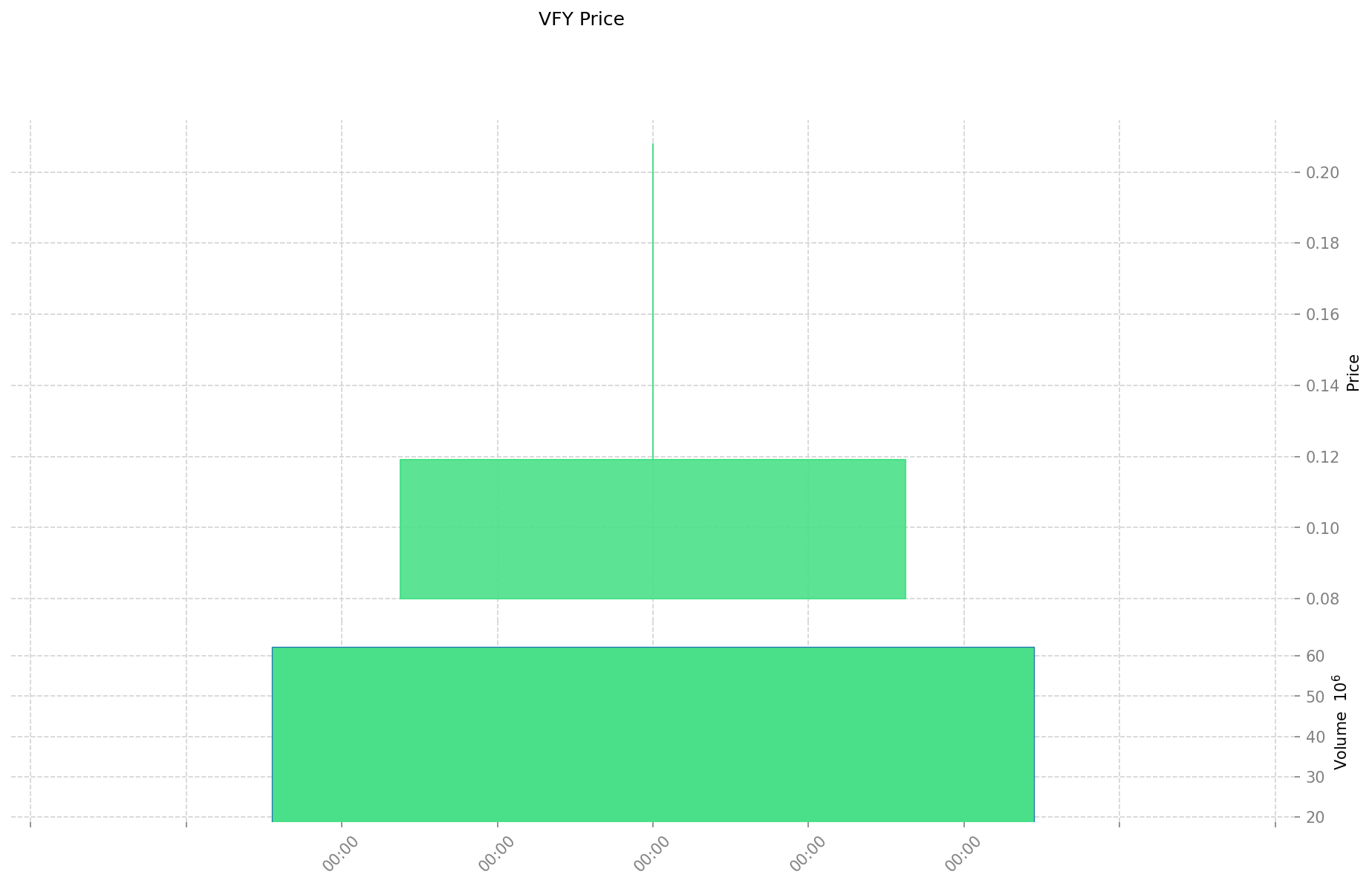

- 2025: VFY launched, price fluctuated between $0.08 and $0.20814

VFY Current Market Situation

As of October 1, 2025, VFY is trading at $0.13245. The cryptocurrency has shown significant volatility in the past 24 hours, with a 64.81% increase. However, it's important to note that VFY is still trading below its all-time high of $0.20814, which was reached on September 30, 2025.

The current market capitalization of VFY stands at $40,529,700, with a circulating supply of 306,000,000 VFY tokens. The 24-hour trading volume is $9,663,308.285, indicating active trading interest in the token.

Despite the recent surge, VFY has experienced a 27.32% decrease in value over the past week and month. This suggests that while there's current positive momentum, the token has faced some challenges in the broader timeframe.

The fully diluted valuation of VFY is $132,450,000, based on the maximum supply of 1,000,000,000 tokens. Currently, 30.6% of the total supply is in circulation.

Click to view the current VFY market price

VFY Market Sentiment Indicator

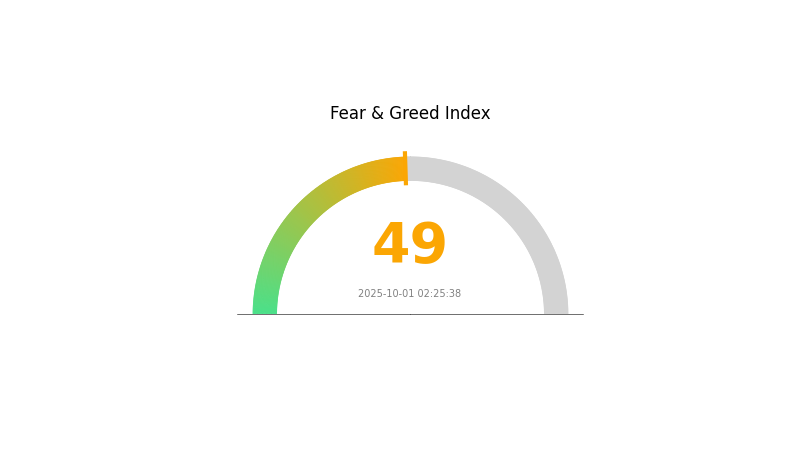

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as we enter October 2025. With a Fear and Greed Index of 49, investors appear to be neither overly pessimistic nor excessively optimistic. This neutral stance suggests a period of stability in the market, with potential for movement in either direction. Traders and investors should remain vigilant, analyzing both technical indicators and fundamental news to make informed decisions. As always, diversification and risk management are key in navigating the ever-changing crypto landscape.

VFY Holdings Distribution

The address holdings distribution data for VFY reveals a notable lack of concentration among top holders. This absence of data suggests a highly decentralized token distribution, where no single address holds a significant portion of the total supply.

This distribution pattern indicates a robust and fair market structure for VFY. The absence of large individual holders reduces the risk of market manipulation and sudden price volatility caused by large sell-offs. It also suggests that the token's ownership is spread across a wide base of users or investors, which is generally considered a positive indicator for the project's health and long-term stability.

The current address distribution reflects a high degree of decentralization in VFY's ecosystem. This decentralized structure enhances the token's resilience against potential market shocks and aligns well with the principles of decentralized finance. It also implies a more democratic governance structure if VFY employs any on-chain voting mechanisms.

Click to view the current VFY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

2. Key Factors Influencing VFY's Future Price

Supply Mechanism

- Ecosystem Partnerships: VFY's utility is enhanced through ZKV's ecosystem collaborations, where partners use it for settlements and incentives. As scenarios like Arbitrum and ApeChain are implemented, the demand for VFY is expected to grow significantly.

Institutional and Whale Dynamics

- Enterprise Adoption: Collaborations with platforms like Arbitrum and ApeChain are driving VFY's adoption and utility in the crypto ecosystem.

Macroeconomic Environment

- Monetary Policy Impact: Future changes in USD liquidity, fiscal policies, and interest rate expectations are likely to become core drivers of cryptocurrency prices, including VFY.

Technological Development and Ecosystem Building

- Ecosystem Applications: The implementation of VFY in various scenarios through partnerships with Arbitrum, ApeChain, and other platforms is crucial for its ecosystem growth and adoption.

III. VFY Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.09465 - $0.12134

- Neutral forecast: $0.12134 - $0.14561

- Optimistic forecast: $0.14561 - $0.16988 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range predictions:

- 2027: $0.11981 - $0.2308

- 2028: $0.10378 - $0.26861

- Key catalysts: Project milestones, market recovery, and increased utility of VFY

2029-2030 Long-term Outlook

- Base scenario: $0.19356 - $0.24432 (assuming steady market growth and project development)

- Optimistic scenario: $0.24432 - $0.29074 (assuming strong market conditions and widespread adoption)

- Transformative scenario: Above $0.29074 (extreme favorable conditions such as major partnerships or technological breakthroughs)

- 2030-12-31: VFY $0.24432 (potential average price, reflecting significant growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.16988 | 0.12134 | 0.09465 | -8 |

| 2026 | 0.20676 | 0.14561 | 0.08736 | 9 |

| 2027 | 0.2308 | 0.17619 | 0.11981 | 33 |

| 2028 | 0.26861 | 0.20349 | 0.10378 | 53 |

| 2029 | 0.25258 | 0.23605 | 0.19356 | 78 |

| 2030 | 0.29074 | 0.24432 | 0.20278 | 84 |

IV. Professional VFY Investment Strategies and Risk Management

VFY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate VFY during market dips

- Set price targets for partial profit-taking

- Store in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

VFY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VFY

VFY Market Risks

- High volatility: VFY price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

VFY Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Possible limitations on international transactions

VFY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Maintaining performance as network usage grows

- Competition: Emerging projects with similar or superior technology

VI. Conclusion and Action Recommendations

VFY Investment Value Assessment

VFY presents a high-risk, high-potential investment opportunity in the zero-knowledge proof verification sector. While it offers innovative technology and growth potential, investors should be aware of the significant volatility and regulatory uncertainties in the crypto market.

VFY Investment Recommendations

✅ Beginners: Allocate a small portion (1-3%) of crypto portfolio, focus on education ✅ Experienced investors: Consider a moderate allocation (5-10%), actively monitor market developments ✅ Institutional investors: Conduct thorough due diligence, potentially allocate up to 15% based on risk tolerance

VFY Trading Participation Methods

- Spot trading: Buy and sell VFY on Gate.com's spot market

- Staking: Participate in VFY staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving VFY tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

U vs DOT: Understanding the Different Safety Standards for Motorcycle Helmets

2025 MINA Price Prediction: Analyzing Growth Potential and Market Trends for the Lightweight Blockchain

How Has ZEC's Recent Price Surge Affected Its On-Chain Metrics and Exchange Flows?

How to Analyze a Cryptocurrency Project's Fundamentals: 5 Key Factors to Consider

2025 VFYPrice Prediction: Analyzing Market Trends and Future Value Potential of VFY in a Shifting Crypto Landscape

What Is the Future of Zcash (ZEC) Based on Its Fundamentals?

2025 CLORE Price Prediction: Expert Analysis and Market Forecast for Distributed Cloud Computing Token

2025 OSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 STOS Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

2025 VON Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Exploring Cardano: Future Prospects and Investment Potential