User_any

Hallo zusammen,

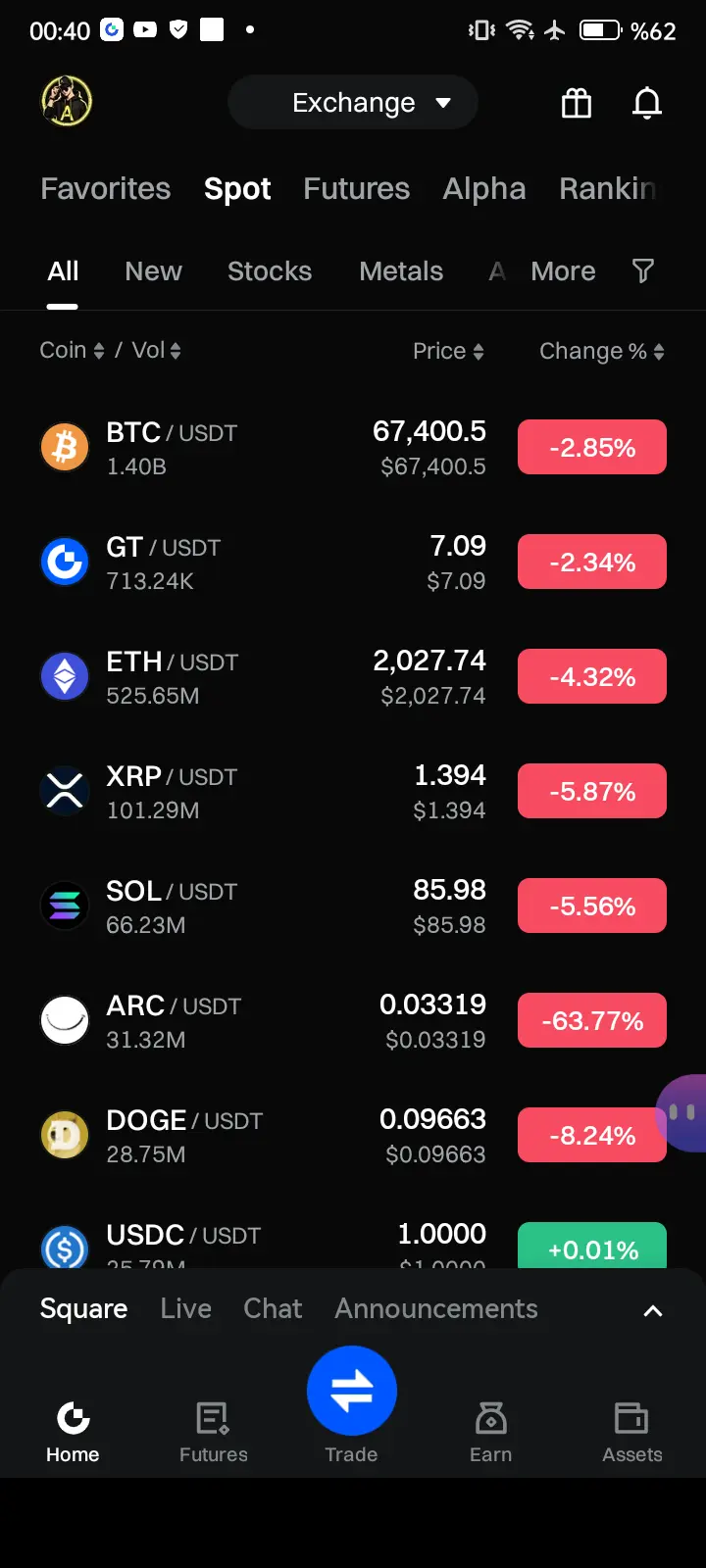

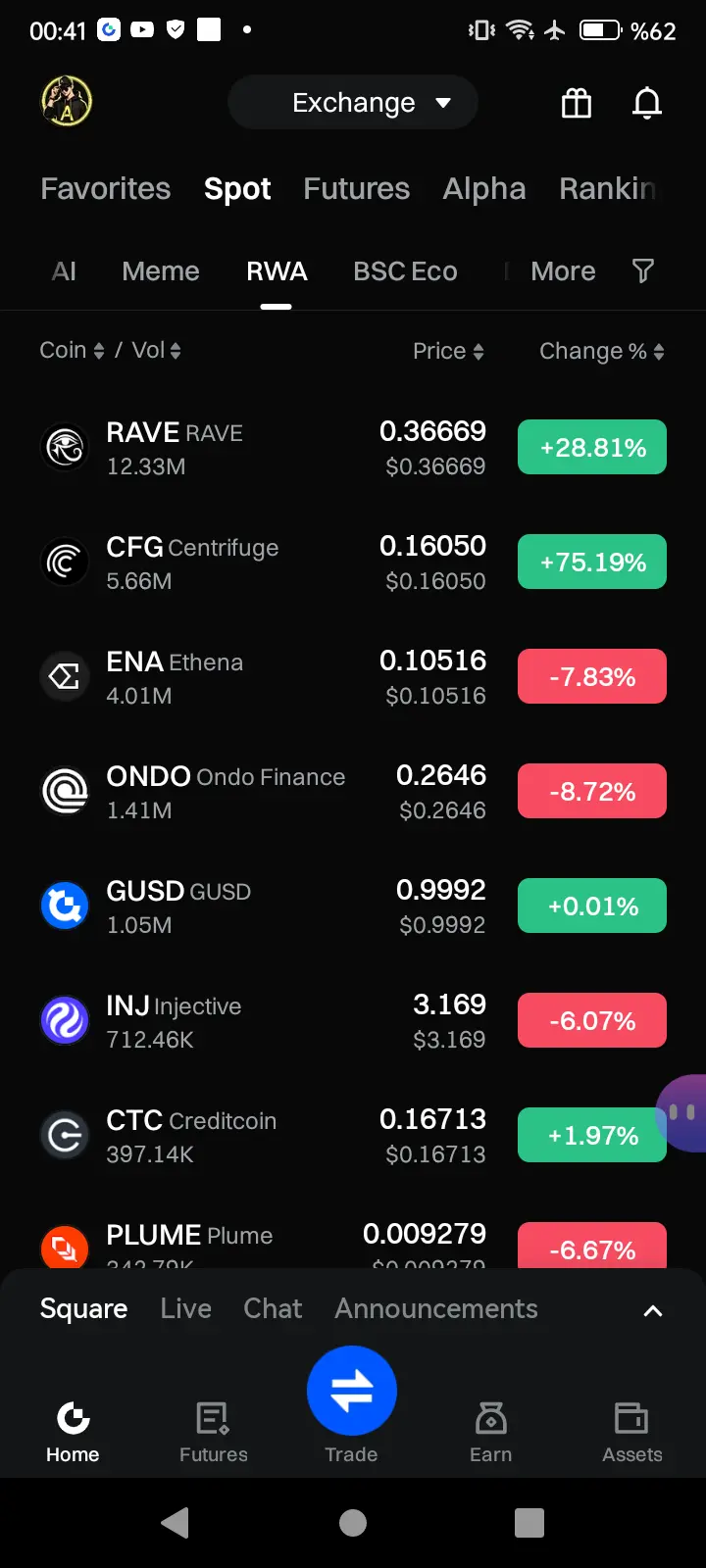

Wir befinden uns mitten in einem rasanten Übergang vom traditionellen, klassischen Verständnis von Kryptowährungen hin zu einer Integration in ein neues System. Als Gate-Nutzer sind wir Teil dieses enormen Wandels. Neben ETFs sind RWAs zu den Favoriten von Investoren und Portfolios geworden. Milliarden von Dollar an Mitteln wandern weg von der klassischen Anlagelogik, und mit der Beschleunigung der Tokenisierung wächst das Interesse an RWAs täglich.

Bis 2025 hat sich alles verändert. Wir erleben einen schnellen Übergang von klassischen Anlageinstrumenten und -verständnissen zu

Original anzeigenWir befinden uns mitten in einem rasanten Übergang vom traditionellen, klassischen Verständnis von Kryptowährungen hin zu einer Integration in ein neues System. Als Gate-Nutzer sind wir Teil dieses enormen Wandels. Neben ETFs sind RWAs zu den Favoriten von Investoren und Portfolios geworden. Milliarden von Dollar an Mitteln wandern weg von der klassischen Anlagelogik, und mit der Beschleunigung der Tokenisierung wächst das Interesse an RWAs täglich.

Bis 2025 hat sich alles verändert. Wir erleben einen schnellen Übergang von klassischen Anlageinstrumenten und -verständnissen zu

- Angebot

- 32

- 29

- 6

- Teilen

CryptoAlice :

:

Zum Mond 🌕Mehr anzeigen

Der Aufstieg der KI im Krypto #DeepDiveCreatorCamp

Wie intelligente Agenten das Spiel verändern

Mann, die Krypto-Welt schläft nie, oder? In letzter Zeit spricht jeder darüber, wie KI in alles Mögliche eindringt – von Zahlungen bis Handel – und ich dachte, ich teile meine Meinung dazu. Es ist Februar 2026, und mit all den regulatorischen grünen Lichtern, die aufleuchten, fühlt sich dieser KI-Krypto-Mix an, als würde er explodieren. Ich verfolge das schon eine Weile, und ehrlich gesagt, bringt es mich dazu, meine ganze Strategie neu zu überdenken – nicht nur Hype, sondern echte Entwicklungen, di

Original anzeigenWie intelligente Agenten das Spiel verändern

Mann, die Krypto-Welt schläft nie, oder? In letzter Zeit spricht jeder darüber, wie KI in alles Mögliche eindringt – von Zahlungen bis Handel – und ich dachte, ich teile meine Meinung dazu. Es ist Februar 2026, und mit all den regulatorischen grünen Lichtern, die aufleuchten, fühlt sich dieser KI-Krypto-Mix an, als würde er explodieren. Ich verfolge das schon eine Weile, und ehrlich gesagt, bringt es mich dazu, meine ganze Strategie neu zu überdenken – nicht nur Hype, sondern echte Entwicklungen, di

- Angebot

- 13

- 12

- Reposten

- Teilen

cryptoLog :

:

Zum Mond 🌕Mehr anzeigen

- Angebot

- 3

- 5

- Reposten

- Teilen

ThePriceWillIncreaseTo314 :

:

Die drittgrößte Meermuttergesellschaft der Amerikaner, vor anderthalb Wochen gab es bereits das pi/usdt-Handelspaar bei MeermuttergesellschaftenMehr anzeigen

- Angebot

- 9

- 5

- Reposten

- Teilen

WallStreetTrendResearch :

:

Der Handel basiert im Wesentlichen auf Wahrscheinlichkeiten: Je weniger Operationen, desto höher die Gewinnwahrscheinlichkeit. Wenn du den richtigen Punkt erkennst, erhöhe deine Position. Bei Kursrückgängen Nachkäufe tätigen, bei Kursanstiegen reduzieren – mach den Handel nicht falsch, sonst steigen die Haltekosten immer weiter an.Mehr anzeigen

Check-in bei Stream, Sprint für VIP+1 und monatlichen Bonus https://www.gate.com/campaigns/4098?ref=VQBFUFLCBA&ref_type=132

Original anzeigen

- Angebot

- 2

- 2

- Reposten

- Teilen

GateUser-4492b407 :

:

GOGOGO 2026 👊Mehr anzeigen

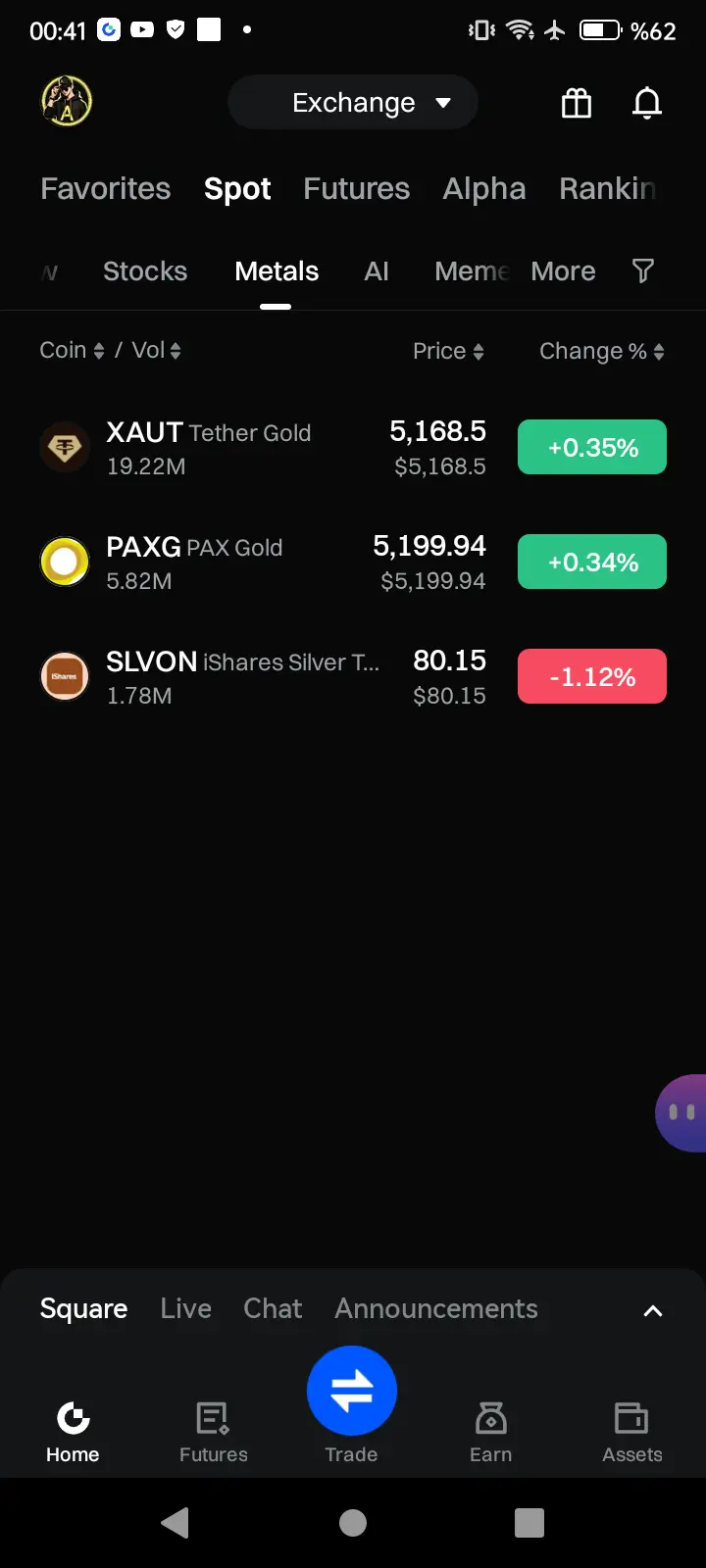

掘金老猫 · Frühmorgen-Goldanalyse Rückblick

Spot-Gold(XAUUSD)

Gestern Nacht wurde Gold im von uns angegebenen Bereich von 5205~5215 präzise abgewiesen. Der Kurs erreichte heute frühzeitig etwa 5205 und fiel wie erwartet zurück, was unsere Short-Positionen bestätigt. Die Abweisung in diesem Bereich war stark, und der Rückgang entspricht unserer Einschätzung eines Abwärtstrends.

Nachrichtenlage: Die US-Arbeitsmarktdaten außerhalb der Landwirtschaft übertrafen die Erwartungen, was die Marktteilnehmer in der Erwartung bestärkte, dass die Federal Reserve die hohen Zinsen beibehalten wird. Der US-Dolla

Original anzeigenSpot-Gold(XAUUSD)

Gestern Nacht wurde Gold im von uns angegebenen Bereich von 5205~5215 präzise abgewiesen. Der Kurs erreichte heute frühzeitig etwa 5205 und fiel wie erwartet zurück, was unsere Short-Positionen bestätigt. Die Abweisung in diesem Bereich war stark, und der Rückgang entspricht unserer Einschätzung eines Abwärtstrends.

Nachrichtenlage: Die US-Arbeitsmarktdaten außerhalb der Landwirtschaft übertrafen die Erwartungen, was die Marktteilnehmer in der Erwartung bestärkte, dass die Federal Reserve die hohen Zinsen beibehalten wird. Der US-Dolla

- Angebot

- 1

- 2

- Reposten

- Teilen

huangjinshizi :

:

Cat Brother, bei einem 500-fachen Hebel auf Trafi, wie hoch ist normalerweise der Stop-Loss?Mehr anzeigen

- Angebot

- 1

- 2

- Reposten

- Teilen

LirivasiIsATraditionalDance :

:

1000x Vibes 🤑Mehr anzeigen

🎉 #GateSquare $50K Red Packet Giveaway! 🎉

Bereite dich auf die größte Verlosung der Saison vor! Wir verschenken 50.000 $ in roten Umschlägen an unsere großartige Community. Verpasse nicht deine Chance, ein Stück abzubekommen!

So nimmst du teil:

1️⃣ Folge GateSquare auf unseren offiziellen Kanälen.

2️⃣ Erledige die einfachen Aufgaben im Giveaway-Event.

3️⃣ Lade deine Freunde ein und erhöhe deine Belohnungen!

💰 Belohnungen: 50.000 $ verteilt in roten Umschlägen — je mehr du dich engagierst, desto höher sind deine Chancen!

⏰ Beeil dich! Nur für begrenzte Zeit. Mach jetzt mit und sei Teil des S

Original anzeigenBereite dich auf die größte Verlosung der Saison vor! Wir verschenken 50.000 $ in roten Umschlägen an unsere großartige Community. Verpasse nicht deine Chance, ein Stück abzubekommen!

So nimmst du teil:

1️⃣ Folge GateSquare auf unseren offiziellen Kanälen.

2️⃣ Erledige die einfachen Aufgaben im Giveaway-Event.

3️⃣ Lade deine Freunde ein und erhöhe deine Belohnungen!

💰 Belohnungen: 50.000 $ verteilt in roten Umschlägen — je mehr du dich engagierst, desto höher sind deine Chancen!

⏰ Beeil dich! Nur für begrenzte Zeit. Mach jetzt mit und sei Teil des S

- Angebot

- 3

- 1

- Reposten

- Teilen

MrFlower_XingChen :

:

Gefällt Kommentare zu meinem Beitrag- Angebot

- 4

- 1

- Reposten

- Teilen

GateUser-e8f0c5cc :

:

Und es werden sogar Daten manipuliert- Angebot

- 1

- 1

- Reposten

- Teilen

EagleEye :

:

Beobachte es genau, danke fürs Teilen.Trading, Halten und Staking: Verwechsele niemals

Im Kryptowährungsbereich gibt es nicht nur eine Möglichkeit, Gewinne zu erzielen, sondern drei Hauptansätze.

Trading

Häufig kaufen und verkaufen, um von Preisänderungen zu profitieren.

Potenzial für schnelle Gewinne, aber hohes Risiko ohne Strategie, Disziplin und Risikomanagement.

Methode anspruchsvoll, ohne ernsthafte Ausbildung nicht zu empfehlen.

Halten

Eine Kryptowährung kaufen und langfristig behalten.

Ansatz ist stabiler und weniger stressig.

Geeignet für Anfänger und geduldige Investoren.

Staking

Seine Kryptowährungen sperren, um am Betr

Original anzeigenIm Kryptowährungsbereich gibt es nicht nur eine Möglichkeit, Gewinne zu erzielen, sondern drei Hauptansätze.

Trading

Häufig kaufen und verkaufen, um von Preisänderungen zu profitieren.

Potenzial für schnelle Gewinne, aber hohes Risiko ohne Strategie, Disziplin und Risikomanagement.

Methode anspruchsvoll, ohne ernsthafte Ausbildung nicht zu empfehlen.

Halten

Eine Kryptowährung kaufen und langfristig behalten.

Ansatz ist stabiler und weniger stressig.

Geeignet für Anfänger und geduldige Investoren.

Staking

Seine Kryptowährungen sperren, um am Betr

- Angebot

- 1

- 1

- Reposten

- Teilen

Mr.Phil :

:

Und sag mir, wusstest du das schon? Teile deine Meinung hier in den Kommentaren und abonniere.Circle erreicht $770M Umsatz, da USDC dem Krypto-Winter trotzt - - #sec #sepa #usdc

USDC-0,01%

- Angebot

- 4

- 1

- Reposten

- Teilen

Sekayla28 :

:

Selbst in einer solchen Zeit kann man mit Krypto Geld verdienen.Der plötzliche Absturz in den frühen Morgenstunden, obwohl er kurzzeitig die Nähe von 66.600 erreichte, stellt aus technischer Sicht vielmehr einen effektiven Test einer wichtigen Unterstützung dar. Dieser Bereich ist nicht nur eine frühere Zone mit hohem Handelsvolumen, sondern fällt auch mit dem 60-Tage-Durchschnitt der Tageslinie zusammen. Nachdem der Preis diesen Bereich berührte, kam es zu einer schnellen Erholung und einer langen unteren Schattenlinie, was auf eine starke Unterstützung nach unten hin hindeutet und ein Signal für die Erschöpfung der Abwärtsdynamik ist. Gleichzeitig hat di

BTC-0,69%

- Angebot

- 2

- 4

- Reposten

- Teilen

WhenTheMountainDoesn'tMove,The :

:

Ansturm 2026 👊Mehr anzeigen

- Angebot

- 4

- 1

- Reposten

- Teilen

mkmknjbhvgcf :

:

81 können nicht erreicht werden, noch 18- Angebot

- Gefällt mir

- 1

- Reposten

- Teilen

E8andy88 :

:

待 töten Schaf#OORT Am schlimmsten ist es, dass ich es damals auf dem Höchststand gekauft habe, außerhalb des Marktes von jemand anderem für 2 US-Dollar verleitet wurde, was meinen größten Verlust verursachte. In den letzten zwei Jahren wurde ich immer enttäuschter von ihm, der Höchststand lag bei 0.2, alles verkauft. Später stellte ich fest, dass es immer niedriger wurde, und schließlich fühlte ich, dass es keine Hoffnung mehr gibt.

OORT5,95%

- Angebot

- 2

- 1

- Reposten

- Teilen

CryptoNomad :

:

Keine Angst, keine Reue, keine Beschwerden, bald an die Börse. Bei Kursrückgängen kaufen#深度创作营

#加密市场反弹

Ein verrückter Tag an den Märkten! Das Timing dieser Erholung ist fast filmreif—während der rechtliche Druck zunimmt, scheint die „unsichtbare Hand“, die den Markt jeden Morgen geschlagen hat, sich zurückzuziehen.

Hier ist eine Zusammenfassung des aktuellen Chaos und was es für Ihr Portfolio bedeutet:

1. Das „10-Uhr-Mysterium“: Zufall oder Gerichts-Vorsichtsmaßnahme?

Das Verschwinden des Verkaufs um 10 Uhr ist das Gesprächsthema der Stadt. Seit Monaten scherzten Investoren (und weinten) über die systematischen Verkaufswellen, die auftraten, als der US-Markt an Schwung gewan

Original anzeigen#加密市场反弹

Ein verrückter Tag an den Märkten! Das Timing dieser Erholung ist fast filmreif—während der rechtliche Druck zunimmt, scheint die „unsichtbare Hand“, die den Markt jeden Morgen geschlagen hat, sich zurückzuziehen.

Hier ist eine Zusammenfassung des aktuellen Chaos und was es für Ihr Portfolio bedeutet:

1. Das „10-Uhr-Mysterium“: Zufall oder Gerichts-Vorsichtsmaßnahme?

Das Verschwinden des Verkaufs um 10 Uhr ist das Gesprächsthema der Stadt. Seit Monaten scherzten Investoren (und weinten) über die systematischen Verkaufswellen, die auftraten, als der US-Markt an Schwung gewan

- Angebot

- 5

- 1

- Reposten

- Teilen

CryptoChampion :

:

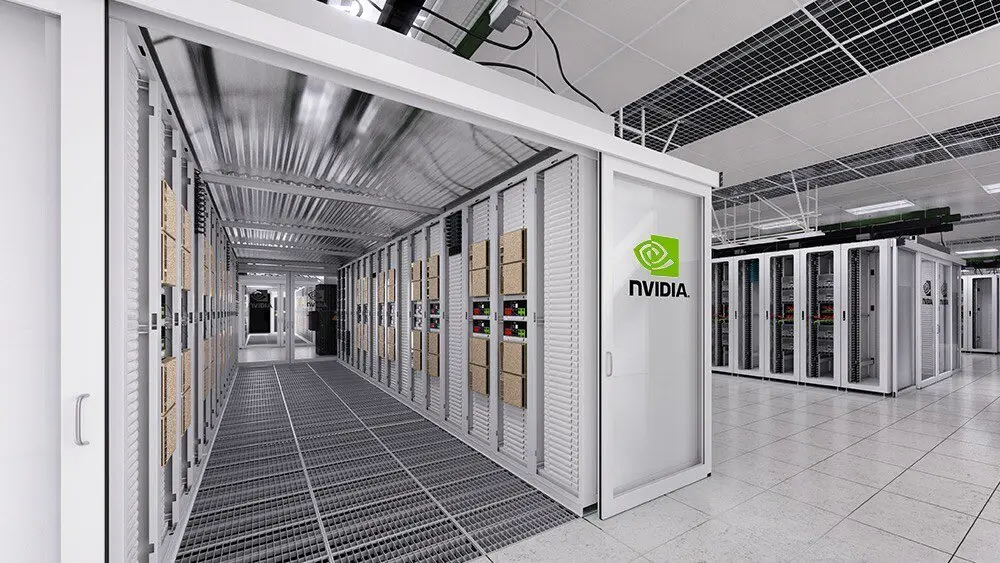

Zum Mond 🌕$NVDA hat eine Marktkapitalisierung von 4,7T

Der Markt ist wahrscheinlich nervös, dass diese Bewertung nur mit multi-hundert-Milliarden-Dollar AI-CAPEX-Ausgaben aufrechterhalten werden kann

Es besteht eine gute Chance, dass sich das Overton-Fenster in Bezug auf Bewertungen drastisch verschiebt

Vielleicht sind hunderte Milliarden Dollar an CAPEX nicht das, was der Markt für das Höchste hält

Vielleicht ist es tatsächlich eine winzige Menge im Vergleich zu dem, was in den nächsten zehn Jahren kommen könnte, wenn die KI voranschreitet

Wenn das passiert, würde $NVDA bei 20x 2026er Gewinn pro Aktie

Original anzeigenDer Markt ist wahrscheinlich nervös, dass diese Bewertung nur mit multi-hundert-Milliarden-Dollar AI-CAPEX-Ausgaben aufrechterhalten werden kann

Es besteht eine gute Chance, dass sich das Overton-Fenster in Bezug auf Bewertungen drastisch verschiebt

Vielleicht sind hunderte Milliarden Dollar an CAPEX nicht das, was der Markt für das Höchste hält

Vielleicht ist es tatsächlich eine winzige Menge im Vergleich zu dem, was in den nächsten zehn Jahren kommen könnte, wenn die KI voranschreitet

Wenn das passiert, würde $NVDA bei 20x 2026er Gewinn pro Aktie

- Angebot

- 3

- 1

- Reposten

- Teilen

GateUser-06070724 :

:

Es gibt nur eine Sache zu sagen: Es ist ein Riese.Mehr laden

Trendthemen

Mehr anzeigen6.8K Beliebtheit

345.34K Beliebtheit

Hot Gate Fun

Mehr anzeigen- MC:$2.46KInhaber:10.00%

- MC:$2.49KInhaber:20.27%

- 3

1

hc

MC:$2.44KInhaber:10.00% - MC:$2.46KInhaber:10.00%

- MC:$2.44KInhaber:20.00%

Anheften