Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

Gate on-chain observation (November 7): Tether increases Bitcoin holdings again; Paradigm holds $763 million in HYPE

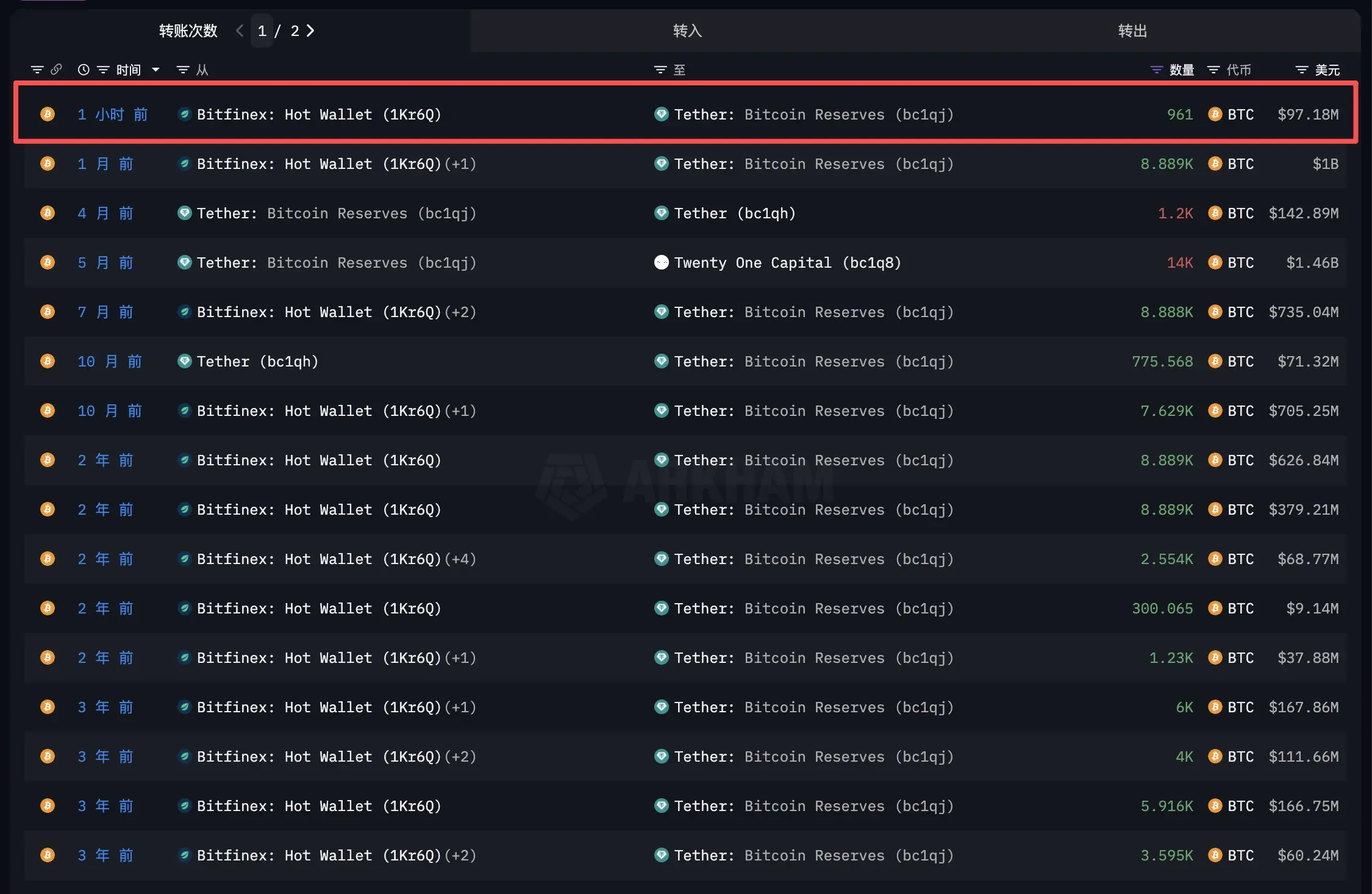

In the past 24 hours, the cryptocurrency market has presented a complex picture of institutional deployment coexisting with high leverage risks. An emerging on-chain wallet received a large sum of 630 BTC (worth $64.2 million), while Tether increased its holdings by 961 BTC, indicating that institutional buying remains solid.

The Ethereum market shows clear divergence. On one hand, the high-leverage long positions of "Brother Maji" are nearing liquidation, while on the other hand, "Bottom-fishing Whale" continues to buy 1601 ETH, demonstrating an "buy more as prices fall" attitude among institutional funds. In the altcoin sector, HYPE has attracted attention due to Paradigm's massive holdings and whale accumulation, while ZEC's long and short positions have escalated into a $30 million "meat grinder" battlefield. The current core market contradiction lies in the process of risk release between long-term institutional allocations and high-leverage speculative positions.

MarketWhisper·11-07 12:47

Tether invested $98.9 million to acquire an additional 961 BTC, bringing the total Bitcoin holdings to over 86,000 coins.

The issuer of the stablecoin USDT, Tether, recently purchased 961 Bitcoins valued at approximately $98.9 million, increasing its total Bitcoin reserves to over 86,000 coins. This acquisition is part of Tether's reserve diversification strategy, aiming to shift reserves from traditional assets like U.S. Treasuries to Bitcoin. Against the backdrop of Bitcoin reaching new highs, Tether's continuous and regular purchasing behavior clearly demonstrates long-term confidence in Bitcoin as the ultimate reserve asset.

BTC0.33%

MarketWhisper·11-07 11:31

Tether nearly spent 100 million yuan to buy the dip! Bitcoin holdings amount to 87,296 coins, with an unrealized profit of 4.5 billion USD.

Tether, acting as a "whale," has made a move. On-chain data shows that on November 6th, Tether withdrew 961 Bitcoins from exchange addresses, with a market value of approximately $97.18 million. This is not an isolated incident but part of the latest actions following the policy established in 2023 to allocate 15% of net profits into Bitcoin. Tether's Bitcoin holdings have accumulated to 87,296 coins, estimated to be worth $8.84 billion based on current market prices.

MarketWhisper·11-07 06:44

Stablecoins are disruptive. Who will become the disruptor?

Clay Christensen's theory of disruptive innovation explains that initially inexpensive products can reshape industries. Stablecoins have shown strong performance in emerging markets, attracting ignored customers. However, existing financial institutions have not overlooked this innovation; instead, they are actively following suit. In the future, stablecoins could become a massive market asset by 2030.

LUNA-2.39%

金色财经_·11-06 11:28

Tether Signs Partnership with Vietnam's Da Nang

Key Notes

Da Nang approved a 36-month pilot allowing USDT-to-VND conversions through Basal Pay under its International Financial Center sandbox authority.

Vietnam's Resolution 05/2025/NQ-CP bans fiat-backed stablecoins nationally, while Resolution 222/2025/QH15 grants Da Nang exemptions for pilo

Coinspeaker·11-06 03:41

Tether signed a memorandum of cooperation with Da Nang City in Vietnam to promote the construction of Blockchain digital governance infrastructure.

According to Deep Tide TechFlow news on November 5th, Tether announced the signing of a memorandum of cooperation with the People's Committee of Da Nang City, Vietnam, aimed at advancing the city's digital infrastructure and innovative governance model development.

According to the memorandum, both parties will jointly research and develop mechanisms to support the responsible integration of blockchain, digital assets, and peer-to-peer technology. This initiative will leverage international best practices to advance transparent, efficient, and resilient digital governance solutions.

Tether will support Da Nang City in formulating relevant policies on blockchain technology, digital assets, sandbox experimentation, and tokenization of real-world assets, and will share global experiences to assist the city in creating a comprehensive framework that meets international standards. Both parties will also collaborate with various universities and research institutions in Vietnam to develop blockchain, peer-to-peer technology, and artificial intelligence education programs, and design specialized training plans to strengthen the construction and management capabilities of the regional blockchain payment system.

DeepFlowTech·11-05 13:08

IMF Expert Report: Stablecoins Cause Surge in Demand for US Treasury Bonds, Posing Financial Risks

In the rapidly evolving International Monetary System, US stablecoins are quietly playing a key role. According to the research report "The Rise of Stablecoins and Implications for Treasury Markets" published in October 2025 by IMF experts Sonja Davidovic, Tarek Ghani, and Mariano Moszoro, stablecoins are rapidly penetrating the global payment system while significantly purchasing US Treasury bonds, leading to profound impacts on US fiscal stability and global financial markets.

This report by the Brookings Institution

ChainNewsAbmedia·11-05 10:53

The largest stablecoin shareholders in the world revealed! A plastic surgeon and a Chinese prisoner transformed into billionaires.

At the peak of the fintech wave, Tether is planning to raise up to $20 billion by selling only 3% of its shares. If this move reaches the planned cap, the market valuation of stablecoin giant Tether will soar to an astonishing $500 billion. A core team of fewer than 10 people firmly holds the reins of this stablecoin empire with a Circulating Supply of $170 billion.

MarketWhisper·11-04 09:29

Tether CEO: The engineering team made significant progress last week in QVAC, WDK, and BCI/AI.

According to Mars Finance, Tether CEO Paolo Ardoino tweeted that his engineering team made significant progress last week on QVAC (the AI development platform launched by Tether), WDK (the Open Source toolkit), and BCI/AI (brain-computer interface / artificial intelligence). Some of the latest information will be shared in the coming days.

MarsBitNews·11-04 04:24

Gate Research Institute: BEAT rise exceeded 58% | Tether's net profit this year surpassed 10 billion USD

crypto market panorama

BTC (-0.87% | Current Price 108,989 USDT): Over the past 24 hours, the BTC price has shown a weak oscillating trend overall. After a period of sideways consolidation, the price failed to effectively break through the upper resistance level around 111,000 USD, subsequently experiencing a continuous decline, currently oscillating around 108,900 USD. From the perspective of moving averages, the short-term moving averages (MA5, MA10) have turned downward and formed resistance above the price, while the MA30 is also showing a flattening and slightly downward trend, indicating a significant weakening of short-term bullish momentum. The EMA indicator crossover also shows signs of short-term bearish dominance. From the rhythm of the trend, the price has repeatedly encountered resistance around 110,500 USD, with support below in the 108,000 USD range; if it breaks below this range, it may further test the previous low of 106,200 USDT.

GateResearch·11-03 08:27

Gate Research Institute: BEAT rise exceeded 58% | Tether's net profit this year surpassed 10 billion USD

encryption asset panorama

BTC (-0.87% | Current Price 108,989 USDT)

In the past 24 hours, the price of BTC has shown a generally weak oscillating trend. After a period of horizontal consolidation, the price failed to effectively break through the upper resistance level of around 111,000 dollars, and subsequently experienced a continuous decline, currently oscillating around 108,900 dollars. From the moving average structure, the short-term moving averages (MA5, MA10) have turned downward and formed resistance above the price, while MA30 is also showing a flat downward trend, indicating a significant weakening of short-term bullish momentum. The EMA indicator crossover also shows signs of short-term bearish dominance. In terms of price rhythm, the price has been repeatedly blocked near 110,500 dollars, with support below at the 108,000 dollar level. Once this range is broken, it may further retest the previous low of 106,200.

GateResearch·11-03 08:14

PA Daily | Bitcoin White Paper Release 17th Anniversary; Tether's Net Profit in the First Three Quarters Surpasses $10 Billion

Today’s News Highlights:

1. The release of the Bitcoin White Paper marks the 17th anniversary

2. The three major U.S. stock indices have each increased by at least 6 consecutive months, Coinbase up over 4%

3. Binance Alpha will launch THORWallet (TITN) on November 3rd

4. Aster adjusts S3 buyback and airdrop mechanism: 50% buyback and burn, 50% returned to locked airdrop addresses

5. Tether’s net profit in the first three quarters exceeds $10 billion, USDT circulating supply reaches $174 billion

6. MEXC Chief Strategy Officer apologizes to crypto influencer The White Whale and unfreezes $3 million account funds

7. Pump

PANews·11-01 09:25

Tether’s Q3 Report Reveals $10B Profit and $6.8B Surplus

Forget the daily chart noise for a moment. Let's talk about the plumbing. The cash.

Tether, the crypto market’s central bank, just released its

BitcoinInsider·10-31 23:16

Tether’s profit in Q1-Q3 surpassed $10 billion: report

Tether netted a record-breaking $10 billion plus profit in the first nine months of 2025, according to the latest attestation detailing the stablecoin issuer’s financial performance.

USDT issuer shared details of its financial results for the first three quarters of the year on October 31.

The

BitcoinInsider·10-31 19:06

Tether Reports $10 Billion Profit in 2025 So Far—Here's How That Compares to the Big Banks

In brief

Tether reported $10 billion in profit for the first three quarters of 2025---surpassing Bank of America, and nearing Goldman Sachs and Morgan Stanley's earnings.

The company's profits stem largely from returns on $135 billion in U.S. Treasuries backing its USDT reserves.

Decrypt·10-31 18:30

Tether hits $10b profit mark with record $135b in treasuries

Tether reported over $10 billion in profits and significant U.S. Treasury exposure, positioning itself as a leading global holder of U.S. debt. With strong reserves and new USDT issuance, it continues to reinforce investor trust in its financial stability.

BTC0.33%

Cryptonews·10-31 16:48

Tether-backed crime unit freezes $300m of illicit funds

Tether and its T3 partners have frozen over $300 million in criminal assets, a milestone revealing a year-long, multi-continent offensive against crypto money laundering and fraud.

Summary

Tether-backed T3 Financial Crime Unit has frozen over $300 million in illicit funds across 23

Cryptonews·10-31 15:12

Shareholders of the world's largest stablecoin company have transformed into the world's top billionaires.

At the pinnacle of the fintech wave, a name called Tether is rewriting the global wealth landscape at an incredible speed. Currently, this world's largest stablecoin USDT issuer is planning to raise up to $20 billion by selling just 3% of its shares. If this move reaches its planned cap, Tether's market valuation will soar to an astonishing $500 billion.

What concept does $500 billion represent? This figure not only surpasses the hotly sought-after Open AI (valued at about $300 billion) and Musk's Space X (valued at about $450 billion), but also exceeds the combined market capitalization of Wall Street's two legendary giants - Goldman Sachs (market cap of $216 billion) and Blackstone Group (market cap of $148 billion).

However, even more intriguing than this astronomical figure are the mysterious faces hidden behind the valuation. Who are they? A group of fewer than ten core members.

LinkFocus·10-31 11:06

How Tether Transitioned from Dollar Pegging to Trust Pegging

Tether is strategically transforming by tokenizing gold products like XAUT, the renminbi stablecoin CNHT, and the pound stablecoin GBPT, expanding its product line to a multi-asset, compliant market. Its newly launched USDT0 aims to achieve cross-chain liquidity and enhance trust. This expansion reflects the diversification trend in the stablecoin market, focusing on compliance and regional adaptability.

XAUT-0.03%

金色财经_·10-31 10:30

The market capitalization of USDC has risen by 72%, far exceeding USDT, with JPMorgan warning: Tether's European market is under threat.

According to a report by JPMorgan analysts, Circle's USDC stablecoin is significantly outperforming Tether's USDT in terms of on-chain activity and market capitalization growth. Since January of this year, the market capitalization of USDC has skyrocketed from approximately $43 billion to about $74 billion, an increase of 72%, far exceeding USDT's growth of 32% during the same period. Analysts believe this divergence is primarily due to USDC's clearer regulatory framework and increasing institutional adoption, while USDT faces resistance from delisting and authorization issues brought by the European MiCA regulation.

MarketWhisper·10-31 03:24

Cryptocurrency trading losses can only be borne by oneself? Web3 lawyer interprets court ruling

The Tongling City Court in Anhui Province handled a civil case arising from virtual currency Trade. The judgment concluded that the transaction between the parties was invalid due to violating public order and good morals, and the plaintiff must bear the losses themselves. The article analyzes the legal status of virtual currency and the dynamics of civil and commercial trials, noting that related disputes are gradually being accepted by courts, but legal regulation still has deficiencies. Participants are advised to proceed with caution.

PANews·10-30 23:05

Tether's mainstream payment journey begins with digital asset "tips".

Tether partners with Rumble to launch a digital asset tipping feature, marking an important advancement in mainstream payment. Through Rumble Wallet, users will be able to directly use digital assets to tip content creators, allowing Tether's stablecoin to be more widely integrated into everyday spending. This move not only changes Tether's business model but could also reshape its position in digital payments, transforming from an infrastructure provider to an Application Layer payment brand.

金色财经_·10-30 11:38

A Comprehensive Understanding of Stable: Tether's On-Chain Sovereign Counterattack and the Ambition for a Stablecoin-Specific Chain

"Why are there reminders everywhere, but as soon as I open the page, there's no quota left?" a user complained on the X platform, voicing the frustration of many. In October 2025, the first phase of the Stable pre-deposit event was sold out immediately, with $825 million in quota snapped up in just 22 minutes.

On-chain data reveals a more shocking fact: $700 million of the allocation was preemptively scooped up by a few whale addresses before the official announcement was made.

MarketWhisper·10-30 08:05

Tether Flips South Korea in US Debt Holdings - Coinspeaker

Tether has become the 17th largest holder of US debt, surpassing South Korea and others, with $135 billion in assets. The company celebrated reaching 500 million verified users and anticipates significant profit growth, projecting nearly $15 billion by 2025.

XAUT-0.03%

Coinspeaker·10-29 13:47

Tether is loaded with U.S. Treasury bonds! The scale of holdings has soared to $135 billion, surpassing South Korea to rank 17th in the world.

Tether CEO Paolo Ardoino stated that Tether currently holds $135 billion in US Treasury bonds, making it the 17th largest holder of US debt in the world, surpassing South Korea and nearing Brazil. This rise reflects the influence of stablecoins in the global financial system and assists individuals in emerging markets in obtaining dollarization tools. The market capitalization of USDT is approximately $183.2 billion, firmly ranking third among Crypto Assets.

動區BlockTempo·10-29 10:52

Money Laundering of 166 million USD in Crypto Assets! China Sentences Five to Prison Revealing the USDT Dark Side

A Beijing court sentenced five individuals to prison terms of two to four years on March 21, 2025, for using USDT to conduct money laundering activities involving up to 166 million USD in crypto assets between January and August 2023. The case was announced at the Financial Street Forum annual conference on October 28, 2025, marking one of the most significant prosecutions of crypto financial crimes in China.

MarketWhisper·10-29 09:26

The Twilight of the Giants: How the New Stablecoin Nobility is Eroding the Empires of Tether and Circle?

Original Title: Apps and Chains, Not Issuers: The Next Wave of Stablecoin Economics Belongs to Decentralized Finance

Original author: Simon

Source:

Reprint: Mars Finance

The moat between Tether and Circle is being eroded: distribution channels trump network effects. The stablecoin market share held by Tether and Circle may have peaked in a relative sense – even as the overall supply of stablecoins continues to grow. The total market capitalization of stablecoins is expected to exceed $1 trillion by 2027, but the proceeds of this expansion will not flow primarily to established giants as they did in the previous cycle. On the contrary, more and more shares will flow to "ecological native stablecoins" and "white label issuance" (

MarsBitNews·10-29 07:45

Tether is considering establishing a new entity in the United States to open new channels for political donations.

According to Mars Finance, on October 29, Bloomberg reported that Tether is considering establishing a physical presence in the United States and participating in political donations related to the 2026 U.S. midterm elections. Tether CEO Paolo Ardoino expressed dissatisfaction with the major political action committee (PAC) in the cryptocurrency industry, Fairshake, stating that it ultimately "serves the interests of a certain company."

MarsBitNews·10-29 02:53

Tether disclosed that its physical gold reserves reached 375,572.297 troy ounces.

According to Mars Finance news, Tether announced that its tokenized gold Tether Gold (XAUT) has a market capitalization exceeding 2 billion USD. Tether's total physical gold reserves amount to 375,572.297 troy ounces, stored in Switzerland, fully compliant with the London Good Delivery standards, with a total circulating supply of XAUT tokens being 522,089.3 coins.

XAUT-0.03%

MarsBitNews·10-28 15:35

Will Tether be able to earn $15 billion in 2025? Can the "financial alchemy" model be sustained?

The world's largest stablecoin issuer, Tether, is expected to achieve an astonishing profit of 15 billion USD in 2025, placing it among the most profitable companies globally. Based on a market capitalization of 183.2 billion USD, USDT primarily generates revenue by holding low-risk assets such as U.S. Treasury bonds, while the company also holds 87,475 Bitcoins valued at nearly 10 billion USD. However, barriers to market access in the European Union, downward pressure on interest rates, and competition from traditional financial institutions pose serious challenges to the sustained profitability of this encryption giant.

BTC0.33%

MarketWhisper·10-28 10:26

How are the new stablecoins eating into the empires of Tether and Circle?

Tether and Circle's moats are being eroded: distribution channels outweigh network effects. The market share of stablecoins held by Tether and Circle may have topped out in relative terms—even as the overall supply of stablecoins continues to rise. By 2027, the total market capitalization of stablecoins is expected to exceed $1 trillion, but the benefits of this expansion will not flow primarily to existing giants as they did in the last cycle. Instead, an increasing share will go to "ecosystem-native stablecoins" and "white label issuance" strategies, as Blockchain and applications begin to "internalize" yields with distribution channels.

Currently, Tether and Circle account for about 85% of the circulating stablecoin supply, totaling approximately $265 billion.

The background data is as follows: According to reports, Tet

金色财经_·10-28 10:19

Tether and Circle have minted stablecoins worth 8.5 billion dollars since the collapse.

According to Mars Finance news, monitored by Lookonchain, with Circle having diluted the minting of 750 million USDC in the past, Tether and Circle have minted stablecoins worth 8.5 billion USD since the collapse.

MarsBitNews·10-27 14:39

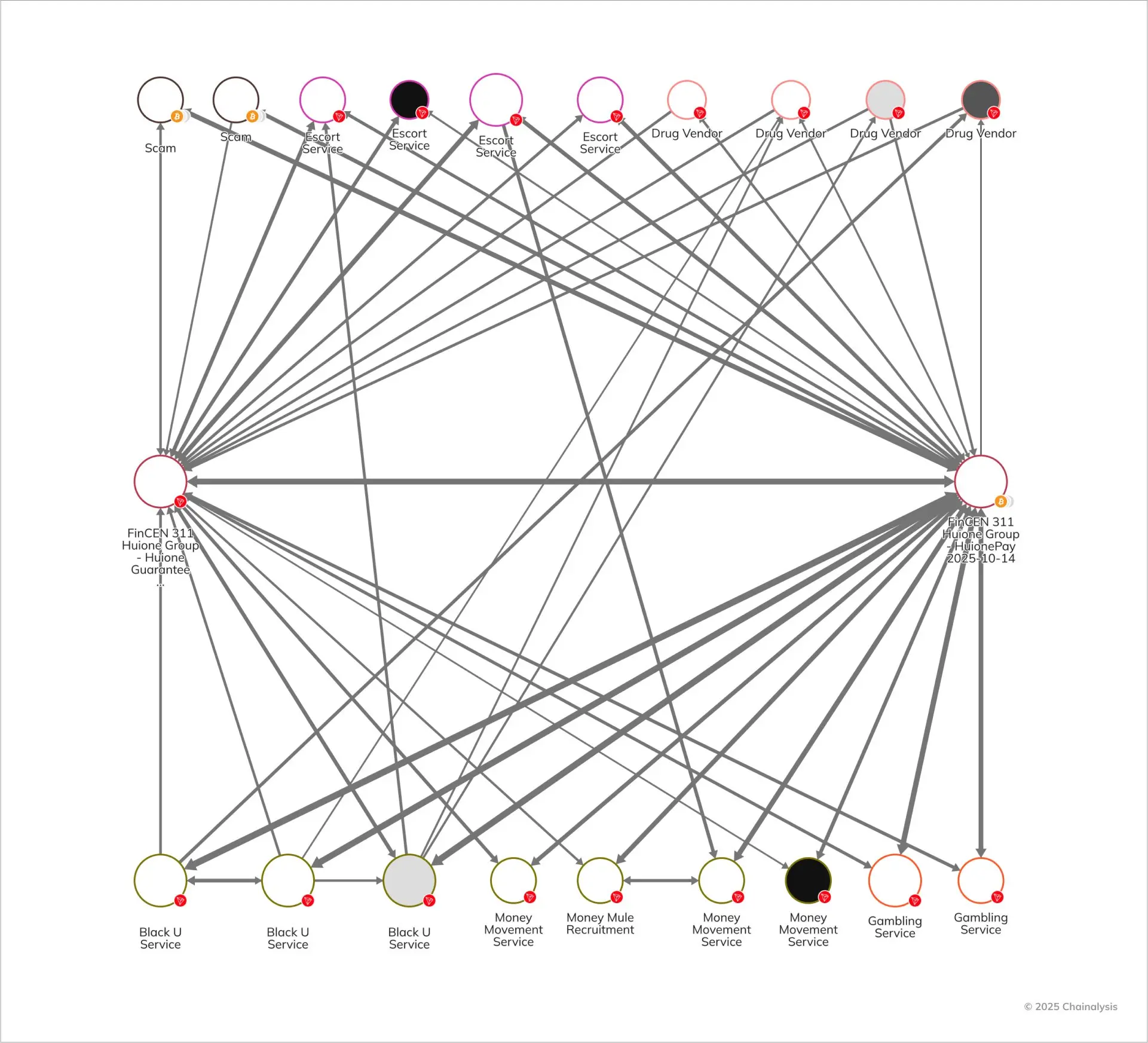

The controversy over Money Laundering in Cambodia has erupted again! Huione Group's encrypted transfers with the Korean exchange surged by 1400%.

The transfer of crypto assets between South Korea's largest exchange and Cambodia's Huione Guarantee has surged nearly 1,400 times, reaching 8.9 million USD. Data from the Financial Supervisory Service (FSS) obtained by opposition lawmakers shows that the transfer amount between South Korea's five major crypto assets exchanges and Huione reached 12.8 billion KRW in 2024, a dramatic increase from 9.22 million KRW during the same period in 2023.

MarketWhisper·10-27 09:09

Tether profit margin 99%, estimated to earn 15 billion dollars this year

Tether CEO Paolo Ardoino stated that the company estimates a profit of 15 billion USD this year, with a profit margin as high as 99%. With the rapid growth of stablecoin, Tether plans to attract more investments, with a valuation potentially reaching 500 billion USD. The usage of stablecoin in the global payment sector has surged, and the demand from businesses continues to rise.

ChainNewsAbmedia·10-27 04:24

Tether expects an annual profit of up to 15 billion USD! With a reserve of 183 billion USDT, its valuation may exceed 500 billion USD, attracting bids from SoftBank.

The world's largest stablecoin issuer, Tether Holdings Ltd., expects its profits to approach $15 billion this year, with astonishing profitability attracting investors to flock to buy stakes in this privately held company. The company's CEO, Paolo Ardoino, confirmed that despite holding approximately $183 billion in circulating USDT, Tether is not lacking external investment but is negotiating with heavyweight investors including SoftBank Group Corp. and Ark Investment Management LLC to sell about 3% of its shares to raise $20 billion. If the deal goes through, Tether's valuation could reach $500 billion, placing it among the most valuable private companies in the world.

MarketWhisper·10-27 01:19

Tether CEO: Many centralized AI companies are acting as "AI treasure vaults".

According to Mars Finance, Tether's CEO Paolo Ardoino stated on the X platform that many centralized artificial intelligence companies are acting as "AI Treasury (Artificial Intelligence Treasury)", but artificial intelligence will not be confined to closed gardens in the long run.

MarsBitNews·10-26 10:30

Rumble Partners With Tether to Launch Bitcoin Tipping for Creators By Mid-December

Rumble will launch Bitcoin tipping for creators through a partnership with Tether by mid-December.

Creators can get instant Bitcoin payments from fans using Rumble’s new digital wallet feature.

Tether’s $775 million investment supports Rumble’s plan to expand crypto payments for online creators.

BTC0.33%

CryptoNewsLand·10-25 10:14

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreBattle of the Builders

Cardano schedules Battle of the Builders for November 11, a live pitch event for projects building or planning to build on Cardano. The top three teams will win prizes, with applications open until October 3.

2025-11-10

AMA on X

Sushi will host an AMA on X with Hemi Network on March 13th at 18:00 UTC to discuss their latest integration.

2025-11-12

Sub0 // SYMBIOSIS in Buenos Aires

Polkadot has announced sub0 // SYMBIOSIS, its new flagship conference, to be held in Buenos Aires from November 14 to 16. The event is described as hyper immersive, aiming to bring builders and the broader ecosystem together under one roof.

2025-11-15

DeFi Day Del Sur in Buenos Aires

Aave reports that the fourth edition of DeFi Day del Sur will be held in Buenos Aires on November 19th.

2025-11-18

DevConnect in Buenos Aires

COTI will participate in DevConnect in Buenos Aires on November 17th-22nd.

2025-11-21