Post content & earn content mining yield

placeholder

DragonFlyOfficial

#GlobalTechSell-OffHitsRiskAssets

Dragon Fly Official Analysis

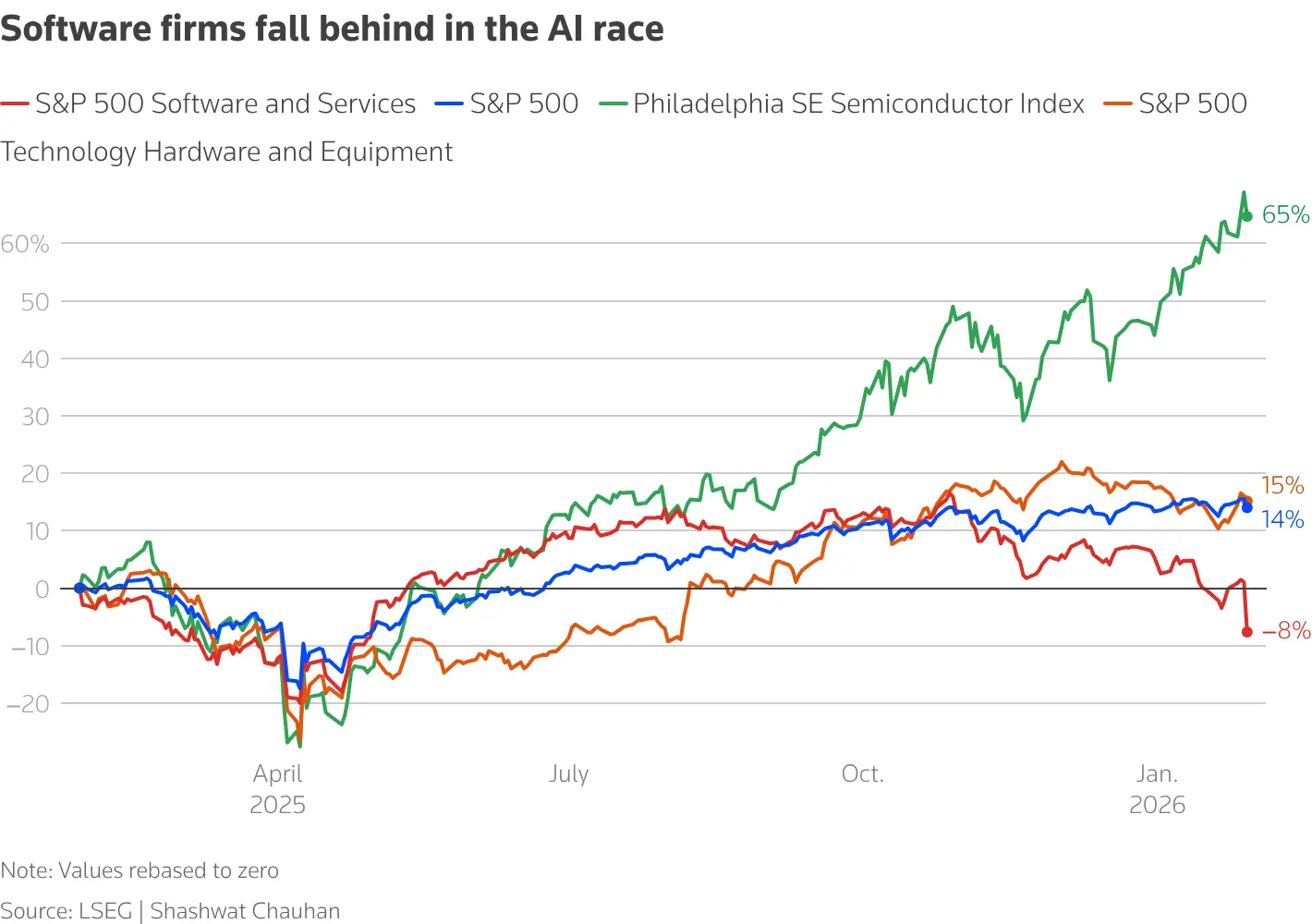

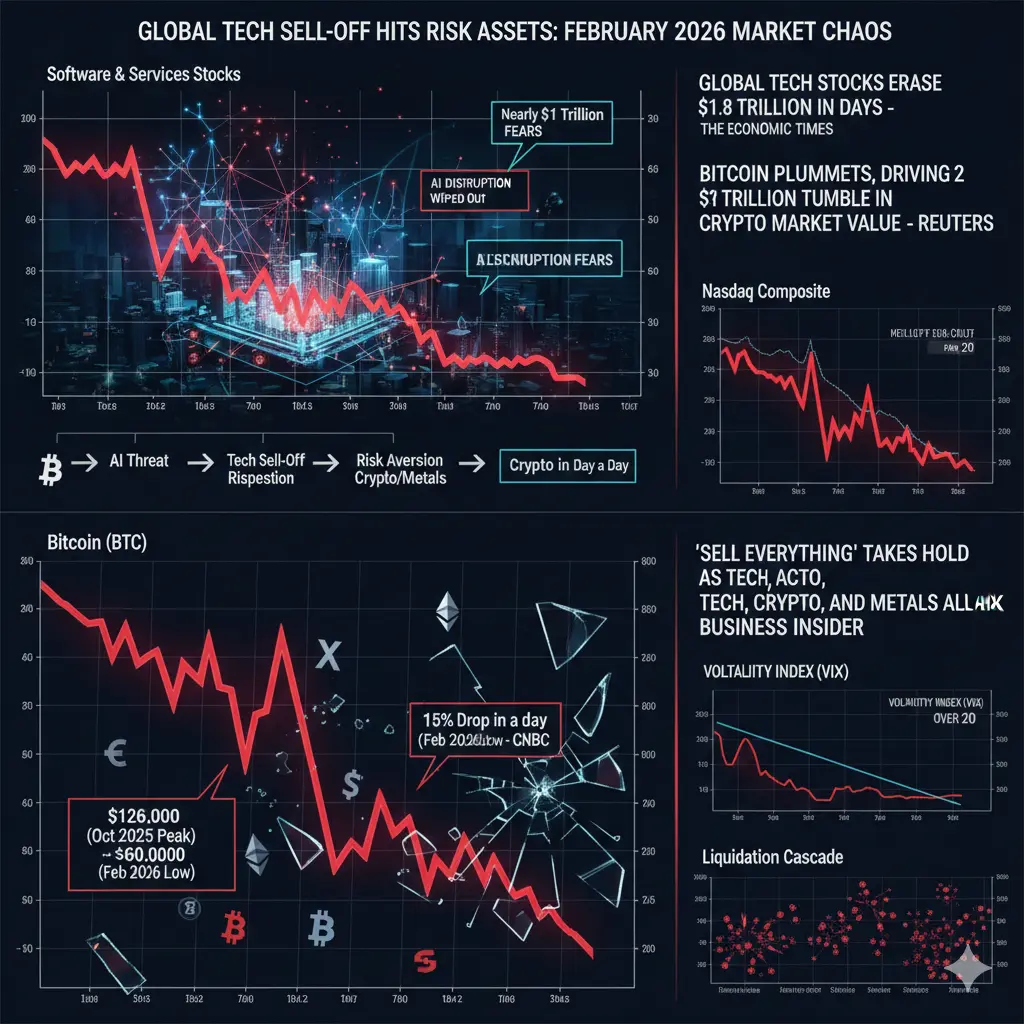

Global tech stocks experienced a sharp sell-off today, and as expected, **risk assets across the board followed suit** — including Bitcoin, ETH, and GT token. This coordinated decline reflects **systemic market stress** rather than isolated news.

📊 **Deep Research Insights**

**1️⃣ Macro & Market Drivers**

* Rising real yields and tightening monetary policy triggered the tech sell-off.

* Liquidity rotations caused crypto and other risk assets to drop simultaneously.

* Investor sentiment shifted to **risk-off**, leading to temporar

Dragon Fly Official Analysis

Global tech stocks experienced a sharp sell-off today, and as expected, **risk assets across the board followed suit** — including Bitcoin, ETH, and GT token. This coordinated decline reflects **systemic market stress** rather than isolated news.

📊 **Deep Research Insights**

**1️⃣ Macro & Market Drivers**

* Rising real yields and tightening monetary policy triggered the tech sell-off.

* Liquidity rotations caused crypto and other risk assets to drop simultaneously.

* Investor sentiment shifted to **risk-off**, leading to temporar

- Reward

- 2

- 2

- Repost

- Share

QueenOfTheDay :

:

Buy To Earn 💎View More

- Reward

- 2

- 2

- Repost

- Share

婺州散修PlbWuzhouCasual :

:

Every day, I look forward to your sharing. Thank you!View More

🇯🇵 Japan's Nikkei 225 Index hits a record high, soaring 6% following Prime Minister Fumio Kishida's victory.

After Fumio Kishida's official win and appointment as Japan's Prime Minister, the Japanese stock market experienced a strong positive feedback, with the Nikkei 225 Index surging about 6% in a single day and reaching a new all-time high, indicating that the capital market is highly optimistic about his policy expectations.

Fumio Kishida's style continues the Abe approach, which is "Abenomics 2.0."

Market focus points include:

Opposition to premature rate hikes

Continuing loose fiscal p

After Fumio Kishida's official win and appointment as Japan's Prime Minister, the Japanese stock market experienced a strong positive feedback, with the Nikkei 225 Index surging about 6% in a single day and reaching a new all-time high, indicating that the capital market is highly optimistic about his policy expectations.

Fumio Kishida's style continues the Abe approach, which is "Abenomics 2.0."

Market focus points include:

Opposition to premature rate hikes

Continuing loose fiscal p

BTC2.26%

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$4.5K

Create My Token

2.9

Key Events This Week:

February 10th: The White House will hold a stablecoin yield discussion meeting again next Tuesday;

February 11th: The US will release January non-farm payroll data at 21:30; market expects 70,000 new jobs and an unemployment rate of 4.4%

February 13th: At 21:30, January CPI data will be released; core CPI growth is expected to drop to the lowest since early 2021

BTC

The market pressure remains high, liquidity has not recovered. The recent decline was significant but did not show obvious bearish signals. This situation is the most concerning because, without a clear re

View OriginalKey Events This Week:

February 10th: The White House will hold a stablecoin yield discussion meeting again next Tuesday;

February 11th: The US will release January non-farm payroll data at 21:30; market expects 70,000 new jobs and an unemployment rate of 4.4%

February 13th: At 21:30, January CPI data will be released; core CPI growth is expected to drop to the lowest since early 2021

BTC

The market pressure remains high, liquidity has not recovered. The recent decline was significant but did not show obvious bearish signals. This situation is the most concerning because, without a clear re

- Reward

- like

- Comment

- Repost

- Share

Don't rush to sell the 2055 position just yet. Consider reducing your position around 2100 to lock in profits, and then watch for 2130-2180.

View Original

- Reward

- 2

- Comment

- Repost

- Share

🔹 Asia-Pacific equities and Bitcoin surge in tandem: Is the crypto market entering a cyclical reversal as well?

- Reward

- 1

- Comment

- Repost

- Share

People born in China between 1980 and 1989, the core productive force of society known as the post-80s generation, total 223 million. As of 2025, 11 million have passed away. The post-70s generation, with a total of 218 million, has seen 4.4 million deaths by 2025. The post-90s, born in 211 million, have experienced 6 million deaths. The post-00s, born in 159 million, have had 2 million deaths.

View Original

- Reward

- like

- Comment

- Repost

- Share

🌈 Gate Live Streaming Inspiration - February 9

Trending Topic Recommendations:

🔹 Asia-Pacific stock markets and Bitcoin surge simultaneously, are crypto assets also experiencing a cycle reversal?

🔹 Tom Lee speaks again: Ethereum has experienced a "V-shaped rebound" after each of its last 8 crashes. Can history repeat itself this time?

🔹 Bitcoin posts its largest weekly decline since the FTX collapse. The market is severely oversold. Does this mean a rebound is imminent?

🔹 Was this round of sharp decline caused by forced liquidation of ETF options? Are massive leverage liquidations a "blac

View OriginalTrending Topic Recommendations:

🔹 Asia-Pacific stock markets and Bitcoin surge simultaneously, are crypto assets also experiencing a cycle reversal?

🔹 Tom Lee speaks again: Ethereum has experienced a "V-shaped rebound" after each of its last 8 crashes. Can history repeat itself this time?

🔹 Bitcoin posts its largest weekly decline since the FTX collapse. The market is severely oversold. Does this mean a rebound is imminent?

🔹 Was this round of sharp decline caused by forced liquidation of ETF options? Are massive leverage liquidations a "blac

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Reversal from extremity, and after decline comes prosperity 🌞 When things reach their extreme, they will turn around; after adversity, there will be peace and harmony.

#PartialGovernmentShutdownEnds PostShutdownMarketOutlook

The conclusion of the partial U.S. government shutdown marks a pivotal moment for both traditional and digital markets, shifting the environment from heightened uncertainty to greater clarity. With federal operations fully restored, investor confidence and liquidity conditions are beginning to normalize, creating more predictable frameworks for capital deployment across asset classes.

Bitcoin and Ethereum have already reflected early stabilization, with prices consolidating around $67,000–$68,000 and $1,950–$2,000 respectively. These ran

The conclusion of the partial U.S. government shutdown marks a pivotal moment for both traditional and digital markets, shifting the environment from heightened uncertainty to greater clarity. With federal operations fully restored, investor confidence and liquidity conditions are beginning to normalize, creating more predictable frameworks for capital deployment across asset classes.

Bitcoin and Ethereum have already reflected early stabilization, with prices consolidating around $67,000–$68,000 and $1,950–$2,000 respectively. These ran

- Reward

- 1

- Comment

- Repost

- Share

more hate pleasei wanna buy the orange coin lowerthanks

- Reward

- like

- Comment

- Repost

- Share

BREAKING: BAD BUNNY HAS GAINED MORE YARDS THAN THE PATRIOTS

- Reward

- like

- Comment

- Repost

- Share

ai

qq

Created By@DoYouLikeSummer?

Listing Progress

0.00%

MC:

$2.41K

Create My Token

#BitcoinBouncesBack

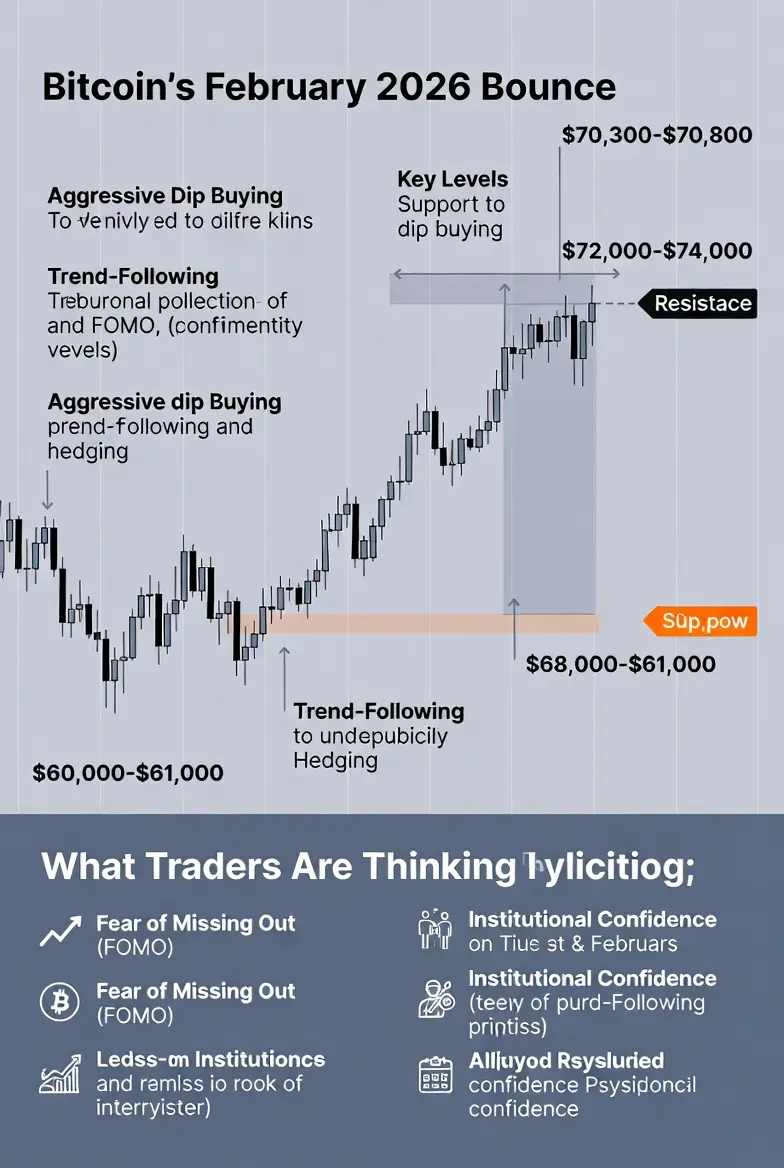

Bitcoin staged a remarkable rebound in early February 2026 after one of its sharpest corrections in years. After reaching an all-time high near $126,000 in late 2025, BTC plunged to $60,000–$61,000 on February 5–6, a ~50% drawdown. Forced liquidations, over-leveraged positions, and broader market risk-off drove the sharp decline.

Starting February 6, BTC rebounded 10–17% in a single session, reclaiming the $70,000–$71,000 range. As of February 9, Bitcoin trades around $70,300–$70,800, with strong trading volumes confirming active buyer interest. Market sentiment has shifte

Bitcoin staged a remarkable rebound in early February 2026 after one of its sharpest corrections in years. After reaching an all-time high near $126,000 in late 2025, BTC plunged to $60,000–$61,000 on February 5–6, a ~50% drawdown. Forced liquidations, over-leveraged positions, and broader market risk-off drove the sharp decline.

Starting February 6, BTC rebounded 10–17% in a single session, reclaiming the $70,000–$71,000 range. As of February 9, Bitcoin trades around $70,300–$70,800, with strong trading volumes confirming active buyer interest. Market sentiment has shifte

BTC2.26%

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊🔹 Asia-Pacific equities and Bitcoin surge in tandem: Is the crypto market entering a cyclical reversal as well?

- Reward

- like

- Comment

- Repost

- Share

Invite Friends 7-Day Fun: Check in every day, receive USDT every day https://www.gate.com/campaigns/4027?ref=VLVDV15CAQ&ref_type=132&utm_cmp=7doQBcVs

View Original

- Reward

- 1

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets

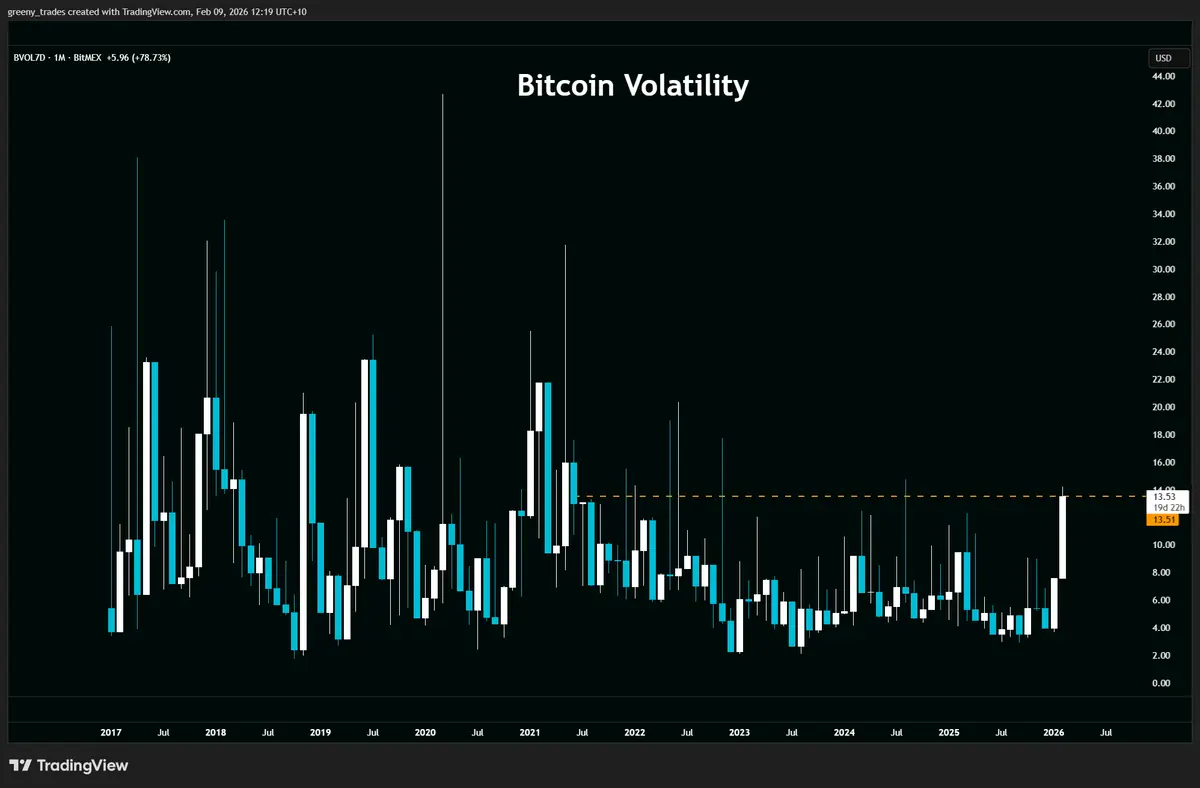

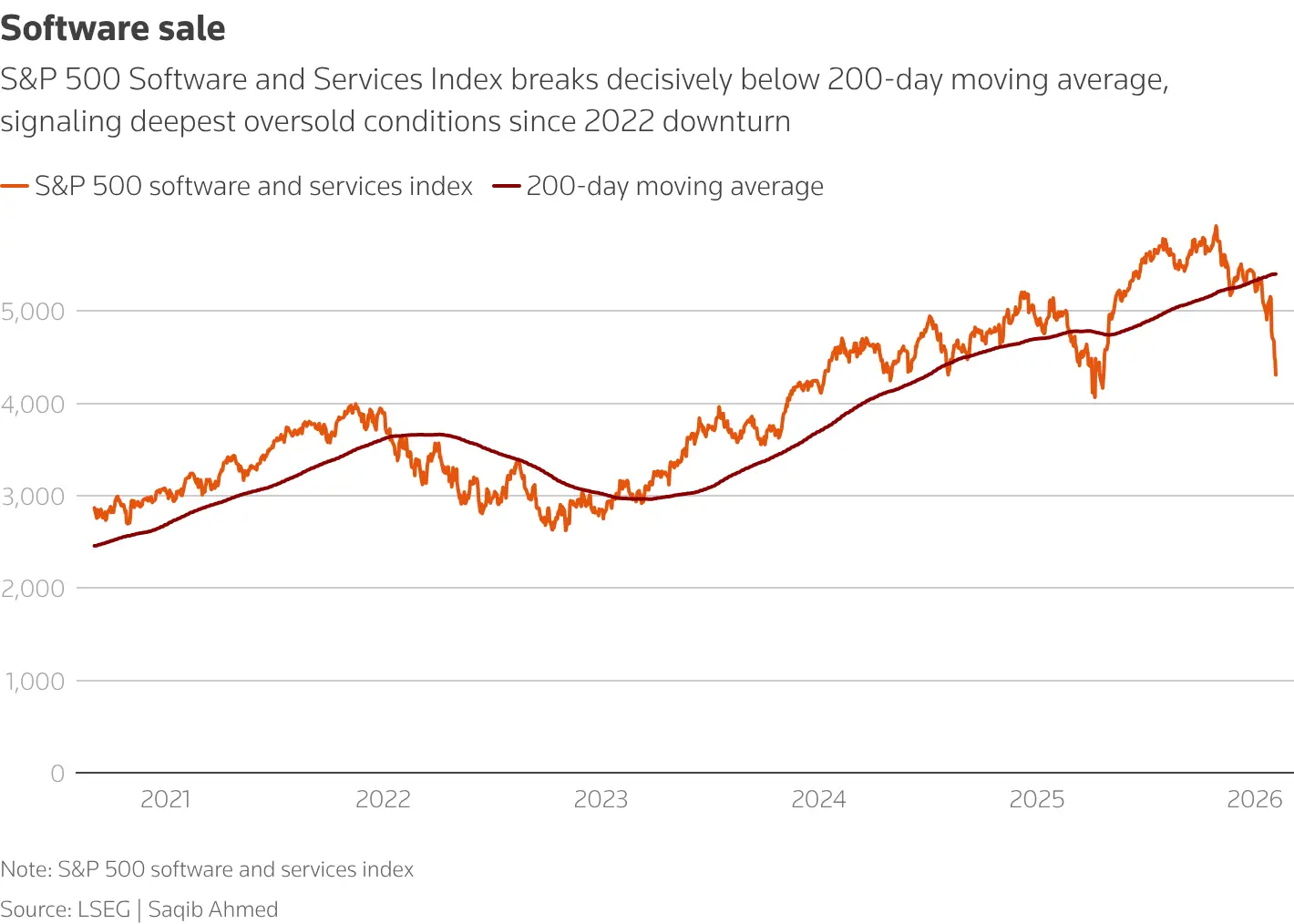

The phrase "Global Tech Sell-Off Hits Risk Assets" captures the dramatic market event from roughly February 3–6, 2026 (with ripples into the weekend), where fears over AI disruption to software businesses, massive unchecked AI capital spending, weak economic signals, and profit-taking triggered a sharp decline in tech stocks. This "risk-off" mood quickly spread to correlated high-risk assets like cryptocurrencies, precious metals, and speculative plays, leading to cascading losses amplified by high volume, thin liquidity, and leverage unwinds.

Here’s the comp

The phrase "Global Tech Sell-Off Hits Risk Assets" captures the dramatic market event from roughly February 3–6, 2026 (with ripples into the weekend), where fears over AI disruption to software businesses, massive unchecked AI capital spending, weak economic signals, and profit-taking triggered a sharp decline in tech stocks. This "risk-off" mood quickly spread to correlated high-risk assets like cryptocurrencies, precious metals, and speculative plays, leading to cascading losses amplified by high volume, thin liquidity, and leverage unwinds.

Here’s the comp

BTC2.26%

- Reward

- 5

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

🇰🇷🐳 According to Yonhap, Korea\'s FSS announced its 2026 plan on February 9. This includes investigations into high-risk #crypto manipulations such as whale activities, containment/ramp schemes, API orders, and SNS misinformation using #AI text and surge detection tools. The plan also involves creating a new Digital Asset Basic Act group for phase-2 legislation support, issuance and #trading disclosure, licensing manuals, and refined exchange fee management and disclosure. #crypto

- Reward

- 1

- Comment

- Repost

- Share

Cryptocurrency Today Observation February 9, 2026

1. Market Trends

BTC rebounds after overselling, altcoins generally decline.

U.S. stocks rebound, gold and silver rebound.

2. Market Hotspots:

1. Public chain ETH stops falling, Yili Huaping liquidates all ETH positions.

2. Launch platform BNKR surges, BNKR is an AI launch platform on the Base chain.

3. Gold and silver RWA XAU, XAG rebound, long rates are 180% and 240% respectively.

View Original1. Market Trends

BTC rebounds after overselling, altcoins generally decline.

U.S. stocks rebound, gold and silver rebound.

2. Market Hotspots:

1. Public chain ETH stops falling, Yili Huaping liquidates all ETH positions.

2. Launch platform BNKR surges, BNKR is an AI launch platform on the Base chain.

3. Gold and silver RWA XAU, XAG rebound, long rates are 180% and 240% respectively.

- Reward

- like

- Comment

- Repost

- Share

Market Analysis:

The current short-term market will continue to fluctuate and consolidate, with BTC and ETH repeatedly testing the 70,000 and 2,000 levels. Beware of trap setups for a bullish move! In the past 24 hours, over 90,000 traders were liquidated, totaling 330 million, with both bulls and bears suffering losses. Panic sentiment has eased but not disappeared.

Macroeconomic Outlook:

1. The Federal Reserve has a 77.3% probability of not cutting interest rates in March, with a hawkish stance still dominant, making rate cut expectations unlikely;

2. U.S. stocks are volatile, and the positi

View OriginalThe current short-term market will continue to fluctuate and consolidate, with BTC and ETH repeatedly testing the 70,000 and 2,000 levels. Beware of trap setups for a bullish move! In the past 24 hours, over 90,000 traders were liquidated, totaling 330 million, with both bulls and bears suffering losses. Panic sentiment has eased but not disappeared.

Macroeconomic Outlook:

1. The Federal Reserve has a 77.3% probability of not cutting interest rates in March, with a hawkish stance still dominant, making rate cut expectations unlikely;

2. U.S. stocks are volatile, and the positi

- Reward

- like

- Comment

- Repost

- Share

Every morning, I walk along this river and always see this tranquil illusion! Actually, from my perspective, I find it very beautiful, but most people don't notice it because they are in a hurry.

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More171.66K Popularity

181 Popularity

105 Popularity

10.93K Popularity

3.66K Popularity

News

View MoreRootData: RION will unlock tokens worth approximately $1.07 million in one week

4 m

RootData: VANA will unlock tokens worth approximately $3.85 million in one week

4 m

Jia Yueteng: Opposes any reverse stock splits and will promote four key measures to combat illegal and malicious short selling

5 m

RootData: GPS will unlock tokens worth approximately $1.18 million in one week

5 m

Overview of the popular cryptocurrencies as of February 9, 2026, with the top three in popularity being: Pippin, Dusk, and GoMining.

5 m

Pin