# BitwiseFilesforUNISpotETF

6.85K

MoonGirl

#BitwiseFilesforUNISpotETF

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

- Reward

- like

- Comment

- Repost

- Share

# BitwiseFilesforUNISpotETF

🚨 DeFi Goes Mainstream: Bitwise Files for Uniswap Spot ETF

The ETF wave just crashed into the

DeFi world. Bitwise Asset Management has officially filed with the SEC to

launch a Spot Uniswap (UNI) ETF. If approved, this would be the first

ETF of its kind, offering traditional investors direct exposure to the largest

decentralized exchange (DEX) protocol.

Here is why this filing is a massive

milestone for crypto:

1. DeFi Meets Wall Street So far, Spot ETFs have been limited to layer-1 blockchains

like Bitcoin and Ethereum. Filing for a protocol token like UNI is

🚨 DeFi Goes Mainstream: Bitwise Files for Uniswap Spot ETF

The ETF wave just crashed into the

DeFi world. Bitwise Asset Management has officially filed with the SEC to

launch a Spot Uniswap (UNI) ETF. If approved, this would be the first

ETF of its kind, offering traditional investors direct exposure to the largest

decentralized exchange (DEX) protocol.

Here is why this filing is a massive

milestone for crypto:

1. DeFi Meets Wall Street So far, Spot ETFs have been limited to layer-1 blockchains

like Bitcoin and Ethereum. Filing for a protocol token like UNI is

- Reward

- like

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF

Bitwise filing for a UNI spot ETF has reignited discussion around DeFi’s next phase of institutional recognition. While Bitcoin and Ethereum ETFs have already reshaped market expectations, this move signals something deeper: decentralized finance protocols are now entering conversations once reserved for traditional assets. A spot ETF tied to Uniswap would mark a major step in bridging open-source finance with regulated investment structures.

This filing reflects growing confidence that DeFi is no longer a fringe experiment but a core component of the digital asset

Bitwise filing for a UNI spot ETF has reignited discussion around DeFi’s next phase of institutional recognition. While Bitcoin and Ethereum ETFs have already reshaped market expectations, this move signals something deeper: decentralized finance protocols are now entering conversations once reserved for traditional assets. A spot ETF tied to Uniswap would mark a major step in bridging open-source finance with regulated investment structures.

This filing reflects growing confidence that DeFi is no longer a fringe experiment but a core component of the digital asset

- Reward

- 3

- 5

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

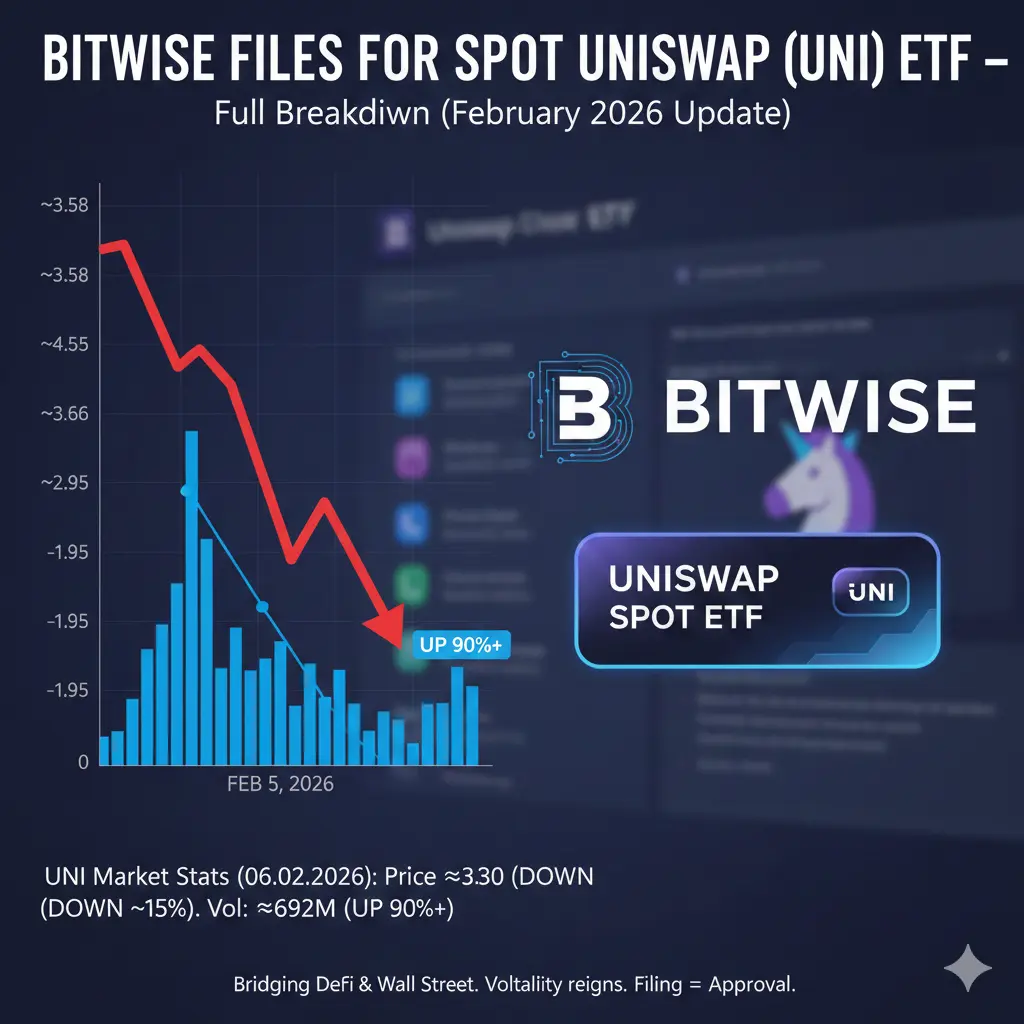

#BitwiseFilesforUNISpotETF Bitwise Moves to Bridge DeFi & Wall Street

Big news in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF. This would be the first spot ETF tracking the price of Uniswap’s governance token (UNI).

If approved, the ETF would allow traditional investors to gain direct exposure to UNI’s spot price via brokerage accounts, without needing to hold the token themselves. Custody would be handled by Coinbase Custody (initially no staking, but that could be added later). This

Big news in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF. This would be the first spot ETF tracking the price of Uniswap’s governance token (UNI).

If approved, the ETF would allow traditional investors to gain direct exposure to UNI’s spot price via brokerage accounts, without needing to hold the token themselves. Custody would be handled by Coinbase Custody (initially no staking, but that could be added later). This

- Reward

- 3

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#BitwiseFilesforUNISpotETF

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

thanks for information sent every day dear 🙂View More

#BitwiseFilesforUNISpotETF Bitwise Moves to Bridge DeFi & Wall Street

Big news in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF. This would be the first spot ETF tracking the price of Uniswap’s governance token (UNI).

If approved, the ETF would allow traditional investors to gain direct exposure to UNI’s spot price via brokerage accounts, without needing to hold the token themselves. Custody would be handled by Coinbase Custody (initially no staking, but that could be added later). This

Big news in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF. This would be the first spot ETF tracking the price of Uniswap’s governance token (UNI).

If approved, the ETF would allow traditional investors to gain direct exposure to UNI’s spot price via brokerage accounts, without needing to hold the token themselves. Custody would be handled by Coinbase Custody (initially no staking, but that could be added later). This

- Reward

- 7

- 11

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BitwiseFilesforUNISpotETF #BitwiseFilesforUNISpotETF

In a significant development for decentralized finance (DeFi) and the broader cryptocurrency market, Bitwise Asset Management has officially filed for a spot Uniswap (UNI) ETF with the U.S. Securities and Exchange Commission (SEC) — a landmark step that could open the door for mainstream investors to gain regulated exposure to the native token of the leading decentralized exchange protocol.

This filing, submitted on February 5–6, 2026, marks the first formal attempt by a major asset manager to launch a spot ETF tied directly to Uniswap’s U

In a significant development for decentralized finance (DeFi) and the broader cryptocurrency market, Bitwise Asset Management has officially filed for a spot Uniswap (UNI) ETF with the U.S. Securities and Exchange Commission (SEC) — a landmark step that could open the door for mainstream investors to gain regulated exposure to the native token of the leading decentralized exchange protocol.

This filing, submitted on February 5–6, 2026, marks the first formal attempt by a major asset manager to launch a spot ETF tied directly to Uniswap’s U

- Reward

- 10

- 13

- Repost

- Share

HighAmbition :

:

thnxx sharing informationView More

#BitwiseFilesforUNISpotETF

Big move in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF — the first spot ETF aimed at tracking the price of Uniswap's governance token, UNI.

This would allow traditional investors (via brokerage accounts) to gain direct exposure to UNI's spot price without needing to hold the token themselves, custody handled by Coinbase Custody (no staking at launch, but potential addition later). It's a major step toward bridging DeFi protocols with regulated Wall Street

Big move in the DeFi space: Bitwise Asset Management officially filed an S-1 registration statement with the U.S. SEC on February 5, 2026, for the Bitwise Uniswap ETF — the first spot ETF aimed at tracking the price of Uniswap's governance token, UNI.

This would allow traditional investors (via brokerage accounts) to gain direct exposure to UNI's spot price without needing to hold the token themselves, custody handled by Coinbase Custody (no staking at launch, but potential addition later). It's a major step toward bridging DeFi protocols with regulated Wall Street

- Reward

- 11

- 13

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#BitwiseFilesforUNISpotETF

Comprehensive Analysis and Market Implications

Bitwise’s filing for a UNI Spot ETF represents a landmark development in the evolution of decentralized finance (DeFi) adoption within regulated financial markets. Unlike derivative-based ETFs, which rely on futures contracts and synthetic exposure, a spot ETF directly holds the underlying asset in this case, Uniswap’s UNI token. This distinction is significant because it provides investors with true price tracking, greater transparency, and reduced counterparty risk, making it a more attractive vehicle for institution

Comprehensive Analysis and Market Implications

Bitwise’s filing for a UNI Spot ETF represents a landmark development in the evolution of decentralized finance (DeFi) adoption within regulated financial markets. Unlike derivative-based ETFs, which rely on futures contracts and synthetic exposure, a spot ETF directly holds the underlying asset in this case, Uniswap’s UNI token. This distinction is significant because it provides investors with true price tracking, greater transparency, and reduced counterparty risk, making it a more attractive vehicle for institution

UNI9.51%

- Reward

- 7

- 10

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#BitwiseFilesforUNISpotETF Institutional adoption in cryptocurrency markets is now extending beyond Bitcoin and Ethereum toward the core infrastructure of decentralized finance. Following the success of spot BTC and ETH ETFs, Bitwise Asset Management’s filing for a spot Uniswap (UNI) ETF represents a strategic milestone — signaling that DeFi governance assets are entering the regulatory and institutional mainstream.

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

- Reward

- 3

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Hold on tight, we're about to take off 🛫View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

126.27K Popularity

25.23K Popularity

390.34K Popularity

10.36K Popularity

9.25K Popularity

8K Popularity

6.85K Popularity

7.62K Popularity

5.04K Popularity

3.23K Popularity

16.2K Popularity

10.1K Popularity

22.81K Popularity

30.36K Popularity

25.39K Popularity

News

View MoreETH drops below 2050 USDT

15 m

BTC drops below 69,000 USDT

17 m

The Arweave network has not produced a block for over 24 hours.

24 m

"BTC OG Insider Whale" transferred 1,599 BTC to a new wallet in the past 2 hours

37 m

Data: 195.33 BTC transferred from an anonymous address, then routed through a relay to another anonymous address

43 m