# TraditionalFinanceAcceleratesTokenization

1.04K

HanssiMazak

#TraditionalFinanceAcceleratesTokenization Traditional finance is no longer observing tokenization from a distance. It is actively accelerating toward it. What was once framed as an experimental concept is now becoming a structural strategy as banks, asset managers, and financial institutions seek faster settlement, lower operational costs, and programmable ownership. Tokenization is evolving from a crypto-native idea into a core pillar of modern financial infrastructure.

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

At its core, tokenization is about efficiency and control. By representing real-world assets on blockchain networks, instit

- Reward

- 4

- 1

- Repost

- Share

LittleQueen :

:

Watching Closely 🔍️#TraditionalFinanceAcceleratesTokenization reflects the growing trend of mainstream financial institutions leveraging blockchain technology to tokenize traditional assets. From equities and bonds to real estate and commodities, major banks, investment funds, and insurance companies are increasingly converting their physical or financial assets into digital tokens. Tokenization allows these assets to be traded, transferred, or fractionalized on blockchain networks, offering unprecedented levels of liquidity, transparency, and accessibility.

📈 How Traditional Finance is Driving Tokenization can

📈 How Traditional Finance is Driving Tokenization can

- Reward

- 5

- 6

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#TraditionalFinanceAcceleratesTokenization

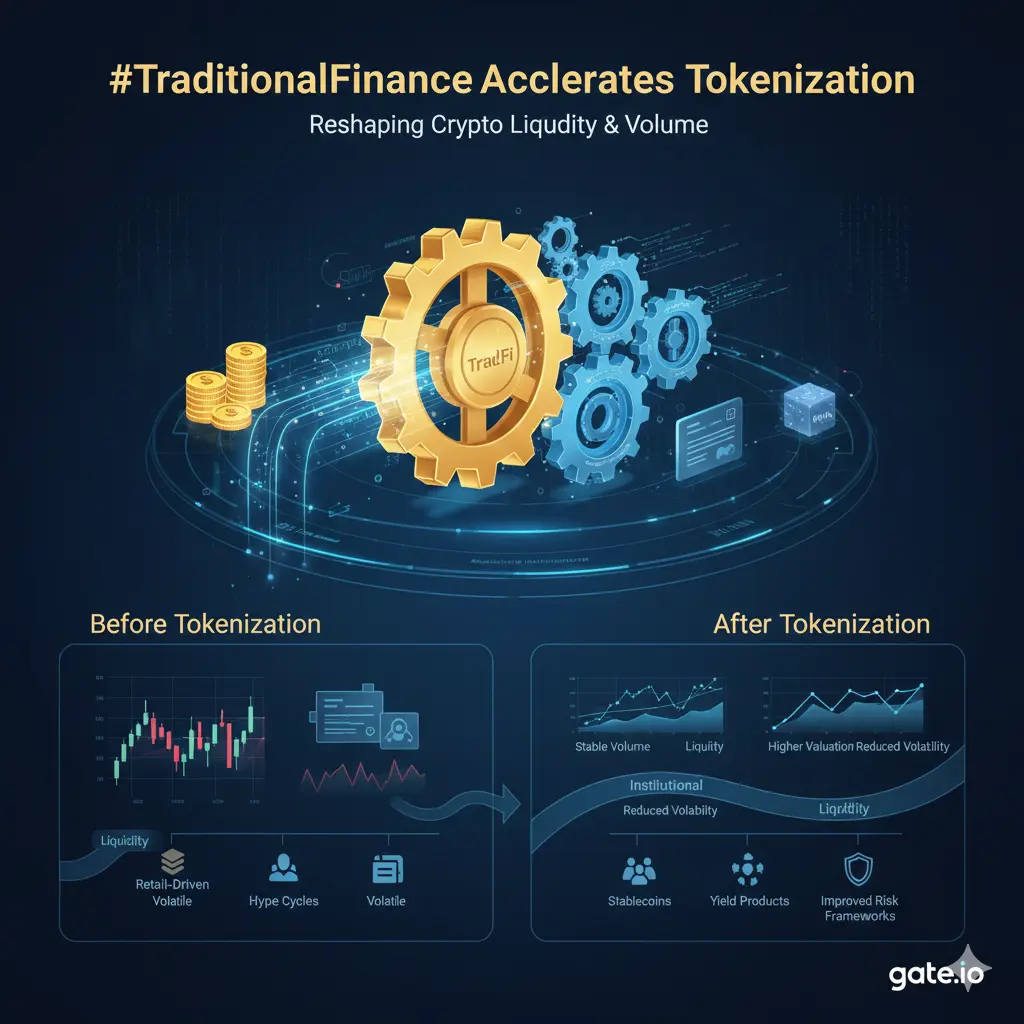

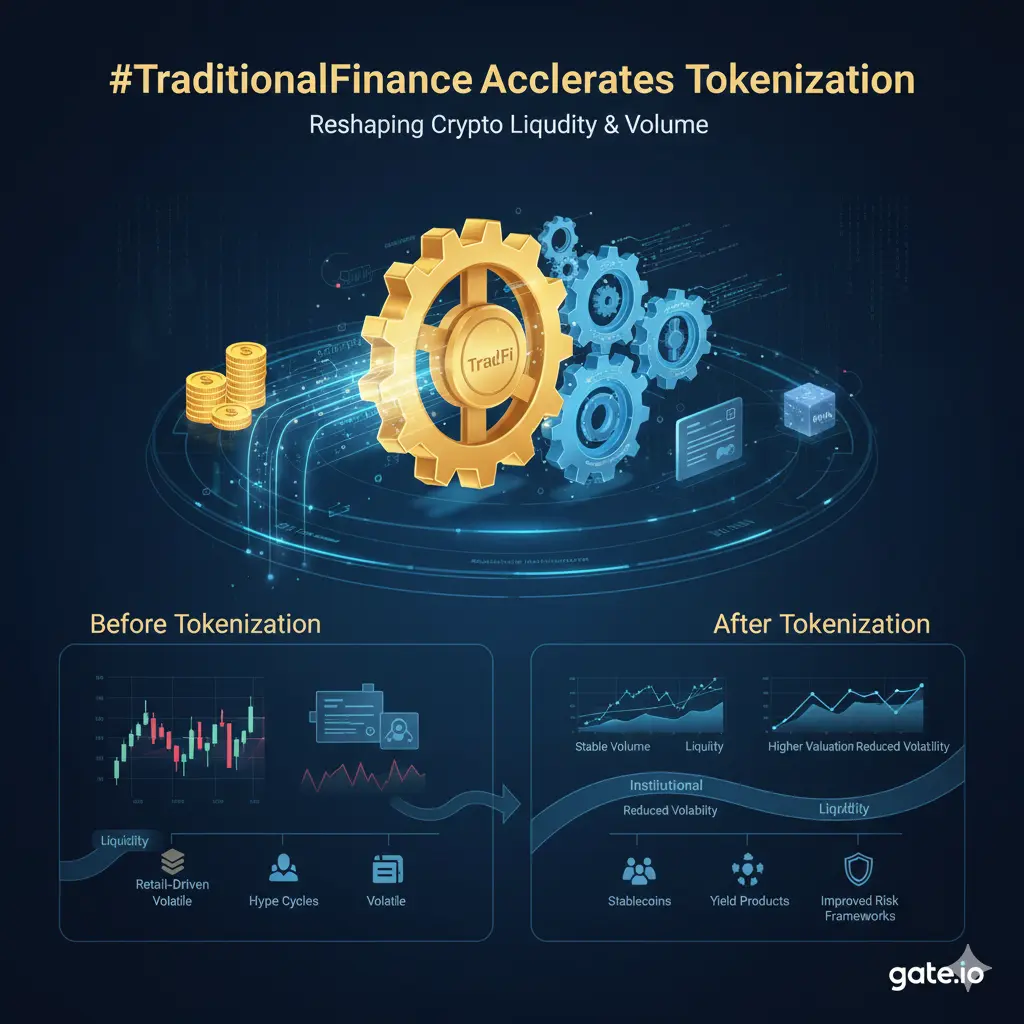

Tokenization — the process of converting real-world assets into digital tokens on a blockchain — is rapidly gaining momentum as traditional finance (TradFi) embraces it. Here’s a breakdown of why this matters:

1️⃣ Real-World Assets Become More Liquid

Tokenization turns assets like real estate, bonds, and commodities into tradable digital tokens. This increases liquidity because fractional ownership becomes easier and markets operate 24/7.

2️⃣ Lower Barriers to Entry for Investors

Instead of needing large capital to invest in an asset (a building or a

Tokenization — the process of converting real-world assets into digital tokens on a blockchain — is rapidly gaining momentum as traditional finance (TradFi) embraces it. Here’s a breakdown of why this matters:

1️⃣ Real-World Assets Become More Liquid

Tokenization turns assets like real estate, bonds, and commodities into tradable digital tokens. This increases liquidity because fractional ownership becomes easier and markets operate 24/7.

2️⃣ Lower Barriers to Entry for Investors

Instead of needing large capital to invest in an asset (a building or a

- Reward

- 7

- 8

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#TraditionalFinanceAcceleratesTokenization

Traditional finance is no longer watching tokenization from the sidelines—it is actively accelerating its adoption.

Once considered an experimental concept limited to crypto-native projects, tokenization has now entered the core strategy of major banks, asset managers, and financial institutions.

This shift marks a critical turning point where traditional finance (TradFi) and blockchain technology are beginning to merge in practical, scalable ways.

Tokenization refers to the process of converting real-world assets—such as bonds, equities, real estat

Traditional finance is no longer watching tokenization from the sidelines—it is actively accelerating its adoption.

Once considered an experimental concept limited to crypto-native projects, tokenization has now entered the core strategy of major banks, asset managers, and financial institutions.

This shift marks a critical turning point where traditional finance (TradFi) and blockchain technology are beginning to merge in practical, scalable ways.

Tokenization refers to the process of converting real-world assets—such as bonds, equities, real estat

- Reward

- 1

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization The Shift Toward Digital Assets

Traditional financial institutions are increasingly embracing tokenization, signaling a major shift in how capital markets operate. From tokenized stocks and bonds to fractionalized real estate and commodities, this trend is bridging conventional finance with blockchain technology. February 2026 is seeing heightened activity as banks, asset managers, and hedge funds explore new ways to integrate digital assets, creating both structural opportunities and broader adoption for the crypto ecosystem.

Drivers of Tokenization

Traditional financial institutions are increasingly embracing tokenization, signaling a major shift in how capital markets operate. From tokenized stocks and bonds to fractionalized real estate and commodities, this trend is bridging conventional finance with blockchain technology. February 2026 is seeing heightened activity as banks, asset managers, and hedge funds explore new ways to integrate digital assets, creating both structural opportunities and broader adoption for the crypto ecosystem.

Drivers of Tokenization

- Reward

- 5

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

Tokenization is the process of converting real-world assets or financial instruments into digital tokens on the blockchain, unlocking liquidity, transparency, and 24/7 tradability. This is not hype or speculation; it is a structural liquidity event quietly reshaping crypto markets from the inside out. When traditional finance accelerates tokenization, the first changes appear not in headlines, but in capital flow, liquidity deployment, and price stability. Markets evolve quietly, long before public sentiment catches up.

For traders like Trader Hazrat

- Reward

- 9

- 12

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

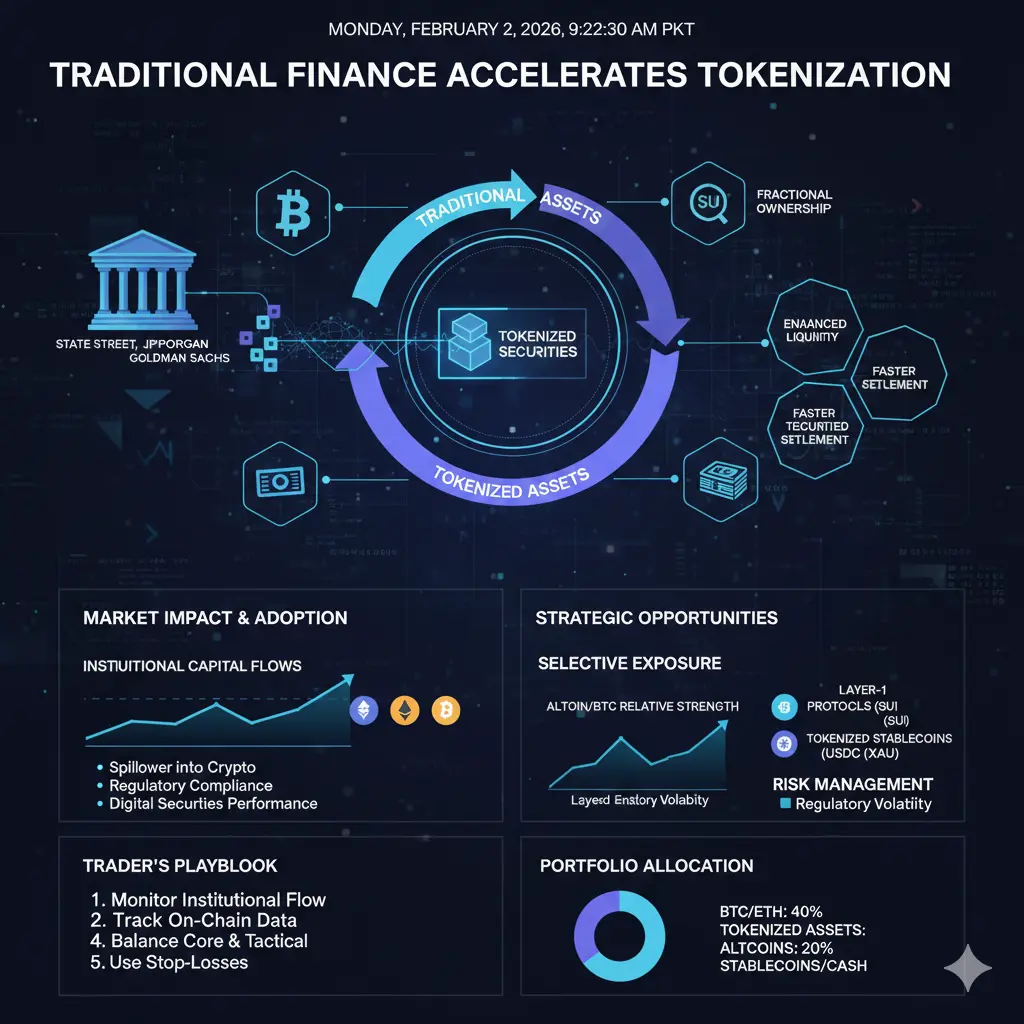

# TraditionalFinanceAcceleratesTokenization

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

DEFI-1.7%

- Reward

- like

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

Traditional financial institutions are accelerating their adoption of blockchain technology, marking a pivotal shift in the intersection of traditional finance and digital assets. Major players such as State Street, JPMorgan, and Goldman Sachs are launching digital asset platforms aimed at tokenizing conventional financial products, including equities, bonds, and derivatives. This trend not only digitizes traditional assets but also enhances liquidity, transaction speed, and operational efficiency, effectively bridging the gap between legacy financia

- Reward

- 4

- 5

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

376.87K Popularity

5.27K Popularity

5.17K Popularity

3.54K Popularity

2.31K Popularity

4.03K Popularity

2.05K Popularity

2.89K Popularity

1.89K Popularity

23 Popularity

53.4K Popularity

68.25K Popularity

20.2K Popularity

25.61K Popularity

201.26K Popularity

News

View MoreOptimism will transfer 6,400 ETH for liquid staking, moving a total of 6,400 ETH to facilitate liquidity provision and staking activities.

3 m

Hyperliquid Ecosystem Assistance Fund has repurchased over 40 million HYPE tokens in total.

7 m

MGBX will launch WzToken (WZB) spot trading on the platform.

12 m

Gate Instant Swap launches the 4th Lucky Draw, share to win 60,000 USDT

17 m

Gate launches the 76th phase of the contract points airdrop, with a single transaction earning nearly $26.

18 m

Pin