#TrumpAnnouncesNewTariffs – Future Macro & Crypto Market Outlook

The recent tariff policy shift announced by Donald Trump following the February 20, 2026 ruling by the United States Supreme Court is shaping a new phase of trade-policy-driven macro volatility. The replacement tariff structure — moving from an initial global 10% import duty toward a 15% worldwide tariff framework — is being interpreted by markets as a politically noisy but economically bounded shock rather than a systemic financial disruption.

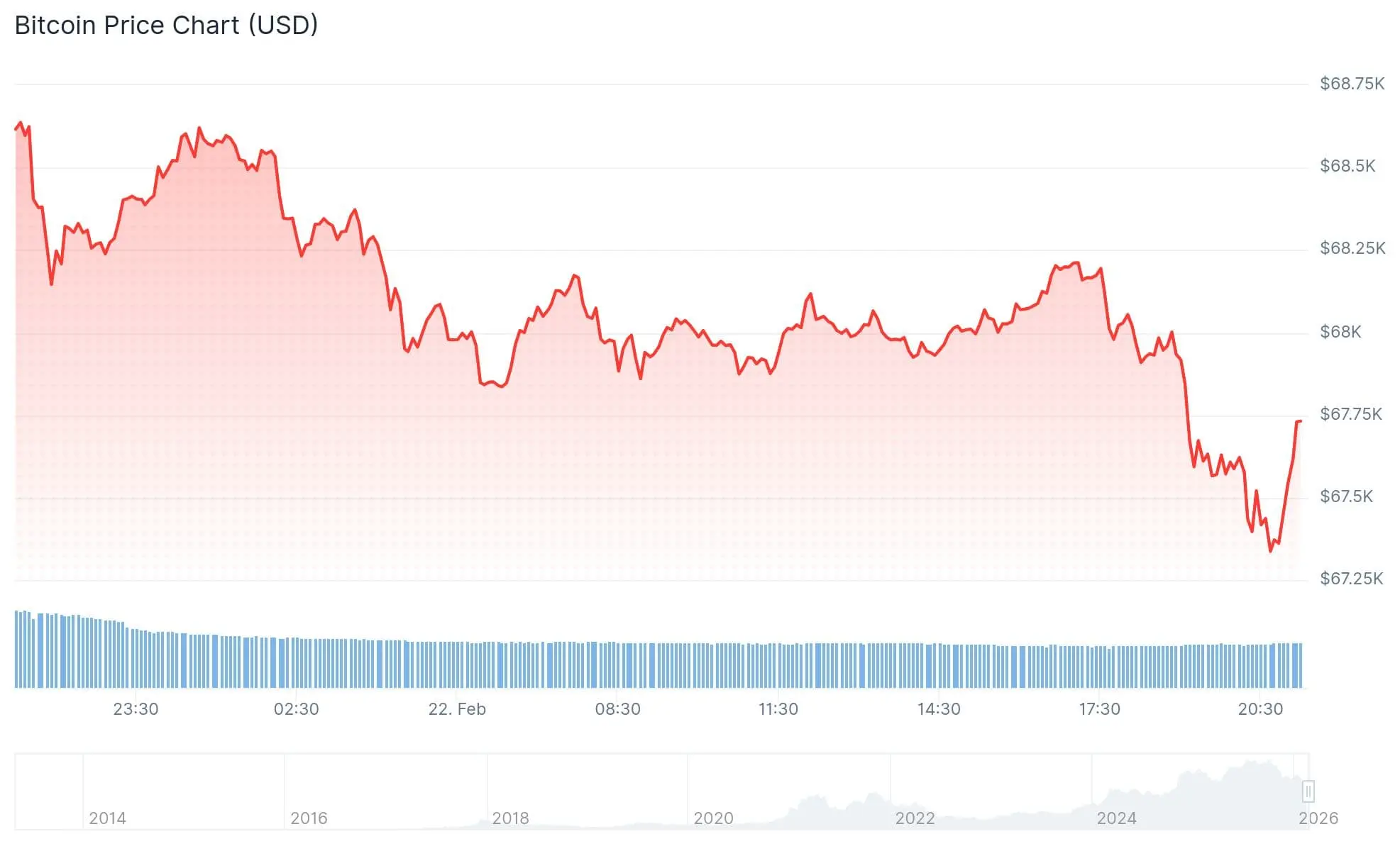

The cryptocurrency market has shown notable resilience during this policy transition. Bitcoin has maintained a consolidation band near $67K–$68.5K, while Ethereum has held around the $1,970–$1,980 range. The overall crypto market capitalization remains close to $2.4 trillion, reflecting muted downside pressure compared to earlier trade conflict cycles. Market participants are increasingly treating tariff headlines as short-term volatility triggers rather than structural risk events.

Price reaction analysis across the policy announcements shows relatively contained movement magnitude. The Supreme Court decision generated a relief-style catalyst effect, driving BTC upward by roughly 1–2% intraday, with higher-beta altcoins such as Solana and other growth assets outperforming in rebound phases. Subsequent tariff announcements produced brief dips followed by stabilization, with intraday swings generally remaining within the 1–3% volatility band.

Liquidity conditions across major exchanges have improved compared to earlier trade war periods. Traders are rotating temporarily into stable assets such as USD Coin (USDC) and Tether (USDT), which reduces forced liquidation cascades and supports faster post-headline recoveries. Deep order-book liquidity in BTC-paired markets has helped absorb shock waves more efficiently in the 2026 trading cycle.

Trading volume has also surged following policy headlines. Daily digital asset trading volume has recently approached the $110–$120 billion range, indicating strong participation during volatility events. Volume expansion during price dips is being interpreted by technical traders as a signal of potential capitulation-style accumulation or momentum reversal opportunities rather than sustained bearish pressure.

From a macroeconomic perspective, tariffs could indirectly influence crypto through inflation and currency channel effects inside the United States. Higher import costs may sustain inflationary pressure, potentially keeping monetary policy relatively restrictive. However, geopolitical trade uncertainty can also strengthen the narrative of Bitcoin as a digital store-of-value alternative, particularly during periods of global confidence fluctuation.

Overall, the current environment suggests that tariff escalation is functioning more as a volatility amplifier than a structural crash driver for crypto markets. Institutional participants continue monitoring Federal Reserve liquidity signals, trade retaliation risk, and regulatory developments such as the ongoing digital asset reform discussions. The dominant market theme remains resilience under uncertainty — not panic liquidation — which aligns with the broader maturation trajectory of the digital asset ecosystem. 🚀📊#GateSquare$50KRedPacketGiveaway

$TRUMP

The recent tariff policy shift announced by Donald Trump following the February 20, 2026 ruling by the United States Supreme Court is shaping a new phase of trade-policy-driven macro volatility. The replacement tariff structure — moving from an initial global 10% import duty toward a 15% worldwide tariff framework — is being interpreted by markets as a politically noisy but economically bounded shock rather than a systemic financial disruption.

The cryptocurrency market has shown notable resilience during this policy transition. Bitcoin has maintained a consolidation band near $67K–$68.5K, while Ethereum has held around the $1,970–$1,980 range. The overall crypto market capitalization remains close to $2.4 trillion, reflecting muted downside pressure compared to earlier trade conflict cycles. Market participants are increasingly treating tariff headlines as short-term volatility triggers rather than structural risk events.

Price reaction analysis across the policy announcements shows relatively contained movement magnitude. The Supreme Court decision generated a relief-style catalyst effect, driving BTC upward by roughly 1–2% intraday, with higher-beta altcoins such as Solana and other growth assets outperforming in rebound phases. Subsequent tariff announcements produced brief dips followed by stabilization, with intraday swings generally remaining within the 1–3% volatility band.

Liquidity conditions across major exchanges have improved compared to earlier trade war periods. Traders are rotating temporarily into stable assets such as USD Coin (USDC) and Tether (USDT), which reduces forced liquidation cascades and supports faster post-headline recoveries. Deep order-book liquidity in BTC-paired markets has helped absorb shock waves more efficiently in the 2026 trading cycle.

Trading volume has also surged following policy headlines. Daily digital asset trading volume has recently approached the $110–$120 billion range, indicating strong participation during volatility events. Volume expansion during price dips is being interpreted by technical traders as a signal of potential capitulation-style accumulation or momentum reversal opportunities rather than sustained bearish pressure.

From a macroeconomic perspective, tariffs could indirectly influence crypto through inflation and currency channel effects inside the United States. Higher import costs may sustain inflationary pressure, potentially keeping monetary policy relatively restrictive. However, geopolitical trade uncertainty can also strengthen the narrative of Bitcoin as a digital store-of-value alternative, particularly during periods of global confidence fluctuation.

Overall, the current environment suggests that tariff escalation is functioning more as a volatility amplifier than a structural crash driver for crypto markets. Institutional participants continue monitoring Federal Reserve liquidity signals, trade retaliation risk, and regulatory developments such as the ongoing digital asset reform discussions. The dominant market theme remains resilience under uncertainty — not panic liquidation — which aligns with the broader maturation trajectory of the digital asset ecosystem. 🚀📊#GateSquare$50KRedPacketGiveaway

$TRUMP