Agent8

Entered the crypto world in 2018, experienced multiple rounds of bull and bear market transitions, a practical veteran!

Agent8

Don't hold onto luck in the face of a sharp decline!

Bitcoin is now experiencing a significant drop after a prolonged period of consolidation, hitting a new low and breaking through the consolidation range. Other cryptocurrencies are falling even more sharply! So now is not the time to buy the dip, and you should not go against the trend to go long!

Wait until Bitcoin breaks below the 80,000 level, then stabilize before rebounding and gradually accumulating!

Bitcoin is now experiencing a significant drop after a prolonged period of consolidation, hitting a new low and breaking through the consolidation range. Other cryptocurrencies are falling even more sharply! So now is not the time to buy the dip, and you should not go against the trend to go long!

Wait until Bitcoin breaks below the 80,000 level, then stabilize before rebounding and gradually accumulating!

BTC-5.55%

- Reward

- like

- Comment

- Repost

- Share

Gold has recently experienced a continuous surge, but digital gold Bitcoin remains sluggish. Ultimately, Bitcoin and gold are completely different investment assets. Gold is being continuously bought by "official funds + safe-haven funds," while Bitcoin is still regarded by the mainstream as a high-risk asset.

The core contradiction in the current market is the struggle between: the safe-haven demand in the "chaotic times" of the macro environment (positive for gold) and the risk appetite suppression caused by the uncertainty of Federal Reserve policies (negative for Bitcoin).

Next, it depends

The core contradiction in the current market is the struggle between: the safe-haven demand in the "chaotic times" of the macro environment (positive for gold) and the risk appetite suppression caused by the uncertainty of Federal Reserve policies (negative for Bitcoin).

Next, it depends

BTC-5.55%

- Reward

- like

- Comment

- Repost

- Share

The plunge has begun! When will Bitcoin fall below “8”?

Last Sunday, both Bitcoin and ETH dropped to the previously mentioned second target level, then rebounded. After the rebound, Bitcoin still dropped with increased volume to a new low!

Early this morning, after the Federal Reserve's interest rate decision, Bitcoin led the entire market to start declining. Now it is accelerating downward. In the previous 8 rate decisions for 2025, the crypto market saw 7 declines and 1 rise, because current interest rates are too high (still at 3.5-3.75%). Unless the Federal Reserve gives a clear easing

View OriginalLast Sunday, both Bitcoin and ETH dropped to the previously mentioned second target level, then rebounded. After the rebound, Bitcoin still dropped with increased volume to a new low!

Early this morning, after the Federal Reserve's interest rate decision, Bitcoin led the entire market to start declining. Now it is accelerating downward. In the previous 8 rate decisions for 2025, the crypto market saw 7 declines and 1 rise, because current interest rates are too high (still at 3.5-3.75%). Unless the Federal Reserve gives a clear easing

- Reward

- like

- Comment

- Repost

- Share

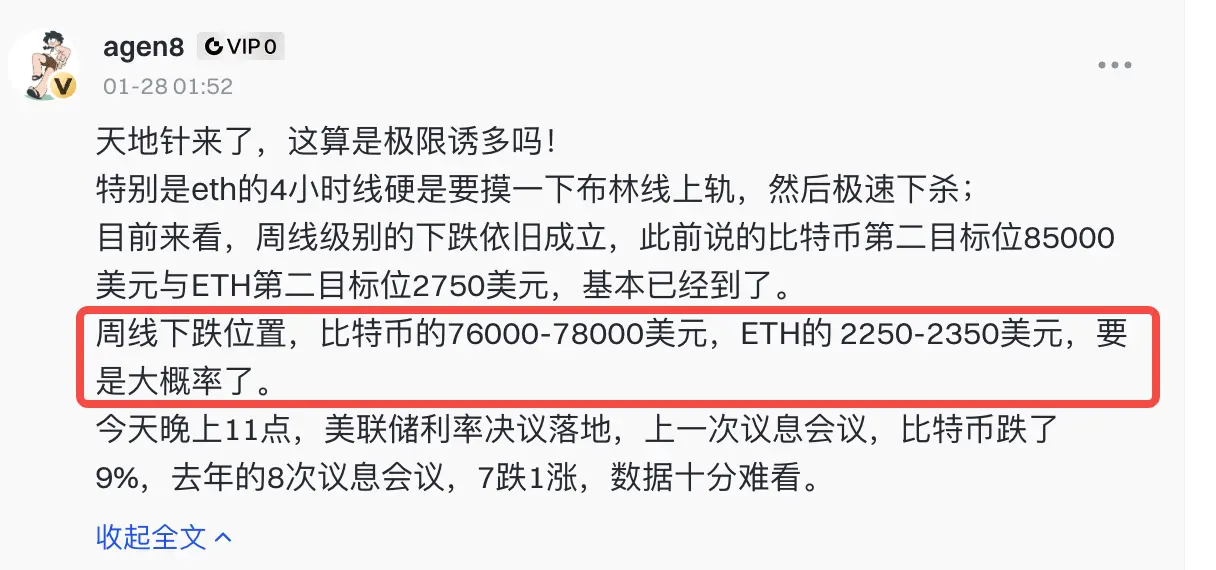

The Earth Needle is here, is this considered extreme manipulation?

Especially with ETH's 4-hour chart trying to touch the upper Bollinger Band, then rapidly dropping;

Currently, the weekly decline still holds, and the previously mentioned second target for Bitcoin at $85,000 and ETH at $2,750 are basically reached.

On the weekly decline, Bitcoin's $76,000-$78,000 and ETH's $2,250-$2,350 are highly probable levels.

Tonight at 11 PM, the Federal Reserve interest rate decision will be announced. In the last meeting, Bitcoin fell 9%. In the eight rate meetings last year, 7 declined and 1 rose, whi

View OriginalEspecially with ETH's 4-hour chart trying to touch the upper Bollinger Band, then rapidly dropping;

Currently, the weekly decline still holds, and the previously mentioned second target for Bitcoin at $85,000 and ETH at $2,750 are basically reached.

On the weekly decline, Bitcoin's $76,000-$78,000 and ETH's $2,250-$2,350 are highly probable levels.

Tonight at 11 PM, the Federal Reserve interest rate decision will be announced. In the last meeting, Bitcoin fell 9%. In the eight rate meetings last year, 7 declined and 1 rose, whi

- Reward

- like

- Comment

- Repost

- Share

The big turning point is here. Will there be continued sharp declines?

Tomorrow at 11 PM, the Federal Reserve's interest rate decision will be announced. The mainstream view is to keep the rate unchanged at 3.5~3.75%; it all depends on what is said at the 11:30 press conference.

On the other hand, Trump is trying to seize Greenland, prompting European institutional funds to start massive sell-offs of American assets. The US is very likely to face a "stock, bond, and currency triple kill" situation. At that time, a collapse in the crypto market is also very possible.

From a technical perspectiv

View OriginalTomorrow at 11 PM, the Federal Reserve's interest rate decision will be announced. The mainstream view is to keep the rate unchanged at 3.5~3.75%; it all depends on what is said at the 11:30 press conference.

On the other hand, Trump is trying to seize Greenland, prompting European institutional funds to start massive sell-offs of American assets. The US is very likely to face a "stock, bond, and currency triple kill" situation. At that time, a collapse in the crypto market is also very possible.

From a technical perspectiv

- Reward

- like

- Comment

- Repost

- Share

India's Nipah virus outbreak has a fatality rate of up to 75%!

For the crypto world, could this trigger another major crash like the 3.12 crash caused by COVID-19 in 2020?

Is the current decline somewhat related to this!

75%, that fatality rate is a bit exaggerated, even more than the COVID-19 pandemic at the beginning of 2020;

And now there are no vaccines or specific medicines, the Indian government’s governance ability is poor, and even East University is not just a street away. Could this trigger a global spread? Now the UK, Thailand, and several other countries have already started streng

View OriginalFor the crypto world, could this trigger another major crash like the 3.12 crash caused by COVID-19 in 2020?

Is the current decline somewhat related to this!

75%, that fatality rate is a bit exaggerated, even more than the COVID-19 pandemic at the beginning of 2020;

And now there are no vaccines or specific medicines, the Indian government’s governance ability is poor, and even East University is not just a street away. Could this trigger a global spread? Now the UK, Thailand, and several other countries have already started streng

- Reward

- like

- Comment

- Repost

- Share

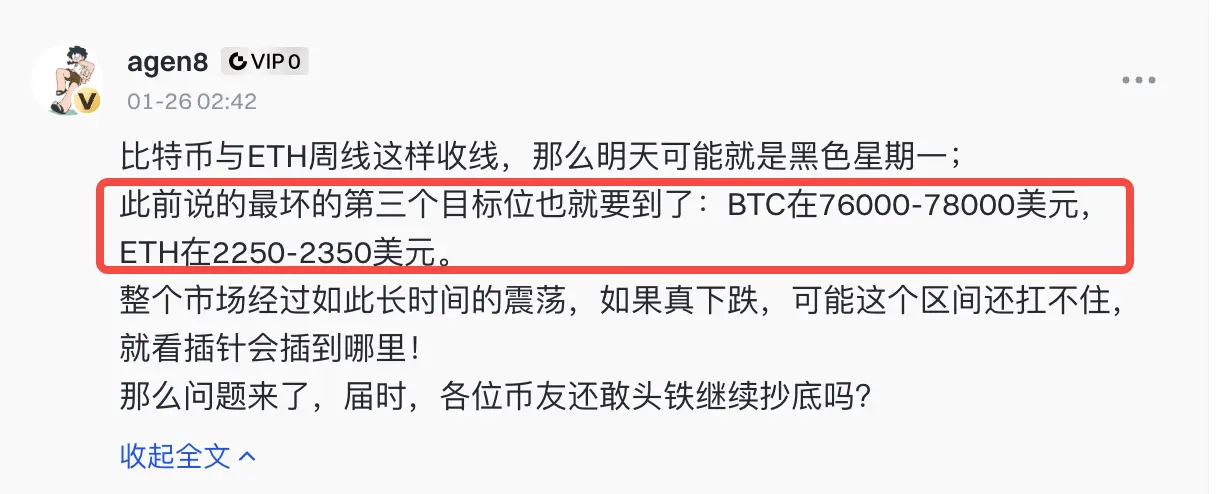

Bitcoin and ETH weekly candles close like this, so tomorrow might be Black Monday;

The worst third target level I mentioned earlier is also approaching: BTC at $76,000-$78,000, ETH at $2,250-$2,350.

After such a long period of fluctuation, if a decline really happens, this range might not hold, it all depends on where the dip will go!

So the question is, at that time, will you still dare to stubbornly buy the dip?

View OriginalThe worst third target level I mentioned earlier is also approaching: BTC at $76,000-$78,000, ETH at $2,250-$2,350.

After such a long period of fluctuation, if a decline really happens, this range might not hold, it all depends on where the dip will go!

So the question is, at that time, will you still dare to stubbornly buy the dip?

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and the entire market are still in a downward channel and could experience a sudden stampede-like crash at any moment.

The biggest recent destabilizing factor is the US-EU "Greenland Tariff" incident triggered by Trump. Although yesterday announced the withdrawal of the 10% tariffs on eight European countries, causing the market to plunge and then quickly rebound, the core geopolitical strategic control (over Greenland) has not disappeared.

Additionally, Trump's tendency to "apply maximum pressure and then quickly compromise," known as the "Trump-style TACO deal," means the market risk

View OriginalThe biggest recent destabilizing factor is the US-EU "Greenland Tariff" incident triggered by Trump. Although yesterday announced the withdrawal of the 10% tariffs on eight European countries, causing the market to plunge and then quickly rebound, the core geopolitical strategic control (over Greenland) has not disappeared.

Additionally, Trump's tendency to "apply maximum pressure and then quickly compromise," known as the "Trump-style TACO deal," means the market risk

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and ETH have already reached the first support level mentioned earlier, and ETH short positions have automatically taken profits! The fish feed cost for 2026 is in hand!

At this point, there should be a rebound, but it shouldn't go against the trend, because the current market is most likely heading toward the second target level.

If Bitcoin drops below 7, it would definitely be bad, but for long-term believers, it's a welcome bottoming opportunity.

View OriginalAt this point, there should be a rebound, but it shouldn't go against the trend, because the current market is most likely heading toward the second target level.

If Bitcoin drops below 7, it would definitely be bad, but for long-term believers, it's a welcome bottoming opportunity.

- Reward

- like

- Comment

- Repost

- Share

In 2026, the U exchange rate for soft girl currency will continue to depreciate, currently falling below 7. This is just the beginning; at least for the next one or two years, it will experience oscillating decline. If you are a person from Dongda, and your final consumption is RMB-denominated, then now is not the time to stockpile U in large quantities.

Overall, the US dollar will depreciate in the future, especially once it reaches a certain threshold, which will accelerate depreciation. Therefore, Bitcoin will definitely continue to rise, and breaking through 1 million may just be the begin

Overall, the US dollar will depreciate in the future, especially once it reaches a certain threshold, which will accelerate depreciation. Therefore, Bitcoin will definitely continue to rise, and breaking through 1 million may just be the begin

BTC-5.55%

- Reward

- like

- Comment

- Repost

- Share

Of course, the current market is sluggish, with Bitcoin experiencing oscillations and declines. One of the main reasons is that institutions and large holders are still accumulating coins. It is said that they need to accumulate 5 million Bitcoins, and so far, only over 1 million have been accumulated. Meanwhile, the exchange wallet balances are continuously decreasing, currently only 2.45 million.

In this situation, institutions will not make large-scale purchases. They will buy gradually, like iceberg orders. Under these circumstances, the market will continue to fluctuate, and they will fin

In this situation, institutions will not make large-scale purchases. They will buy gradually, like iceberg orders. Under these circumstances, the market will continue to fluctuate, and they will fin

BTC-5.55%

- Reward

- like

- Comment

- Repost

- Share

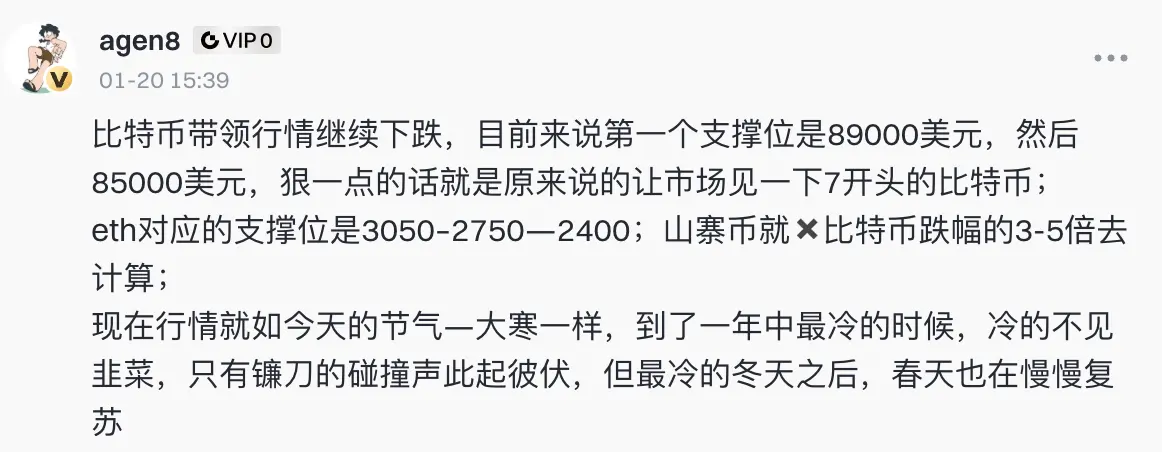

Bitcoin continues to lead the market downward. Currently, the first support level is at $89,000, then $85,000, and more aggressively, as previously mentioned, let the market see Bitcoin starting with 7;

The support levels for ETH are at 3050–2750–2400; for altcoins, it’s ✖, calculated at 3-5 times the decline of Bitcoin;

The current market situation is like today’s solar term—Major Cold—reaching the coldest part of the year, so cold that only the sound of sickles clashing can be heard, with no sign of the greens. But after the coldest winter, spring is slowly beginning to revive.

View OriginalThe support levels for ETH are at 3050–2750–2400; for altcoins, it’s ✖, calculated at 3-5 times the decline of Bitcoin;

The current market situation is like today’s solar term—Major Cold—reaching the coldest part of the year, so cold that only the sound of sickles clashing can be heard, with no sign of the greens. But after the coldest winter, spring is slowly beginning to revive.

- Reward

- like

- Comment

- Repost

- Share

Why are the big players in Dubai and Singapore's crypto circles everywhere now? Because here, you can solve all your gray industry and identity grounding issues;

Tax avoidance is just a drop in the bucket. The legitimate realization of crypto assets here has already formed a complete industry chain:

1. First, through legal, widespread U exchange shops (I’ve noticed many Dubai Longcheng restaurants have U payment codes), you can exchange for USD, EUR, and other fiat currencies within minutes. Even if you have billions in assets, the exchange cycle won't exceed 24 hours;

2. Then, a professional

View OriginalTax avoidance is just a drop in the bucket. The legitimate realization of crypto assets here has already formed a complete industry chain:

1. First, through legal, widespread U exchange shops (I’ve noticed many Dubai Longcheng restaurants have U payment codes), you can exchange for USD, EUR, and other fiat currencies within minutes. Even if you have billions in assets, the exchange cycle won't exceed 24 hours;

2. Then, a professional

- Reward

- 1

- Comment

- Repost

- Share

X (Twitter) will launch Smart Cashtag next month, which means that in the future, you can not only view market prices on X, but also embed on-chain smart contract addresses (to prevent scams from fake coins with the same name), and you can also buy and sell directly.

As a platform with 200 million daily active users, this is definitely a long-term benefit. It will help more people worldwide learn about Bitcoin and other cryptocurrencies, and will greatly promote activity among crypto projects and KOLs on the X platform, as well as attract new retail investors to the entire crypto space.

The X

As a platform with 200 million daily active users, this is definitely a long-term benefit. It will help more people worldwide learn about Bitcoin and other cryptocurrencies, and will greatly promote activity among crypto projects and KOLs on the X platform, as well as attract new retail investors to the entire crypto space.

The X

BTC-5.55%

- Reward

- like

- Comment

- Repost

- Share

Are institutions and big players also unable to hold on? They are starting to deposit Bitcoin and ETH into exchanges!

In just 24 hours, there was a net inflow of 1930 Bitcoins, which means nearly 200 million USD worth of Bitcoin might be used to sell off!

Is this to cut losses or for holiday spending? Actually, you can't trust institutions too much; many times, institutions are also just bigger little guys.

The European and American Christmas holidays will end gradually from January 4-6. During this period, without capital support, even a small sell-off can cause a big drop. During this period

View OriginalIn just 24 hours, there was a net inflow of 1930 Bitcoins, which means nearly 200 million USD worth of Bitcoin might be used to sell off!

Is this to cut losses or for holiday spending? Actually, you can't trust institutions too much; many times, institutions are also just bigger little guys.

The European and American Christmas holidays will end gradually from January 4-6. During this period, without capital support, even a small sell-off can cause a big drop. During this period

- Reward

- like

- 1

- Repost

- Share

MorningSun :

:

Waiting for 30,000The rebound of BTC and ETH may be coming to an end, as the weekly level decline continues, and the market has not improved, but the data is already overbought.

Already occurred / Market digested: US CPI → No further deterioration, European & UK central banks → Neutral stance, Bank of Japan → No sudden hawkish turn.

There is a possibility of a rebound after a period of consolidation at a high level, but the current upward movements are opportunities for shorting and profit-taking. BTC is first looking at 85,000, then 80,000, while ETH is at 2,740 and 2,500, unless BTC can break through and stab

View OriginalAlready occurred / Market digested: US CPI → No further deterioration, European & UK central banks → Neutral stance, Bank of Japan → No sudden hawkish turn.

There is a possibility of a rebound after a period of consolidation at a high level, but the current upward movements are opportunities for shorting and profit-taking. BTC is first looking at 85,000, then 80,000, while ETH is at 2,740 and 2,500, unless BTC can break through and stab

- Reward

- like

- Comment

- Repost

- Share

Christmas is coming soon, and it looks like a Christmas crash is inevitable, with a plunge brewing.

Bitcoin has already broken through $85,000, just waiting for $80,000. Where will the deadly dip occur? Can the previous low of $74,000 hold?

Most altcoins have already been wiped out, and the next 90% of coins will go to zero. When Bitcoin falls below $85,000 and it's not a leading coin, just cut your losses and sell.

Bitcoin has already broken through $85,000, just waiting for $80,000. Where will the deadly dip occur? Can the previous low of $74,000 hold?

Most altcoins have already been wiped out, and the next 90% of coins will go to zero. When Bitcoin falls below $85,000 and it's not a leading coin, just cut your losses and sell.

BTC-5.55%

- Reward

- 1

- Comment

- Repost

- Share

Although late, but finally here. Currently in a position that is neither here nor there, any major financial event triggers sharp fluctuations.

Although the US CPI is positive, it’s of little use. BTC held for 3 hours and then dropped, just as predicted this afternoon: short-term rebound, medium-term still bearish. Now every rebound is an opportunity to short and sell.

The market here still needs a violent shakeout to completely crush hope! No one dares to call for a big bull run.

Although the US CPI is positive, it’s of little use. BTC held for 3 hours and then dropped, just as predicted this afternoon: short-term rebound, medium-term still bearish. Now every rebound is an opportunity to short and sell.

The market here still needs a violent shakeout to completely crush hope! No one dares to call for a big bull run.

BTC-5.55%

- Reward

- 1

- Comment

- Repost

- Share

BTC and ETH are now in a "weak oversold sideways consolidation in a downtrend," which is a typical downtrend continuation;

Although there are short-term rebound conditions, the medium-term structure remains bearish; the true direction depends on the five major economic events announced intensively over the next two days, as mentioned in the previous tweet. The most influential are tonight at 9:30 PM US CPI data (if the data exceeds expectations, expect further decline) and tomorrow at 11:00 AM Japan interest rate decision (likely rate hike, continue to fall);

The current volume-consolidation i

View OriginalAlthough there are short-term rebound conditions, the medium-term structure remains bearish; the true direction depends on the five major economic events announced intensively over the next two days, as mentioned in the previous tweet. The most influential are tonight at 9:30 PM US CPI data (if the data exceeds expectations, expect further decline) and tomorrow at 11:00 AM Japan interest rate decision (likely rate hike, continue to fall);

The current volume-consolidation i

- Reward

- like

- Comment

- Repost

- Share

This wave of the Heaven and Earth Needle insertion is well done! First lure the short, then lure the long, and then a sharp drop!

In the past two days, five major data releases have been announced, making it a tumultuous autumn:

Thursday the 18th

20:00, Bank of England interest rate decision

21:15, European Central Bank interest rate decision

21:30, US CPI data release;

Friday the 19th

11:00, Bank of Japan interest rate decision;

21:30, PCE data release;

Next, it depends on whether Bitcoin can hold at 80,000–82,000 USD. This has been the main accumulation zone for the past two years. If it can

View OriginalIn the past two days, five major data releases have been announced, making it a tumultuous autumn:

Thursday the 18th

20:00, Bank of England interest rate decision

21:15, European Central Bank interest rate decision

21:30, US CPI data release;

Friday the 19th

11:00, Bank of Japan interest rate decision;

21:30, PCE data release;

Next, it depends on whether Bitcoin can hold at 80,000–82,000 USD. This has been the main accumulation zone for the past two years. If it can

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More14.11K Popularity

11.91K Popularity

9.76K Popularity

4.15K Popularity

42.34K Popularity

Hot Gate Fun

View More- MC:$3.24KHolders:10.00%

- MC:$3.22KHolders:10.00%

- MC:$3.27KHolders:20.00%

- MC:$3.27KHolders:10.00%

- MC:$3.26KHolders:10.00%

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889