EagleEye

#BOJRateHikesBackontheTable

JPMorgan Flags BOJ Hikes Could Yen Liquidity Reshape Crypto Risk? My Thoughts and Insights

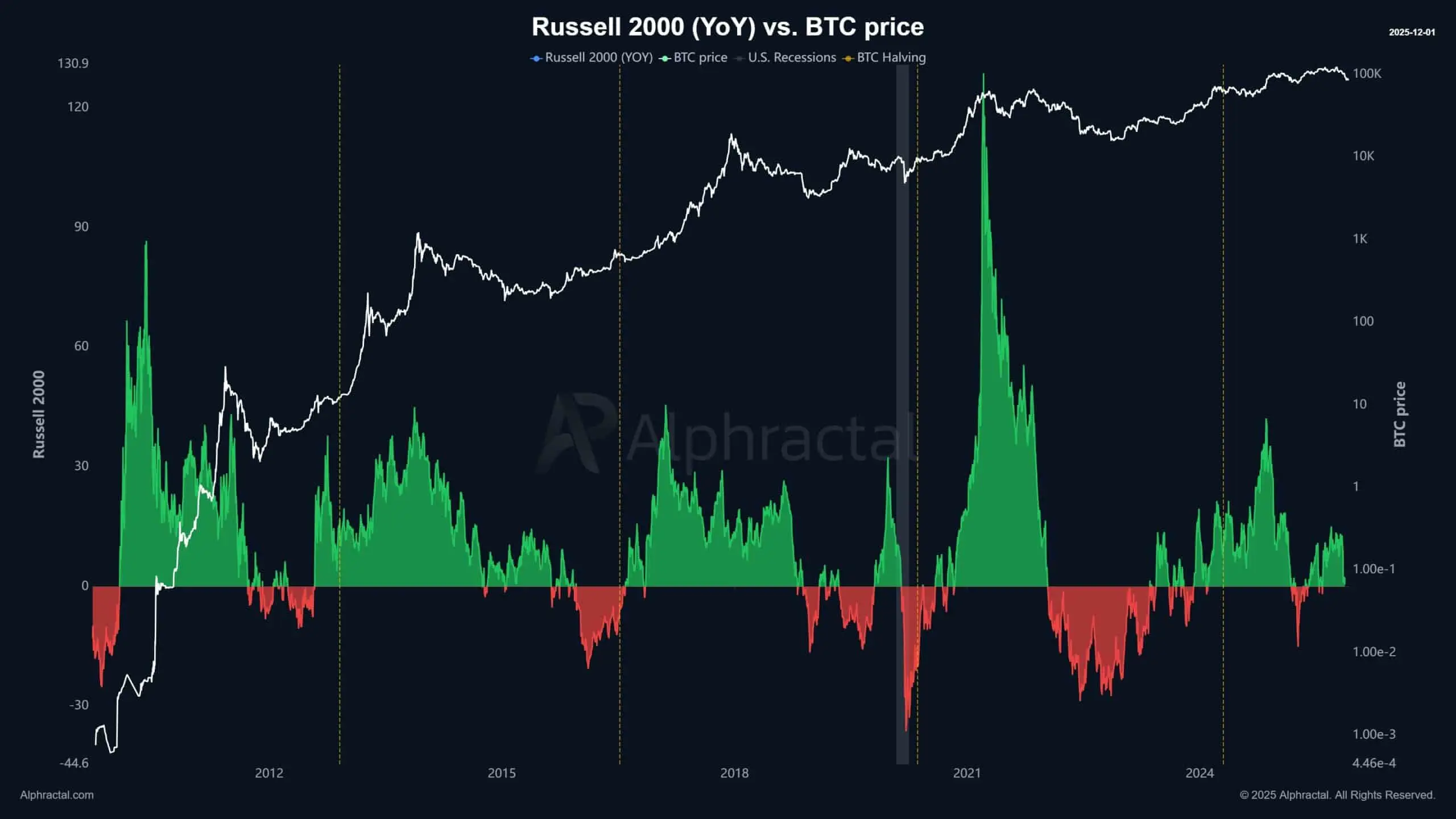

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026. On the surface, that might sound modest. In reality, for global markets especially crypto this could be a big deal.

Why? Because the yen isn’t just another currency. It’s been the backbone of global cheap liquidity for decades.

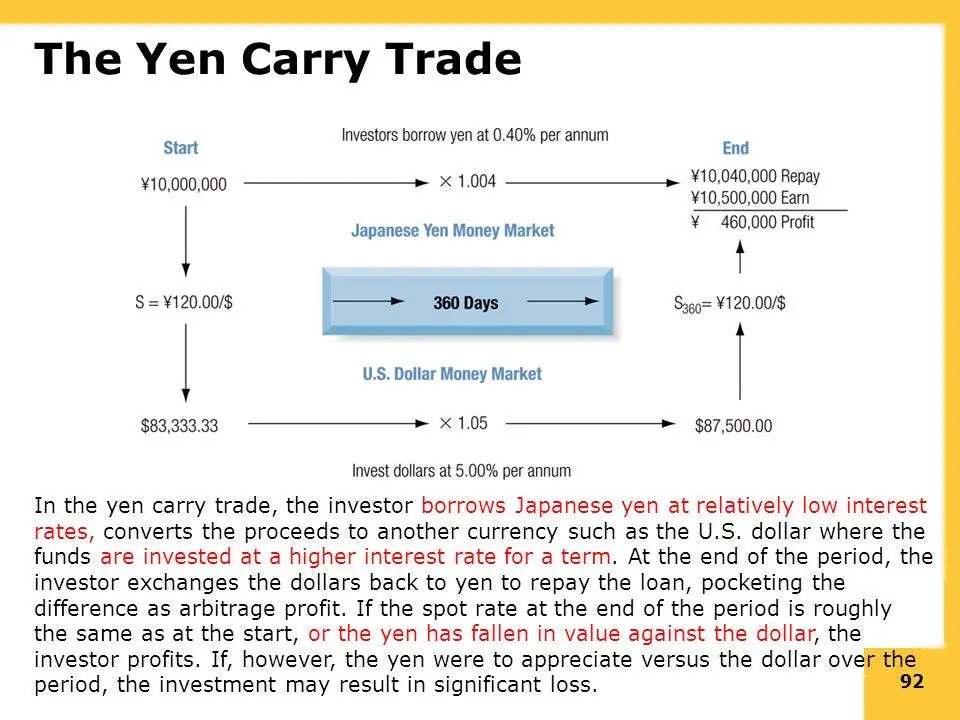

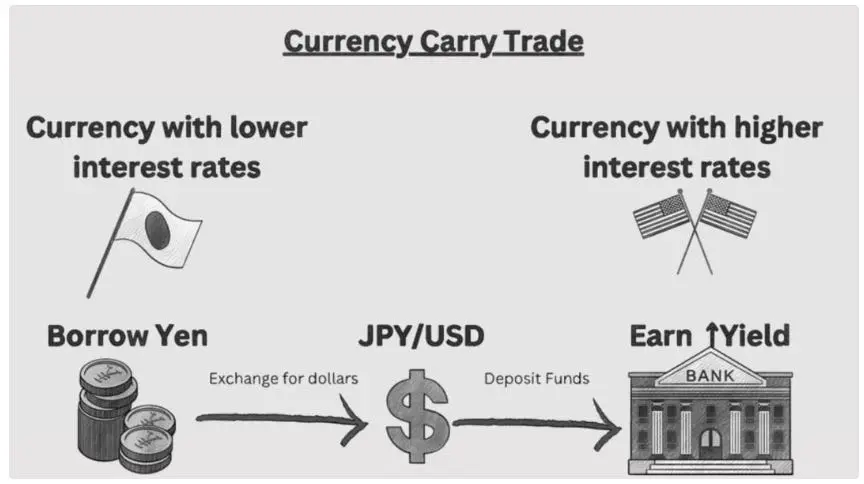

Why the Yen Matters More Than It Seems

Japan has been the world’s funding engine. Ultra-low rates turned the yen into the preferred curren

JPMorgan Flags BOJ Hikes Could Yen Liquidity Reshape Crypto Risk? My Thoughts and Insights

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates toward 1.25% by end-2026. On the surface, that might sound modest. In reality, for global markets especially crypto this could be a big deal.

Why? Because the yen isn’t just another currency. It’s been the backbone of global cheap liquidity for decades.

Why the Yen Matters More Than It Seems

Japan has been the world’s funding engine. Ultra-low rates turned the yen into the preferred curren

BTC0,76%