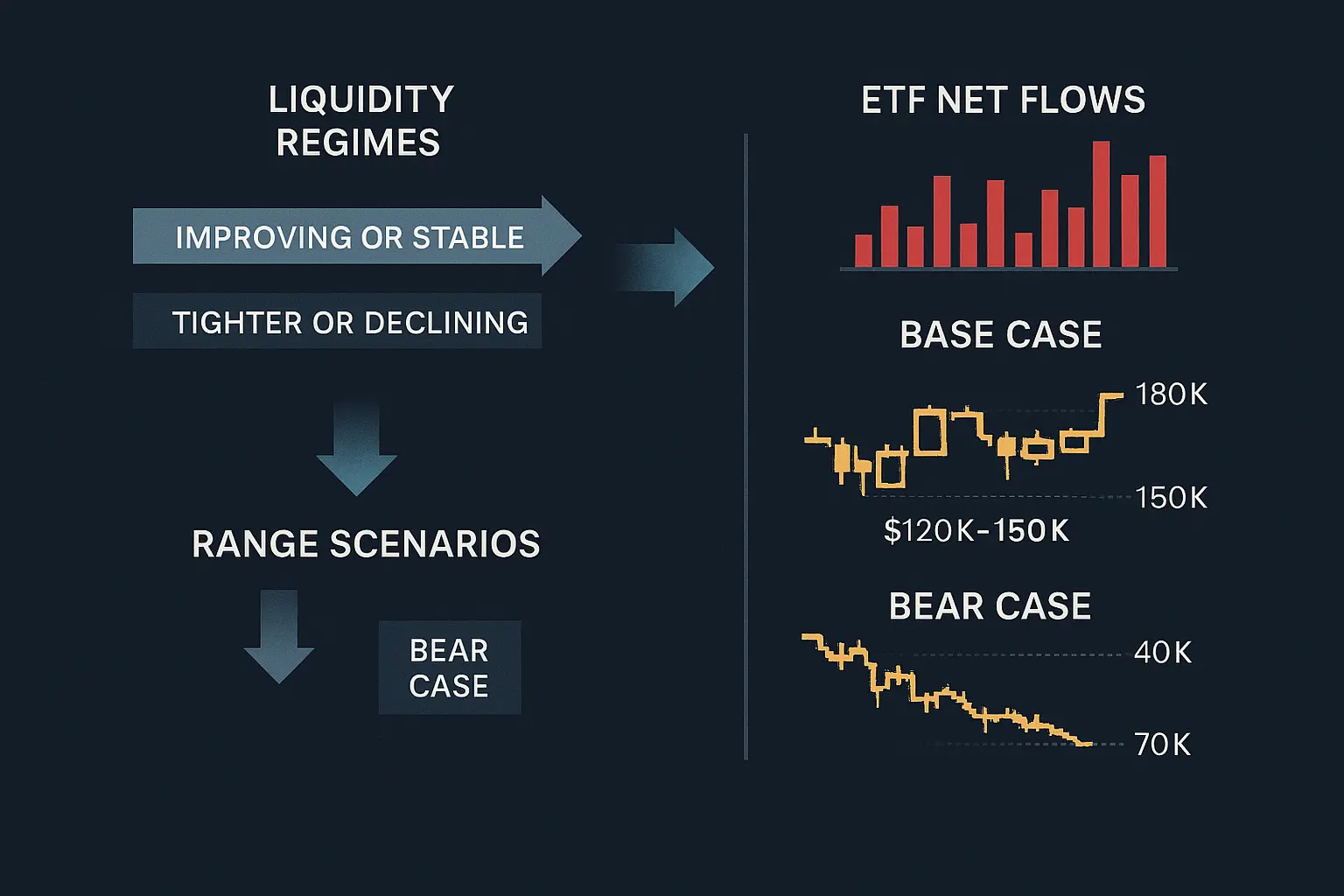

#比特币2026价格预测 Waiting for a Turn: Can Bitcoin Reclaim $100,000 in 2026? Institutional Predictions and Market Signals Fully Analyzed

At the start of a new year, a core question facing everyone is: after the correction, does Bitcoin still have hope of returning above $100,000?

Currently, technical charts indeed carry a cautious tone. The weekly trend once raised concerns that a bear market was already settled. However, the most fascinating aspect of the market is that it often brews unexpected turns while most people's opinions are aligned. Looking at recent market movements, Bitcoin has not ch

At the start of a new year, a core question facing everyone is: after the correction, does Bitcoin still have hope of returning above $100,000?

Currently, technical charts indeed carry a cautious tone. The weekly trend once raised concerns that a bear market was already settled. However, the most fascinating aspect of the market is that it often brews unexpected turns while most people's opinions are aligned. Looking at recent market movements, Bitcoin has not ch

BTC1,03%