# CryptoMarketRebound

604.9K

As gold and silver weaken, crypto has staged a rebound. Bitcoin broke above $90,000 overnight, sparking a broad market rally led by PEPE and strong gains in ETH, SOL, SUI, and DOGE. Did you catch this move? Are you buying, selling, or staying on the sidelines? Share your strategy.

HanssiMazak

#CryptoMarketRebound From Rebound to the Next Phase of Market Maturity

The crypto market rebound is no longer just a short-term reaction—it is gradually evolving into a more structured recovery phase. After months of heavy selling, uncertainty, and emotional trading, the market is beginning to show signs of normalization. Volatility still exists, but the tone has shifted from panic to patience, suggesting that participants are reassessing value rather than rushing for exits.

Bitcoin continues to act as the backbone of this transition. Its ability to defend major support zones and move within c

The crypto market rebound is no longer just a short-term reaction—it is gradually evolving into a more structured recovery phase. After months of heavy selling, uncertainty, and emotional trading, the market is beginning to show signs of normalization. Volatility still exists, but the tone has shifted from panic to patience, suggesting that participants are reassessing value rather than rushing for exits.

Bitcoin continues to act as the backbone of this transition. Its ability to defend major support zones and move within c

- Reward

- 5

- 83

- Repost

- Share

MrFlower_XingChen :

:

Happy New Year! 🤑View More

#CryptoMarketRebound 🔥 Early-Year Market Momentum Begins | Gate Live Discussion

The new year has officially kicked off with strong market momentum 🚀

Prices are rising fast, but volatility and divergence are increasing.

💭 Key Question:

Is this the right time to add positions with the trend, or is it wiser to wait for a healthy pullback?

📈 Trend-following rewards speed

📉 Patience protects capital

👉 Join Gate Live, share your market view with logic and experience, and compete for the leaderboard.

🎁 Rewards:

Limited-edition Gate × RedBull merchandise

📌 How to Participate • Enter 5 live roo

The new year has officially kicked off with strong market momentum 🚀

Prices are rising fast, but volatility and divergence are increasing.

💭 Key Question:

Is this the right time to add positions with the trend, or is it wiser to wait for a healthy pullback?

📈 Trend-following rewards speed

📉 Patience protects capital

👉 Join Gate Live, share your market view with logic and experience, and compete for the leaderboard.

🎁 Rewards:

Limited-edition Gate × RedBull merchandise

📌 How to Participate • Enter 5 live roo

- Reward

- 3

- 7

- Repost

- Share

AylaShinex :

:

1000x VIbes 🤑View More

Strong Start to 2026: Spot Bitcoin ETFs See Massive Inflows Amid Renewed Institutional Interest

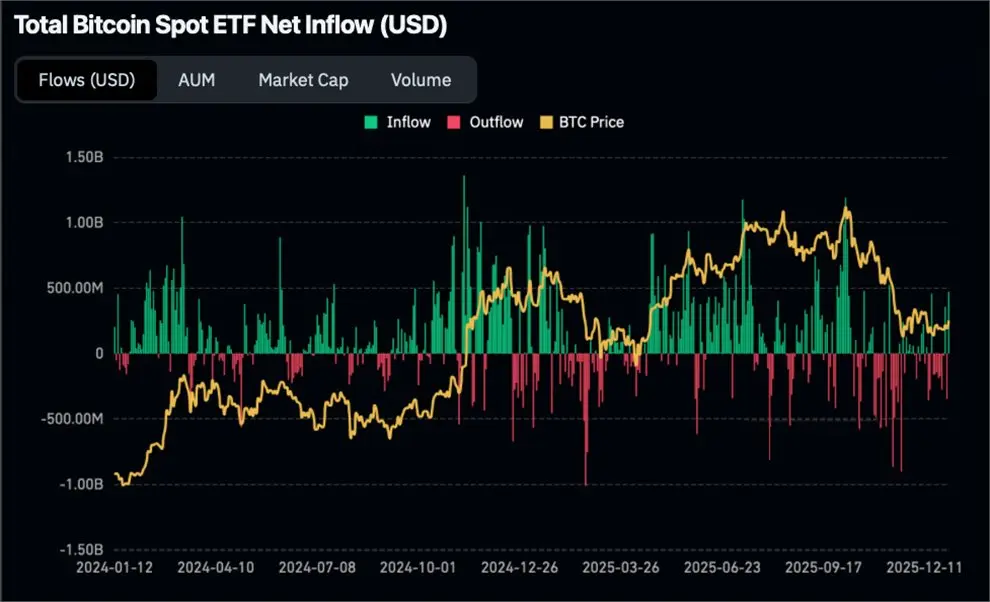

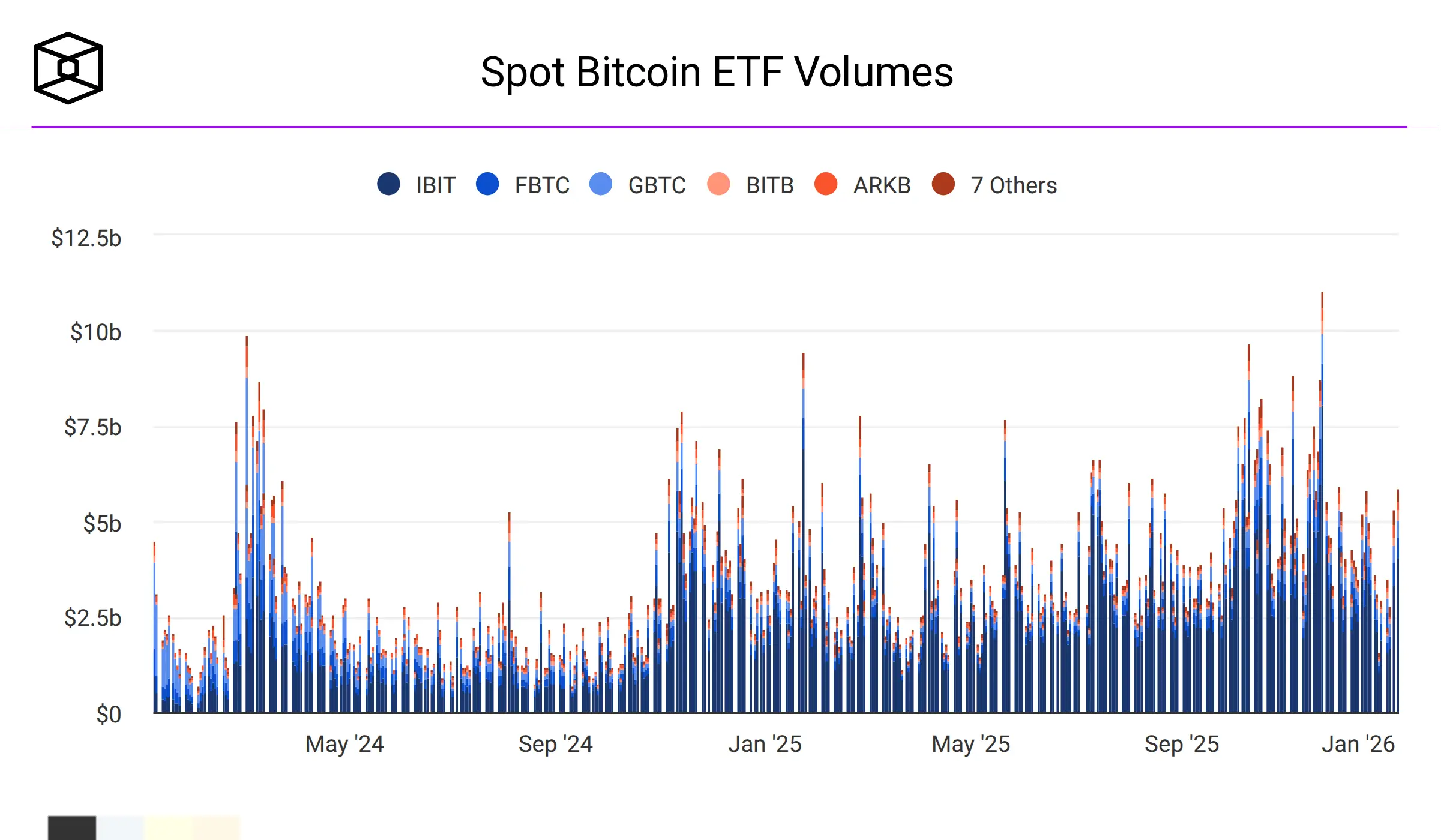

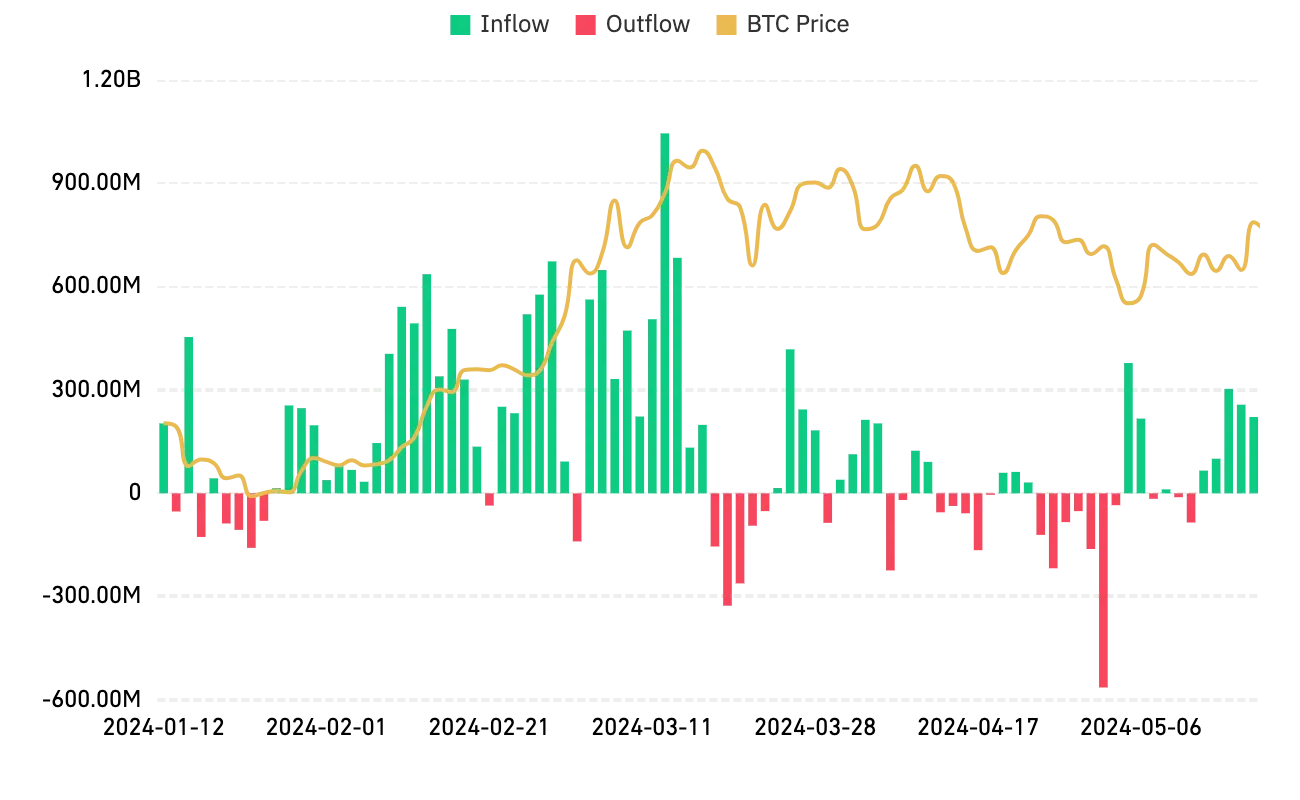

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

- Reward

- 63

- 86

- Repost

- Share

Moonchart :

:

Happy New Year! 🤑View More

#ETHTrendWatch 🚀

Ethereum’s Strategic Positioning in 2026

As 2026 unfolds, Ethereum stands at a pivotal stage in its evolution. No longer viewed solely as a smart-contract platform, ETH has matured into a core financial asset and global settlement layer for the digital economy. Its role now spans yield generation, decentralized infrastructure, real-world asset tokenization, and institutional-grade financial products.

This year is less about speculative hype — and more about structural strength, sustained adoption, and long-term value creation.

📊 Market Structure & Price Outlook

Ethereum is c

Ethereum’s Strategic Positioning in 2026

As 2026 unfolds, Ethereum stands at a pivotal stage in its evolution. No longer viewed solely as a smart-contract platform, ETH has matured into a core financial asset and global settlement layer for the digital economy. Its role now spans yield generation, decentralized infrastructure, real-world asset tokenization, and institutional-grade financial products.

This year is less about speculative hype — and more about structural strength, sustained adoption, and long-term value creation.

📊 Market Structure & Price Outlook

Ethereum is c

- Reward

- 12

- 19

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

🟠 Bitcoin Above $90,000: A Psychological Break That Matters

Bitcoin’s move above $90,000 is more than just a price milestone—it’s a sentiment reset.

After the choppy, low-conviction price action that defined the end of 2025, the market finally looks like it’s shaking off year-end fatigue. As of January 6, 2026, BTC has already tagged the $93,000 level, and the behavior beneath the surface tells a much bigger story.

This isn’t happening in isolation. We’re seeing a clear capital rotation away from defensive assets and back into high-beta risk.

🔍 Market Context: Why This Rally Feels Different

Bitcoin’s move above $90,000 is more than just a price milestone—it’s a sentiment reset.

After the choppy, low-conviction price action that defined the end of 2025, the market finally looks like it’s shaking off year-end fatigue. As of January 6, 2026, BTC has already tagged the $93,000 level, and the behavior beneath the surface tells a much bigger story.

This isn’t happening in isolation. We’re seeing a clear capital rotation away from defensive assets and back into high-beta risk.

🔍 Market Context: Why This Rally Feels Different

- Reward

- 2

- 1

- Repost

- Share

BabaJi :

:

BTC above $90K feels more like a sentiment shift than a simple price move.#CryptoMarketRebound The rebound phase of the crypto market is not just about prices moving up again — it’s about confidence slowly returning to a space that rewards patience, discipline, and strategic thinking. After every correction, the market reshapes its structure, filtering out noise and emotional decisions, and leaving room for those who stayed focused on long-term value rather than short-term hype. This period is where smart positioning matters more than speed, where risk management becomes a mindset, not a rule, and where psychology separates reactive traders from strategic participan

- Reward

- 25

- 27

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

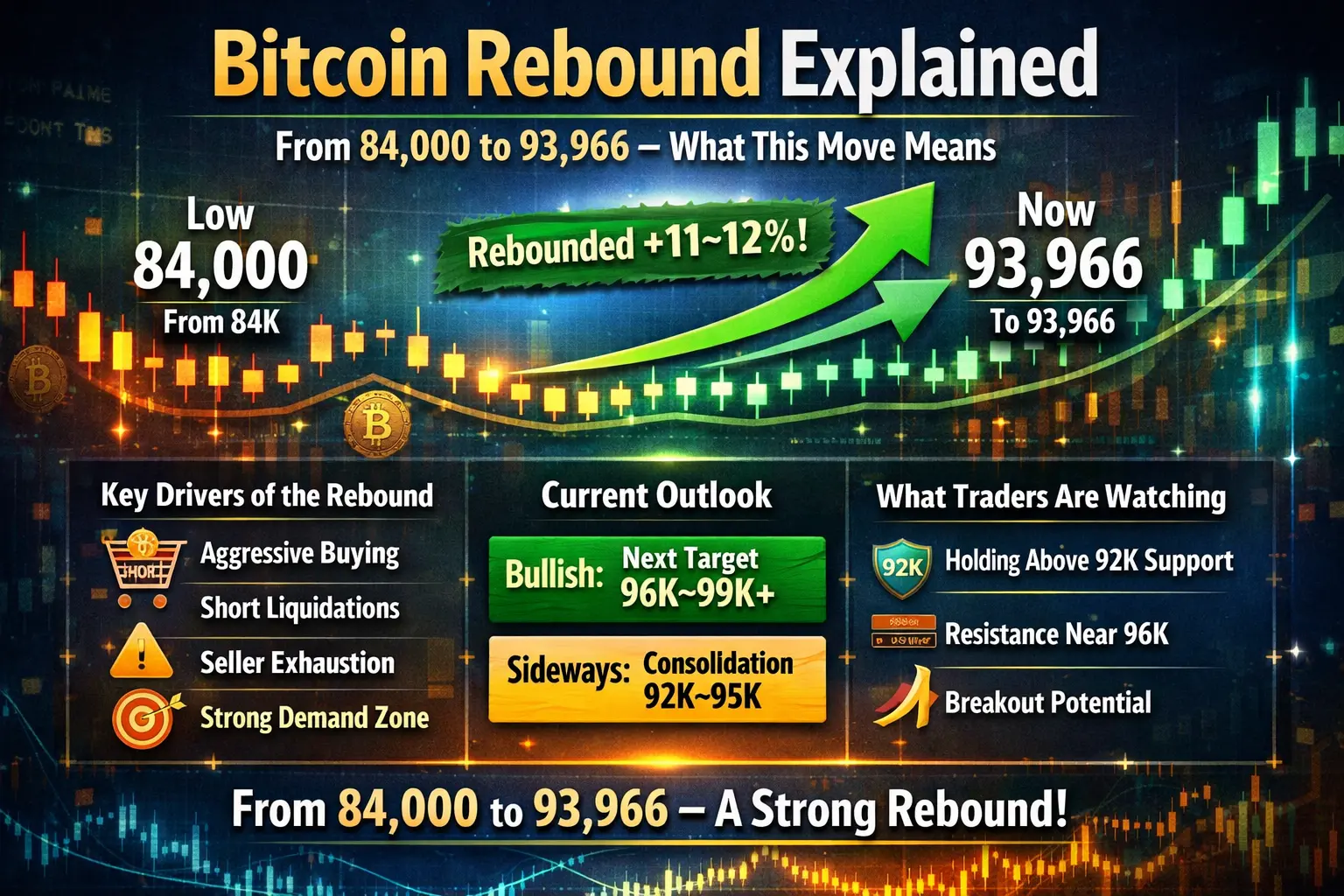

#CryptoMarketRebound

Bitcoin Rebound Explained

From 84,000 to 93,966 — What This Move Means

Bitcoin recently dropped to around 84,000, where strong buying interest appeared. From that level, the market reversed direction and BTC has now climbed to 93,966, confirming a solid rebound.

🔻 How Big Was the Rebound?

The move from 84,000 → 93,966 represents a rebound of approximately 11–12%.

This is not a weak bounce — it reflects real demand entering the market.

Key drivers behind this rebound:

Aggressive spot buying near 84K

Short position liquidations

Exhaustion of selling pressure

Buyers defendi

Bitcoin Rebound Explained

From 84,000 to 93,966 — What This Move Means

Bitcoin recently dropped to around 84,000, where strong buying interest appeared. From that level, the market reversed direction and BTC has now climbed to 93,966, confirming a solid rebound.

🔻 How Big Was the Rebound?

The move from 84,000 → 93,966 represents a rebound of approximately 11–12%.

This is not a weak bounce — it reflects real demand entering the market.

Key drivers behind this rebound:

Aggressive spot buying near 84K

Short position liquidations

Exhaustion of selling pressure

Buyers defendi

BTC-1,35%

- Reward

- 27

- 23

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#CryptoMarketRebound

Crypto Market Rebound: Short-Term Relief or Structural Shift?

1. Why This Rebound Matters

The recent rebound across digital assets arrives at a sensitive moment for global markets. With gold and silver showing short-term weakness, capital rotation back into crypto has reignited an old debate: is this move a tactical bounce driven by positioning, or an early signal of renewed risk appetite in digital assets? Bitcoin reclaiming the $90,000 level has acted as a psychological catalyst, pulling the broader market higher.

Rather than focusing on price excitement, this moment de

Crypto Market Rebound: Short-Term Relief or Structural Shift?

1. Why This Rebound Matters

The recent rebound across digital assets arrives at a sensitive moment for global markets. With gold and silver showing short-term weakness, capital rotation back into crypto has reignited an old debate: is this move a tactical bounce driven by positioning, or an early signal of renewed risk appetite in digital assets? Bitcoin reclaiming the $90,000 level has acted as a psychological catalyst, pulling the broader market higher.

Rather than focusing on price excitement, this moment de

- Reward

- 18

- 20

- Repost

- Share

EagleEye :

:

Excellent post! Very motivating and inspiringView More

Strong Start to 2026: Spot Bitcoin ETFs See Massive Inflows Amid Renewed Institutional Interest

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

- Reward

- 6

- Comment

- Repost

- Share

📈 Post Draft: The Rebound is Real!

Headline: Waking up to Green Candles! 🟢🚀 #CryptoMarketRebound

Is this the start of the legendary 2026 bull run? After a choppy end to 2025, the market is finally showing its teeth again. We aren't just seeing a bounce; we're seeing a fundamental shift in momentum!

Why the rebound is hitting different this week:

• 💎 Bitcoin Resilience: BTC has reclaimed the $91k level, flipping the Fear & Greed Index from "Fear" to "Neutral" for the first time in months.

• 🐳 Institutional Inflows: Spot ETFs just recorded nearly $500M in single-day inflows—the "smart money

Headline: Waking up to Green Candles! 🟢🚀 #CryptoMarketRebound

Is this the start of the legendary 2026 bull run? After a choppy end to 2025, the market is finally showing its teeth again. We aren't just seeing a bounce; we're seeing a fundamental shift in momentum!

Why the rebound is hitting different this week:

• 💎 Bitcoin Resilience: BTC has reclaimed the $91k level, flipping the Fear & Greed Index from "Fear" to "Neutral" for the first time in months.

• 🐳 Institutional Inflows: Spot ETFs just recorded nearly $500M in single-day inflows—the "smart money

- Reward

- 14

- 9

- Repost

- Share

Tradeguru909 :

:

DYOR 🤓View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

22.52K Popularity

85.86K Popularity

33.55K Popularity

12.74K Popularity

13.19K Popularity

11.96K Popularity

11.13K Popularity

10.93K Popularity

76.55K Popularity

23.71K Popularity

84.5K Popularity

22.42K Popularity

52.95K Popularity

46.18K Popularity

181.02K Popularity

News

View MoreDeribit: Cryptocurrency options trading activity causes Bitcoin price to be suppressed around $90,000

1 m

Aster launches the $50,000 "The Metal Surge Metal Token Trading Challenge"

5 m

ETH fell below 2950 USDT

8 m

BTC (Bitcoin) down 1.17% in the last 24 hours

8 m

"Lightning Reverse" whale closes BTC and ETH short positions, totaling a profit of $351,000

11 m

Pin